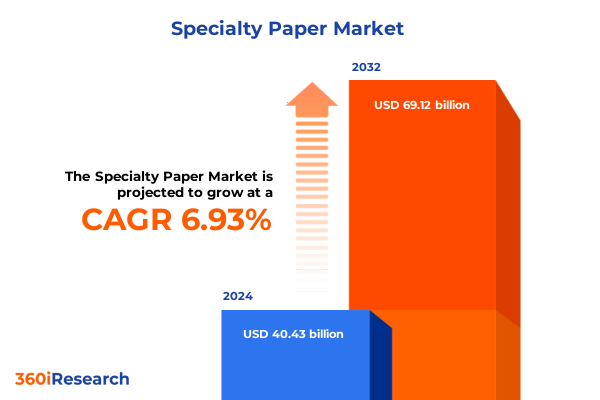

The Specialty Paper Market size was estimated at USD 43.21 billion in 2025 and expected to reach USD 46.02 billion in 2026, at a CAGR of 6.93% to reach USD 69.12 billion by 2032.

Unveiling the Pivotal Importance and Emerging Trends Driving the Specialty Paper Sector Across Diverse Industrial and Consumer Markets

The specialty paper sector has emerged as a cornerstone in modern manufacturing and consumer applications, reflecting a convergence of functional innovation and tailored performance. Across industries ranging from automotive components to healthcare diagnostics, specialty paper solutions offer unique properties-such as enhanced durability, chemical resistance, and precision printability-that distinguish them from conventional paper grades. As organizations pursue differentiation and efficiency gains, the demand for advanced substrate materials that can withstand rigorous processing and end-use requirements has intensified.

Recent developments in materials science and coating technologies have amplified the potential of specialty paper, enabling applications that were previously infeasible. Innovations in synthetic substrates and security-grade papers are driving new use cases in anti-counterfeiting measures, while high-performance release liners and carbonless forms are streamlining operational workflows in labeling and business forms industries. Consequently, specialty paper is no longer a niche segment but an integral component in a wide array of value chains.

Considering these evolving dynamics, an expert assessment of current trends, regulatory influences, and technological breakthroughs is crucial for decision-makers aiming to harness growth opportunities. This executive summary distills the most critical insights from comprehensive market intelligence, ensuring leaders can swiftly grasp the underlying forces shaping the specialty paper landscape and formulate strategies that capitalize on emerging avenues for innovation and competitive advantage.

Mapping the Shift from Traditional Paper Solutions to Innovative Specialty Offerings Amid Rapid Technological and Regulatory Evolutions

The specialty paper market is undergoing a profound transformation as traditional product definitions give way to hybrid solutions tailored to specialized performance criteria. Digitalization has elevated standards for print precision, compelling manufacturers to refine coating processes and substrate formulations to meet exacting graphic arts requirements. Meanwhile, the global push for sustainability has accelerated the adoption of recycled and bio-based fibers, prompting a strategic shift away from petroleum-derived materials and towards renewable resources.

At the same time, regulatory changes-ranging from stringent environmental mandates in Europe to new chemical compliance standards in North America-are reshaping production methodologies and supply chain strategies. Industry participants are leveraging advanced analytics and real-time monitoring systems to ensure adherence to evolving regulations, while investing in green chemistry to reduce volatile organic compound emissions and water usage. As a result, firms that proactively integrate environmental and digital considerations into their product roadmaps are securing competitive advantages in both mature and emerging markets.

In parallel, the proliferation of applications such as flexible packaging, diagnostic media, and smart labels is driving cross-segment convergence, eroding traditional boundaries between paper types. This convergence has fostered collaborative ventures between paper producers, coating specialists, and technology providers, accelerating the pace of innovation and broadening the applicability of specialty substrates. Accordingly, mastering these transformative shifts is essential for organizations seeking to maintain relevance and resilience amid rapid technological and regulatory change.

