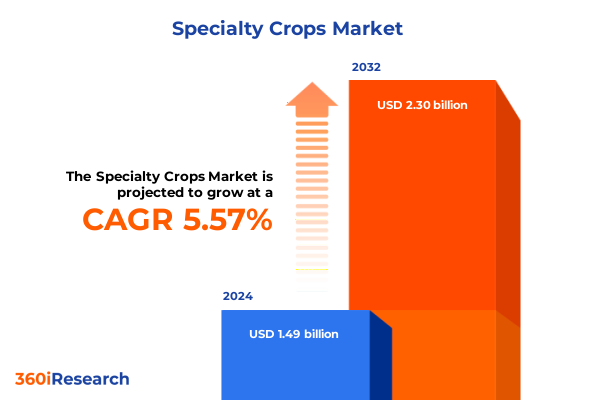

The Specialty Crops Market size was estimated at USD 1.57 billion in 2025 and expected to reach USD 1.66 billion in 2026, at a CAGR of 5.58% to reach USD 2.30 billion by 2032.

Setting the Stage for Evolving Dynamics in the U.S. Specialty Crops Market Amid Global Challenges and Growth Opportunities

Specialty crops, spanning vibrant fruits, robust vegetables, flavorful herbs, aromatic spices, and nutrient-rich nuts, have swiftly transcended their niche origins to occupy a central role in the United States agricultural landscape. Amid shifting consumer demands toward health, sustainability, and culinary exploration, these categories present both unprecedented opportunities and complex challenges for growers, processors, and distributors alike.

Over the past decade, consumer consciousness around nutritional value, provenance, and environmental stewardship has catalyzed higher demand for clean-label, traceable, and sustainably produced goods. In parallel, digitalization has revolutionized both cultivation practices and supply chain transparency, enabling real-time monitoring and deeper engagement with end-users. Consequently, industry participants are called to adapt their operations, embrace innovation, and realign strategic priorities.

Yet this momentum unfolds within a tapestry of global disruptions, from climate variability and labor constraints to evolving trade policies and logistical bottlenecks. Against this backdrop, understanding the intersection of market forces, regulatory shifts, and technological advancements has never been more critical for those aiming to secure resilient growth and sustained profitability in the specialty crops sector.

This executive summary distills crucial insights across transformative shifts, tariff impacts, segmentation dynamics, regional variations, leading corporate strategies, and actionable recommendations. It is crafted to equip stakeholders with the knowledge and contextual perspective necessary to navigate today’s complexities and to chart a clear path forward.

Rapid Technological Innovations and Sustainability Imperatives Redefining Cultivation Processing and Distribution Pathways in Specialty Crops

Precision agriculture technologies, from satellite-guided planting to sensor-driven soil analytics, have redefined how specialty crops are cultivated, enabling producers to optimize yields, reduce waste, and conserve resources. Meanwhile, advances in post-harvest processing-such as controlled atmosphere storage and high-pressure rinsing-have extended product shelf life and broadened distribution reach, reinforcing the value chain at each node.

Concurrently, sustainability imperatives have accelerated the adoption of regenerative practices, integrated pest management, and water-use efficiency measures. Forward-leaning organizations are forging partnerships to certify regenerative supply chains, embedding carbon sequestering techniques and circular waste management into their operational DNA.

Distribution has also undergone a metamorphosis, as digital marketplaces and direct-to-consumer platforms amplify market access for artisanal and small-scale producers. Traceability protocols leveraging blockchain are enhancing food safety compliance and deepening consumer trust in provenance claims, while automation in packing and sorting facilities delivers speed and consistency at scale.

Together, these forces are converging to create an ecosystem that not only elevates quality and resilience but also reorients competitive advantage around agility, transparency, and environmental responsibility.

Escalating Trade Barriers and Their Ripple Effects on Input Costs Supply Chains and Global Competitiveness in the Specialty Crops Sector

In 2025, a constellation of tariff measures has reshaped the economics of specialty crop production and trade, generating upstream cost pressures and redistributing sourcing patterns. Heightened duties on agricultural machinery imports have elevated capital expenditures for growers, compelling the pursuit of domestic equipment solutions and phased modernization plans.

