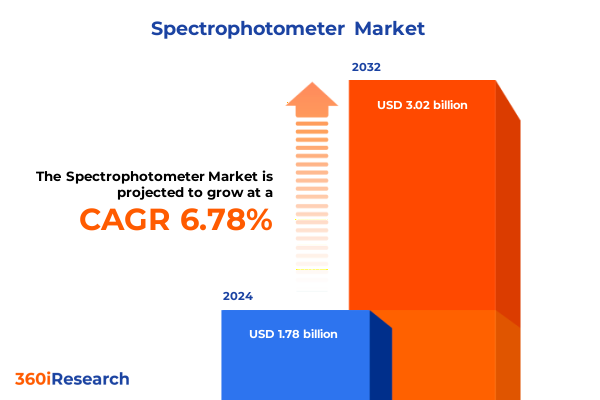

The Spectrophotometer Market size was estimated at USD 1.90 billion in 2025 and expected to reach USD 2.02 billion in 2026, at a CAGR of 6.83% to reach USD 3.02 billion by 2032.

Illuminating the Future of Spectrophotometry: Navigating Precision Analytical Tools in Evolving Scientific and Industrial Environments

Spectrophotometry stands at the vanguard of analytical measurement techniques, providing unparalleled precision in quantifying interactions between electromagnetic radiation and matter. From the determination of compound concentration in pharmaceutical formulations to the monitoring of environmental pollutants in water and air, spectrophotometers form the backbone of quality control, research, and regulatory compliance across a multitude of industries. Their ability to deliver rapid, non-destructive analysis with high reproducibility has cemented their status as indispensable tools for laboratories, production facilities, and field applications.

In recent years, the convergence of advanced materials science, digital integration, and evolving customer requirements has propelled spectrophotometer technology into new frontiers. This executive summary offers a holistic overview of the market dynamics shaping the spectrophotometer landscape, including key shifts in innovation, trade policies, and end-user expectations. By framing the current state of play, we aim to equip decision-makers with the context necessary to anticipate emerging opportunities and navigate potential challenges in an increasingly competitive environment.

Identifying Disruptive Technological Advances and Market Forces Reshaping Spectrophotometry Applications Across Diverse Sectors

The spectrophotometer arena is experiencing profound transformation driven by the integration of digital platforms and the democratization of analytical performance. Recent breakthroughs in instrument miniaturization have resulted in portable and handheld solutions that rival the sensitivity and accuracy of traditional benchtop units. This shift toward mobility empowers field scientists and quality control teams to perform real-time analyses outside the confines of centralized laboratories, enhancing responsiveness in applications such as environmental monitoring and on-site process control.

Concurrently, the rise of artificial intelligence and machine learning algorithms has disrupted data interpretation workflows, automating spectral deconvolution and trend detection. Predictive analytics platforms are now capable of recommending corrective actions based on spectral patterns, thereby reducing human error and accelerating throughput. Additionally, the proliferation of cloud-based architectures has enabled seamless data storage and remote collaboration, fostering cross-functional insights and enabling geographically dispersed teams to coalesce around shared datasets.

On the material science front, novel light sources and detector arrays are delivering expanded wavelength coverage and superior signal-to-noise ratios. The introduction of back-thinned CCD sensors and advanced grating designs has elevated instrument sensitivity, unlocking new applications in trace component analysis and real-time reaction monitoring. Meanwhile, regulatory frameworks are evolving to incorporate spectrophotometric methods as part of official testing protocols, further solidifying their role in quality assurance and compliance regimes.

Examining the Multifaceted Consequences of New Trade Measures on Spectrophotometer Supply Chains and Procurement Dynamics Globally

The imposition of additional duties on imports from China under Section 301, coupled with the suspension of the de minimis exemption for shipments valued under $800, has exerted significant pressure on global spectrophotometer supply chains. As of January 1, 2025, most scientific instruments originating from designated regions have incurred supplementary tariffs of up to 50 percent, prompting manufacturers and distributors to reassess sourcing strategies and cost models. These developments have catalyzed a wave of near-shoring initiatives, with an emphasis on domestic production and localized assembly to mitigate exposure to punitive trade measures.

