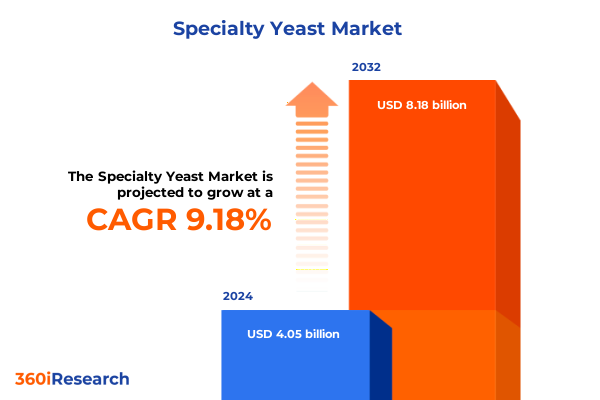

The Specialty Yeast Market size was estimated at USD 4.41 billion in 2025 and expected to reach USD 4.81 billion in 2026, at a CAGR of 9.41% to reach USD 8.28 billion by 2032.

Unveiling the Crucial Role of Specialty Yeast Across Industries to Highlight Market Dynamics and Strategic Opportunities for Stakeholders

Specialty yeast serves as the invisible catalyst behind a remarkable spectrum of products that define modern food, beverage, pharmaceutical, and bioindustrial sectors. Far from being a single uniform ingredient, specialty yeast encompasses a variety of strains and formulations engineered to deliver unique functional attributes, from optimized fermentation profiles in craft breweries to enhanced nutritional value in dietary supplements. This introduction explores its multifaceted significance and frames the strategic context for stakeholders seeking to navigate its complexities.

Across bakeries, the transition from bulk active dry yeast to high-performance instant and fresh variants reflects an unyielding demand for consistency, speed, and sensory quality. Brewers and distillers, meanwhile, rely on precisely calibrated ale and lager strains to achieve nuanced flavor profiles, control fermentation kinetics, and maintain brand differentiation. Nutritional yeast, marketed as flakes or powders, satisfies health-conscious consumers seeking umami flavor and rich B-vitamin content, while probiotic yeast strains such as Saccharomyces boulardii drive emerging opportunities in gut health products. As the lines between food, pharma, and energy sectors blur, industry leaders must cultivate a deep understanding of these applications to remain competitive.

In this executive summary, we contextualize recent technological developments, regulatory shifts, and market dynamics against a backdrop of evolving consumer preferences and geopolitical factors. By examining transformative shifts, tariff implications, segmentation intelligence, regional performance, and corporate strategies, we aim to furnish decision-makers with a cohesive narrative and actionable insights. The ensuing sections will guide readers through critical considerations, ensuring a comprehensive overview of the specialty yeast landscape without prescriptive market forecasts or estimations.

Exploring Groundbreaking Technological Innovations and Sustainability Trends Reshaping the Specialty Yeast Ecosystem to Address Emerging Consumer and Industrial Demands

Innovations in strain engineering and bioprocess design have ignited a renaissance in specialty yeast applications. Advances in synthetic biology enable the development of yeast variants with enhanced stress tolerance, tailored metabolic pathways, and refined flavor compound production. Such breakthroughs empower producers to achieve faster fermentation cycles, higher yields, and reduced off-flavor generation. Concurrently, continuous fermentation systems and precision bioreactors allow real-time monitoring and automated control, elevating reproducibility and operational efficiency.

Sustainability has emerged as an equally transformative force, prompting players across the value chain to adopt circular economy principles. Waste streams from agriculture, brewery spent grains, and glycerol byproducts are now being repurposed as feedstocks for yeast cultivation, driving down raw material costs while minimizing environmental footprints. Lifecycle assessments, carbon neutrality targets, and green labeling increasingly influence purchasing decisions, compelling suppliers to bolster transparency and traceability.

Moreover, consumer demand for clean-label, plant-based, and functional ingredients spurs the development of yeast-derived proteins and bioactive compounds. Applications in nutraceuticals and personalized nutrition harness yeast’s inherent capacity for micronutrient biosynthesis, aligning with emerging wellness trends. As regulatory bodies refine guidelines for novel ingredients and labeling, companies that anticipate compliance requirements and collaborate with certification agencies will secure first-mover advantages. Collectively, these technological and sustainability-driven shifts are redefining competitive boundaries and unlocking new pathways for value creation.

