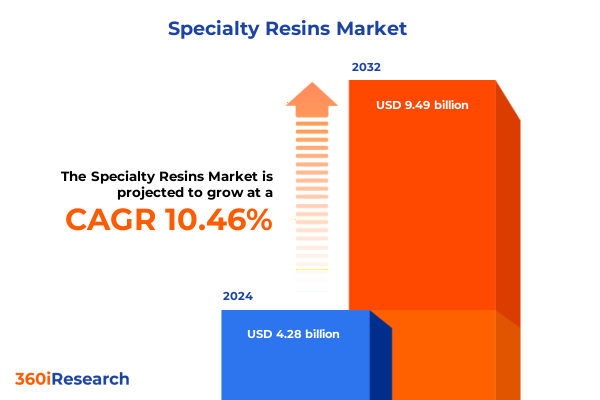

The Specialty Resins Market size was estimated at USD 4.60 billion in 2025 and expected to reach USD 4.96 billion in 2026, at a CAGR of 10.87% to reach USD 9.49 billion by 2032.

An In-Depth Introduction to the Specialty Resins Sector Highlighting Critical Roles, Market Drivers, and Evolving Regulatory Influences

The specialty resins sector serves as a foundational pillar across diverse industrial applications, underpinning innovations that range from high-performance coatings and advanced composites to precision adhesives and electronic encapsulants. Throughout the past decade, manufacturers have placed greater emphasis on material performance and specialized functionality as end users demand solutions that enhance durability, sustainability, and operational efficiency. In parallel, regulatory landscapes and environmental commitments are reshaping supply chain priorities, challenging stakeholders to balance technical advancement with ecological responsibility.

This executive summary provides a concise yet comprehensive overview of the specialty resins market, illuminating key drivers, transformative trends, and strategic market dynamics. It aims to equip industry leaders, investors, and decision-makers with a clear understanding of current conditions and prepares them for anticipated shifts in technology adoption, regional growth patterns, and competitive positioning. With the accelerated push toward cleaner production methods and resilient supply chains, this report highlights critical insights necessary to stay ahead in a rapidly evolving landscape.

How Sustainability, Digitalization, and Collaborative Innovation Are Dramatically Transforming the Specialty Resins Industry

Over the last several years, the specialty resins landscape has undergone transformative shifts driven by sustainability imperatives, digital innovation, and the pursuit of high-performance materials. Manufacturers increasingly prioritize bio-based and low-VOC formulations, responding to global commitments to reduce carbon footprints and comply with stringent environmental regulations. Advances in polymer chemistry are enabling the development of renewable monomer feedstocks, which in turn are fostering circular economy models and strengthening brand reputations through demonstrable ecological stewardship.

Simultaneously, the integration of digital tools across R&D and production processes is reshaping how resins are conceived, tested, and commercialized. Artificial intelligence and machine learning platforms expedite the discovery of novel resin chemistries, optimizing formulations for thermal stability, mechanical strength, and adhesion properties more rapidly than traditional methods. Moreover, IoT-enabled processing equipment affords real-time quality monitoring, minimizing batch variability and reducing waste-thereby enhancing cost efficiency and responsiveness to market requirements.

Beyond technological leaps, collaborative innovation ecosystems have emerged as a defining feature of the specialty resins domain. Cross-sector partnerships among chemical providers, tier-one end user OEMs, academic institutions, and research consortia are yielding proprietary solutions tailored to advanced composites, electronic encapsulation, and corrosion-resistant coatings. These alliances accelerate time-to-market, provide co-development opportunities for customized applications, and establish competitive differentiation in sectors as diverse as aerospace, automotive, and infrastructure.

Analyzing the Far-Reaching Consequences of 2025 U.S. Tariffs on Supply Chains, Sourcing Strategies, and Polymer Manufacturing

In 2025, the cumulative impact of newly enacted U.S. tariffs on resin intermediates and finished formulations has become a pivotal factor shaping supplier strategies and procurement decisions. Companies reliant on imported raw materials from key trading partners have witnessed a noticeable escalation in input costs, prompting immediate reassessment of sourcing strategies. As tariffs have increased landed costs, manufacturers are reallocating orders to domestic producers and exploring alternative chemistries to mitigate margin erosion.

This realignment has, in turn, sparked upstream investment in local polymer production facilities to enhance supply chain resilience and reduce exposure to trade-related volatility. Capital expenditures are being directed toward expanding capacity for specialty epoxies, polyurethanes, and high-performance acrylics, ensuring stable availability of critical feedstocks. At the same time, end users engaged in high-growth sectors such as electronics and aerospace have accelerated substance substitution programs, testing novel resin platforms that deliver comparable performance while sidestepping tariff-affected inputs.

