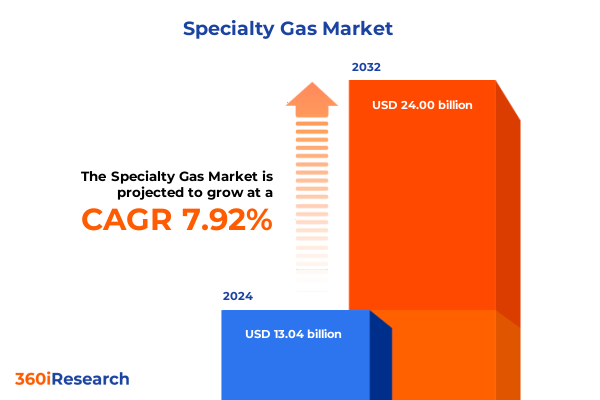

The Specialty Gas Market size was estimated at USD 14.06 billion in 2025 and expected to reach USD 15.04 billion in 2026, at a CAGR of 7.93% to reach USD 24.00 billion by 2032.

Pioneering Insights into the Specialty Gas Market’s Critical Role in Driving Technological Innovation and Industrial Excellence

The specialty gas sector represents a critical backbone for an array of high-precision industrial and research applications, functioning as the invisible yet indispensable catalyst behind modern technological progress. At the outset, it’s essential to appreciate how specialty gases span a remarkable range of uses, from enabling semiconductor fabrication with ultra-high-purity blends to calibrating analytical instruments that underpin stringent environmental monitoring protocols. Within this landscape, the emphasis on consistency, purity, and delivery precision underscores the pivotal role that these gases play in enhancing both operational efficiency and regulatory compliance across industries.

In recent years, the industry has been propelled forward by breakthroughs in gas blend formulations and generation technologies that cater to the escalating demand for customized mixtures and on-site production capabilities. These innovations are not merely incremental improvements; rather, they redefine what is feasible in contexts as diverse as medical device sterilization, food and beverage preservation, and advanced materials research. Consequently, companies that align their strategies with this intricate ecosystem of performance requirements and quality benchmarks are better positioned to capture emerging opportunities.

Moreover, the interplay between technological advancement and sustainability imperatives has never been more pronounced. Organizations are increasingly tasked with reducing carbon footprints and minimizing waste while maintaining the rigorous purity standards intrinsic to specialty gas applications. This dual mandate drives investments in cleaner production methods, energy-efficient supply chains, and circular gas reuse initiatives. As we delve deeper into this executive summary, it becomes evident that mastering these converging forces is essential for stakeholders aiming to secure competitive advantage in an environment marked by complexity and rapid transformation.

Emerging Transformations Reshaping Global Specialty Gas Utilization and Supply Chains Amid Rapid Technological and Regulatory Evolution

Across the past decade, the specialty gas market has experienced sweeping transformations, fueled by the relentless acceleration of digitalization and the expanding frontiers of advanced manufacturing. On one hand, the proliferation of Industry 4.0 techniques has introduced sophisticated remote monitoring systems for cylinder inventories and gas purity analytics, enabling suppliers and end-users to optimize consumption, anticipate maintenance needs, and mitigate safety risks in real time. On the other hand, the integration of artificial intelligence and machine learning platforms into gas production and blending operations is reshaping the contours of quality assurance, reducing human error, and accelerating product development cycles.

Simultaneously, regulatory frameworks are evolving to impose more stringent safety, environmental, and traceability requirements. These regulatory shifts compel stakeholders to adopt comprehensive compliance strategies that encompass everything from leak detection protocols to full-spectrum lifecycle tracking of gas cylinders. As a result, industry participants are forming collaborative alliances with technology providers to implement blockchain-enabled tracking systems that guarantee chain-of-custody integrity and automated regulatory reporting.

In parallel, the rise of application-specific gas blends has spurred tailored R&D efforts aimed at addressing unique process challenges, such as inert gas environments for metal additive manufacturing or specialty noble gas mixtures for next-generation photonics research. The cumulative effect of these shifts is a market environment characterized by heightened complexity, deeper interdependencies among stakeholders, and a premium on agile innovation. It is within this dynamic matrix of technological leaps and regulatory developments that the specialty gas industry must navigate to secure sustainable, long-term growth.