Assessing the Comprehensive Effects of 2025 United States Tariff Measures on Supply Chains Pricing and Competitive Positioning in the Specialty Yeast Sector

Tariff measures enacted in the United States as of January 1, 2025, introduced new levies on specialty yeast imports originating from key exporting regions, significantly altering cost structures along the supply chain. Organizations that previously relied on European and Asian suppliers for premium ale and lager strains encountered immediate price escalations for imported biomass and starter cultures. In response, domestic manufacturers accelerated capacity expansions and public-private partnerships to localize production, mitigating the volatility induced by cross-border duties.

Beyond direct cost implications, these tariff policies prompted a reconfiguration of logistics networks. Importers re-evaluated shipping routes to minimize exposure to port congestion and demurrage charges, while investing in cold-chain infrastructure to preserve strain viability during longer transit times via alternative corridors. Simultaneously, end-product prices for craft beverages and specialty baked goods adjusted upward, eliciting scrutiny from regulatory bodies overseeing consumer price inflation. Strategic procurement teams now prioritize diversified sourcing, including opportunistic spot purchases from non-tariffed origins.

Longer term, tariff-driven headwinds underscore the importance of vertical integration and raw material security. Producers that invested in proprietary strain libraries and built in-house propagation facilities strengthened their resilience against geopolitical disruptions. Nonetheless, smaller enterprises with limited capital faced heightened barriers to entry and scale-up, intensifying consolidation pressures within the sector. In navigating these evolving dynamics, stakeholders must balance cost considerations with quality imperatives, ensuring that alternative sourcing strategies sustain both regulatory compliance and product performance.

Interpreting Nuanced Market Segmentation Based on Product Types Formulations and Applications to Uncover Strategic Growth Pathways

Market segmentation yields granular insights into demand drivers and product positioning, illuminating where growth and innovation intersect. When examined by product type, baking yeast holds enduring relevance, with its subdivisions of active dry, fresh, and instant formats each satisfying distinct operational needs in artisanal and industrial bakeries. Brewer’s yeast, divided into ale and lager strains, fuels flavor diversity across the global beer landscape, while distiller’s yeast workflows differentiate between industrial-grade biomass used for fuel ethanol and specialized spirit production.

Nutritional yeast, marketed as flakes and powders, caters to health-oriented consumers seeking nutritional fortification and savory flavor enhancement in plant-based recipes. Meanwhile, probiotic yeast, represented primarily by Saccharomyces boulardii, serves therapeutic applications in gastrointestinal health. Overlaying these categories, form-based segmentation-distinguishing between dry (active dry and instant) and liquid (compressed and cream) variants-reveals logistical and shelf-life considerations that influence supplier selection and distribution strategies.

Application-based perspectives further refine strategic focus. In animal feed, yeast’s protein-rich composition and gut-modulating effects support livestock performance, whereas biofuel operations require robust strains optimized for fuel and industrial ethanol. Within brewing and distilling contexts, yeast performance dictates production efficiency, flavor consistency, and regulatory compliance. Finally, channels of distribution-offline retail and wholesale versus online direct and e-commerce platforms-reflect evolving procurement behaviors, with digital marketplaces enabling direct engagement and data-driven demand forecasting.

By synthesizing these segmentation layers, industry stakeholders can identify under-served niches, align portfolio investments with high-value opportunities, and calibrate go-to-market strategies. Such a multifaceted view fosters differentiated positioning, guiding both product development and channel expansion initiatives without reliance on aggregated forecasts.

This comprehensive research report categorizes the Specialty Yeast market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

- Distribution Channel

Decoding Regional Performance Drivers and Emerging Opportunities Across Americas Europe Middle East and Africa and Asia Pacific Specialty Yeast Markets

Geographic contexts shape both consumption patterns and production ecosystems, creating distinct performance profiles across the Americas, Europe Middle East and Africa, and Asia Pacific regions. In the Americas, established bakery traditions in North America coexist with burgeoning craft brewing scenes in Latin America, where local entrepreneurs leverage indigenous grains and yeast strains to differentiate their portfolios. Regulatory frameworks in the United States and Canada incentivize clean-label claims, while cross-border trade agreements influence raw material flows from Canada and Mexico.

