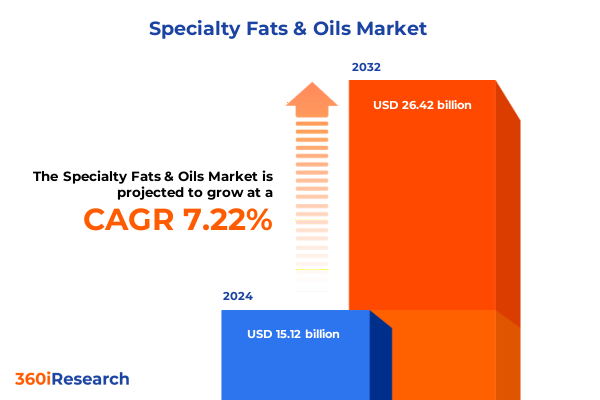

The Specialty Fats & Oils Market size was estimated at USD 16.16 billion in 2025 and expected to reach USD 17.29 billion in 2026, at a CAGR of 7.27% to reach USD 26.42 billion by 2032.

Unveiling the Strategic Landscape of Specialty Fats and Oils Industry Through a Comprehensive Executive Overview That Defines Market Drivers and Opportunities

In an era defined by evolving consumer preferences and heightened sustainability expectations, the specialty fats and oils sector stands at a pivotal juncture. The convergence of health consciousness, clean-label demands and indulgence seeker behaviors has driven manufacturers and ingredient suppliers to rethink traditional formulations. As plant-based diets gain mainstream acceptance, formulators are exploring novel oils and fats that deliver both functional performance and nutritional benefits. Concurrently, heightened scrutiny of carbon footprints and environmental impact has compelled industry stakeholders to adopt traceability measures across the supply chain, from plantation to processing facility.

Against this backdrop of dynamic change, the cushioning role of specialty fats and oils in food texture, stability and shelf life remains critical. Innovations in enzymatic modification and interesterification techniques are unlocking tailored melting profiles and improved mouthfeel properties, while advancements in fractionation technologies are enabling cleaner process chemistries. Moreover, the integration of digital platforms is streamlining procurement, quality monitoring and sustainability reporting, reinforcing the strategic importance of data-driven insights. This introduction sets the stage for a comprehensive exploration of how market shifts, trade policies, segmentation dynamics and regional nuances will shape the industry’s trajectory in the coming years.

Examining Transformational Market Shifts in Specialty Fats and Oils Industry Driven by Sustainability Innovation Consumer Preferences and Supply Chain Resilience

The specialty fats and oils industry has undergone transformative shifts fueled by an intensified focus on sustainable sourcing and consumer-driven innovation. With the proliferation of eco-certifications and net-zero targets, companies are collaborating with NGOs and technology providers to deploy blockchain-enabled traceability systems. This digital transformation not only validates claims around deforestation-free palm oil and regenerative agriculture but also enhances supply chain resilience against geopolitical disruptions and climate variability.

Meanwhile, changing consumer tastes have accelerated demand for novel functional lipids that offer nutritional enrichment beyond mere caloric value. Formulators are leveraging structured lipids and botanical extracts to craft products that support cognitive health, cardiovascular wellness and targeted nutritional profiles. In tandem, the rise of direct-to-consumer e-commerce channels has prompted ingredient manufacturers to develop small-batch, high-purity oils with premium branding, enabling artisanal and niche food producers to access global markets.

Concurrently, regulatory evolution is reshaping product portfolios, as authorities tighten labeling requirements on trans fats and mandate clearer declarations of saturated fat content. Industry players are responding by investing in next-generation enzymatic processes that yield low-saturation lipid fractions without hydrogenation. Thus, the interplay between sustainability mandates, digital innovation and shifting consumer expectations underscores a period of profound industry reconfiguration.