Analyzing the Cumulative Repercussions of 2025 United States Tariff Adjustments on Specialty Gas Supply Chains and Market Accessibility

Entering 2025, policy changes emanating from the United States have injected new dynamics into the global specialty gas landscape, as a series of tariff adjustments under Section 301 and related measures have reconfigured cost structures for key volumes of imported gases and associated equipment. Although these tariffs were introduced with the aim of safeguarding domestic industries, they have also prompted supply chain stakeholders to reexamine sourcing strategies and logistical pathways. In particular, end users reliant on high-purity gases sourced from Chinese production hubs have encountered incremental cost pressures, necessitating more robust contingency planning and supplier diversification.

Furthermore, the cumulative impact of these tariffs is not constrained to immediate transactional costs. From a strategic standpoint, heightened import levies have accelerated discussions around expanding local generation facilities, particularly microbulk and on-site gas synthesis units, as companies strive to mitigate geopolitical risk. In tandem, downstream sectors such as semiconductor manufacturing and specialty chemical processing have begun evaluating potential shifts in production footprints to regions offering friendlier trade terms or incentives for domestic gas infrastructure investment.

Looking ahead, it is clear that the immediate disruptions wrought by tariff escalations will evolve into a more enduring paradigm of regionalized supply networks, whereby resilience and proximity assume greater importance than sheer cost competitiveness. Stakeholders who leverage this juncture to fortify localized distribution hubs and forge strategic partnerships across borders will be best positioned to navigate ongoing policy volatility and secure uninterrupted access to critical specialty gases.

Unveiling Critical Segmentation Insights to Navigate Diverse Specialty Gas Applications, Gas Types, Purity Grades, End-User Industries and Delivery Modes

When dissecting the specialty gas domain through the lens of application, it becomes apparent that distinct operational demands underpin each segment. In analytical and calibration contexts, the precision of gas mixtures drives the reliability of measurement and laboratory outcomes. Chemical processing and environmental monitoring both place a premium on consistent supply and ultra-low contamination thresholds, while the stringent atmospheres required in semiconductor manufacturing hinge on specific blend formulations. Likewise, sectors such as food and beverage preservation and medical and healthcare depend on specialized gas properties to ensure product safety, sterility, and regulatory compliance. In metal fabrication, inert gas protection during welding processes further underscores the intricate nexus between application requirements and gas specification.

Turning to gas types, the market’s diversity spans calibration gases tailored for instrument standardization, noble gases prized for their inertness, rare gases valued for specialized optical and analytical attributes, and sophisticated blends engineered for niche research or production needs. Within the noble gases segment, argon serves as the workhorse for general industrial uses, helium delivers unmatched thermal conductivity for cryogenics, and neon, krypton, and xenon each cater to lighting, laser technologies, and advanced imaging applications. Specialty gas blends further branch out into calibration blends vital for quality control, research and development blends that accelerate innovation cycles, and semiconductor blends designed to meet the exacting purity standards of chip fabrication.

Purity grade considerations also exert a profound influence on supply chain decisions, as the distinction between industrial grade, high purity, research grade, and ultra high purity can dictate storage conditions, handling protocols, and equipment compatibility. Meanwhile, end-user industry dynamics reveal how focal sectors such as chemicals and petrochemicals, healthcare and pharmaceuticals, electronics and semiconductors, environmental and analytical services, food and beverage, and metal fabrication each drive unique consumption patterns and contractual frameworks.

Finally, modes of delivery-from bulk supply channels for high-volume applications to cylinders for flexible demand profiles, microbulk installations that bridge the gap between scale and adaptability, and on-site generation systems offering self-sufficiency-demonstrate how logistical considerations interplay with operational imperatives. The cylinder segment itself subdivides into specialty cylinder variants engineered for specific gas formulations and standard cylinders that facilitate streamlined interchangeability across applications.