Meanwhile, the Europe Middle East and Africa corridor exhibits complex interplays between heritage distilling markets in Western Europe and rapidly expanding nutraceutical demand in the Middle East. African feed sectors increasingly adopt yeast-based supplements to enhance animal health, but infrastructural limitations pose logistical challenges. European players lead in strain innovation and quality certification, setting benchmarks for global compliance standards.

Asia Pacific represents the fastest evolving region, driven by exponential growth in biofuel mandates, rising consumer health awareness in Southeast Asia, and unparalleled e-commerce penetration in East Asia. Local manufacturers in China and India scale capacity to meet both domestic and export needs, while regulatory harmonization efforts under ASEAN and regional trade agreements facilitate cross-border collaboration. Yet, competition from cost-competitive suppliers necessitates continuous innovation and adherence to stringent quality metrics.

Recognizing these regional nuances enables organizations to tailor product offerings, invest in region-specific R&D, and optimize distribution networks. By doing so, companies can effectively bridge global competencies with localized market demands, ensuring agility in a geopolitically dynamic environment.

This comprehensive research report examines key regions that drive the evolution of the Specialty Yeast market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players to Reveal Competitive Strategies Strategic Partnerships and Innovation Portfolios in the Specialty Yeast Realm

A cohort of industry leaders drives innovation, sets quality benchmarks, and steers competitive dynamics. Lesaffre, with its century-long heritage, continues to invest in bioprocess optimization and strategic joint ventures targeting emerging applications in bioenergy and nutrition. Chr. Hansen leverages its microbial expertise to expand probiotic portfolios, collaborating with academic institutions to explore novel gut-health formulations. Angel Yeast demonstrates a dual focus on capacity expansion in Asia and the development of premium baking and brewing strains, aligning closely with regional consumption patterns.

Kerry Group integrates yeast technology within its broader taste and nutrition platform, emphasizing clean-label ingredient systems and personalized nutrition solutions. Lallemand stands out for its commitment to sustainability, pioneering carbon-neutral production facilities and circular feedstock models. Beyond these established players, a rising wave of biotech startups specializes in custom strain development, leveraging CRISPR-based editing and high-throughput screening to deliver bespoke functional traits.

Collaborations between global corporations and niche innovators have become increasingly prevalent, enabling rapid commercialization of advanced yeast strains. Mergers and acquisitions further consolidate core competencies, driving scale advantages in R&D and production. As supply chain resilience and regulatory compliance rise to the forefront, companies investing in integrated quality management systems and traceable seed-stock repositories gain strategic leverage.

Understanding the competitive landscape and each player’s innovation trajectory equips decision-makers to forge alliances, benchmark performance, and anticipate disruptive entrants. Such insights form the basis for informed partnership negotiations and targeted expansion strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Specialty Yeast market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AEB Group S.p.A.

- Agrano GmbH & Co. KG

- Alltech, Inc.

- Angel Yeast Co., Ltd.

- Archer Daniels Midland Company

- Aria Ingredients Inc.

- Associated British Foods plc

- Beldem S.A.

- Biorigin Alimentos e Ingredientes Ltda

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- Foodchem International Corporation

- Halcyon Proteins Pty. Ltd.

- Jeevan Biotech Pvt. Ltd.

- Kemin Industries, Inc.

- Kerry Group plc

- KOHJIN Life Sciences Co., Ltd.

- Koninklijke DSM N.V.

- Lallemand Inc.

- Leiber GmbH

- Lesaffre SA

- Levex Chemicals Inc.

- Nutreco N.V.

- Oriental Yeast Co., Ltd.

- Synergy Flavors LLC

- Titan Biotech Ltd.

Strategic Imperatives for Industry Leaders to Capitalize on Innovation Streamline Supply Chains and Enhance Market Resilience

To thrive amid technological disruption and geopolitical volatility, industry leaders must align strategic priorities with emerging market imperatives. First, allocating resources toward advanced strain engineering and fermentation process innovation will yield differentiated products capable of commanding premium positions in target segments. Establishing collaborative research consortia with academic and biotech partners accelerates development timelines and spreads risk.

Second, building redundant and agile supply chains mitigates the impact of tariff fluctuations and logistical bottlenecks. This involves diversifying sourcing across multiple geographies, investing in localized propagation facilities, and integrating real-time monitoring tools for end-to-end visibility. Such resilience not only safeguards margins but also underpins sustainable growth targets.

