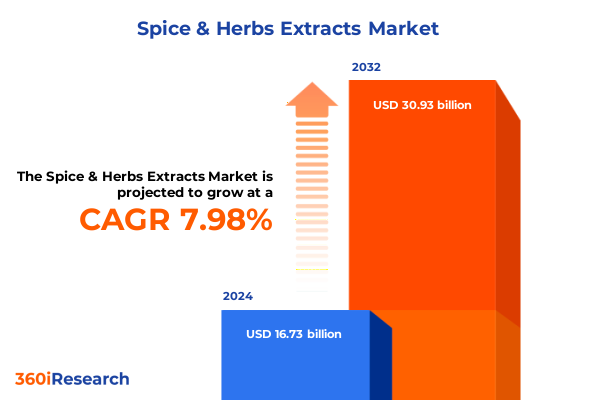

The Spice & Herbs Extracts Market size was estimated at USD 18.03 billion in 2025 and expected to reach USD 19.44 billion in 2026, at a CAGR of 8.01% to reach USD 30.93 billion by 2032.

Exploring the Complex Interplay of Traditional Culinary Heritage and Cutting-Edge Extraction Technologies Shaping the Spice and Herb Extracts Market

Spice and herb extracts occupy a vital intersection where centuries-old culinary traditions converge with modern scientific innovation. These concentrated formulations encapsulate the essence of botanicals, offering both flavor and functionality as consumers seek elevated culinary experiences and tangible health benefits. Against this backdrop, the market has evolved beyond simple seasoning applications to encompass a broad array of industries, from clean-label food and beverage formulations to sophisticated nutraceutical and cosmetic ingredients. As a result, stakeholders are navigating an increasingly intricate environment where the demands of taste, efficacy, and sustainability must be balanced.

In recent years, extraction technologies have undergone a rapid transformation to meet these multifaceted needs. Traditional methods such as steam distillation now coexist with advanced techniques like supercritical fluid extraction, each selected to optimize yield, purity, and environmental impact. Meanwhile, end users are redefining value through a heightened focus on natural and traceable supply chains. This convergence of consumer preference and technological capability has created fertile ground for innovation, prompting manufacturers, ingredient suppliers, and platform companies to collaborate in new ways. Through this synthesis of heritage and high-tech processes, the spice and herb extracts market is poised to enter a phase of unprecedented growth and complexity.

Unraveling the Transformative Shifts Redefining Global Spice and Herb Extract Dynamics in Response to Health, Sustainability, and Consumer Preference Trends

The landscape of spice and herb extracts is undergoing a profound transformation driven by shifting consumer attitudes and regulatory frameworks. Modern consumers are increasingly drawn to products that offer demonstrable health benefits, placing functional ingredients such as turmeric and rosemary at the forefront of new product development. In parallel, the surging emphasis on environmental responsibility has elevated sustainable sourcing and eco-friendly extraction methods as strategic imperatives. As organizations align their operations with sustainability goals, they are investing in technologies that reduce solvent usage and energy consumption, thereby reinforcing brand credibility while mitigating environmental risk.

Concurrently, regulatory bodies around the world are introducing more stringent safety and labeling requirements for botanical extracts. These developments are motivating supply chain players to enhance traceability mechanisms and adopt more rigorous quality assurance protocols. Companies that embrace these changes early can differentiate themselves through transparency, while those that lag risk encountering compliance challenges and reputational setbacks. Overall, the synergy of consumer-driven wellness aspirations, sustainability mandates, and evolving regulations is reshaping market dynamics, prompting enterprises to reimagine product portfolios and operational workflows.

Analyzing the Wide-Ranging Cumulative Impact of the 2025 U.S. Tariffs on Imported Spice and Herb Extracts Across Complex Supply Chains

The United States imported over two billion dollars’ worth of spices and related ingredients in 2024, with countries such as Vietnam, India, and Brazil supplying critical flavoring agents that cannot be commercially cultivated on domestic soil. Many of these botanical products, including black pepper and cinnamon, require tropical climates that the U.S. cannot replicate, meaning tariffs on such imports directly translate to higher costs for food manufacturers and end consumers without fostering local production alternatives.