This comprehensive research report categorizes the Specialty Gas market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Gas Type

- Purity Grade

- Delivery Mode

- Application

- End-User Industry

Examining Strategic Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific for Optimized Specialty Gas Market Engagement

Geographic perspectives shed crucial light on the competitive contours and investment climate shaping the specialty gas market. In the Americas, robust industrial activity, particularly within the chemicals and petrochemicals space, converges with a growing semiconductor fabrication landscape in the United States, driving demand for high-purity blends and on-site generation solutions. Across North and South America, recent infrastructure initiatives aimed at expanding midstream gas capabilities and enhancing logistical networks have fortified regional resilience to global supply chain shocks.

Meanwhile, Europe, Middle East & Africa present a multifaceted tableau where mature industrial economies coexist alongside emerging markets with evolving regulatory frameworks. In Western Europe, stringent environmental mandates and carbon reduction targets have catalyzed the adoption of green gas technologies and advanced monitoring services. The Middle East’s expansive petrochemical complexes rely heavily on reliable specialty gas delivery, while African markets are gradually expanding their analytical and healthcare capacities, spurring nascent demand for calibration and medical-grade gases.

Asia-Pacific continues to spearhead growth for specialty gas providers, underpinned by exponential expansion in semiconductor fabrication facilities, chemical processing plants, and cutting-edge research centers. Government incentives in key markets such as South Korea and Taiwan have accelerated technology park development, fueling the need for ultra-high purity gases. Even as regional trade tensions introduce episodic disruptions, the sustained appetite for innovative gas solutions across manufacturing, healthcare, and environmental sectors underscores the strategic importance of tailored regional approaches.

This comprehensive research report examines key regions that drive the evolution of the Specialty Gas market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players Driving Innovation, Collaboration, and Competitive Differentiation in the Global Specialty Gas Sector

A cadre of globally recognized gas producers and specialized service providers anchors the competitive environment, each distinguished by its technological expertise, network reach, and customer-centric solutions. Air Products and Air Liquide continue to set industry benchmarks through extensive research partnerships and digital platform integrations that facilitate real-time supply chain transparency. Linde leverages its global engineering network to deliver turnkey on-site generation units, while Taiyo Nippon Sanso and Messer group emphasize modular microbulk solutions and agile cylinder management services tailored to evolving end-user needs.

Similarly, regional champions and agile innovators are reshaping market dynamics with targeted offerings. Matheson Tri-Gas has carved a niche in specialty blend customization and responsive cylinder logistics across North America, whereas Gulf Cryo’s deep regional knowledge underpins its success in serving Middle Eastern petrochemical clusters. Elsewhere, emerging technology-focused providers are pioneering novel gas separation membranes and AI-driven purity analytics, signaling a continued shift toward integrated digital-physical solutions that enhance operational efficiency and compliance.

Collectively, these key players not only compete on conventional metrics such as portfolio breadth and distribution footprint but also on the ability to co-develop bespoke gas applications with strategic customers. As specialist end users demand increasingly tailored solutions and seamless integration, leadership in collaborative R&D initiatives and flexible commercial models will define the next frontier of competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Specialty Gas market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Alchemie Gases & Chemicals Pvt. Ltd.

- American Welding & Gas

- BASF SE

- Chemix Gases

- CK Group

- Coregas Pty Ltd.

- Exxon Mobil Corporation

- Heublein Gase UG

- ILMO Products Company

- Jiangsu Kaimei Electronic Materials Co., Ltd.

- Kanto Denka Kogyo Co. Ltd.

- Linde PLC

- Maharashtra Gas Co.

- Merck KGaA

- MESA Specialty Gases & Equipment

Formulating Actionable Strategic Recommendations for Industry Leaders to Strengthen Resilience and Achieve Sustainable Growth in Specialty Gases

Industry leaders must prioritize supply chain resilience by cultivating multifaceted sourcing strategies. By diversifying procurement channels across geographies and integrating on-site generation capabilities, organizations can mitigate exposure to tariff-driven cost fluctuations and geopolitical disruptions. In doing so, firms should engage in strategic alliances with equipment manufacturers and technology partners to accelerate deployment of microbulk and on-site synthesis installations, thereby securing uninterrupted gas access while optimizing total cost of ownership.

