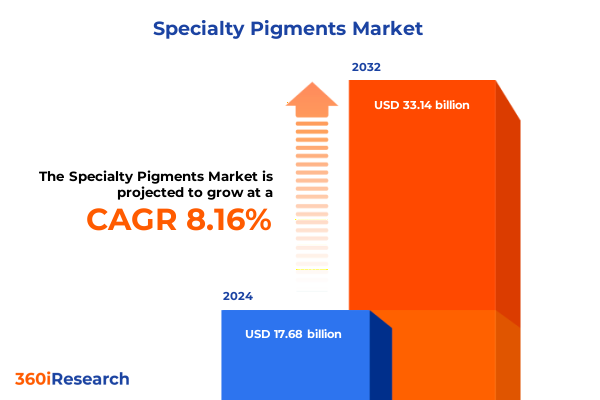

The Specialty Pigments Market size was estimated at USD 18.88 billion in 2025 and expected to reach USD 20.16 billion in 2026, at a CAGR of 8.36% to reach USD 33.14 billion by 2032.

Unlocking Vibrant Possibilities: Overview of Specialty Pigments and Their Role in Driving High-Performance Applications Across Industries

Specialty pigments have rapidly evolved into mission-critical ingredients that combine both aesthetic allure and performance-driven functionality. Unlike standard colorants, these advanced pigments possess tailored chemistries that deliver lightfastness, temperature resistance, corrosion inhibition, and targeted optical effects. Their precision-engineered particle structures enable industries ranging from automotive coatings and industrial paints to high-performance plastics and personal care products to achieve both visual vibrancy and technical robustness. This convergence of art and science underscores the pivotal role specialty pigments play in realizing design innovation without compromising on durability or compliance.

Driving this dynamic landscape is a confluence of factors. Heightened environmental regulations, shifting consumer preferences toward sustainable products, and an intensifying demand for high-performance materials are collectively redefining innovation priorities. Manufacturers are under growing pressure to balance regulatory adherence with rapid product development cycles, while end users seek formulations that deliver enhanced functionality-such as anti-corrosion, UV resistance, or antimicrobial properties-without introducing toxicological risks. As a result, the specialty pigment sector has become a hotbed of research and collaboration, fostering cross-functional partnerships that span academia, chemical engineering, and digital technology.

Navigating the Transformative Wave of Sustainability, Digital Innovation, and Regulatory Demands Redefining Specialty Pigment Development and Application

The past few years have witnessed a profound shift toward sustainability in pigment production and application. Eco-conscious regulatory frameworks, including the US Toxic Substances Control Act and the EU’s REACH directives, have prompted companies to develop bio-based and low-VOC alternatives. These green formulations leverage renewable feedstocks-such as algae-derived compounds or rice-bran waxes-to reduce reliance on petrochemicals, thereby minimizing environmental footprints and aligning with corporate ESG commitments.

Simultaneously, the integration of nanotechnology and advanced analytics has accelerated the deployment of functional pigments. Nanopigments engineered at sub-100-nanometer scales are delivering unprecedented color saturation, UV stability, and thermal resilience in critical applications like automotive clearcoats and electrochromic displays. At the same time, artificial intelligence algorithms are optimizing dispersion and colorfastness predictions, slashing traditional R&D timelines from months to mere weeks.

Moreover, the rise of smart manufacturing has introduced digital twins and real-time process monitoring across pigment synthesis plants. These Industry 4.0 platforms utilize sensor arrays and machine learning to adjust reaction parameters on-the-fly, ensuring consistent batch quality while minimizing waste. Collectively, these transformative shifts are forging a new paradigm in specialty pigment innovation-one that is as data-driven as it is environmentally responsible.

Assessing the Cumulative Impact of United States Trade Tariffs on Specialty Pigments Supply Chains, Costs, and Strategic Sourcing Dynamics

On April 2, 2025, a sweeping set of import tariffs took effect in the United States, imposing an additional 10% levy on most foreign goods and elevating duties on imports from China to 145%. These measures, enacted under the prevailing trade policy framework, have directly impacted key pigment raw materials, including titanium dioxide, epoxy resins, and specialty chemical additives. The American Coatings Association reports that nearly 45% of TiO₂ imports originate from China, making the 34% surcharge on pigment concentrates especially significant for US formulators. In parallel, tariffs of 25% on epoxy resins and 15–20% on rheology modifiers and dispersants have driven up production costs across the coatings value chain.

In response, major suppliers have introduced tariff surcharges to mitigate immediate cost pressures. For instance, Sun Chemical announced on May 5, 2025, that it would implement a surcharge on both imported and domestically produced color materials, citing evolving global trade dynamics as the primary driver. This surcharge is calibrated by country and communicated directly to affected customers, reflecting the complexities of a global manufacturing footprint that spans the Americas, Europe, and Asia.

