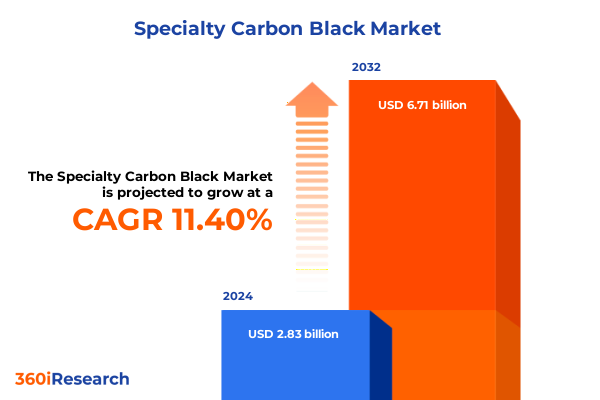

The Specialty Carbon Black Market size was estimated at USD 3.14 billion in 2025 and expected to reach USD 3.50 billion in 2026, at a CAGR of 11.43% to reach USD 6.71 billion by 2032.

Unveiling the Dynamics of the Specialty Carbon Black Market with Key Drivers Challenges and Emerging Opportunities in a Rapidly Evolving Landscape

The specialty carbon black market stands at a pivotal crossroads as technological innovation, sustainability mandates, and shifting supply dynamics converge to reshape the competitive terrain. Against a backdrop of intensifying regulatory scrutiny and the accelerating electrification of end markets, this research captures the critical forces dictating industry trajectories. From automotive and electronics to coatings and plastics, specialty carbon black applications are diversifying, driven by demand for enhanced performance characteristics and environmental credentials.

This executive summary distills the essence of a comprehensive analysis, highlighting key trends, market drivers, and strategic imperatives. The report navigates through the transformative shifts redefining value chains, assesses the cumulative impact of United States tariffs enacted in 2025, and delivers granular segmentation and regional insights to guide targeted initiatives. By integrating forward-looking perspectives and evidence-based recommendations, this document equips decision-makers with the clarity and confidence required to anticipate disruptions, optimize operations, and capture sustainable growth avenues in an increasingly competitive global landscape.

Transformative Technological and Regulatory Shifts Reshaping the Value Chain and Competitive Differentiation in Specialty Carbon Black

A confluence of macroeconomic and technological shifts is fundamentally altering the specialty carbon black landscape. Rapid advancements in battery materials and next-generation electronic components have elevated conductive and antistatic grades from niche to strategic imperatives. Simultaneously, heightened environmental regulations and customer demands for lower carbon footprints are prompting manufacturers to innovate greener production methods and alternative feedstocks.

Supply chain resilience has emerged as a top priority, with industry participants reevaluating sourcing strategies in response to raw material volatility and logistics disruptions. Digitalization, from predictive maintenance to data-driven process optimization, is accelerating operational efficiency and enabling real-time quality control. Meanwhile, investment in research and development is unlocking novel functional properties, such as improved dispersion in inks and coatings and enhanced reinforcement in advanced polymers. Together, these transformative shifts are redefining value creation and competitive differentiation across the specialty carbon black ecosystem.

Cumulative Impact of 2025 United States Tariffs on Production Economics Supply Chain Resilience and Competitive Positioning

United States tariffs introduced in 2025 have had a profound cumulative effect on the specialty carbon black market, triggering price adjustments, supply realignments, and strategic partnerships. Escalating duties on imports of high-performance precursor materials have upstream ripple effects, compelling domestic producers to reassess procurement frameworks and explore alternative feedstock sources. The resulting cost pressures have been partially absorbed through operational efficiencies and lean manufacturing initiatives, while some companies have pursued vertical integration to secure critical inputs.

On the downstream side, raw material price pass-through to customers has been judiciously managed to preserve margins and maintain competitiveness across application segments. Companies with diversified geographical footprints have mitigated exposure to tariff-induced volatility, whereas those heavily reliant on single-source imports have intensified efforts to localize production and fortify regional alliances. Overall, the 2025 tariff environment has underscored the importance of agile supply chain design and strategic resilience planning in sustaining profitability and growth.

Comprehensive Segmentation Insights Highlighting Performance Demands Processing Routes and End-Use Dynamics Creating Market Differentiation

The market landscape is multifaceted, reflecting nuanced variations across distinct application categories, product grades, end-user industries, processing routes, and particle size distributions. Within batteries and electronics, the antistatic and conductive subsegments are propelled by surging demand for energy storage solutions and advanced electronic assemblies, where conductivity and stability are paramount. In coatings and inks, the differentiation between packaging coatings and printing inks underscores the need for tailored surface finish and color consistency.

