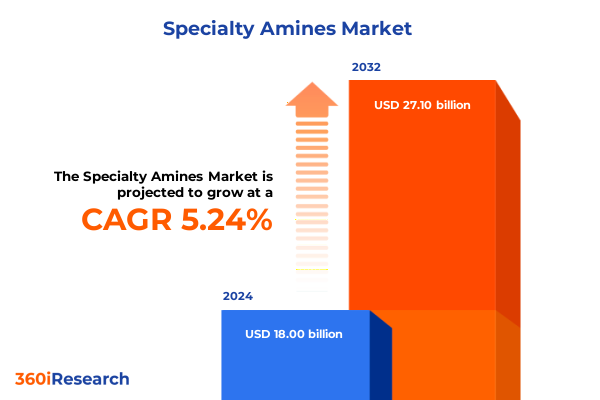

The Specialty Amines Market size was estimated at USD 18.96 billion in 2025 and expected to reach USD 19.97 billion in 2026, at a CAGR of 6.31% to reach USD 29.10 billion by 2032.

Unveiling the Crucial Role of Specialty Amines in Modern Industries and the Drivers Shaping Their Evolution in Today’s Chemical Landscape

The specialty amines market plays a pivotal role in modern industrial processes, underpinning the synthesis of surfactants, corrosion inhibitors, flocculants, and numerous specialty formulations. Its versatility stems from the unique chemical properties of amines, which enable precise functionalization across a diverse array of applications-from agrochemicals to pharmaceuticals. The complexity of this market arises from its intricate value chain, where raw material sourcing, production technology, and regulatory frameworks intersect to shape competitive dynamics.

Amid shifting macroeconomic conditions and evolving sustainability imperatives, industry participants are navigating unprecedented pressures. Volatile feedstock prices, tightened environmental regulations, and the imperative for operational agility are compelling manufacturers to reassess traditional business models. Simultaneously, downstream customers demand higher performance and eco-friendly credentials, intensifying the need for innovation in amine chemistries.

Navigating Transformative Shifts as Sustainability, Digitalization, and Regulatory Dynamics Revolutionize the Specialty Amines Industry

The specialty amines industry is undergoing a profound transformation as manufacturers embrace sustainability and circular economy principles. Driven by stricter regulatory frameworks and heightened customer expectations, companies are reallocating research and development budgets toward bio-based production pathways. Alternative feedstocks-ranging from vegetable oil derivatives to lignocellulosic byproducts-are being adopted to replace traditional petrochemical inputs. This shift not only addresses regulatory mandates like the EU’s REACH restrictions but also aligns with market demand for low-carbon and renewable products. For instance, a significant portion of new amine patent filings now focuses on biogenic synthesis routes, reflecting a strategic pivot toward greener chemistry and lifecycle-focused commercial strategies.

Simultaneously, catalyst innovation is unlocking more efficient and selective reaction pathways, reducing energy consumption and by-product formation. Research into renewable-inspired catalytic designs has demonstrated notable gains in atom economy and process mass intensity, underscoring the need for continuous development of sustainable production methods. These advances are fostering closer collaborations between chemical producers and academic institutions, as both seek to refine bio-based transformation techniques that can compete with well-established petrochemical processes.

Digital technologies are also reshaping operational paradigms, with smart manufacturing, AI-driven analytics, and predictive maintenance becoming integral to competitive performance. Leading producers are deploying digital twin models to optimize reactor conditions and anticipate downtime, thereby enhancing reliability and cost efficiency. Meanwhile, blockchain and advanced analytics are enhancing supply chain transparency, enabling real-time visibility into raw material provenance and quality metrics. Together, these technological and sustainable innovations are converging to redefine the specialty amines landscape, demanding agility and strategic foresight from industry leaders.