Despite the immediate pressure on procurement budgets, these shifts are also fostering greater geographic diversification of supply networks, leading to more agile logistics frameworks. Forward-looking organizations are leveraging multi-sourcing strategies and collaborative vendor agreements to safeguard production continuity, ultimately strengthening their competitive positioning amid ongoing trade uncertainties.

Comprehensive Market Segmentation Insights Spanning Product Chemistries Applications End-Use Industries and Innovative Technology Platforms

The specialty resins market segmentation reveals nuanced dynamics that inform strategic prioritization across product, application, end-use, technology, form, and sales channel dimensions. Within the product type category, five core chemistries dominate: acrylic systems, where methyl methacrylate leads due to its versatile transparency and hardness; epoxy formulations grounded in bisphenol A and bisphenol F, prized for superior adhesion and thermal resistance; phenolic resins, encompassing both novolac and resole variants, valued for flame retardance; polyester chemistries, including saturated and unsaturated options that serve as the backbone for composite matrices; and polyurethane technologies, split between aliphatic and aromatic formulations to cater to UV stability requirements.

On the application front, specialty resins are tailored to distinct end-use demands. Adhesives and sealants bifurcate into pressure-sensitive and structural grades, addressing everything from flexible packaging to load-bearing assemblies. Coatings segments span automotive finishes, decorative and architectural paints, marine protection systems, and industrial protective layers, each demanding unique resin characteristics. Composites leverage fiber-reinforced formulations for high-strength lightweight constructs, whereas construction resins find their place in flooring and insulation. Electronics applications rely on circuit board encapsulants and protective potting compounds designed to safeguard delicate circuitry.

End-use industry insights further refine strategic focus, with aerospace and defense seeking ultra-high-performance materials, automotive and transportation pushing for weight reduction coupled with durability, construction prioritizing weather and fire resistance, electrical and electronics demanding dielectric stability, and packaging looking for barrier properties and recyclability. Technological platforms span powder, radiation-curable, solvent-based, UV-curable, and water-based systems, each chosen for processing efficiencies and environmental considerations. Resin forms-granules, liquids, pellets, and powders-are optimized for specific manufacturing workflows, while sales channels range from direct engagements to distributor partnerships and growing e-commerce platforms that cater to agile buyers.

This comprehensive research report categorizes the Specialty Resins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Form

- Application

- End Use Industry

- Sales Channel

In-Depth Regional Analysis Highlighting Growth Drivers Regulatory Impacts and Supply Chain Dynamics Across Key Global Markets

Regional dynamics in the specialty resins market underscore significant variation in growth drivers, regulatory frameworks, and supply chain configurations. Within the Americas, longstanding chemical manufacturing hubs are complemented by emerging clusters in the U.S. Gulf Coast and Latin America, where petrochemical feedstocks remain competitively priced. Progressive environmental policies are incentivizing renewable content and low-emission production, fostering innovation in bio-based resin platforms and driving collaborative research initiatives with local universities and tech centers.

In Europe, the Middle East, and Africa, the landscape is shaped by stringent regulations on volatile organic compounds and energy efficiency requirements, guiding manufacturers toward water-based and UV-curable systems. Industrial corridors in Western Europe and the Gulf Cooperation Council nations continue to expand capacity for high-performance epoxy and phenolic resins, driven by robust aerospace, automotive, and electronics sectors. Meanwhile, growing construction projects across the Middle East and Africa are fueling demand for advanced coatings, insulation solutions, and fire-resistant composites.

The Asia-Pacific region remains the largest consumption market, propelled by rapid urbanization, infrastructure development, and strong automotive production. China and India lead investments in domestic specialty resin capacity, focusing on both traditional chemistries and next-generation technologies like powder and radiation-curable formulations to meet escalating industrial and consumer needs. Regional supply chain agility is further enhanced by improving logistics networks and cross-border trade agreements, positioning Asia-Pacific as a pivotal growth engine.

This comprehensive research report examines key regions that drive the evolution of the Specialty Resins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Corporate Strategies Revealing How Leading Resin Manufacturers Are Driving Innovation Expansion and Sustainable Practices

A review of leading companies reveals a competitive landscape defined by strategic investments in innovation, capacity expansion, and sustainability initiatives. Industry incumbents have prioritized strengthening their global production footprint through targeted acquisitions and joint ventures, securing access to critical feedstocks and advanced process technologies. Research and development budgets are increasingly allocated toward high-value, differentiated offerings-such as ultra-low free formaldehyde phenolic resins and next-generation UV-curable polymers designed for rapid curing applications.

Commercial strategies of top players emphasize value-added services, including technical support centers and custom application labs that enable close collaboration with key end-users. Digitalization efforts have also gained prominence, with enterprise platforms facilitating real-time supply chain visibility, predictive maintenance of production assets, and interactive customer portals for order management and product selection. Sustainability commitments are being underscored by transparent ESG reporting, renewable energy procurement, and development of closed-loop recycling programs for resin byproducts.