Effective March 4, 2025, a 25% tariff was instituted on all imports from Mexico and Canada. These two NAFTA neighbors serve as key sources for items ranging from dried chilies and oregano to mustard seeds and culinary oils. The additional duties have compelled importers to reconsider supply arrangements, exploring alternative origins such as India, Vietnam, and Indonesia to alleviate tariff-related cost pressures. However, transitioning supply chains entails qualification cycles and potential disruptions in product consistency, challenging businesses to balance cost containment with quality assurance.

On top of the existing duties on Chinese-origin spices, the U.S. policy framework added an extra 10% tariff on a broad slate of ingredients-bringing total rates on select items to between 20% and 35%. Garlic, ginger, star anise, certain chili powders, and extracts have seen dramatic cost escalations. As a result, companies are intensifying efforts to identify new supply regions and negotiating long-term contracts to cap input price volatility, although the fragmented nature of global spice production limits flexibility for many businesses.

Large manufacturers have reported significant margin compression due to these cumulative tariffs. For example, one leading global spice producer warned that the current policy environment could result in annual incremental costs approaching ninety million dollars, prompting the company to accelerate strategic sourcing initiatives and to selectively adjust pricing in key markets. This level of impact highlights the urgent need for proactive risk mitigation and adaptive supply chain strategies within the sector.

Leveraging Product Formulation, Extraction Technology and Distribution Channels Analyses to Uncover Actionable Segmentation Insights for Spice and Herb Extract Markets

Understanding the nuances of market segmentation is essential to identifying growth pockets and aligning product offerings with end-user requirements. From a product perspective, the market bifurcates into herb extracts and spice extracts, each encompassing both mixed and single-origin formulations. Within the herb extract category, single-herb products such as basil, oregano, and rosemary extracts are tailored for applications that demand specific flavor or bioactive characteristics, whereas mixed-herb blends offer complex sensory profiles favored in culinary and functional assays. Similarly, spice extracts divide into single-spice concentrates like black pepper, cinnamon, and turmeric, while mixed-spice mixtures deliver multifaceted taste experiences.

Form factor further differentiates market opportunities, as capsules, liquids, oils, and powders each fulfill distinct processing and formulation criteria. Capsules and powders are prized in the nutraceutical realm for precise dosing and stability, whereas oils and liquid concentrates are preferred in cosmetic and food applications that require rapid solubilization or aroma intensification. The selection of extraction methods-ranging from cold pressing and steam distillation to solvent-based processes using ethanol or water, as well as supercritical fluid techniques-directly impacts product purity, yield, and sustainability credentials. Decision-makers must weigh the trade-offs between extraction efficiency, solvent residues, and environmental footprint.

Applications of spice and herb extracts span cosmetics, food and beverages, nutraceuticals, and pharmaceuticals, each with unique regulatory and functional demands. Distribution pathways, including commercial and industrial direct sales alongside online and retail channels, influence purchasing behavior and gross margins. Commercial and industrial buyers often prioritize bulk pricing and consistency, while online and retail segments emphasize branding, packaging innovation, and convenience. By synthesizing these segmentation dimensions, organizations can craft targeted value propositions and optimize channel strategies to serve distinct customer cohorts effectively.

This comprehensive research report categorizes the Spice & Herbs Extracts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Extraction Method

- Application

- Distribution Channel

Deciphering Regional Market Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific to Illuminate Strategic Growth and Investment Opportunities

Regional dynamics demonstrate marked divergences in production capabilities, consumption patterns, and regulatory frameworks. In the Americas, the United States plays a dual role as a major importer of tropical-origin spices and a leading innovator in extraction technologies. While import reliance remains high for botanical assets such as pepper, vanilla, and nutmeg, the region’s strong R&D infrastructure supports advanced formulation and clean-label initiatives. Latin American suppliers, particularly Mexico and Brazil, continue to dominate raw spice exports, though evolving tariff regimes and logistical bottlenecks are encouraging some buyers to diversify sourcing across Central and South America.