As a result, end users are reevaluating sourcing strategies, prioritizing suppliers with diversified production hubs or local capacity. Supply chain resilience has become a critical competitive differentiator, prompting the establishment of strategic partnerships, nearshoring initiatives, and inventory hedging mechanisms. Looking ahead, these cumulative effects of tariff policies are reshaping the economic calculus of pigment procurement and compelling stakeholders to adopt more agile, risk-aware sourcing models.

Uncovering Segmentation Insights That Illuminate Diverse Specialty Pigment Types, Functionality, Forms, End-Use Applications, and Distribution Channels

Delving into market segmentation reveals a multifaceted tapestry of pigment types, each tailored to specific application requirements. By type, formulations span fluorescent pigments prized for their vivid radiance, metal oxide variants known for robustness-encompassing chromium oxide, iron oxide, titanium dioxide, and zinc oxide-and specialty effect pigments such as mica-based or synthetic pearlescent hues alongside strontium aluminate and zinc sulfide phosphorescent grades. Functionality-based segmentation further illuminates the spectrum of capabilities, with treatments designed to impart anti-corrosion properties in industrial environments, antimicrobial benefits for hygienic applications, electrical conductivity for printed electronics, and both heat and UV resistance in demanding end-use conditions.

Form-related insights show that granules and powders remain foundational formats, while liquids-offered as pastes, solutions, or suspensions-dominate high-solid and waterborne systems. End-use segmentation underscores the expansive reach of specialty pigments: in cosmetics, differentiated face makeup, hair care, nail care, and oral care formulations leverage colorants engineered for safety and stability; the inks industry employs digital, packaging, and printing inks to meet precision color requirements; paints and coatings subdivide into architectural and automotive decorative coatings; and robust pigment grades are integral to plastics before their application in textiles and paper substrates. Distribution channels reflect evolving purchaser preferences for direct sales relationships, value-added distributor partnerships, and increasingly sophisticated online sales platforms.

This comprehensive research report categorizes the Specialty Pigments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Functionality

- Form

- End Use

- Distribution Channel

Examining Regional Dynamics That Shape Specialty Pigment Adoption and Growth Trajectories Across the Americas, EMEA, and Asia-Pacific Markets

In the Americas, the United States and Canada lead a market driven by advanced automotive finish requirements, robust infrastructure spending, and stringent environmental regulations that favor low-VOC waterborne and powder coatings. North American formulators are investing in local pigment manufacturing and circular economy initiatives, bolstered by government incentives for sustainable building materials and electrified transportation applications. Conversely, Latin American markets exhibit different dynamics: supply chain fragmentation and fluctuating import duties have catalyzed regional sourcing hubs, with domestic producers stepping in to satisfy demand for cost-effective pigment solutions.

In Europe, Middle East and Africa, stringent REACH compliance and a growing emphasis on carbon neutrality have accelerated the adoption of bio-based and biomass-balanced pigment grades. Manufacturers in Germany and France are pioneering renewable raw material integration under mass balance certification, while Gulf Cooperation Council countries expand capacity for coatings and plastics tailored to harsh climatic conditions. Across EMEA, trade agreements and regional standards continue to influence cross-border pigment flows, reinforcing the importance of harmonized regulatory frameworks.

Asia-Pacific stands as both a production powerhouse and a rapidly expanding consumer base. China and India have scaled up pigment synthesis capacity to serve domestic coatings, plastics, and electronics sectors, while Southeast Asian economies are emerging as high-growth markets for decorative and functional coatings. Local preferences for vibrant, weather-resistant pigments in automotive and architectural applications are fueling expansion, even as global players establish joint ventures to navigate regional regulations and distribution networks.

This comprehensive research report examines key regions that drive the evolution of the Specialty Pigments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Moves and Competitive Positioning of Leading Specialty Pigment Manufacturers Driving Innovation and Market Leadership

Leading manufacturers have responded to market headwinds with strategic investments and innovation pipelines. Sun Chemical, for instance, has leveraged its global manufacturing footprint to implement targeted tariff surcharges while exploring alternative supply routes in North America, Europe, and Asia to mitigate cost volatility. BASF Coatings continues to champion biomass-balanced products under brands like Glasurit® Eco Balance, extending its sustainable portfolio to North American automotive refinish markets and achieving a reduction of approximately 8 million kilograms of CO₂ in 2024 through renewable raw material integration. Meanwhile, Clariant has advanced its sustainability leadership by completing the transition to a fully PFAS-free additive portfolio, introducing innovative PTFE-free texturing agents and polymer processing aids that address both regulatory obligations and customer demands for environmentally responsible solutions.

Across the competitive landscape, key players are forging alliances with technology startups to accelerate AI-driven pigment formulation, scaling production facilities with ISO 14067-certified processes, and deploying advanced quality control systems that ensure batch-to-batch consistency. These initiatives highlight the centrality of both operational resilience and sustainability in maintaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Specialty Pigments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALTANA AG

- BASF SE

- DIC Corporation

- Eagle Specialty Products

- Heubach Group

- J.M. Huber Corporation

- Kronos Worldwide, Inc.