Heightened logistics costs have also influenced procurement timelines, with extended lead times becoming commonplace as suppliers adapt to elevated customs processing requirements. To maintain competitive pricing, industry stakeholders are increasingly negotiating long-term supply contracts, locking in favorable rates and securing preferential treatment through bonded warehouse arrangements. Furthermore, alliances between equipment OEMs and domestic component suppliers are gaining traction, enabling the development of tariff-resilient product portfolios that leverage non-subject materials and alternative manufacturing geographies.

Despite these headwinds, the tariff-induced price adjustments have heightened awareness of total cost of ownership, spurring buyers to prioritize instrument durability, modular upgradability, and remote diagnostic capabilities. In response, manufacturers are enhancing warranties and offering flexible service models to preserve customer loyalty. Looking ahead, sustained collaboration between industry associations, regulatory bodies, and trade authorities will be essential in shaping policies that balance economic interests with the imperative for scientific progress.

Delineating Core Spectrophotometer Segmentation Insights Spanning Product Types Technologies Applications End Users Portability and Wavelength Capabilities

In the realm of product architecture, spectrophotometers span a spectrum of analytical modalities, from atomic absorption to UV-visible systems, each tailored to distinct measurement challenges. Atomic absorption platforms, available in both flame and graphite furnace configurations, excel in trace metal quantification, whereas fluorescence instruments-offered as benchtop and portable units-extend sensitivity to the nanogram level for biomolecular assays. Fourier-transform infrared devices, whether benchtop or portable, enable robust molecular fingerprinting across organic compounds, while near-infrared solutions accommodate benchtop, handheld, and portable formats to address quality control in pharmaceuticals and agriculture. UV-visible systems further diversify the market by delivering offline, online, and portable configurations that support real-time process monitoring and environmental screening.

Technological segmentation reveals a parallel evolution in optical and detector components. Instruments based on CCD array technology, including back-thinned and front-illuminated variants, deliver superior quantum efficiency for low-light applications. Dispersive systems leverage concave grating, Czerny-Turner, and Echelle designs to optimize spectral resolution, whereas filter-based spectrophotometers utilize acousto-optic and lithium niobate technologies for rapid wavelength scanning. Interferometric approaches, embodied in Fabry-Perot and Michelson architectures, provide unparalleled resolution for high-fidelity spectral analysis.

Across applications, clinical diagnostics has embraced spectrophotometry for disease biomarker quantification and hematology, while environmental monitoring employs air and water analysis workflows to safeguard public health. The food and beverage industry relies on spectrophotometric quality control and safety testing to ensure compliance with regulatory standards, and the pharmaceutical sector deploys instruments for both quality assurance and research and development. Academic and industrial research laboratories further drive demand through exploratory studies and method development.

End users span research institutes, universities, hospital and independent clinical labs, government and private environmental agencies, as well as process and testing laboratories within food, beverage, and pharmaceutical companies. Portability preferences intersect with usage scenarios, distinguishing inline online monitoring and process analytical technology installations from laboratory benchtop and floor-standing systems, as well as handheld and transportable instruments suited for field operations. Finally, wavelength range segmentation encompasses far-infrared and mid-infrared bands, mid-wave and short-wave NIR regions, UVA, UVB, and UVC classes, and visible light subdivisions across blue, green, and red bands, enabling highly specialized analyses across diverse scientific and industrial contexts.

This comprehensive research report categorizes the Spectrophotometer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Portability

- Wavelength Range

- Application

- End User

Exploring Regional Dynamics and Regulatory Drivers Shaping Spectrophotometer Adoption Across Americas EMEA and Asia Pacific Landscapes

In the Americas, sustained investments in pharmaceutical manufacturing, environmental enforcement, and food safety have fueled demand for high-performance spectrophotometers. North American laboratories are increasingly adopting portable and online systems to enhance responsiveness and reduce operational bottlenecks. Government initiatives promoting domestic production of scientific equipment have spurred OEM expansions in the United States, while collaborative research grants have facilitated the integration of advanced detector technologies in academic institutions.