Assessing the Cumulative Consequences of Recent United States Tariffs on Specialty Fats and Oils Supply Chains Pricing Structures and Industry Competitiveness

In 2025, a series of newly implemented United States tariffs on imported fats and oils have compounded input cost pressures and compelled strategic recalibrations across the value chain. Tariff escalations targeting cocoa butter equivalents, palm kernel derivatives and high-oleic oils have led to reshaped sourcing strategies, as buyers pivot from traditional suppliers in Europe and Southeast Asia toward Latin American producers and integrated domestic refiners. Although these measures aim to protect local processors, they have also triggered margin compression for manufacturers reliant on economies of scale in import-dependent product lines.

As a consequence, ingredient developers are accelerating investment in alternative lipid platforms, including enzymatically modified fats and microalgae-derived oils, to mitigate volatility. Several leading companies have renegotiated long-term purchase agreements and established captive refineries in Gulf Coast zones to insulate operations from further tariff shocks. Conversely, smaller niche players have leveraged these trade dynamics as a competitive lever, offering specialized formulations exempt from certain duty schedules, such as tailored dairy fat replacers optimized for clean-label bakery applications.

Looking ahead, the cumulative impact of these trade measures underscores the strategic imperative of diversified supply networks and closer alignment with tariff committees. Firms that proactively adapt their procurement architectures and invest in tariff engineering capabilities will be better positioned to navigate policy fluctuations and safeguard profitability in an increasingly complex trade environment.

Deep Insights into Market Segmentation across Product Types Forms Functionalities Sources Distribution Channels and End-User Verticals Driving Industry Dynamics

A nuanced understanding of market segmentation is essential to unlock targeted growth avenues in the specialty fats and oils sector. When analyzing product types, specialty fats can be further dissected into bakery fats, cocoa butter alternatives, confectionery fats, dairy fat replacers and nutritional and functional fats. Bakery fats such as margarines, pastry fats and shortenings drive texture and layering in pastry goods, while cocoa butter equivalents, replacers and substitutes address cost optimization for chocolate formulations. Coating fats and filling fats cater to the sensory demands of confectionery applications, and dairy fat replacers offer lactose-free alternatives for diverse end products. Nutritional and functional fats are rapidly evolving, delivering omega-rich blends and bioactive lipid profiles for health-centric offerings. On the oils side, avocado, coconut, grapeseed, palm, sesame, soybean and sunflower oils deliver distinct fatty acid spectra and functional advantages, enabling formulators to address oxidative stability, flavor neutrality or nutraceutical positioning.

Examining the market through the lens of form reveals a tripartite structure encompassing liquid, semi-solid and solid presentations, each tailored to specific processing requirements and end-use applications. Functionality segmentation highlights roles as color enhancers, flavor carriers, mouthfeel enhancers, nutritional boosters, shelf-life extenders, stabilizing agents and texturizers, underscoring the multi-dimensional impact of lipids in finished products. The source dimension contrasts animal-based origins, prized for their organoleptic fidelity, against plant-based variants that satisfy vegan and sustainability criteria. Distribution pathways traverse offline channels-such as food ingredient distributors and foodservice suppliers-and online marketplaces that facilitate digital procurement efficiencies. Finally, the diverse end-user landscape spans animal nutrition, food and beverage, hospitality, industrial and chemical uses, personal care and cosmetics, and pharmaceutical and nutraceutical applications, signifying the broad reach of specialty lipids across sectors.

This comprehensive research report categorizes the Specialty Fats & Oils market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Functionality

- Source

- Distribution Channel

- End-User

Strategic Overview of Specialty Fats and Oils Market Dynamics Emphasizing Opportunities and Challenges across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a pivotal role in shaping competitive advantages and growth trajectories within the specialty fats and oils landscape. In the Americas, robust R&D investment in North American hubs is fostering clean-label innovations and high-oleic oil expansions, while Latin American producers are capitalizing on abundant feedstock supplies to secure global export markets. Trade agreements and infrastructure upgrades across Central and South America are enhancing export capacities, even as local governments fine-tune sustainability regulations to address deforestation concerns.

Across Europe, Middle East and Africa, stringent regulatory regimes in the European Union are driving adoption of sustainable certification frameworks and mandating stricter labeling standards. Manufacturers in the EU are leveraging renewable energy integration and zero-waste processes to meet ambitious carbon-neutrality commitments. Meanwhile, Middle Eastern markets are witnessing rapid adoption of health-focused formulations, with fortified oils gaining traction among wellness-oriented consumer segments. In Africa, emerging processing clusters are seeking strategic partnerships to scale up value-added refining and to meet growing domestic demand for fortified cooking fats.

