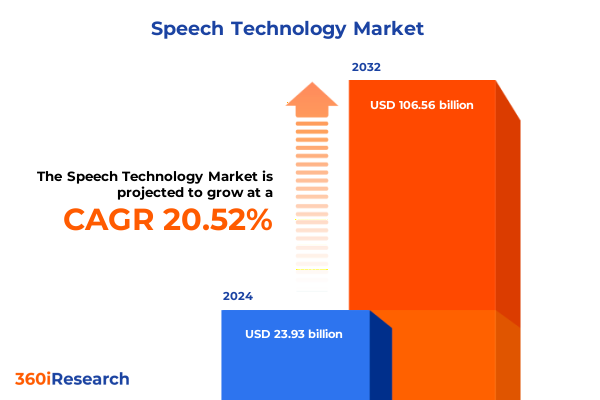

The Speech Technology Market size was estimated at USD 28.95 billion in 2025 and expected to reach USD 34.41 billion in 2026, at a CAGR of 20.45% to reach USD 106.56 billion by 2032.

Unveiling the Next Era of Voice-Driven Interfaces and Applications Reshaping Communication and Productivity Worldwide

As the digital economy matures, voice interactions are no longer a futuristic concept but rather an integral component of how individuals and organizations engage with technology. Recent advancements in speech recognition, natural language processing, and voice synthesis have catalyzed a shift from text-centric interfaces to seamless conversational experiences. This evolution is fueled by the convergence of artificial intelligence, cloud computing, and edge processing, enabling real-time responsiveness and contextual understanding across devices. As a result, speech technology has emerged as a cornerstone of modern user experience design and operational efficiency initiatives.

In light of these developments, this executive summary offers a comprehensive exploration of the speech technology landscape today. It illuminates the transformative trends reshaping human-computer interaction, examines the influence of new trade policies on supply chains and innovation, and provides in-depth segmentation analysis to reveal where value is being created. By synthesizing regional variations and profiling leading industry players, the summary equips decision-makers with the clarity needed to chart a strategic course. Through concise yet thorough coverage, this document sets the stage for actionable insights and recommendations that support sustainable growth in an increasingly voice-enabled world.

Exploring Pivotal Technological Breakthroughs and Adoption Trends That Are Rapidly Redefining Speech Technology Across Industries Globally

The speech technology landscape is undergoing transformative shifts driven by breakthroughs in deep learning architectures and contextual language models. These advancements have significantly enhanced the accuracy of automatic speech recognition, allowing systems to interpret diverse accents and dialects with unprecedented precision. Simultaneously, innovations in natural language processing have elevated conversational AI beyond simple command-and-control paradigms, enabling applications to engage in nuanced, multi-turn dialogues. This evolution is further amplified by progress in speaker diarization, which distinguishes between multiple participants in real-world scenarios, and by rapid strides in text to speech synthesis that produce natural, expressive voices.

Moreover, the democratization of edge computing is reshaping deployment strategies by facilitating on-device speech processing that minimizes latency and safeguards data privacy. Organizations are adopting hybrid models that balance cloud scalability with on-premises control, thereby optimizing performance across latency-sensitive use cases. As a result, businesses are embedding voice-enabled features into a growing array of applications, from customer service bots to in-vehicle assistants, reflecting a broader trend toward ambient computing. These converging technical and architectural shifts are fundamentally redefining how enterprises harness the power of voice to drive value and differentiation.

Assessing the Comprehensive Effects of New United States Tariffs on Speech Technology Supply Chains, Costs, and Innovation Trajectories in 2025

In 2025, the introduction of new United States tariffs on imported technology components has exerted multifaceted impacts on the speech technology ecosystem. Hardware manufacturers reliant on international supply chains have confronted increased costs for microprocessors, specialized sensors, and networking modules that underpin voice-enabled devices. These added expenses have reverberated through the value chain, prompting suppliers and system integrators to reassess sourcing strategies and renegotiate contracts to preserve margin profiles. Additionally, software vendors have needed to adjust pricing models to account for elevated support and maintenance demands as clients navigate hardware procurement challenges.

Beyond cost considerations, the tariff landscape has spurred companies to accelerate localization of manufacturing and assembly operations. Organizations are investing in regional production hubs to mitigate exposure to trade policy fluctuations and to ensure continuity of service for enterprise and consumer deployments. This strategic realignment is fostering closer collaboration between technology providers and domestic electronics manufacturers, which in turn is catalyzing joint R&D initiatives focused on resilient hardware designs optimized for voice processing. As supply chains adapt, the cumulative effect of tariffs is reshaping innovation pathways, ultimately driving a more diversified and geographically distributed speech technology market.