Within Europe, the Middle East, and Africa, a dense network of smallholder spice farms coexists with large-scale extractors, fostering a competitive environment enriched by indigenous botanical knowledge. Regulatory authorities in the European Union increasingly emphasize stringent safety and labeling standards, driving operators to invest in traceability and certification programs. Meanwhile, the Middle East serves as a critical redistributor to North Africa and adjacent markets, leveraging well-established trade corridors. Elevated demand for natural preservatives and botanical actives in emerging markets of Africa is spurring localized extraction capabilities, though infrastructure constraints and power shortages pose operational challenges.

The Asia-Pacific region consolidates a complex tapestry of origin and consumption hubs. India, Vietnam, Indonesia, and China collectively supply a significant share of global spice volumes and are scaling up further processing capabilities to capture more value domestically. At the same time, Asia-Pacific end markets-particularly in Japan, South Korea, and Australia-are witnessing rising interest in functional extracts for health supplements and personal care. Government support for agricultural modernization and incentives for green extraction technologies are catalyzing innovation, though fragmented regulatory landscapes require careful navigation by multinational enterprises.

This comprehensive research report examines key regions that drive the evolution of the Spice & Herbs Extracts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives, Innovation, and Competitive Positioning of Leading Spice and Herb Extract Companies Shaping Market Development

Leading companies are executing diverse strategies to secure competitive advantage, from focused organic growth investments to targeted mergers and acquisitions. Global spice veterans have bolstered their portfolios by integrating adjacent capabilities-such as downstream formulation services and private-label partnerships-expanding touchpoints along the value chain. Simultaneously, specialized ingredient providers are doubling down on niche botanicals, leveraging proprietary extraction platforms to deliver high-purity concentrates tailored for nutraceutical and cosmeceutical applications.

Innovation is also manifesting through collaborative ventures among extract manufacturers, research institutions, and technology partners. Such alliances facilitate the co-development of novel delivery formats-like encapsulated volatile oils and controlled-release powder systems-addressing the growing demand for efficacy and end-user convenience. Moreover, these collaborations often incorporate sustainability criteria, optimizing solvent recovery and reducing carbon footprints to meet evolving stakeholder expectations.

On the competitive front, agility in sourcing and logistics has emerged as a critical differentiator. Companies that have cultivated regional supply resilience-by fostering direct relationships with multi-generation spice growers or investing in local processing hubs-enjoy greater flexibility in responding to tariff shifts and supply disruptions. This strategic balance of scale, specialization, and geographic diversity is rewriting the rules of engagement, enabling market leaders to capture new growth vectors while mitigating risk.

This comprehensive research report delivers an in-depth overview of the principal market players in the Spice & Herbs Extracts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Botanic Healthcare Group

- British Pepper & Spice

- Cosmark Pty Ltd.

- Döhler GmbH

- Firmenich International SA

- Givaudan SA

- Huisong Pharmaceuticals

- International Taste Solutions Ltd.

- Kalsec Inc.

- Kerry Group PLC

Formulating Actionable Strategic Imperatives to Empower Industry Leaders in Navigating Tariff Complexities, Segment Diversities, and Regional Expansion Challenges

To navigate the increasingly complex market environment, industry leaders should prioritize portfolio diversification by aligning products with high-growth applications and emerging consumer trends. This imperative involves expanding single-origin offerings in tandem with innovative mixed blends while optimizing form factors and extraction pathways to meet sector-specific demands. Investment in green and continuous-extraction technologies can yield both cost savings and sustainability credits, resonating with environmentally conscious buyers and enhancing brand equity.

Supply chain resilience must be reinforced through proactive tariff mitigation strategies, including multi-regional sourcing frameworks and contingency partnerships with alternative origin suppliers. By establishing a diversified network of trusted growers and processors, organizations can reduce exposure to geopolitical volatility and raw material shortages. In parallel, companies should leverage advanced analytics to dynamically model cost scenarios and optimize contract durations, thereby preserving margin integrity.

