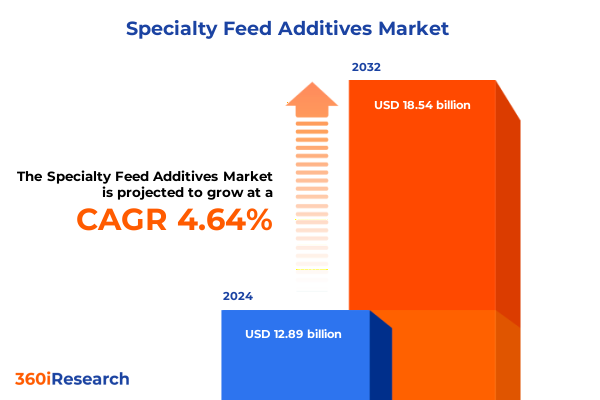

The Specialty Feed Additives Market size was estimated at USD 13.44 billion in 2025 and expected to reach USD 14.02 billion in 2026, at a CAGR of 4.70% to reach USD 18.54 billion by 2032.

Navigating the Evolving Dynamics of Specialty Feed Additives to Enhance Animal Health Performance and Sustainable Production

The specialty feed additives market has entered a pivotal phase marked by heightened consumer awareness around animal health and protein quality. In response, producers are shifting from traditional growth promoters to science-led solutions that prioritize gut wellness, immune support, and nutrient absorption. This transition signifies not only a refinement of formulations but also an elevation in research intensity as manufacturers invest heavily in novel bioactive compounds and precision delivery mechanisms. Consequently, stakeholders across the value chain are redefining best practices, integrating advanced analytics, and aligning product portfolios with emerging regulatory standards. These collective efforts have transformed the feed additives sector into a hub of innovation where multidisciplinary collaboration between nutritionists, veterinarians, and biotechnologists is essential.

Moreover, the evolving landscape underscores the strategic importance of aligning product development with sustainability objectives. Demand for antibiotic-free and naturally derived additives continues to gain momentum, driven by both regulatory constraints and consumer preferences for cleaner labels. As such, companies are forging new partnerships to secure access to cutting-edge ingredients, leveraging green chemistry, and optimizing supply chain transparency. This convergence of technological, regulatory, and consumer forces lays the groundwork for a dynamic growth trajectory in specialty feed additives, where differentiation stems from demonstrable health outcomes and environmental stewardship.

Key Industry Disruptions and Innovative Breakthroughs Driving Unprecedented Shifts in the Specialty Feed Additives Landscape

Recent years have unveiled transformative shifts rooted in breakthroughs spanning biotechnological innovation to digital integration. Leading research entities and commercial players have accelerated development of next-generation enzymes tailored for targeted nutrient release, while microbial fermentation techniques are unlocking novel prebiotic and probiotic strains with enhanced stability and efficacy. Simultaneously, the incorporation of data-driven decision support platforms is enabling real-time monitoring of feed conversion ratios and health biomarkers, thus empowering nutritionists to fine-tune additive blends on a batch-by-batch basis. This fusion of life sciences and Industry 4.0 methodologies has revolutionized how additives are evaluated, positioned, and optimized, fostering a more responsive, customized approach to animal performance.

Alongside technological advances, regulatory frameworks have adapted to recognize the distinct mode-of-action profiles of specialty additives. Approvals for non-antibiotic growth promoters and mycotoxin binders have witnessed more structured, science-driven pathways, which in turn has encouraged increased R&D expenditures and elevated entry barriers for generic solutions. At the same time, cross-sector collaborations have spawned integrated platforms that couple feed additive efficacy trials with traceability solutions, bolstering quality assurance and end-to-end transparency. Through these convergent trends, the industry is transitioning away from one-size-fits-all formulations toward an era wherein precision nutrition, underpinned by both digital and biotechnological breakthroughs, defines competitive advantage.

Evaluating the Comprehensive Effects of Newly Implemented 2025 United States Tariffs on Specialty Feed Additives Trade Flows

The 2025 tariff adjustments imposed by the United States have materially influenced specialty feed additives trade flows, compelling both importers and domestic producers to reevaluate sourcing strategies. Elevated duties on select antioxidant and enzyme categories have prompted supply chain realignments, with manufacturers seeking tariff-exempt nations or investing in localized production capabilities. Consequently, while certain ingredient costs have edged upward, integrated players with in-country manufacturing footprints are gaining greater pricing latitude and logistical flexibility.

Concurrently, the realignment of procurement corridors has catalyzed new alliances between North American formulators and exporters from tariff-friendly regions. These partnerships emphasize quality certifications, lead times, and sustainable sourcing credentials to offset tariff-driven cost pressures. Over time, this dynamic is fostering a more resilient ecosystem where diversified supplier portfolios and strategic inventory management mitigate volatility. In this context, stakeholders are leveraging data analytics to model tariff impacts at the SKU level, optimizing blend compositions to preserve margin goals while sustaining product efficacy. Through these adaptive measures, the industry is navigating the tariff landscape with greater agility, ensuring continuity of supply and maintaining competitive positioning.