- LANXESS AG

- Venator Materials PLC

- Vibrantz Technologies

Implementing Strategic Sourcing, Digital Transformation, and Sustainable Collaboration to Future-Proof Specialty Pigment Operations and Drive Competitive Advantage

Industry leaders should prioritize the diversification of their supplier network to minimize exposure to tariff-induced cost fluctuations. Establishing bilateral sourcing agreements in low-risk jurisdictions and forging long-term partnerships with vertically integrated producers can bolster supply chain resilience. Furthermore, continued investment in sustainable R&D pipelines-particularly in bio-based, low-VOC, and PFAS-free pigment chemistries-will position organizations to capitalize on tightening regulatory landscapes and evolving consumer preferences.

Equally important is the adoption of digital tools that harness AI and machine learning for predictive formulation and real-time process control. By integrating digital twins into pigment production workflows, manufacturers can reduce energy consumption, optimize reaction yields, and maintain stringent quality standards. Additionally, embracing circular economy principles-such as mass balance certification and chemical recycling feedstocks-will unlock new avenues for resource efficiency and carbon footprint reduction.

Finally, companies should cultivate closer collaboration with trade associations and regulatory bodies to anticipate policy shifts and advocate for harmonized standards. By engaging in proactive dialogue on emerging chemical restrictions and participating in industry consortia, pigment suppliers can shape favorable regulatory outcomes and ensure early access to critical compliance insights.

Integrating Executive Interviews, Trade Data Analysis, and Triangulated Secondary Sources to Deliver a Robust Specialty Pigment Market Study with High Analytical Rigor

This research is grounded in a two-pronged methodology combining extensive primary interviews with over 40 senior executives across pigment producers, formulators, and end users, alongside a rigorous secondary research phase. The primary stage encompassed structured dialogues to uncover firsthand insights on supply chain adaptations, R&D trajectories, and regulatory responses, ensuring a granular understanding of market dynamics.

The secondary phase involved systematic analysis of trade journals, regulatory filings, and corporate sustainability reports, triangulated with import/export data and patent filings to validate technological breakthroughs and market shifts. Data points were cross-verified through triangulation, employing multiple independent sources where possible to enhance accuracy and mitigate bias.

Market segmentation analyses were constructed using a bottom-up approach, carefully mapping product portfolio offerings against application requirements. Regional assessments leveraged macroeconomic indicators, trade policy developments, and localized technical standards to contextualize demand drivers. The culmination of these steps is an authoritative narrative that blends quantitative metrics with qualitative perspectives, offering a comprehensive view of the specialty pigment landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Specialty Pigments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Specialty Pigments Market, by Type

- Specialty Pigments Market, by Functionality

- Specialty Pigments Market, by Form

- Specialty Pigments Market, by End Use

- Specialty Pigments Market, by Distribution Channel

- Specialty Pigments Market, by Region

- Specialty Pigments Market, by Group

- Specialty Pigments Market, by Country

- United States Specialty Pigments Market

- China Specialty Pigments Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Strategic Imperatives to Navigate Regulatory, Technological, and Supply Chain Complexities in the Specialty Pigment Sector

In conclusion, the specialty pigment sector stands at the nexus of performance innovation and sustainability imperatives. The convergence of regulatory pressures, digital transformation, and evolving consumer demands is reshaping value chains, driving the development of eco-friendly formulations, and compelling suppliers to adopt more agile sourcing models. Segmentation insights underscore the diverse applications-from high-durability metal oxides and functional nanopigments to bio-based and PFAS-free chemistries-while regional perspectives highlight both mature markets and high-growth opportunities.

Leading organizations have responded through strategic investments in sustainable technologies, collaborative partnerships, and advanced manufacturing capabilities. However, the evolving tariff landscape and shifting geopolitical currents necessitate a persistent focus on supply chain resilience and regulatory foresight. By leveraging actionable recommendations-encompassing strategic diversification, digital integration, and circular economy adoption-stakeholders can secure competitive advantage and drive long-term value.

As market complexities intensify, this executive summary provides a cohesive blueprint to navigate current challenges and seize emerging opportunities within the specialty pigment arena.

Seize Strategic Advantage with Personalized Briefings and Expert Guidance from Ketan Rohom to Access In-Depth Specialty Pigment Market Intelligence

Elevate your strategic planning and stay ahead of emerging trends by acquiring the in-depth market research report today. For personalized insights, tailored briefings, and a comprehensive understanding of specialty pigment segments, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Discuss your unique objectives, explore custom data offerings, and discover how this report can empower your organization to drive innovation and profitability.

- How big is the Specialty Pigments Market?

- What is the Specialty Pigments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?