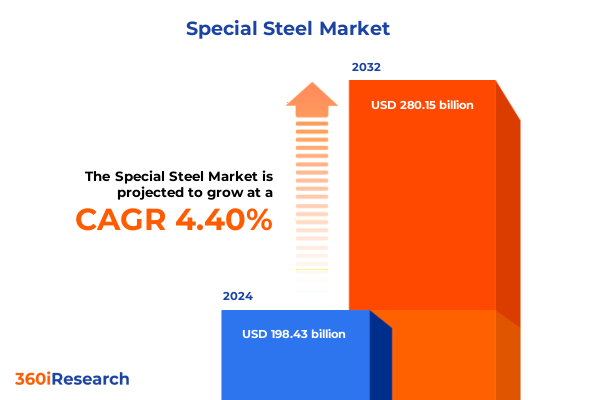

The Special Steel Market size was estimated at USD 206.76 billion in 2025 and expected to reach USD 215.57 billion in 2026, at a CAGR of 4.43% to reach USD 280.15 billion by 2032.

Navigating the Crucial Role of Special Steel in Modern Manufacturing Amidst Global Disruptions and Technological Evolution

The special steel industry stands at the intersection of traditional manufacturing resilience and rapid technological advancement, establishing itself as a cornerstone for high-performance applications across aerospace, automotive, energy, and infrastructure. In an era marked by geopolitical tension, supply chain disruptions, and escalating sustainability mandates, special steel producers and end users alike face the imperative to adapt swiftly in order to maintain operational continuity and competitive edge. Recent quarters have underscored the heightened market volatility, as evidenced by fluctuations in European operating profits amid global tariff uncertainties and energy cost pressures observed in leading steelmakers in July 2025. Concurrently, the accelerating adoption of digital tools, from predictive maintenance algorithms to real-time process optimization, is redefining efficiency benchmarks and forging new pathways for value creation across the value chain.

Against this backdrop, decision makers must navigate a multifaceted landscape where technological innovation, regulatory developments, and evolving customer needs converge. The demand for specialized grades of steel-engineered for exceptional strength, toughness, or corrosion resistance-is expanding in tandem with global infrastructure investments and the energy transition, particularly in sectors such as renewables, defense, and advanced manufacturing. As stakeholders evaluate strategic priorities, understanding the interplay of market drivers and emerging risks will prove essential for capturing growth opportunities and reinforcing supply chain resilience.

Embracing Industry 4.0 and Sustainability Imperatives as Foundational Shifts Reshape the Special Steel Value Chain and Competitive Dynamics

Industry 4.0 paradigms and heightened environmental regulations have catalyzed transformative shifts across the special steel landscape, compelling stakeholders to embrace innovation as a fundamental driver of competitiveness. Leading mills are increasingly integrating artificial intelligence and machine learning frameworks to elevate predictive maintenance capabilities, enabling near-zero unplanned downtime and optimized asset utilization across blast furnaces and rolling mills. In parallel, the proliferation of digital twin technology and advanced process controls is empowering producers to simulate complex metallurgical processes in silico, accelerating alloy development cycles and reducing time to market for next-generation grades.

Moreover, stringent decarbonization targets have injected a renewed focus on low-carbon production pathways and circular economy principles. As highlighted by recent analyses of China’s steel decarbonization roadmap, transitioning substantial blast furnace outputs toward electric arc furnace operations could unlock CO₂ emissions reductions exceeding 160 million metric tons, thereby realigning global competitiveness dynamics for low-carbon steel. This regulatory momentum is complemented by collaborative industry initiatives and public–private partnerships that seek to deploy hydrogen-based direct reduction and carbon capture technologies, underscoring a collective drive toward net-zero objectives and long-term resource efficiency.