Unveiling Critical Segment Dynamics Shaping the Specialty Feed Additives Market through Product Animal Species Form and Distribution Channels

A nuanced examination of the specialty feed additives space reveals distinct patterns across multiple segmentation dimensions that influence product development and market positioning. Considering product typology, the field spans antioxidants, enzymes, mycotoxin binders, organic acids, prebiotics, and probiotics. Each category exhibits unique drivers: antioxidants are increasingly leveraged for oxidative stress reduction in high-performance poultry, enzymes optimize nutrient bioavailability in monogastrics, mycotoxin binders ensure feed safety under variable grain quality, organic acids modulate gut pH for improved nutrient uptake, and prebiotics and probiotics enhance microbial balance with growing interest in antibiotic alternatives.

When addressing application by animal species, the market encompasses aquaculture-which is further differentiated into finfish and shellfish-that demands additives for water stability and immune resilience; companion animals segmented into cats and dogs where tailored palatability and health claims predominate; poultry subdivided into breeders, broilers, and layers focused on egg quality, growth rate, and feed conversion efficiency; ruminants divided into beef and dairy systems stressing rumen function and milk composition; and swine split into growers and sows where reproductive performance and gut health are paramount. In addition, product form exerts significant influence through the availability of granules, liquid concentrates, and powder forms, each suited to specific feed manufacturing processes and farm-level dosing regimens. Distribution channels further define market access, ranging from direct sales models catering to large integrators, to regional distributors serving mid-tier operations, and online platforms enabling flexible procurement for specialized end users. This layered segmentation framework informs strategic decision making, guiding stakeholders in tailoring product portfolios and go-to-market approaches to distinct component needs and channel expectations.

This comprehensive research report categorizes the Specialty Feed Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Animal Species

- Form

- Source

- Distribution Channel

- End User

Exploring Regional Performance and Growth Catalysts across the Americas Europe Middle East & Africa and Asia-Pacific Markets

Regional variations profoundly shape the adoption patterns and growth catalysts in specialty feed additives. In the Americas, advanced production infrastructures and mature regulatory environments support rapid uptake of premium gut health enhancers and enzyme solutions, while ongoing consolidation among integrators drives procurement scale economies. As a result, manufacturers emphasize product standardization balanced with regional customization, leveraging local trial networks to validate performance claims.

Across Europe, the Middle East & Africa, regulatory stringency around antibiotic use has accelerated demand for mycotoxin binders and organic acids, prompting suppliers to secure region-specific approvals and engage in public-private research initiatives. Moreover, sustainability mandates and circular economy frameworks in Europe are steering innovation toward byproduct-derived additives and lifecycle assessment certifications.

In the Asia-Pacific region, surging protein consumption and the rise of intensive aquaculture operations underpin significant interest in probiotics and prebiotics tailored for waterborne species. Rapid industrialization and evolving farm-level capabilities are encouraging formulators to establish local R&D centers and manufacturing hubs to meet variable quality standards and competitive pricing pressures. These regional profiles underscore the importance of adaptive strategies that reconcile global innovation with local execution nuances.

This comprehensive research report examines key regions that drive the evolution of the Specialty Feed Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players’ Strategic Initiatives Partnerships and Innovations to Drive Competitive Advantage in Specialty Feed Additives

The competitive landscape of specialty feed additives is defined by a constellation of leading firms and emerging challengers, each deploying differentiated strategies to capture market share and drive value creation. Established multinational entities are expanding their portfolios through strategic acquisitions of biotech startups that specialize in novel probiotic strains or enzyme optimization platforms. This inorganic growth complements internal R&D pipelines, enabling rapid commercialization of next-generation solutions and fostering cross-border technology transfer.

Simultaneously, mid-sized specialists are forging collaborations with academic institutions to access precision fermentation techniques, while nimble regional players capitalize on local ingredient sourcing and regulatory acumen to develop cost-effective, region-tailored formulations. A notable trend among these companies is the integration of digital services-such as feeding recommendation apps and performance tracking dashboards-to augment additive efficacy claims with real-world data. In doing so, they not only enhance customer engagement but also create long-term lock-in effects based on actionable insights. Overall, the sector is witnessing an interplay between scale players focused on end-to-end offerings and agile innovators targeting high-growth niche segments, thereby intensifying competitive dynamics and broadening the spectrum of available solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Specialty Feed Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adisseo France SAS

- Agropur Cooperative

- Alltech

- Amano Enzyme Inc.

- AMCO Proteins

- Archer Daniels Midland Company

- ARVESTA BV

- Ashland Inc.

- Axiom Foods, Inc.

- Axiom Foods, Inc.

- BASF SE

- Bentoli, Inc.

- Brookside Agra

- Cargill, Incorporated

- Centafarm SRL

- Compass Minerals

- Crespel & Deiters GmbH & Co KG

- Elanco Animal Health

- Evonik Industries AG

- Global Nutrition International by NUANCE BIOTECH

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Jubilant Ingrevia Limited

- K+S Aktiengesellschaft

- Kemin Industries, Inc.