Assessing the Comprehensive Ripple Effects and Adaptive Strategies Emerged in Response to United States Tariff Adjustments on Specialty Paper in 2025

United States tariff policies implemented in early 2025 have induced substantial ripple effects throughout the specialty paper ecosystem. Increases on imported raw materials such as synthetic polymers, chemical coatings, and pulp derivatives have elevated input costs, compelling manufacturers to reevaluate sourcing strategies and adjust pricing structures. Concurrently, downstream converters and label printers have faced margin pressures as they absorb or pass through these added costs to end-customers.

To mitigate the financial strain, many domestic producers have pursued backward integration, forging partnerships with chemical suppliers or investing in captive production of key coating agents. This strategic maneuver not only enhances supply chain resilience but also grants greater control over input quality and cost fluctuations. Similarly, import-dependent firms have explored nearshoring alternatives, shifting orders to regional suppliers in Latin America and Asia to benefit from tariff exemptions and reduced freight expenses.

Despite these adaptive strategies, the tariff environment has underscored the importance of long-term agility and operational flexibility. Industry leaders are allocating resources to automated production lines and digital procurement platforms, enabling faster switching between raw material specifications and alternative supplier networks. As the sector navigates these policy-driven headwinds, organizations that embed tariff risk management into their broader strategic planning will be better positioned to sustain profitability and capitalize on emerging market opportunities.

Deciphering Critical Market Segmentation Dynamics Spanning Paper Type, Application, Material Type, Basis Weight, and Industry Verticals

Critical market segmentation illuminates the distinct value propositions and growth drivers across multiple dimensions of specialty paper. When examined by paper type, carbonless paper addresses the legacy needs of multi-part forms, while label stock variants-including permanent, removable, and self-adhesive options-serve the burgeoning labeling markets that demand precise adhesion profiles. Security paper remains indispensable for high-integrity applications where counterfeit resistance is paramount, and synthetic paper continues to gain traction in environments requiring tear resistance and moisture immunity. Release liners complement these offerings by facilitating clean separation in adhesive systems.

Turning to applications, business forms and envelopes persist as foundational pillars, but graphic arts and labeling segments have surged as brands prioritize on-package messaging and dynamic promotions. In packaging, the distinctions between food-, industrial-, and pharma-grade substrates underscore the need for barrier properties, regulatory compliance, and print clarity that align with stringent safety standards. Material type further differentiates the market: coated papers enhance surface smoothness for high-resolution printing, while specialty boards provide stiffness for premium packaging formats; uncoated grades and synthetic substrates offer tactile authenticity or robustness for specialized requirements.

Evaluating basis weight reveals strategic choices that balance cost, durability, and functional requirements. Light-weight grades optimize material usage for labels and envelopes, medium-weight papers accommodate durable forms and packaging facades, and heavy-weight products deliver structural integrity for industrial dunnage and specialty liners. Across industry verticals, automotive applications leverage precision labels for component tracking, food and beverage capitalize on beverage labels and food packaging to reinforce brand identity, healthcare depends on diagnostic papers, medical labels, and pharmaceutical packaging for patient safety, and personal care and industrial sectors optimize material performance for durability and compliance. This nuanced segmentation framework underscores the multifaceted nature of the specialty paper landscape.

This comprehensive research report categorizes the Specialty Paper market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Paper Type

- Material Type

- Basis Weight

- Application

- Industry

Uncovering Distinct Growth Trajectories and Demand Drivers Across Key Global Regions Including Americas, EMEA, and Asia-Pacific Markets

Regional analysis uncovers contrasting demand patterns and strategic priorities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, innovation in sustainable packaging and on-demand printing has catalyzed investments in recycled fiber content and digital label technologies. Manufacturers have capitalized on proximity to key raw material sources and robust supply chains to accelerate new product launches, while end-users in North America place a premium on compliance with environmental and safety regulations.

Within Europe, Middle East & Africa, regulatory rigor and consumer awareness are potent drivers. The European Union’s extended producer responsibility initiatives and the Ecolabel certification framework have elevated sustainability credentials, prompting a shift towards bio-based papers and solvent-free coatings. Middle East markets, buoyed by infrastructure projects and packaging modernization, are exhibiting robust growth, while Africa’s emerging economies are investing in anti-counterfeiting security papers for banknotes, certificates, and legal documents.