Revealing How Component, Deployment Mode, Application, and Industry End User Segmentation Illuminate Diverse Opportunities and Challenges in Speech Technology Markets

A nuanced understanding of market segmentation reveals where speech technology solutions are gaining traction and which service components are driving adoption. When considering the component dimension, consulting, integration services, support and maintenance, and training are fueling success stories in large-scale enterprise rollouts. Meanwhile, software capabilities such as automatic speech recognition, natural language processing, speaker diarization, text to speech, and voice biometrics are unlocking new user experiences and enhancing operational workflows.

Exploring deployment mode segmentation highlights the ongoing shift toward cloud-based offerings, which provide rapid scalability and continuous updates, even as on-premises solutions remain critical for organizations with strict data residency and latency requirements. Application segmentation showcases how call analytics, dictation and transcription, interactive voice response, virtual assistants, and voice search each address distinct business challenges, from customer engagement to workforce productivity. Finally, end-user industry segmentation illustrates that sectors such as automotive and transportation, banking, financial services and insurance, government and defense, healthcare, information technology and telecom, and retail and e-commerce are leveraging speech technology to reduce costs, improve service levels, and innovate user interactions.

This comprehensive research report categorizes the Speech Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Application

- End User Industry

Analyzing the Contrasting Dynamics and Growth Potentials of the Americas, Europe Middle East Africa, and Asia Pacific in the Global Speech Technology Arena

Evaluating regional dynamics in the speech technology market underscores distinct growth trajectories and strategic considerations across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, rapid adoption of cloud-native speech solutions is driven by financial services and retail organizations seeking to enhance customer experiences while streamlining call center operations. Meanwhile, government agencies are implementing voice biometrics for secure citizen identification, and healthcare providers are deploying transcription services to accelerate clinical documentation.

Conversely, Europe Middle East and Africa exhibit a complex regulatory landscape that shapes deployment priorities. Striking a balance between data privacy mandates and the demand for advanced conversational AI, enterprises are investing in hybrid architectures that align with local compliance frameworks. In Asia Pacific, a surge in smartphone penetration and a proliferation of digital assistants has fueled widespread experimentation with voice-enabled applications in automotive infotainment and e-commerce. Regional language diversity is propelling investments in multilingual speech models, creating a vibrant ecosystem of startups and established players collaborating to address local market nuances.

This comprehensive research report examines key regions that drive the evolution of the Speech Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategies, Innovations, and Competitive Positioning of Leading Speech Technology Providers Shaping Market Evolution Today

Leading providers in the speech technology space are distinguished by their strategic investments in R&D, ecosystem partnerships, and vertical-focused solutions. Global cloud titans have integrated advanced speech APIs into their platforms, offering seamless scalability and developer ecosystems that accelerate time to market for voice-enabled applications. Simultaneously, specialized vendors are differentiating through domain-specific models tailored to industries such as healthcare and finance, where accuracy and compliance are paramount.

In parallel, telecommunications companies are embedding voice AI capabilities directly into network infrastructure, optimizing performance for low-latency use cases and expanding managed service offerings. Collaborative efforts between chip manufacturers and algorithm developers are yielding hardware-accelerated speech processing units that reduce power consumption and enhance on-device intelligence. Emerging companies continue to challenge incumbents by introducing modular architectures and open frameworks that facilitate rapid innovation. Taken together, these varied approaches illustrate a competitive landscape in which strategic alliances and technological leadership define market positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Speech Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Group Holding Limited

- Amazon.com Inc

- Apple Inc

- Baidu Inc

- Cerence Inc

- Cisco Systems Inc

- Deepgram Inc

- Google LLC

- iFLYTEK Co Ltd

- International Business Machines Corporation

- LumenVox

- Microsoft Corporation

- Nuance Communications Inc

- Oracle Corporation

- Pindrop Security

- ReadSpeaker AI

- Sensory Inc

- SoundHound AI Inc

- Speechmatics

- Suki AI

- Tencent Technology Shenzhen Co Ltd

- Uniphore

- Verint Systems Inc

- Voicegain

- Yellow AI

Delivering Strategic and Operational Guidance for Industry Leaders to Capitalize on Emerging Speech Technology Trends and Market Opportunities Effectively

To capitalize on emerging opportunities, industry leaders should prioritize strategic initiatives that align technological capabilities with business objectives. Investing in proprietary AI research and bespoke speech models tailored to vertical use cases can create significant differentiation and drive customer loyalty. Concurrently, organizations must diversify supply chains by establishing partnerships with regional hardware suppliers and exploring alternative manufacturing hubs to mitigate tariff-related risks.