In Asia-Pacific, the region stands as the fastest-growing theatre, propelled by rising incomes, urbanization and evolving dietary preferences. Demand for coconut and palm-based specialty oils remains strong in Southeast Asia, while East Asian markets are increasingly embracing avocado and grapeseed applications for premium culinary and cosmetic uses. Government incentives in India and China to bolster domestic processing capacities are reshaping trade flows, and heightened focus on supply chain resilience is spurring investments in cold-chain logistics and digital traceability platforms.

This comprehensive research report examines key regions that drive the evolution of the Specialty Fats & Oils market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Initiatives and Competitive Positioning of Leading Specialty Fats and Oils Manufacturers Driving Innovation Sustainability and Market Expansion

Leading participants in the specialty fats and oils domain are differentiating through sustainability commitments, product portfolio diversification and strategic collaborations. Cargill has deepened its traceability infrastructure, deploying satellite monitoring and blockchain for palm oil transparency, while also expanding enzymatic interesterification capabilities to support low-trans product lines. ADM continues to leverage its biotech platforms to introduce customized structured lipids that address emerging nutritional trends, reinforcing partnerships with nutraceutical firms to co-develop high-value functional ingredients.

AAK has solidified its position in cocoa butter alternatives by investing in dedicated blending facilities and forging alliances with cocoa supply cooperatives to secure raw material consistency. Bunge is enhancing downstream integration, increasing capacity for fractionation and refining to deliver turnkey solutions for retailers seeking private-label specialty fats. Oleon’s joint ventures with green chemistry innovators are accelerating the development of oleo-based surfactants and stabilized oil fractions for cosmetic and industrial end markets.

IOI Loders-Croklaan continues to champion certified sustainable palm and kernel oils, while Wilmar emphasizes its global refining footprint and traceable sourcing model. Fuji Oil is breaking ground in plant-based dairy fat analogs, enabling vegan cheese and dessert applications with high melt performance. Koninklijke DSM brings a nutritional edge through its range of omega-3 enriched and structured lipid blends, targeting cognitive and cardiovascular health segments. These emblematic strategies illustrate how top-tier firms are orchestrating innovation, sustainability and market reach to maintain leadership in a competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Specialty Fats & Oils market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAK AB

- Apical Group Ltd.

- Archer Daniels Midland Company

- Basso Fedele & Figli Srl

- Bunge Limited

- Cargill, Incorporated

- Fuji Oil Co., Ltd.

- Golden Agri-Resources Ltd.

- IFFCO Group

- IOI Corporation Berhad

- K.S.P. Group

- Liberty Oil Mills Ltd.

- Louis Dreyfus Company B.V.

- Manildra Group

- Mewah Group.

- Musim Mas Group

- Olam Group Limited

- Olenex Sàrl

- Oleon NV

- Richardson International Limited

- SD Guthrie Berhad

- The Nisshin OilliO Group, Ltd

- Vandemoortele N.V.

- Wilmar International Limited

- Wilmar International Ltd

Actionable Strategic Roadmap for Industry Leaders to Capitalize on Emerging Trends in Specialty Fats and Oils with Sustainable Innovation Partnerships

Industry leaders seeking to fortify their market standing should prioritize a multi-pronged agenda that intertwines sustainability, technological innovation and consumer-centric agility. First, building stronger alliances with feedstock suppliers through shared-value partnerships will secure transparent supply chains and foster regenerative agricultural practices, ensuring long-term resilience against climate volatility. Second, investing in cutting-edge lipid modification platforms-such as enzymatic interesterification and microencapsulation-can yield differentiated product offerings that meet evolving sensory and nutritional demands without reliance on hydrogenation.