Finally, building robust strategic partnerships-with research institutions for pioneering applications, with technology firms for innovative processing, and with distribution platforms for enhanced market reach-will underpin long-term competitive advantage. These alliances should be underpinned by transparent sustainability and traceability standards to foster stakeholder trust. By weaving these tactical initiatives into a cohesive strategic roadmap, industry players can adapt swiftly to shifting external pressures while capitalizing on emergent opportunities.

Detailing a Multi-Source Research Methodology Integrating Stakeholder Engagement, Trade Data Analysis, and Technical Validation for Market Insight Rigor

This study employs a multi-source research methodology designed to ensure analytical rigor and objectivity. Primary research included structured interviews with senior executives at spice manufacturers, extract technology providers, and key end-user organizations, supplemented by input from leading trade associations. These discussions provided firsthand insights into strategic priorities, operational constraints, and innovation pipelines.

Secondary research encompassed review of trade data, regulatory filings, and scientific literature to validate market drivers and technological trajectories. Industry reports, patent databases, and sustainability certifications were analyzed to map the competitive landscape and gauge the adoption of green extraction methods. Trade flow analyses, drawn from customs databases, elucidated the evolving impact of tariff policies on supply chain configurations.

Quantitative findings were cross-referenced with external expert feedback to refine key segmentation frameworks and to authenticate regional dynamics. Special attention was paid to methodology transparency and reproducibility, with documented validation steps for data sources and interview protocols. This comprehensive approach ensures that conclusions and recommendations rest on a robust evidentiary foundation, offering stakeholders credible and actionable market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Spice & Herbs Extracts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Spice & Herbs Extracts Market, by Product Type

- Spice & Herbs Extracts Market, by Form

- Spice & Herbs Extracts Market, by Extraction Method

- Spice & Herbs Extracts Market, by Application

- Spice & Herbs Extracts Market, by Distribution Channel

- Spice & Herbs Extracts Market, by Region

- Spice & Herbs Extracts Market, by Group

- Spice & Herbs Extracts Market, by Country

- United States Spice & Herbs Extracts Market

- China Spice & Herbs Extracts Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Critical Analytical Insights and Strategic Imperatives to Conclude on the Future Trajectory of Value Creation in the Spice and Herb Extracts Industry

The convergence of culinary heritage and advanced extraction science is forging a vibrant landscape of opportunity within the spice and herb extract sector. Segmentation analyses reveal that a nuanced approach-balancing single-origin purity with multi-ingredient complexity and aligning extraction methods with end-use requirements-will unlock new application frontiers. Meanwhile, the advent of stricter regulatory standards and sustainability mandates is steering market participants toward greener technologies and more traceable supply chains.

Cumulative tariff pressures in the United States have underscored the critical need for supply chain agility and sourcing diversification. Companies that proactively embrace multi-regional procurement and invest in strategic partnerships will be best positioned to absorb policy shifts and maintain competitive pricing. At the same time, regional market dynamics point to rich innovation ecosystems across diverse geographies-from R&D epicenters in North America and Europe to origin-led value creation in Asia-Pacific.

Moving forward, the industry’s trajectory will be defined by its capacity to integrate technological advances with consumer-driven imperatives for health, authenticity, and sustainability. Stakeholders that craft coherent strategies across segmentation, sourcing, and partnerships can chart a path toward resilient growth and value creation in this intricate market landscape.

Connect with Associate Director Ketan Rohom to Secure Tailored Access to the Spice and Herb Extract Market Research Report and Strategic Support

To gain comprehensive, actionable insights into the evolving spice and herb extract landscape, and to explore customized strategic support aligned with your organization’s unique objectives, please connect directly with Associate Director of Sales & Marketing, Ketan Rohom. Ketan brings extensive expertise in market dynamics, segmentation nuances, and regulatory implications, ensuring you receive tailored guidance to maximize competitive advantage. Whether you seek in-depth analysis of extraction technologies or guidance on navigating complex trade environments, Ketan can arrange a personalized briefing or facilitate access to the full market research report. Reach out today to secure your strategic edge in this dynamic industry and transform insights into accelerated growth.

- How big is the Spice & Herbs Extracts Market?

- What is the Spice & Herbs Extracts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?