Tariffs on intermediate inputs, including fertilizers and packaging materials, have further squeezed operational margins, particularly for processors reliant on steel cans and glass bottles. As a result, many market participants have initiated strategic realignments of supply chains, exploring near-sourcing strategies in Central America for certain produce lines while negotiating volume discounts with multiple global suppliers.

On the export front, reciprocal duties on select U.S. specialty crop exports have tempered international demand growth, incentivizing strategic pivot toward markets with more favorable trade frameworks. Concurrently, some regions have responded with subsidy adjustments to support local producers, intensifying competition in key categories such as berries and tree nuts.

The cumulative impact of these tariffs underscores the necessity for dynamic scenario planning, diversified procurement strategies, and robust cost-management frameworks that enable industry stakeholders to sustain competitiveness and mitigate exposure to policy volatility.

Unearthing Critical Market Segmentation Drivers Across Crop Types Product Forms Distribution Channels and Application Verticals

When examining segmentation by crop type, fruits dominate overall volume, with berries and citrus demonstrating pronounced growth driven by functional health attributes and year-round availability. Stone fruits command niche appeal during limited harvest windows, whereas tropical fruits are carving out a premium segment through imported exotic varieties. Within herbs and spices, demand for fresh basil and cilantro continues to rise alongside surging interest in turmeric supplements. Nuts, led by almonds in tree nut production, remain a staple in plant-based snacking and dairy alternatives, while peanuts sustain their role in both processing and direct consumption channels. Regarding vegetables, leafy greens hold the largest share in ready-to-eat formats, whereas tomatoes and peppers are increasingly processed into value-added sauces and offerings.

From the standpoint of product form, fresh formats consistently capture the lion’s share of revenue, buoyed by advancements in modified atmosphere packaging and cold chain logistics. Frozen offerings have experienced a resurgence as they deliver extended shelf life and convenience, especially under individual quick freeze technologies. Canned specialties maintain a loyal consumer base in sectors favoring shelf stability, while juices and concentrates leverage extractive innovations to enhance flavor retention. Dried applications, including freeze-dried fruit powders and dehydrated herbs, are capitalizing on demand from nutraceutical and functional food manufacturers.

In distribution channels, supermarkets and hypermarkets remain the primary conduits for specialty crops, supported by dedicated produce departments and in-store sampling initiatives. However, direct-to-consumer e-commerce models and pure-play online retailers are capturing incremental growth by offering subscription services and hyper-personalized assortments. Specialty stores continue to serve curated shopper segments valuing organic, heirloom, and artisanal products, while convenience outlets play a tactical role in urban quick-grab consumption moments.

Turning to application, the food sector represents the largest end-use, with bakery, confectionery, and ready meal manufacturers integrating specialty crop ingredients to satisfy clean-label mandates. The beverage segment is bifurcated between alcoholic infusions featuring fruit concentrates and non-alcoholic wellness blends showcasing botanical extracts. Nutraceutical applications harness concentrated antioxidants and bioactives in functional food formulations and dietary supplements, while pharmaceuticals and cosmetics utilize select extracts for bioactive properties and natural pigment applications.

This comprehensive research report categorizes the Specialty Crops market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Crop Type

- Product Form

- Application

- Distribution Channel

Regional Nuances Shaping Specialty Crop Demand and Supply Chain Resilience Across the Americas EMEA and Asia-Pacific

Throughout the Americas, the United States remains a hub for specialty crop innovation, fueled by a sophisticated retail ecosystem and abundant domestic research infrastructure. Canada and Mexico play complementary roles, both as major exporters of off-season produce and as vital sources of labor and agro-inputs. Regional trade agreements continue to influence planting schedules and varietal selections, shaping cross-border flows of berries, tomatoes, and avocados.