Within Europe, the Middle East, and Africa, regulatory harmonization through frameworks such as REACH and the European Pharmacopoeia has driven widespread adoption of spectrophotometric validation protocols. The European Union’s emphasis on green analytical chemistry has accelerated the deployment of portable NIR and FTIR instruments for on-site compliance testing, particularly in the agrochemical and renewable energy sectors. Meanwhile, increased funding for scientific infrastructure in Gulf Cooperation Council nations is creating new opportunities for instrument suppliers, especially in environmental monitoring and petrochemical analysis.

Asia-Pacific markets, led by China, Japan, and India, are characterized by rapid industrialization and burgeoning R&D expenditures. Stringent quality standards in pharmaceutical and food production have elevated the importance of spectrophotometric solutions, while government-sponsored technology parks and innovation hubs are fueling local instrument development. Moreover, the strategic focus on semiconductor and battery manufacturing in East Asia is driving demand for specialized atomic absorption and UV-visible spectrophotometers to support trace impurity analysis and process control.

This comprehensive research report examines key regions that drive the evolution of the Spectrophotometer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Leading Industry Players and Their Strategic Innovations That Influence Competitive Positioning in the Spectrophotometer Market

Agilent Technologies maintains a leading position through its broad portfolio of UV-visible, FTIR, and atomic absorption spectrophotometers, complemented by software platforms that streamline data management and regulatory compliance. The company’s investment in cloud-based analytics and digital service offerings has strengthened customer engagement and facilitated predictive maintenance capabilities. Thermo Fisher Scientific distinguishes itself with modular instrument architectures and robust global service networks, ensuring minimal downtime for critical laboratory operations and reinforcing its appeal among large-scale pharmaceutical and environmental testing facilities.

Shimadzu Corporation leverages its heritage in precision optics to deliver high-resolution dispersive spectrophotometers and advanced CCD array detectors, while enhancing user experience through intuitive interfaces and automation features. PerkinElmer focuses on expanding its handheld NIR and standalone FTIR product lines for field applications, addressing the growing need for rapid, on-site material identification in food safety and environmental monitoring. Concurrently, Metrohm is carving out a niche in vibrational spectroscopy with its portable Raman and NIR instruments, targeting process analytical technology implementations in pharmaceutical manufacturing.

Emerging players are differentiating through bespoke solutions for specialized applications, such as hyperspectral imaging integrations and miniaturized sensor modules for Internet of Things connectivity. Strategic partnerships between instrument vendors and software developers are reinforcing the value proposition of turnkey analytics platforms, while targeted acquisitions are enabling rapid entry into adjacent spectroscopic modalities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Spectrophotometer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies Inc.

- Analytik Jena GmbH

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- Danaher Corporation

- Hitachi High-Tech Corporation

- HORIBA, Ltd.

- JASCO Corporation

- Malvern Panalytical Ltd.

- Merck KGaA

- Metrohm AG

- Mettler-Toledo International Inc.

- PerkinElmer Inc.

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

Implementing Strategic Roadmaps and Collaborative Partnerships to Enhance Growth Trajectories and Foster Innovation in Spectrophotometry

Industry leaders should prioritize the development of modular instrument platforms that enable scalable performance upgrades and seamless integration of emerging detector technologies. By adopting a design philosophy centered on interoperability and future-proof architecture, manufacturers can reduce capital expenditure barriers for end users and foster long-term loyalty. In parallel, forging strategic alliances with sensor and component suppliers will support the creation of tariff-resilient supply chains, ensuring continuity of production amid evolving trade policies.