Concurrently, embracing data-centric operations will unlock significant efficiency gains. Implementing digital twins, coupled with advanced analytics for leak detection and purity trend forecasting, enables predictive maintenance and safety risk reduction. Furthermore, investing in blockchain-enabled traceability platforms can enhance regulatory compliance, reinforce customer confidence, and create new service revenue streams through value-added analytics offerings.

Finally, a heightened focus on sustainability and circular economy principles will differentiate forward-looking companies. Initiatives such as cylinder refurbishment programs, gas recycling systems, and low-carbon production pathways not only align with corporate environmental commitments but also resonate with increasingly eco-conscious end users. By embedding these practices into core operations and partnering with stakeholders across the gas life cycle, industry leaders can drive both environmental impact reduction and competitive differentiation.

Detailing a Robust Research Methodology Integrating Primary Insights and Secondary Analysis to Ensure Comprehensive Specialty Gas Market Intelligence

This study leverages a hybrid research methodology, combining primary insights from in-depth interviews with executive leaders, technical experts, and procurement specialists across specialty gas value chains. Through structured dialogues, the research team captured nuanced perspectives on operational challenges, innovation priorities, and compliance imperatives, ensuring a grounded understanding of stakeholder pain points and strategic imperatives.

Secondary analysis complements these insights with a rigorous review of industry publications, regulatory databases, and technology whitepapers. Patent landscapes and academic journals were systematically examined to identify emerging gas separation technologies and blend formulation breakthroughs. Additionally, trade publications and corporate disclosures informed assessments of recent merger and acquisition activities, capacity expansions, and regional investment trends.

To validate findings, an iterative triangulation process was employed, cross-referencing primary inputs with secondary data and corroborating evidence through statistical snapshots of supply chain disruptions and tariff implementations. This multi-dimensional approach ensures that conclusions are robust, actionable, and reflective of the dynamic specialty gas ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Specialty Gas market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Specialty Gas Market, by Gas Type

- Specialty Gas Market, by Purity Grade

- Specialty Gas Market, by Delivery Mode

- Specialty Gas Market, by Application

- Specialty Gas Market, by End-User Industry

- Specialty Gas Market, by Region

- Specialty Gas Market, by Group

- Specialty Gas Market, by Country

- United States Specialty Gas Market

- China Specialty Gas Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Drawing Conclusive Perspectives on the Critical Role of Specialty Gases in Enabling Technological Advancements and Sustainable Industrial Practices

Throughout this executive summary, the intricate interplay among technological innovation, regulatory shifts, and geopolitical influences has been laid bare, underscoring the multifaceted nature of the specialty gas market. From application-driven segmentation to regional and tariff-related complexities, the findings emphasize that agility and foresight are paramount for organizations aiming to navigate this evolving landscape.

Ultimately, the future trajectory of the specialty gas sector will hinge on stakeholders’ capacity to anticipate shifts, co-create customized solutions, and embed sustainability at the core of their operations. Organizations that harness data-centric tools, cultivate resilient supply chains, and foster collaborative partnerships will emerge as the vanguard of an industry poised at the nexus of high-precision science and industrial transformation.

As the demands placed on specialty gas providers continue to escalate, the imperative for strategic clarity and operational excellence becomes ever more pronounced. This conclusion serves as both a synthesis of key insights and a clarion call for proactive engagement with the opportunities and challenges that lie ahead.

Empowering Decision-Makers with a Clear Path to Acquire In-Depth Specialty Gas Market Research from Ketan Rohom, Associate Director Sales & Marketing

Embarking on the acquired intelligence from this executive summary empowers you to make informed decisions and catalyze strategic growth across the specialty gas spectrum. Ketan Rohom, Associate Director of Sales & Marketing, is poised to guide you through an in-depth exploration of the full market research report. Reach out directly to Ketan to secure comprehensive insights, detailed analyses, and bespoke recommendations tailored to your organization’s unique objectives and challenges. Elevate your strategic roadmap with authoritative data and expert perspectives by initiating a conversation with Ketan Rohom today.

- How big is the Specialty Gas Market?

- What is the Specialty Gas Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?