In Europe, the Middle East, and Africa, stringent regulatory standards on residue levels and environmental practices steer cultivation toward integrated pest management and organic certifications. Europe’s robust demand for high-quality specialty produce is balanced by import dependencies on North African and Near Eastern suppliers, whose irrigation-intensive operations grapple with water scarcity and labor cost volatility. Meanwhile, efforts to develop local Mediterranean cultivars are gaining traction to reduce import reliance and improve supply chain resilience.

Asia-Pacific markets are marked by accelerating urbanization and rising disposable incomes that drive demand for fresh, convenient, and nutritionally rich offerings. China and India, in particular, are expanding import footprints for high-value berries, almonds, and exotic herbs, while domestic producers scale up modern greenhouse and hydroponic systems to meet food security goals. Australia and New Zealand continue to leverage favorable growing conditions and free trade agreements to supply key markets across East and Southeast Asia.

These regional dynamics underscore the importance of localized strategies that reconcile consumer preferences, regulatory frameworks, and resource constraints, ensuring that value chain participants can adapt and flourish in diverse economic and environmental contexts.

This comprehensive research report examines key regions that drive the evolution of the Specialty Crops market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Highlighting Strategic Collaborations Innovation Pipelines and Diversification Efforts among Leading Specialty Crop Players

Major industry participants are sharpening their competitive edge through a blend of vertical integration, innovation partnerships, and portfolio diversification. Leading berry producers have forged alliances with plant breeders and technology firms to develop custom cultivars optimized for flavor, disease resistance, and shelf life, thereby reinforcing their proprietary value propositions.

Among nut processors, strategic acquisitions have expanded processing capacity and broadened geographic reach, enabling scale efficiencies and regional customization of packaging formats. Similarly, herb and spice companies are investing in controlled environment agriculture to ensure consistent quality and traceability, while unlocking year-round production cycles in high-margin markets.

In the distribution arena, legacy retail conglomerates are overhauling produce supply chains through data-driven replenishment systems, AI-powered quality grading, and collaborative forecasting models with growers. E-commerce platforms are differentiating via subscription boxes that feature novel varietals and exclusive small-batch offerings, driving deeper customer engagement and loyalty.

Across applications, food and beverage developers are forming joint ventures with specialty crop innovators to co-create new product lines, blending botanical extracts with conventional ingredients to meet evolving health and wellness claims. Such cross-sector collaboration highlights the shifting contours of competition, where knowledge partnerships become as critical as traditional scale advantages.

This comprehensive research report delivers an in-depth overview of the principal market players in the Specialty Crops market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blue Diamond Growers, Inc.

- Bolthouse Farms, Inc.

- Calavo Growers, Inc.

- Chiquita Brands International Sàrl

- Del Monte Foods, Inc.

- Dole Food Company, Inc.

- Driscoll’s, Inc.

- Fresh Del Monte Produce, Inc.

- Grimmway Farms, Inc.

- Limoneira Company

- Naturipe Farms, LLC

- Ocean Spray Cranberries, Inc.

- Olam International Limited

- Paramount Farms International, LLC

- Phoenix Global DMCC

- Stemilt Growers, LLC

- Sun-Maid Growers of California, LLC

- Sunkist Growers, Inc.

- SunWest Foods, Inc.

- Tanimura & Antle Fresh Foods, Inc.

- Taylor Farms, Inc.

- The Wonderful Company LLC

Strategic Imperatives for Cultivating Resilience Driving Innovation and Capturing Emerging Consumer Trends in the Specialty Crops Industry

Industry leaders should prioritize investments in precision agronomy platforms that harness data analytics, machine learning, and remote sensing to anticipate agronomic challenges and optimize input usage. By building in-house or partnering with ag-tech startups, organizations can achieve greater yield consistency while minimizing resource footprints.

Adopting integrated sustainability frameworks-grounded in circular economy principles and third-party certifications-enables companies to differentiate their offerings and meet escalating retailer and consumer requirements. This involves embedding regenerative soil practices, water stewardship protocols, and renewable energy adoption throughout the supply chain.