Smaller and mid-tier companies are carving out niches by specializing in bespoke formulations or regional expertise, partnering with global material science leaders to co-develop products tailored to local market conditions. This tiered competitive structure fosters a dynamic ecosystem where large integrated producers co-exist with agile innovators, driving continuous performance improvements and application-specific advancements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Specialty Resins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- BASF SE

- Covestro AG

- DIC Corporation

- Dow Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Huntsman Corporation

- LANXESS AG

- LG Chem Ltd.

- Mitsubishi Chemical Group Corporation

- Saudi Basic Industries Corporation

- Sumitomo Bakelite Co., Ltd.

- Wacker Chemie AG

Actionable Recommendations to Foster Sustainable Innovation Diversified Supply Chains and Enhanced Customer-Focused Value Creation

To thrive in the evolving specialty resins arena, industry leaders should prioritize the integration of sustainable materials and circular processes into core product development, ensuring compliance with tightening environmental standards and capitalizing on green premium market segments. Committing resources to digital R&D platforms will accelerate novel chemistry discovery, reduce formulation cycle times, and enhance predictive quality control in manufacturing.

Simultaneously, organizations should diversify supply chain sources by forging strategic partnerships with regional producers and alternative feedstock suppliers, thereby reducing exposure to geopolitical and tariff-related disruptions. Investing in modular production assets and flexible processing lines will enable rapid scale-up for emerging resin technologies while optimizing inventory management under volatile market conditions.

Furthermore, embedding customer-centric value-added services-such as on-site technical assistance, application trials, and digital product configuration tools-will deepen end-user engagement and unlock higher margin opportunities. Lastly, transparent ESG reporting and lifecycle assessments should be standardized, reinforcing corporate credibility and meeting the investor and regulatory demands for sustainability performance.

Detailed Explanation of Research Approach Combining Primary Interviews Secondary Analysis and Quantitative Data Validation

This market analysis is grounded in a rigorous research methodology that triangulates primary interviews, secondary literature, and quantitative data sources. Expert insights were gathered through in-depth discussions with resin manufacturers, industry consultants, research academics, and key end-user procurement and R&D executives, ensuring a balanced perspective on emerging challenges and opportunities.

Secondary research encompassed technical journals, regulatory databases, and corporate disclosures, providing context on raw material availability, technology roadmaps, and regional policy frameworks. Quantitative analysis involved statistical treatment of trade flows, capacity utilization rates, and patent activity, enabling identification of leading innovation clusters. Data validation was performed through cross-referencing proprietary shipment data against publicly reported production volumes to ensure accuracy.

Trend projections and strategic implications were formulated via scenario planning workshops with subject matter experts, focusing on supply chain resilience, technological convergence, and sustainability imperatives. This comprehensive approach ensures that the insights presented reflect current market realities and equip stakeholders with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Specialty Resins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Specialty Resins Market, by Product Type

- Specialty Resins Market, by Technology

- Specialty Resins Market, by Form

- Specialty Resins Market, by Application

- Specialty Resins Market, by End Use Industry

- Specialty Resins Market, by Sales Channel

- Specialty Resins Market, by Region

- Specialty Resins Market, by Group

- Specialty Resins Market, by Country

- United States Specialty Resins Market

- China Specialty Resins Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Concise Conclusion Emphasizing Strategic Imperatives Sustainability Drivers and Regional Differentiation in Specialty Resins

In summary, the specialty resins market stands at a crossroads defined by sustainability demands, digital acceleration, and geopolitical influences reshaping supply chains. The interplay between regulatory pressures and end-user performance requirements is driving rapid innovation across resin chemistries and processing technologies. Companies that effectively integrate green materials, leverage digital tools for accelerated development, and diversify sourcing strategies will secure competitive advantage.

Regional variations underscore the importance of tailoring strategies to local market conditions-whether harnessing Americas’ feedstock strengths, aligning with stringent EMEA regulations, or capitalizing on Asia-Pacific’s manufacturing scale. By embracing collaborative innovation ecosystems and transparent sustainability practices, stakeholders can navigate uncertainties and capture growth in high-value applications such as aerospace, electronics, and advanced coatings.

Unlock Exclusive Market Research on Specialty Resins by Connecting Directly with Our Associate Director of Sales and Marketing

Engage directly with Ketan Rohom, the Associate Director of Sales & Marketing, to gain access to exclusive insights and comprehensive understanding of the specialty resins landscape. By securing this in-depth market research report, decision-makers and industry professionals will be empowered with rigorous analysis, actionable strategies, and data-driven perspectives tailored to navigate current challenges and capitalize on emerging opportunities. Reach out today to unlock the full potential of specialty resins and drive innovation, resilience, and growth within your organization.

- How big is the Specialty Resins Market?

- What is the Specialty Resins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?