Asia-Pacific stands out for its scale and innovation velocity. Rapid growth in e-commerce and pharmaceutical manufacturing has generated heightened demand for specialized packaging and diagnostic media. Regional producers are expanding capacity in China, Japan, and Southeast Asia to meet domestic needs and export ambitions. Meanwhile, cross-border collaborations between technology providers and paper mills are facilitating the introduction of smart label solutions and antimicrobial substrates. These regional distinctions underscore the necessity for tailored go-to-market approaches and strategic alliances to capture the full scope of global opportunities.

This comprehensive research report examines key regions that drive the evolution of the Specialty Paper market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Specialty Paper Providers and Their Strategic Movements Shaping Competitive Dynamics and Innovation Pathways in the Sector

Major players in the specialty paper arena are undertaking strategic initiatives to reinforce market positioning and accelerate innovation. A leading North American producer has expanded its capacity for synthetic substrates through a greenfield investment, integrating state-of-the-art extrusion lines to address growing demand for moisture-resistant papers. At the same time, a European industry stalwart has formed a joint venture with a chemical innovator to develop next-generation barrier coatings that meet stringent food safety standards.

Another global manufacturer has focused on technology licensing agreements, enabling rapid deployment of proprietary printing and coating technologies across multiple regions. This approach has facilitated faster time-to-market for premium graphic arts and security paper solutions. Meanwhile, an Asia-Pacific conglomerate has pursued select acquisitions to bolster its presence in high-growth segments such as pharmaceutical packaging and flexible industrial liners, complementing its existing portfolio of release liners and label stocks.

Across the competitive landscape, partnerships with printing equipment vendors and digital solution providers are becoming more prevalent. By integrating hardware, software, and substrate development, these collaborations are delivering turnkey systems that reduce implementation complexity for end-users. As competition intensifies and differentiation hinges on advanced functionalities, organizations that leverage both organic growth and strategic alliances will secure leadership in the evolving specialty paper market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Specialty Paper market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ahlstrom-Munksjö Oyj

- BillerudKorsnäs AB

- Cascades Inc.

- Domtar Corporation

- Fedrigoni S.p.A.

- Georgia-Pacific LLC

- International Paper Company

- ITC Limited

- JK Paper Ltd.

- Koehler Paper SE

- Mondi plc

- Neenah, Inc.

- Nippon Paper Industries Co., Ltd.

- Oji Holdings Corporation

- Pixelle Specialty Solutions LLC

- Sappi Limited

- Stora Enso Oyj

- Twin Rivers Paper Company

- UPM-Kymmene Oyj

- WestRock Company

Formulating Targeted Strategic Initiatives and Operational Tactics to Empower Industry Stakeholders in Maximizing Specialty Paper Market Opportunities

To thrive in the dynamic specialty paper landscape, industry stakeholders should prioritize a multifaceted strategy that balances innovation with operational resilience. First, allocating resources to develop eco-friendly substrates and solvent-free coatings will not only meet regulatory mandates but also resonate with sustainability-focused customers. Incorporating recycled and bio-based fibers into product formulations can differentiate offerings and enhance brand reputation over the long term.

Second, supply chain diversification is crucial in light of tariff volatility and raw material constraints. Establishing multiple sourcing channels, pursuing nearshoring opportunities, and forging strategic alliances with chemical producers will reduce exposure to geopolitical risks. Concurrently, investments in automation and digital procurement platforms can streamline supplier switching and enable real-time cost optimization.

Third, deepening customer engagement through collaborative R&D and customized solution design will strengthen partnerships and drive premium pricing. Offering additive value-such as integrated smart label features or antimicrobial treatments-can open new application areas and create sticky customer relationships. Finally, embracing advanced analytics for demand forecasting and quality control will bolster decision-making accuracy, minimize waste, and accelerate innovation cycles. By executing these targeted tactics, market leaders can secure competitive advantage and sustain growth in an increasingly complex environment.