Market participants must also cultivate supply chain agility by diversifying sourcing networks across geographies and modalities. Establishing strategic buffer inventories, forging relationships with multiple origin suppliers, and leveraging near-shoring can mitigate exposure to trade disruptions and climate-driven production variability.

Finally, fostering cross-sector collaborations with food, beverage, nutraceutical, and cosmetics innovators unlocks new demand streams for specialty crop ingredients. By co-developing formulations that accentuate bioactive properties, industry stakeholders can capture premium margins and cement their role as indispensable partners in the value chain.

Robust Mixed-Methods Research Framework Ensuring Comprehensive Data Collection and In-Depth Analysis of the Specialty Crops Market

This study employed a mixed-methods approach, combining rigorous primary research with in-depth secondary analysis to build a comprehensive view of the specialty crops market. Primary data was gathered through structured interviews with growers, processors, distributors, and end-use manufacturers, ensuring a diversity of perspectives across the value chain.

Secondary research encompassed an extensive review of publicly available documents, including trade association reports, government publications from agencies such as the USDA, and corporate disclosures from key players. This was complemented by analysis of import-export data, regulatory filings, and relevant peer-reviewed literature to validate emerging trends and quantify structural shifts.

Data triangulation procedures were rigorously applied to reconcile insights from multiple sources, enhance the reliability of findings, and minimize potential biases. Market dynamics were examined through region-specific lenses to account for regulatory heterogeneity, climatic variability, and consumer behavior nuances.

The synthesis of qualitative insights and quantitative data ensures that this report’s conclusions rest on a robust evidentiary foundation, equipping stakeholders with both the strategic context and granular detail necessary to inform high-stakes decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Specialty Crops market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Specialty Crops Market, by Crop Type

- Specialty Crops Market, by Product Form

- Specialty Crops Market, by Application

- Specialty Crops Market, by Distribution Channel

- Specialty Crops Market, by Region

- Specialty Crops Market, by Group

- Specialty Crops Market, by Country

- United States Specialty Crops Market

- China Specialty Crops Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3339 ]

Synthesis of Key Findings Underscoring Growth Catalysts Challenges and Strategic Pathways in the Specialty Crops Domain

The specialty crops sector stands at an inflection point, propelled by technological innovation, evolving consumer values, and shifting trade dynamics. While fresh formats and premium varieties are capturing enhanced consumer interest, operational complexities and policy uncertainties require vigilant risk management.

Segmentation insights reveal that high-nutrient fruits, value-added vegetables, and botanical ingredients offer differentiated growth pathways, whereas distribution and application segments demand agility in meeting both brick-and-mortar and digital channel expectations. Regional nuances further underscore the need for tailored strategies that address regulatory, environmental, and infrastructural particularities.

Competitive analysis highlights the growing importance of strategic collaborations and sustainability credentials as determinants of market leadership. Companies that successfully integrate advanced agronomic techniques, circular economy principles, and cross-industry partnerships will be best positioned to secure long-term value.

By aligning strategic priorities with the recommendations outlined herein, stakeholders can navigate tariff headwinds, capitalize on emergent consumer trends, and drive resilient growth. The insights assembled in this executive summary serve as a catalyst for informed action and sustained competitive advantage.

Empower Your Strategic Decision-Making with Exclusive Insights and Connect Directly with Ketan Rohom for Tailored Market Intelligence

For decision-makers seeking to deepen their understanding and hone their strategies in the specialty crops arena, this comprehensive market research report delivers the clarity and foresight needed to gain a competitive edge. By partnering directly with Ketan Rohom, Associate Director of Sales & Marketing, you gain personalized guidance on how the report’s insights align with your organization’s goals and can drive tangible outcomes in both short-term initiatives and long-term plans.

Take the next step toward actionable intelligence: connect with Ketan Rohom for a tailored consultation, unlock exclusive data visualizations, and receive expert support in translating findings into measurable business growth. Your journey to precision decision-making in the U.S. specialty crops market starts here-invest in the depth of analysis and the caliber of expertise that will shape your success.

- How big is the Specialty Crops Market?

- What is the Specialty Crops Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?