Assessing the Compound Consequences of U.S. Steel Tariff Measures Enacted in 2025 on Supply Chains, Pricing, and Global Sourcing Strategies

The cumulative impact of U.S. tariff measures implemented in 2025 has introduced layered complexity to global sourcing strategies and pricing structures. Effective March 12, 2025, all imports of steel articles and derivative steel articles originating from major trade partners-including the European Union, Japan, South Korea, and Canada-became subject to additional ad valorem duties under Section 232 provisions, following the termination of existing alternative agreements. This reinstatement of 25% tariffs created an immediate shift in cost economics for importers, prompting many to reevaluate supplier portfolios and accelerate procurement from domestic mills.

Subsequently, emerging discussions regarding a potential framework trade deal between the U.S. and EU have introduced prospects for further tariff adjustments, with proposals citing baseline duties of 15% on European goods and elevated steel levies of up to 50% for certain import categories if agreements falter. Industry analysts caution that such a dual-layer tariff architecture would deepen price volatility, spurring European producers to reroute volumes toward non-U.S. markets and exerting downward pressure on regional pricing benchmarks. On the downstream side, research indicates that U.S. importers will pass a significant portion of these elevated duties onto end consumers, potentially inflating costs for steel-intensive sectors such as automotive and appliances by upwards of 15% in the near term.

These evolving trade dynamics underscore the importance of agile procurement frameworks and diversified supply networks, as companies grapple with jurisdictional tariff differentials and seek to mitigate exposure through long-term contracts, nearshoring initiatives, and strategic inventory positioning.

Deciphering Comprehensive Segmentation Patterns Revealing Diverse Demand Profiles Across Special Steel Types, Forms, and Critical End Uses

The special steel market’s landscape is defined by nuanced classifications across alloy compositions, product geometries, and end-use applications, each segment presenting distinct value propositions and growth trajectories. Within the alloy steel portfolio, high-performance categories such as bearing, boron, cryogenic, electrical, and spring steels command premium pricing due to their mechanical integrity under extreme conditions, while carbon varieties-spanning high and ultra-high carbon grades-remain essential for forging and tool-making purposes. Stainless steels, in all its austenitic, duplex, ferritic, and martensitic forms, support corrosion-resistant solutions in chemical processing and marine environments, and tool steels-ranging from alloy tool to carbon tool and high-speed variants-enable precision machining and die-casting operations.

Product form further differentiates market behavior, with bars and rods, coils, forgings, sheets and plates, and tubes and pipes driving unique manufacturing workflows. Coils dominate high-volume stamping processes in automotive assembly, whereas tubes and pipes underpin energy sector infrastructures and off-shore applications. Sheets and plates find extensive use in machinery enclosures and structural frameworks, complemented by forgings for critical components in oil and gas equipment.

Application segmentation highlights aerospace as a pivotal end market, subdivided into aircraft manufacturing and defense equipment, both of which demand the strictest metallurgical standards and traceability protocols. Automotive components leverage advanced high-strength steels to improve fuel efficiency and safety, while the energy sector, machinery, and structural applications continue to absorb specialized grades for pipelines, heavy equipment, and building projects. Together, these interlocking layers form a multidimensional view of demand patterns, guiding suppliers toward targeted product development and go-to-market strategies.

This comprehensive research report categorizes the Special Steel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Form

- Application

- Distribution Channel

Uncovering Regional Growth Drivers and Market Adaptations Across Americas, EMEA, and Asia-Pacific in the Evolving Special Steel Landscape

Regional dynamics in the special steel market reflect disparate regulatory environments, infrastructure investment priorities, and supply chain realignments. The Americas have witnessed a concerted effort to reshore production capacities, driven by U.S. tariff realignments under Section 232 and strategic incentives aimed at bolstering domestic manufacturing resilience. These policies have encouraged integrated steelmakers to expand mill output and invest in electric arc furnace facilities to meet local demand, even as geopolitical considerations shape cross-border trade flows with Canada and Mexico under revised agreements.