Outlining Rigorous Methodological Frameworks and Analytical Approaches Employed to Ensure Depth, Accuracy, and Reliability of Specialty Paper Market Insights

This research employs a robust, multi-stage methodology designed to ensure comprehensive coverage and analytical rigor. The process begins with in-depth secondary research, drawing on published technical papers, regulatory filings, and open-source industry data to establish foundational knowledge of material innovations, application trends, and regional policies. Building on this groundwork, a series of primary interviews with industry executives, R&D scientists, and procurement managers lends qualitative depth to the analysis, uncovering nuanced perspectives on competitive positioning and emerging use cases.

Quantitative data collection involves aggregating production output metrics, trade statistics, and coating consumption volumes, which are then normalized to account for regional variances and fiscal cycles. To verify accuracy, these data sets are cross-referenced against multiple independent sources, including trade associations and customs databases. Advanced analytical techniques-such as trend extrapolation, correlation analysis, and scenario mapping-are employed to dissect tariff impacts, segmentation dynamics, and regional performance indicators.

Finally, expert validation workshops convene seasoned market practitioners to review and refine key findings, ensuring that the report’s conclusions resonate with on-the-ground realities. This iterative approach blends qualitative interviews, quantitative modeling, and peer review, resulting in insights that are both actionable and defensible. By adhering to this methodological framework, the research guarantees a balanced, thorough portrayal of the specialty paper market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Specialty Paper market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Specialty Paper Market, by Paper Type

- Specialty Paper Market, by Material Type

- Specialty Paper Market, by Basis Weight

- Specialty Paper Market, by Application

- Specialty Paper Market, by Industry

- Specialty Paper Market, by Region

- Specialty Paper Market, by Group

- Specialty Paper Market, by Country

- United States Specialty Paper Market

- China Specialty Paper Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings, Strategic Implications, and Conclusive Perspectives to Guide Decision-Makers in the Specialty Paper Industry

The analysis presented herein underscores the multifaceted evolution of the specialty paper sector, driven by technological breakthroughs, regulatory pressures, and shifting demand patterns. The convergence of digital printing requirements and sustainability imperatives has yielded a rich tapestry of product innovations-from high-performance synthetic substrates to eco-conscious coating systems. Concurrently, external forces such as tariff adjustments and environmental mandates have tested supply chain resilience and challenged traditional sourcing paradigms.

Segmentation insights reveal that distinct paper types, application areas, material compositions, basis weights, and industry verticals each offer unique value propositions and growth trajectories. Regional distinctions further highlight the importance of tailored strategies, with the Americas focusing on sustainable packaging, EMEA on regulatory compliance, and Asia-Pacific on scale and rapid innovation deployment. Competitive analysis of leading firms demonstrates the critical role of strategic investments, partnerships, and capacity expansions in shaping market leadership.

Collectively, these findings convey a clear message: organizations that integrate sustainability, digital transformation, and operational adaptability into their core strategies will thrive amid ongoing market complexities. As the specialty paper landscape continues to mature, embracing collaborative innovation and proactive risk management will be paramount in capturing emerging opportunities and safeguarding long-term competitiveness.

Encouraging Decision-Makers to Engage with Ketan Rohom for Customized Insights and Access to the Comprehensive Specialty Paper Market Research Report

Ready to elevate your strategic perspective with in-depth, data-driven insights into the specialty paper market? Connect with Ketan Rohom, Associate Director of Sales & Marketing at our firm, to secure access to the complete market research report. Whether you require tailored analysis on tariff impacts, segmentation trends, or regional growth trajectories, Ketan can provide a customized consultation and guide you through the comprehensive findings. Unlock unparalleled visibility into emerging opportunities, competitive strategies, and best practices that will empower your organization to stay ahead in a rapidly evolving landscape. Reach out today to arrange a detailed briefing and discover how this extensive research can catalyze informed decision-making and sustainable growth for your business

- How big is the Specialty Paper Market?

- What is the Specialty Paper Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?