Assessing the Far-Reaching and Cumulative Effects of 2025 U.S. Tariff Policies on Specialty Amines Supply Chains and Cost Structures

In 2025, U.S. trade policy introduced sweeping tariffs that have reverberated through the specialty amines value chain. The baseline tariff of 10% on all chemical imports was coupled with escalated reciprocal rates-20% for EU-origin goods, 10% for the United Kingdom, 25% for South Korea, and 24% for Japan-culminating in an effective 54% levy on Chinese imports. These measures are intended to address trade imbalances but have also led to significant cost inflations for critical chemical inputs.

Key amine feedstocks, such as methanol and olefin derivatives, have been subject to these levies, prompting freight expenses and underlying prices to surge. Supply chain fees-including proposed maritime levies on Chinese-flagged vessels-have driven freight cost increases of up to 228% and product price hikes in the range of 33–37% for chemicals like ethylene glycol and ethanolamine, according to industry testimony to USTR. These combined burdens have compressed margins for downstream manufacturers of solvents, resin intermediates, and corrosion inhibitors.

The imposition of steep tariffs has spurred a strategic pivot among specialty amines suppliers, who are diversifying procurement away from traditional Chinese sources. Companies are exploring alternative suppliers in Southeast Asia and the Middle East, yet logistical bottlenecks and quality assurance protocols have slowed volume realignments. In parallel, formulators of pharmaceutical-grade intermediates are leveraging existing partnerships with European producers to mitigate exposure.

Critically, these trade measures have catalyzed renewed investments in U.S. production infrastructure. Capital expenditures aimed at expanding batch and continuous amine synthesis capabilities are being accelerated to reduce import reliance and align with federal policy incentives. While the short-term impact has strained supply consistency, the long-term effect may yield a more resilient and regionally diversified supply network, provided industry participants maintain their focus on process innovation and supply chain transparency.

Deriving Strategic Insights from Five Critical Dimensions of Specialty Amines Market Segmentation to Guide Targeted Business Decisions

A robust understanding of specialty amines market segmentation is essential for precise strategic planning. Categorization by type uncovers critical differences in demand drivers: alkyl amines, amino ethers, and aromatic amines serve diverse end-use industries, while amino alcohols-subdivided into diethanolamine, monoethanolamine, and triethanolamine-address specific performance requirements in applications such as corrosion inhibition and surfactant production.

Application-based segmentation further illuminates market dynamics. Agrochemical uses span from herbicides to fungicides and insecticides, each requiring tailored amine intermediates. Flocculants-whether anionic, cationic, or nonionic-play vital roles in water treatment, while surfactant classes including amphoteric, anionic, cationic, and nonionic serve in detergents, personal care, and industrial cleaning.

End-use industry analysis is equally revealing: agriculture, household and personal care, oil and gas, and pharmaceuticals each present distinct quality, supply chain, and regulatory prerequisites. The physical form of amines-liquid, pellet, or powder-affects handling protocols, storage costs, and formulation flexibility, influencing supplier capabilities and downstream manufacturing processes.

Finally, production technology segmentation highlights the competitive edge derived from adsorption, distillation, extraction, and membrane separation processes. Each method carries its own capital intensity, energy profile, and purity outcomes, informing both capital investment decisions and operational optimization strategies.

This comprehensive research report categorizes the Specialty Amines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Form

- Technology

- Application

- End Use Industry

Unlocking Regional Growth Patterns and Competitive Advantages in the Americas, Europe Middle East & Africa, and Asia-Pacific Specialty Amines Markets

Regional dynamics are reshaping competitive advantages in the specialty amines sector. In the Americas, investment incentives and onshore expansion projects have strengthened domestic supply chains. Major chemical hubs in the Gulf Coast region benefit from integrated infrastructure, access to natural gas feedstocks, and supportive policies aimed at bolstering local manufacturing capacity - a trend underscored by substantial project announcements and capacity build-outs.