In Europe, Middle East, and Africa, producers grapple with countermeasure tariffs imposed by the EU in response to U.S. duties, while navigating the EU’s Steel and Metals Action Plan and evolving carbon border adjustment mechanisms. Manufacturers are increasingly leveraging renewable energy sources to offset energy cost pressures and align with the European Green Deal, and Middle Eastern markets are rapidly scaling upstream capacities to supply regional infrastructure projects and petrochemical expansions.

The Asia-Pacific region remains the world’s largest hub for special steel production, underpinned by China’s decarbonization imperatives and India’s infrastructure-driven demand. China’s shift toward electric arc furnace-based production represents a strategic pivot to lower carbon footprints, and Japan and South Korea continue advancing high-grade specialty alloys for automotive export markets. India similarly pursues capacity additions and import substitution strategies to support growth in rail, power, and urban construction segments.

This comprehensive research report examines key regions that drive the evolution of the Special Steel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Special Steel Manufacturers and Their Strategic Initiatives Shaping Innovation, Production, and Market Positioning

The competitive ecosystem of special steel manufacturing is characterized by the interplay of global scale, technological leadership, and strategic regional positioning. At the forefront are steel conglomerates such as China Baowu Group and ArcelorMittal, which collectively accounted for over 190 million metric tons of crude steel output in 2024, underscoring their capacity to influence global pricing dynamics and supply continuity. These industry titans have been actively deploying hydrogen-based direct reduction pilot projects and carbon capture initiatives, signaling a shift toward low-carbon production pathways and long-haul decarbonization commitments.

Mid-tier players such as SSAB and Vallourec illustrate differentiated strategic responses to market pressures. SSAB’s recent financial disclosures highlighted a 28% year-over-year dip in second-quarter operating profit, attributing the decline to elevated tariff-induced volatility and high energy expenditures, while reaffirming its focus on specialty products and proximity to key customers. Meanwhile, Vallourec has leveraged higher U.S. steel prices resulting from new tariffs to bolster full-year profitability projections and achieve early debt reduction milestones, emphasizing contract wins in oil and gas and low-carbon energy segments.

Nippon Steel, POSCO, and United States Steel Corporation round out the leadership cohort, each balancing capacity modernization with targeted alloy development. Their investments in R&D pipelines and integrated supply solutions position them to meet evolving specifications from automotive, aerospace, and energy sector OEMs, while navigating complex trade landscapes and regulatory frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Special Steel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acerinox, S.A.

- Aichi Steel Corporation

- AK Steel International B.V. by CLEVELAND-CLIFFS INC.

- Alleima AB

- Aperam SA

- ArcelorMittal S.A.

- China BaoWu Steel Group Corporation Limited

- Citic Limited

- Daido Steel Co., Ltd.

- Dongbei Special Steel Group Co., Ltd.

- Gerdau S/A

- Goel Steel Company

- HBIS Group

- Hebei Donghai Special Steel Group Co., Ltd.

- Hyundai Steel Co. Ltd.

- JFE Holdings, Inc.

- Jiangsu Longqi Metal Manufacturing Co., Ltd.

- JSW Steel Limited.

- Kobe Steel, Ltd

- Metallus Inc.

- Montanstahl AG

- Nanjing Iron & Steel Group International Trade Co., Ltd.

- Nippon Steel Corporation

- Outokumpu Oyj

- POSCO HOLDINGS INC.

- Salzgitter AG

- SSAB Group

- Subhlaxmi Steel And Alloys Pvt Ltd.

- Swiss Steel Holding AG

- Tata Steel Limited

- Thyssenkrupp AG

- Voestalpine AG

Implementing Targeted Strategies for Resilience and Growth by Leveraging Innovation, Supply Chain Diversification, and Collaborative Partnerships

To capitalize on emerging opportunities and mitigate evolving risks, industry leaders must pursue a multipronged strategic agenda centered on innovation, supply chain agility, and collaborative ecosystems. First, accelerating the deployment of advanced process controls and digital analytics will drive operational excellence, enabling predictive maintenance, yield optimization, and real-time quality assurance that translate into lower total cost of ownership for end customers.