Non-tire rubber applications, spanning cable sheathing, hoses, mechanical parts, and molded goods, demand specific performance attributes ranging from tensile strength to abrasion resistance. In plastics, film, masterbatch, and packaging component manufacturers require precise loading levels and dispersion quality to enhance tensile properties and UV protection. Grade-based diversity highlights carriers and dispersing agents that optimize polymer blending, while conductive variants serve battery conductive pathways and electromagnetic shielding. End-user segmentation across automotive, construction, electrical, and packaging sectors reveals varying adoption curves for specialty grades, reflecting both OEM and aftermarket requirements. Processing technologies, including furnace routes, gas and lamp methods, and thermal approaches, each impart unique morphological characteristics, while particle size classes from coarse to ultrafine influence rheology and optical attributes. Together, these segmentation dimensions illustrate a complex interplay of performance demands and production considerations that define strategic positioning in the specialty carbon black domain.

This comprehensive research report categorizes the Specialty Carbon Black market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Process

- Grade

- Particle Size

- Application

- End User Industry

Regional Market Dynamics Driven by Automotive Electrification Circular Economy Policies and Infrastructure Development Across Americas EMEA and APAC

Regional dynamics in the specialty carbon black market are shaped by a tapestry of economic growth patterns, regulatory environments, and industry clusters. In the Americas, robust automotive production hubs and expanding electronics manufacturing corridors underpin strong demand for conductive and reinforcement grades. Sustainability initiatives and local capacity expansions are catalyzing investments in low-emission production facilities, aligning with broader decarbonization goals.

Europe, Middle East and Africa present a diverse tableau of mature markets and emerging economies. Stringent emissions standards and ambitious circular economy targets in Western Europe are driving the adoption of bio-based feedstocks and closed-loop recycling practices. Meanwhile, construction and packaging growth in Middle Eastern and African markets offers incremental opportunities for specialty carbon black tailored to building materials and flexible packaging applications.

Asia-Pacific stands as the fastest-growing region, fueled by electrification trends, surging consumer electronics demand, and dynamic infrastructure development. Investments in battery gigafactories and advanced polymer manufacturing in China, South Korea, and India are reshaping global supply chains and intensifying competition among regional producers. Government incentives for clean technologies and import substitution policies further reinforce Asia-Pacific’s pivotal role in defining the future trajectory of specialty carbon black.

This comprehensive research report examines key regions that drive the evolution of the Specialty Carbon Black market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning of Market Leaders and Innovators Fueled by Integrated Value Chains Technological Leadership and Sustainability Initiatives

Leading producers in the specialty carbon black arena are differentiated by their integrated value chains, technological prowess, and strategic partnerships. Global incumbents have solidified their positions through targeted acquisitions and joint ventures, extending product portfolios and enhancing regional footprints. Investment in proprietary process technologies and digital platforms has strengthened quality assurance and accelerated new product introductions.

Mid-tier specialists are carving out niche leadership in high-performance formulations, leveraging agile R&D operations to address emerging application demands. Collaborations with battery OEMs, coating formulators, and polymer innovators have produced co-developed solutions that optimize material properties and reduce development timelines. Strategic alliances with raw material suppliers and logistics providers have further fortified supply resilience, enabling these companies to respond swiftly to market shifts.

Simultaneously, new entrants focused on sustainable feedstocks and low-carbon production processes are capturing traction, appealing to customers with ambitious decarbonization targets. By combining differentiated product attributes with traceability and lifecycle analytics, these challengers are catalyzing competitive responses and driving broader industry transformation toward greener, higher-performance specialty carbon blacks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Specialty Carbon Black market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aditya Birla Group

- Atlas Organics Private Limited

- Bridgestone Corporation

- Cabot Corporation

- Cancarb Limited

- China Synthetic Rubber Corporation

- Continental Carbon Company

- Denka Company Limited

- Himadri Speciality Chemicals Ltd.

- Imerys S.A.

- Jiangxi HEIMAO Carbon black Co., Ltd

- Mil-Spec Industries Corporation

- Mitsubishi Chemical Corporation

- OCI COMPANY Ltd.