Moreover, investing in advanced software ecosystems that incorporate machine learning algorithms and remote diagnostic tools will transform data acquisition into actionable intelligence. Centralized dashboards that aggregate spectral data from disparate units empower cross-functional teams to identify trends and anomalies in real time, thereby enhancing decision-making and operational efficiency. Offering flexible service contracts that include predictive maintenance and rapid spare-parts fulfillment can further differentiate vendors in a market where instrument uptime is mission-critical.

On the go-to-market front, targeting underpenetrated segments such as emerging academic research centers and small to mid-sized contract testing laboratories presents substantial growth potential. Tailoring pricing models and distribution partnerships to accommodate regional regulatory requirements and budget constraints will accelerate adoption. Finally, maintaining active engagement with industry consortia and regulatory authorities will enable forward-looking product roadmaps that anticipate compliance changes and leverage new standardization initiatives.

Outlining a Robust Multi Stage Research Framework Integrating Secondary Analysis Expert Interviews and Rigorous Data Validation and Triangulation

This report is underpinned by a rigorous multi-stage research methodology combining in-depth secondary research, expert interviews, and primary data validation. The secondary research phase involved an extensive review of academic literature, patent filings, regulatory guidelines, and corporate disclosures to identify key trends and technological developments. Trade association reports and government publications provided insights into regional policy shifts and tariff impacts.

In the primary research phase, we conducted structured interviews with senior executives, product managers, and end-user stakeholders across spectrophotometer OEMs, research institutions, and contract testing laboratories. These qualitative insights were supplemented by quantitative data obtained through surveys and company briefings, enabling us to triangulate perspectives and ensure data integrity. We employed data triangulation techniques to reconcile discrepancies and validate findings against multiple sources.

Finally, our analysis incorporated scenario-based assessments to evaluate the implications of regulatory changes, technological breakthroughs, and supply chain disruptions. While this report does not include specific market sizing or forecasting figures, it applies a robust analytical framework to assess market attractiveness and emerging opportunities, ensuring that the conclusions and recommendations are both actionable and grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Spectrophotometer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Spectrophotometer Market, by Product Type

- Spectrophotometer Market, by Technology

- Spectrophotometer Market, by Portability

- Spectrophotometer Market, by Wavelength Range

- Spectrophotometer Market, by Application

- Spectrophotometer Market, by End User

- Spectrophotometer Market, by Region

- Spectrophotometer Market, by Group

- Spectrophotometer Market, by Country

- United States Spectrophotometer Market

- China Spectrophotometer Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 5247 ]

Synthesis of Market Dynamics Technological Progress and Strategic Imperatives Defining the Next Phase of Spectrophotometer Industry Evolution

The spectrophotometer market is entering a phase defined by technological convergence, regulatory evolution, and shifting procurement paradigms. Precision measurement capabilities are no longer confined to centralized laboratories but are increasingly extended to field applications and continuous process monitoring. As trade policies recalibrate global supply chains, stakeholders will need to balance cost considerations with the imperative for high-performance analytics and service reliability.

Looking forward, the ability to deliver modular, software-driven solutions that adapt to evolving industry requirements will be central to competitive differentiation. Manufacturers that successfully navigate tariff challenges through strategic supply chain alignments, while investing in AI-enabled data platforms, will capture emerging growth opportunities across established and nascent application segments. By leveraging the insights contained in this report, industry leaders can chart a course that aligns innovation with market needs, ensuring sustained relevance in an increasingly interconnected analytical landscape.

Unlock Strategic Insights and Drive Growth by Engaging with the Spectrophotometer Market Research Report Through a Personalized Consultation

To gain a comprehensive understanding of the spectrophotometer landscape and secure a strategic advantage, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Explore detailed analyses of emerging applications, technology roadmaps, regulatory impacts, and competitive benchmarking in our latest market research report. Engage with expert insights that will inform procurement strategies, R&D investments, and growth initiatives. Contact Ketan Rohom to request a tailored briefing, discuss customized deliverables, and learn how this report can become an indispensable resource for your organization’s decision-making process.

- How big is the Spectrophotometer Market?

- What is the Spectrophotometer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?