Europe, the Middle East & Africa face a more complex environment. Stringent environmental regulations-such as the European Chemicals Agency’s evolving REACH requirements-coupled with ambitious carbon reduction targets, have driven companies to adopt renewable energy and sustainable feedstock strategies across their production networks. Bio-based and circular-economy initiatives are gaining traction, particularly in Northern Europe, where clusters are emerging around renewable chemical production and collaborative research efforts.

Asia-Pacific continues to lead in capacity growth, driven by expansive investments in China, India, and Southeast Asian markets. However, new U.S. tariffs on transshipped goods have prompted Southeast Asian producers to reorient export strategies, while joint-venture projects in Vietnam and Malaysia are reshaping supply-chain geographies. These dynamics underscore the need for agile sourcing strategies and deeper regional partnerships to navigate evolving trade policies and emerging market opportunities.

This comprehensive research report examines key regions that drive the evolution of the Specialty Amines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Competitive Strategies and Differentiation Tactics of Leading Specialty Amines Manufacturers in a Dynamic Market Environment

Leading specialty amines manufacturers are distinguishing themselves through targeted capacity investments, sustainable energy deployments, and precision portfolio management. BASF’s Intermediates division, for example, transitioned its entire European amines portfolio to 100% renewable electricity beginning in May 2025, achieving an annual reduction of approximately 188,000 tonnes of CO₂-equivalent emissions and reinforcing its commitment to supporting customer Scope 3 targets.

Huntsman Corporation has pursued a dual strategy of regional capacity expansion and high-purity product development. Its recent investments include a 50% capacity increase for its JEFFAMINE® polyetheramines in Llanelli, Wales, alongside a planned $70 million expansion to double polyetheramine output on Jurong Island, Singapore. Moreover, Huntsman’s Conroe, Texas site added an E-Grade purification unit for semiconductor-grade amines, positioning it to meet critical high-purity demand in advanced electronics manufacturing.

Evonik has reinforced its Asia-Pacific footprint by breaking ground on a million-euro specialty amine plant in Nanjing, China, slated to serve polyurethane and epoxy curing agent markets. This facility will operate on green electricity and enable faster commercialization of new amine chemistries with reduced VOC emissions, strengthening Evonik’s ability to meet regional demand growth and sustainability goals.

Meanwhile, Dow has undertaken portfolio optimization actions, including the scheduled shutdown of higher-cost upstream assets in Europe to right-size capacity and improve profitability. These strategic moves reflect broader industry efforts to balance global footprint rationalization with investments in high-growth, low-carbon segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Specialty Amines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V

- Alkyl Amines Chemicals Limited

- Arkema S.A.

- BASF SE

- Celanese Corporation

- Clariant AG

- Covestro AG

- Eastman Chemical Company

- Evonik Industries AG

- Huntsman Corporation

- Indo Amines Limited

- INEOS AG

- Kao Corporation

- Lanxess AG

- Merck KGaA

- Mitsubishi Chemical Corporation

- NOF Corporation

- Nouryon Chemicals Holding B.V.

- OQ Chemicals GmbH

- Sasol Limited

- Solvay S.A.

- The Dow Chemical Company

- Tokyo Chemical Industry Co., Ltd.

- Tosoh Corporation

- Wanhua Chemical Group Co., Ltd.

Implementing Actionable Strategies for Specialty Amines Industry Leaders to Strengthen Resilience, Drive Innovation, and Ensure Sustainable Growth

Industry leaders should prioritize a structured approach to sustainability integration by embedding green chemistry metrics into product development pipelines. This entails adopting lifecycle assessments early in R&D to ensure new amine formulations meet emerging environmental regulations and customer ESG benchmarks. Collaborative partnerships with feedstock suppliers can secure reliable bio-based inputs and mitigate raw material variability.

Next, decision-makers must leverage advanced digital tools-such as AI-driven process analytics and digital twins-to optimize reactor performance and supply chain resilience. Implementing predictive maintenance and real-time quality monitoring can reduce unplanned downtime and enhance consistency in high-purity amine production.