Third, commitment to sustainability should permeate both product portfolios and operational footprints. By adopting circular feedstock strategies, reducing energy consumption in fermentation, and transparently communicating environmental credentials, companies can differentiate themselves in competitive procurement processes and secure favorable regulatory treatments.

Lastly, purposeful channel management-balancing traditional wholesale and retail partnerships with direct digital engagement-ensures that organizations capture emerging consumer segments while maintaining established distribution flows. Tailored regional approaches, informed by deep cultural and regulatory understanding, will further optimize go-to-market effectiveness and accelerate new product adoption.

Methodical Approach and Robust Analytical Framework Supporting the Comprehensive Assessment of the Global Specialty Yeast Landscape

The insights presented in this report are the culmination of a rigorous multi-stage methodology designed to ensure analytical robustness and strategic relevance. Initially, extensive secondary research was conducted, drawing from peer-reviewed journals, industry association publications, and regulatory databases to establish a foundational knowledge base. This phase enabled the identification of key product types, formulations, and application domains within the specialty yeast ecosystem.

Subsequently, primary research interviews were carried out with senior executives, fermentation scientists, supply chain experts, and regulatory authorities across multiple regions. These discussions provided qualitative depth, validated emerging trends, and uncovered on-the-ground challenges and best practices. Quantitative data points were triangulated using proprietary databases and public trade statistics, ensuring consistency and mitigating potential biases.

A proprietary segmentation framework was applied to dissect the market across product type, form, application, and distribution mode. Regional deep dives leveraged geopolitical analysis and logistics modeling to evaluate supply chain vulnerabilities and growth catalysts. Competitive benchmarking incorporated patent filings, M&A activity, and R&D investments to map innovation trajectories and identify partnership prospects.

Throughout the process, data integrity checks and peer reviews were implemented to maintain methodological transparency. The result is a cohesive report that balances qualitative insights with quantitative rigor, enabling stakeholders to make informed strategic decisions within the specialty yeast landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Specialty Yeast market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Specialty Yeast Market, by Product Type

- Specialty Yeast Market, by Form

- Specialty Yeast Market, by Application

- Specialty Yeast Market, by Distribution Channel

- Specialty Yeast Market, by Region

- Specialty Yeast Market, by Group

- Specialty Yeast Market, by Country

- United States Specialty Yeast Market

- China Specialty Yeast Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Summarizing Strategic Insights Emphasizing the Imperative of Sustainable Innovation for Long Term Growth in the Specialty Yeast Industry

In summarizing the strategic insights outlined throughout this executive summary, it becomes clear that the specialty yeast sector is undergoing profound transformation driven by technological innovation, sustainability imperatives, and shifting geopolitical forces. The introduction of new tariff regimes has prompted supply chain recalibrations, reinforcing the necessity for regional production resilience and diversified sourcing strategies. At the same time, advances in strain engineering and process optimization continue to elevate performance standards across baking, brewing, distilling, nutraceutical, and biofuel applications.

Segmentation analysis reveals rich opportunities for targeted product development and channel expansion, particularly within health-oriented and industrially demanding segments. Regional assessments underscore the importance of localized strategies that accommodate unique regulatory frameworks, consumer preferences, and logistical infrastructures. Competitive profiling emphasizes the role of collaborative ecosystems, where established industry players and agile startups converge to accelerate innovation and commercialize differentiated offerings.

Looking ahead, success will hinge on the ability of organizations to embed sustainability across their value chains, harness emerging technologies, and cultivate partnerships that amplify R&D capabilities. By adhering to the actionable recommendations provided, industry leaders can position themselves to capture the next wave of growth and solidify their standing in a marketplace characterized by rapid evolution and intensifying competition.

Secure Access to Expert Specialty Yeast Market Intelligence and Personalized Support from Ketan Rohom to Propel Your Strategic Decisions

If you are seeking precise, up-to-date insights into market dynamics, innovative applications, and regulatory impacts within the specialty yeast sector, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise will guide you through tailored solutions, ensure that you access the most relevant data segments and strategic recommendations, and help you integrate these findings into your organization’s growth plans. Secure your market research report today to gain the competitive edge necessary for driving innovation, optimizing supply chains, and capturing new opportunities in an evolving landscape.

- How big is the Specialty Yeast Market?

- What is the Specialty Yeast Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?