- Kerry Group PLC

- Koninklijke DSM N.V.

- Novozymes A/S

- Novus International, Inc.

- Novus International, Inc.

- NUQO Feed additives

- Nutreco N.V.

- Omega Protein Corporation

- Phibro Animal Health Corporation

- Tex Biosciences Pvt Ltd.

- Vitalac

- Volac International Ltd

- Yara International ASA

Practical Strategic Recommendations to Empower Industry Leaders in Capitalizing on Emerging Trends and Overcoming Challenges in Specialty Feed Additives

To thrive amid evolving scientific, regulatory, and trade challenges, industry leaders should pursue a multifaceted strategy centered on innovation ecosystems and operational resilience. First, forging cross-disciplinary research alliances that combine expertise in enzyme engineering, microbial genomics, and formulation science will accelerate pipeline development and reduce time to market. Furthermore, investing in advanced analytics platforms that integrate farm-level performance data with supply chain metrics will enable dynamic pricing strategies and more precise inventory planning, thereby improving margin predictability.

Concurrently, companies must cultivate diversified sourcing networks to mitigate tariff and logistical risks. Establishing joint ventures or toll manufacturing agreements in key import markets can buffer against cost volatility and enhance service responsiveness. Equally important is deepening engagements with end users through digital trials and technical support services, reinforcing customer loyalty while generating proprietary data sets for continuous product optimization. By adopting these measures, leaders can not only safeguard against external disruptions but also unlock new value streams from data-driven offerings and integrated solution suites.

Comprehensive Research Methodology Integrating Qualitative and Quantitative Approaches to Assure Robust Insights in Specialty Feed Additives Analysis

The research underpinning this report deployed a rigorous mixed-methods framework designed to ensure comprehensive and unbiased insights. Primary data collection included structured interviews with nutrition experts, regulatory authorities, and C-level executives from leading feed additive manufacturers across major geographies. These qualitative inputs were triangulated with quantitative surveys targeting formulators, integrators, and end-users, capturing adoption rates, performance feedback, and channel preferences.

Secondary research involved systematic review of peer-reviewed journals, patents, and regulatory filings to track advances in ingredient technologies and approval pathways. Trade data and customs records were analyzed to discern evolving import-export patterns, especially in light of the 2025 tariff regime. Throughout the process, an iterative validation protocol ensured that emerging findings were vetted by an internal advisory board comprising domain specialists, guaranteeing both robustness and relevance. Together, these methodological pillars provide a solid foundation for the strategic conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Specialty Feed Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Specialty Feed Additives Market, by Product Type

- Specialty Feed Additives Market, by Animal Species

- Specialty Feed Additives Market, by Form

- Specialty Feed Additives Market, by Source

- Specialty Feed Additives Market, by Distribution Channel

- Specialty Feed Additives Market, by End User

- Specialty Feed Additives Market, by Region

- Specialty Feed Additives Market, by Group

- Specialty Feed Additives Market, by Country

- United States Specialty Feed Additives Market

- China Specialty Feed Additives Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesis of Key Findings and Strategic Imperatives to Steer Future Growth and Innovation within the Specialty Feed Additives Industry

Drawing together the threads of innovation, regulatory evolution, and strategic adaptation, the findings underscore that success in specialty feed additives hinges on the ability to integrate scientific breakthroughs with agile market execution. Precision nutrition, supported by advanced analytics and digital engagement models, emerges as the central theme uniting disparate segments and regions. Lifecycle considerations-from raw material sourcing through formulation performance and end-user adoption-demand holistic strategies that blend technological excellence with supply chain resilience.

Moreover, the tariff-driven realignment of global trade flows highlights the imperative for diversified manufacturing footprints and flexible sourcing partnerships. Companies that proactively optimize their geographical presence and operational networks will be best positioned to capture growth opportunities and maintain cost competitiveness. Ultimately, the convergence of sustainability imperatives, health-driven formulations, and data-enabled solutions will define the next wave of differentiation, shaping an industry that is both scientifically robust and commercially dynamic.

Take the Next Step Toward Gaining Invaluable Strategic Insights by Connecting with Associate Director Sales & Marketing Ketan Rohom Today

To access the full depth of insights and strategic guidance contained within the specialty feed additives market research report, reach out to Associate Director, Sales & Marketing Ketan Rohom today. Engage in a brief consultation to discuss your organization’s specific challenges and objectives, and discover how the report’s comprehensive analysis can inform targeted product development, optimize supply chain resilience, and support regulatory compliance. By partnering directly with Ketan Rohom, you can secure a tailored package that aligns with your budget and business priorities, ensuring rapid delivery and ongoing support. Take the opportunity to elevate your decision-making capabilities with actionable intelligence that drives growth across product segments, animal species applications, and global regions. Connect now for a strategic conversation that unlocks the competitive advantages and long-term value embedded in this essential market resource

- How big is the Specialty Feed Additives Market?

- What is the Specialty Feed Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?