Operationally, deploying hybrid architectures that leverage both cloud and on-premises resources will enable enterprises to balance performance, security, and cost considerations. Cultivating partnerships with telecommunications operators and system integrators can accelerate adoption by embedding voice capabilities into existing enterprise workflows. Moreover, adopting robust data governance and privacy frameworks will be essential to ensure compliance and maintain user trust. By embracing these actionable recommendations, companies can not only respond to current market dynamics but also anticipate future shifts, positioning themselves for sustained leadership in the evolving speech technology landscape.

Detailing the Rigorous Data Collection, Analysis Techniques, and Validation Processes Underpinning the Robust Insights Presented in This Speech Technology Study

This study employs a rigorous methodology combining primary and secondary research to ensure the accuracy and relevance of its findings. Primary research involved in-depth interviews with C-level executives, product managers, and technology architects across key industries, complemented by detailed surveys of end-user organizations. Secondary research drew upon a wide array of public and proprietary sources, including industry journals, technology whitepapers, regulatory filings, and corporate financial reports.

Data triangulation techniques were applied to reconcile insights from disparate sources, while expert validation workshops ensured that emerging trends and strategic implications were grounded in real-world market dynamics. Quantitative analysis of installation bases, technology adoption rates, and service expenditure patterns was integrated with qualitative assessments of vendor capabilities, partnership ecosystems, and regulatory environments. These combined approaches underpin the integrity of the research, delivering actionable insights that stakeholders can confidently leverage to inform strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Speech Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Speech Technology Market, by Component

- Speech Technology Market, by Deployment Mode

- Speech Technology Market, by Application

- Speech Technology Market, by End User Industry

- Speech Technology Market, by Region

- Speech Technology Market, by Group

- Speech Technology Market, by Country

- United States Speech Technology Market

- China Speech Technology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Critical Findings and Their Strategic Implications for Stakeholders Navigating the Accelerating Speech Technology Landscape in a Post-Tariff Environment

The convergence of advanced AI models, evolving deployment architectures, and shifting regulatory landscapes has set the stage for a new chapter in speech technology. As tariffs reshape supply chain configurations and drive regional diversification, organizations are presented with both challenges and opportunities in optimizing cost structures and fostering innovation. Strategic segmentation analysis reveals that value creation is dispersed across components, applications, and industry verticals, underscoring the need for targeted investments and tailored solutions.

Regional insights further highlight the importance of adaptive strategies that address local regulatory requirements, language diversity, and infrastructure readiness. Competitive profiling underscores that industry leadership is contingent upon a balanced approach combining technological excellence, collaborative ecosystems, and domain expertise. Ultimately, success in this dynamic environment will hinge on an organization’s ability to integrate compelling voice experiences with resilient operational frameworks. By adhering to the actionable recommendations herein, stakeholders can navigate uncertainty, harness growth potential, and secure a competitive edge in the rapidly evolving speech technology arena.

Connect with an Expert to Secure Comprehensive Speech Technology Market Intelligence and Drive Strategic Growth Initiatives

Engaging directly with Ketan Rohom, Associate Director of Sales and Marketing, unlocks a pathway to unparalleled market intelligence tailored to the nuances of the speech technology domain. By connecting with Ketan, stakeholders gain privileged access to an in-depth research repository that distills complex industry developments into actionable insights. This collaboration ensures that critical decisions around strategic investments, product roadmaps, and partnership opportunities are grounded in robust data and expert interpretation. Beyond simply acquiring a report, organizations benefit from customized briefings that highlight specific trends, competitive landscapes, and emerging use cases most relevant to their strategic imperatives.

Initiating a conversation with Ketan Rohom positions you ahead of the curve at a moment when speech technology is rapidly evolving and regulatory environments are in flux. His expertise bridges the gap between technical advancements and business applications, empowering teams to navigate tariff impacts, optimize supply chain strategies, and accelerate go-to-market plans with confidence. Reach out today to secure a comprehensive market research package that will serve as the cornerstone for your next wave of growth initiatives and ensure you maintain a leadership stance in the evolving voice-driven ecosystem.

- How big is the Speech Technology Market?

- What is the Speech Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?