Second, supply chain diversification through nearshoring initiatives, multi-sourcing agreements, and strategic inventory buffering will fortify resilience against tariff fluctuations and geopolitical shocks. By fostering closer partnerships with logistics providers and leveraging bonded warehouse structures, companies can optimize lead times and reduce exposure to import duties.

Third, engaging in consortium-based decarbonization projects-such as shared hydrogen hubs or joint carbon capture ventures-will enable cost sharing and expedite technology scaling, supporting long-term compliance with net-zero mandates. This collaborative approach can extend to material circularity programs that reclaim scrap and reduce reliance on primary feedstocks.

Finally, embedding customer co-innovation frameworks, whereby producers and OEMs jointly develop next-generation alloys and application-specific solutions, will secure long-term offtake agreements and strengthen barriers to entry. Cultivating these strategic imperatives will position organizations to thrive amid dynamic industry headwinds.

Detailing a Robust Multimethod Research Framework Integrating Primary Stakeholder Engagement and Secondary Data Synthesis

This research applies a multimethod approach, integrating qualitative and quantitative techniques to ensure comprehensive market coverage and actionable insights. Primary data was gathered through structured interviews with senior executives, procurement specialists, and R&D leaders across the special steel ecosystem, complemented by in-depth consultations with trade associations and regulatory bodies. Secondary research involved systematic analysis of corporate disclosures, industry publications, government tariff proclamations, and peer-reviewed studies on metallurgical process innovations.

The triangulation process employed cross-verification of inputs, aligning interview feedback with trade flow statistics and production data to validate trend observations. Data normalization protocols were instituted to harmonize terminology and classification schemes, ensuring alignment with global standard taxonomies for steel types, product forms, and application segments. This rigorous methodology underpins the robustness of insights and facilitates scenario planning for stakeholders navigating tariff evolutions, technological adoption curves, and sustainability mandates.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Special Steel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Special Steel Market, by Type

- Special Steel Market, by Product Form

- Special Steel Market, by Application

- Special Steel Market, by Distribution Channel

- Special Steel Market, by Region

- Special Steel Market, by Group

- Special Steel Market, by Country

- United States Special Steel Market

- China Special Steel Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesis of Core Insights Underscoring Strategic Imperatives and Future Directions in the Special Steel Industry

As the special steel sector continues its transition toward digitalization, decarbonization, and geopolitical realignment, stakeholders must stay ahead of convergent trends that shape demand and competitive dynamics. The interplay of advanced alloy development, tariff-driven cost shifts, and regional policy incentives will redefine growth corridors and strategic imperatives for years to come. Producers that excel in operational adaptability, forge collaborative innovation networks, and invest in low-carbon production will emerge as dominant players in a rapidly evolving value ecosystem.

In conclusion, the special steel market’s resilience is anchored in its ability to blend engineering precision with strategic foresight. By systematically addressing supply chain mutability, embracing sustainable production models, and deepening customer partnerships, industry participants can unlock value and secure sustainable growth. As global infrastructure and energy transition agendas gain momentum, the strategic importance of special steel will only intensify, cementing its role as a critical enabler of technological and societal progress.

Connect with Ketan Rohom to Secure Comprehensive Insights and Empower Your Strategic Decisions with the Full Special Steel Market Research

To access the full depth of analysis, including detailed section-by-section breakdowns, advanced data visualizations, and exclusive market intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing, at your earliest convenience. Engage with an expert who can guide your organization through the complexities of the special steel market and deliver actionable insights tailored to your strategic priorities. Secure your comprehensive research report today to position your business ahead of industry shifts and drive long-term competitive advantage.

- How big is the Special Steel Market?

- What is the Special Steel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?