- Omsk Carbon group

- Omsk Carbon Group

- Orion Engineered Carbons GmbH

- PCBL Limited

- Ralson Carbon

- Vizag Chemicals Private Limited

Actionable Strategies for Driving Agility Innovation and Resilience Through Collaborative Ecosystems and Sustainable Production Platforms

Industry leaders aiming to navigate the evolving specialty carbon black landscape should prioritize the diversification of raw material sources and invest in modular, scalable production platforms that accommodate rapid product customization. Embracing digital twins and advanced analytics can unlock performance enhancements and yield improvements, reducing time to market for novel grades while optimizing energy consumption.

Building collaborative ecosystems with battery manufacturers, polymer producers, and coating formulators will facilitate co-innovation and deepen customer engagement. Targeted research into renewable carbon precursors and carbon capture integration will address regulatory pressures and align with evolving sustainability frameworks. Furthermore, establishing regional innovation centers can accelerate localized product development, enabling rapid response to region-specific application requirements.

To mitigate geopolitical and tariff uncertainties, organizations should adopt flexible supply chain architectures, combining nearshoring and multi-sourcing strategies with inventory buffers and dynamic pricing models. Cultivating strategic partnerships across the value chain will enhance risk sharing and foster transparent communication, ensuring resilience and competitive agility in the face of future disruptions.

Overview of the Rigorous Multi-Source Research Framework Integrating Primary Interviews Secondary Analyses and Triangulation Techniques

This analysis is underpinned by a rigorous research methodology combining primary and secondary data sources. Primary insights were gathered through in-depth interviews with C-level executives, technical experts, and procurement professionals spanning specialty carbon black producers and end-user manufacturers. These qualitative engagements provided firsthand perspectives on market drivers, technology adoption, and supply chain challenges.

Secondary research encompassed a comprehensive review of industry white papers, regulatory filings, patent databases, and trade association publications, supplemented by company financial reports and sustainability disclosures. Market triangulation techniques were employed to reconcile data points and validate trends, ensuring robust and unbiased conclusions. Quantitative modeling tools were leveraged to assess supply chain flows, production capacity distributions, and demand patterns across segmentation dimensions and regions.

Quality assurance protocols included peer reviews by independent subject matter experts and cross-validation of findings against third-party benchmarks. The result is a holistic, evidence-based perspective that empowers stakeholders to make informed strategic decisions in the complex and rapidly evolving specialty carbon black market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Specialty Carbon Black market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Specialty Carbon Black Market, by Process

- Specialty Carbon Black Market, by Grade

- Specialty Carbon Black Market, by Particle Size

- Specialty Carbon Black Market, by Application

- Specialty Carbon Black Market, by End User Industry

- Specialty Carbon Black Market, by Region

- Specialty Carbon Black Market, by Group

- Specialty Carbon Black Market, by Country

- United States Specialty Carbon Black Market

- China Specialty Carbon Black Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Synthesizing Key Findings on Technological Evolution Supply Chain Resilience and Sustainability Imperatives Driving Market Leadership

Specialty carbon black is at the forefront of materials innovation, serving as a critical enabler for advancements in energy storage, electronics, sustainable coatings, and high-performance polymers. The intersection of technological breakthroughs, stringent environmental mandates, and dynamic regional growth prospects presents both compelling opportunities and formidable challenges.

Producers that successfully align their operational strategies with evolving application requirements, regulatory landscapes, and customer sustainability goals will secure differentiated market positions. Conversely, those that neglect supply chain resilience, technological agility, or collaborative partnerships risk forfeiting competitive advantage. Ultimately, the specialty carbon black market’s future will be defined by the capacity to deliver customized, high-performance solutions while navigating geopolitical uncertainties and accelerating decarbonization imperatives.

This executive summary encapsulates the critical insights necessary to chart a strategic course through this complex environment, equipping industry participants with the knowledge to capitalize on emerging growth vectors and mitigate potential disruptions.

Exclusive Invitation to Collaborate with Leadership for Immediate Access to Specialty Carbon Black Market Intelligence and Strategic Advisory

To obtain the full in-depth market research report on specialty carbon black and unlock tailored insights and strategic guidance for your organization, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can facilitate access to the latest data, comprehensive analysis, and bespoke advisory support. Engaging with this research will empower your team to capitalize on emerging opportunities, mitigate evolving risks, and position your portfolio for sustained growth in one of the most dynamic materials markets worldwide. Contact him today to explore subscription options, custom deliverables, and collaborative workshops designed to accelerate your decision-making and drive competitive advantage.

- How big is the Specialty Carbon Black Market?

- What is the Specialty Carbon Black Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?