In light of tariff-induced cost pressures, companies should evaluate regional sourcing strategies and consider onshore capacity expansions or toll manufacturing agreements to minimize exposure. Robust scenario planning for trade policy shifts will enable rapid response to altered cost structures and ensure uninterrupted product supply.

Finally, a disciplined portfolio review is essential. By aligning product offerings with high-margin, high-growth segments-such as semiconductor-grade and bio-derived amines-organizations can optimize capital allocation, exit non-core assets, and strengthen financial performance while funding innovation programs.

Detailing a Rigorous Mixed-Method Research Methodology Integrating Primary and Secondary Approaches for Specialty Amines Market Analysis

This analysis combines primary and secondary research methodologies to capture a holistic view of the specialty amines market. Secondary research encompassed comprehensive reviews of trade policy announcements, corporate press releases, regulatory filings, and reputable industry publications. Specialized databases and published technical literature were also leveraged to extract insights on production technologies, sustainability metrics, and supply chain developments.

Primary research involved targeted interviews with senior executives across the specialty chemicals value chain, including R&D leaders, supply chain managers, and commercial strategists. These discussions provided firsthand perspectives on emerging trends, technology adoption, and strategic responses to tariff fluctuations. The interviewing process was guided by a structured questionnaire to ensure consistency and comparability of qualitative inputs.

All collected data underwent rigorous validation through triangulation-cross-checking findings against multiple sources and reconciling discrepancies. Quantitative inputs were corroborated with industry benchmarks and expert consensus, while qualitative insights were subjected to peer review among sector analysts. This blended methodology ensures the credibility and relevance of the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Specialty Amines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Specialty Amines Market, by Type

- Specialty Amines Market, by Product Form

- Specialty Amines Market, by Technology

- Specialty Amines Market, by Application

- Specialty Amines Market, by End Use Industry

- Specialty Amines Market, by Region

- Specialty Amines Market, by Group

- Specialty Amines Market, by Country

- United States Specialty Amines Market

- China Specialty Amines Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Reflections on the Evolving Specialty Amines Sector and Its Crucial Role in Supporting Innovation Across Diverse Industries

The specialty amines sector stands at an inflection point, propelled by stringent environmental mandates, evolving global trade dynamics, and accelerated technological innovation. As sustainability and digitalization become non-negotiable imperatives, manufacturers must realign their strategies to secure resilient supply chains, develop eco-efficient production routes, and capture high-value market niches.

Trade policy shifts, particularly the 2025 tariff regime, have underscored the importance of regional diversification and onshore investment to protect margins and maintain continuity of supply. Meanwhile, segmentation insights reveal that nuanced differences in type, application, and technology must inform targeted product development and go-to-market approaches.

Through deliberate execution of the actionable recommendations and leveraging the comprehensive market data herein, industry participants are well positioned to navigate the complexities of the evolving specialty amines landscape. The combined focus on sustainability, operational excellence, and strategic agility will define the next era of competitive leadership in this critical chemicals sector.

Engage with Ketan Rohom to Secure Comprehensive Specialty Amines Market Insights and Propel Your Strategic Decisions with Expert Guidance

I invite you to engage directly with Ketan Rohom, an experienced Associate Director of Sales & Marketing specializing in the Specialty Amines sector. By partnering with Ketan, you gain access to a tailored dialogue that uncovers the precise questions and challenges most relevant to your strategic roadmap. His in-depth understanding of industry dynamics and buyer requirements ensures that you receive a research offering aligned with your organizational priorities. Reach out to Ketan today to discuss how this comprehensive market intelligence can inform your product development, sourcing strategies, and investment decisions. Seize this opportunity to leverage expert guidance and secure the full market research report that will empower your team to navigate the evolving specialty amines landscape with confidence and clarity.

- How big is the Specialty Amines Market?

- What is the Specialty Amines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?