Third, embedding digital traceability frameworks across procurement and processing units will not only bolster compliance with global sustainability standards but also enhance brand trust among discerning consumers. Fourth, companies should accelerate co-development with biotech and flavor houses to craft next-generation functional lipids that deliver targeted health benefits and sensory experiences. Fifth, establishing agile regional production footprints-particularly in high-growth Asia-Pacific and Latin American markets-will reduce lead times, optimize logistics costs and mitigate tariff-related uncertainties. Sixth, leaders must expand their footprints in the direct-to-consumer channel by enabling small-quantity packaging options and digital marketing strategies, tapping into the premium and artisanal segments.

By executing this strategic roadmap, industry players can harness emerging trends in specialty fats and oils to drive sustainable growth, outperform peers and capture new value pools.

Comprehensive Research Methodology Embracing Qualitative and Quantitative Approaches Expert Interviews Data Triangulation for Robust Market Insights

This research is grounded in a rigorous methodology combining both qualitative and quantitative insights to ensure validity and reliability. Primary data was gathered through structured interviews with senior executives across oilseed processing firms, ingredient formulators and end-user manufacturers, complemented by surveys targeting procurement officers and R&D heads. Secondary data sources encompassed regulatory filings, sustainability disclosures and technical publications, alongside proprietary supply chain databases detailing global feedstock flows and refining capacities.

To enhance analytical robustness, a data triangulation approach was employed, cross-verifying findings from disparate sources and aligning them with observed industry developments. Qualitative inputs were synthesized through thematic analysis, identifying prevailing industry narratives around sustainability, innovation and policy impacts. Quantitative assessments levered statistical techniques to interpret trade flow data, import-export variances and thematic R&D investment patterns. Expert validation panels reviewed preliminary conclusions, ensuring that interpretation of complex tariff landscapes and segmentation nuances accurately reflected market realities. This hybrid framework delivers a comprehensive and defensible view of the specialty fats and oils sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Specialty Fats & Oils market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Specialty Fats & Oils Market, by Type

- Specialty Fats & Oils Market, by Form

- Specialty Fats & Oils Market, by Functionality

- Specialty Fats & Oils Market, by Source

- Specialty Fats & Oils Market, by Distribution Channel

- Specialty Fats & Oils Market, by End-User

- Specialty Fats & Oils Market, by Region

- Specialty Fats & Oils Market, by Group

- Specialty Fats & Oils Market, by Country

- United States Specialty Fats & Oils Market

- China Specialty Fats & Oils Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesis of Key Takeaways from Specialty Fats and Oils Market Analysis Emphasizing Strategic Priorities for Sustainable Growth and Competitive Advantage

The specialty fats and oils industry is navigating a transformative era marked by sustainability imperatives, technological breakthroughs and evolving trade ecosystems. Across multiple segmentation dimensions-ranging from product types and functionalities to distribution channels and end-user verticals-the interplay of consumer demands and regulatory drivers underscores the sector’s complexity. Regional nuances further highlight the importance of tailored market approaches, with each geography presenting distinct opportunities and challenges.

Key players are differentiating through strategic investments in traceability, biotech-enabled lipid innovation and integrated supply chain solutions, while emerging entrants capitalize on niche, clean-label propositions. The cumulative impact of evolving US tariffs serves as a reminder of the critical need for diversified sourcing strategies and tariff mitigation capabilities. As the market continues to expand across food, personal care, industrial and healthcare applications, companies that seamlessly integrate sustainability, digitalization and consumer insight into their core operations will secure a durable competitive advantage.

Engage with Associate Director Sales and Marketing to Secure Comprehensive Specialty Fats and Oils Market Research Insights for Informed Decision-Making

To secure comprehensive insights that will inform your strategic decision-making in the specialty fats and oils arena, reach out to Ketan Rohom, Associate Director of Sales and Marketing. Ketan brings deep expertise in translating complex industry intelligence into actionable strategies, helping your organization harness emerging opportunities and navigate market challenges with confidence. Engaging directly with Ketan will give you priority access to the latest research findings, bespoke analytical support, and tailored recommendations designed to accelerate your growth roadmap. Elevate your competitive edge by partnering with him today to acquire the full market research report and unlock data-driven clarity for your next strategic move

- How big is the Specialty Fats & Oils Market?

- What is the Specialty Fats & Oils Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?