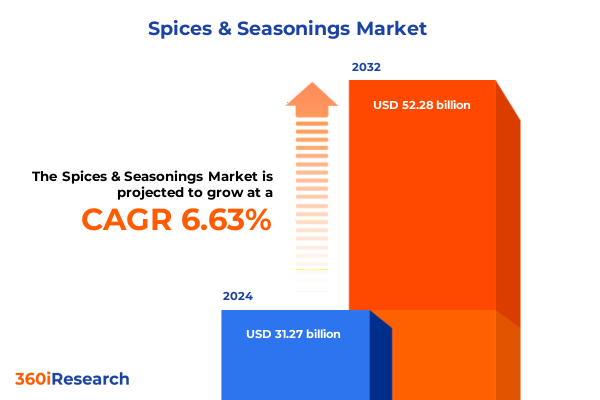

The Spices & Seasonings Market size was estimated at USD 33.37 billion in 2025 and expected to reach USD 35.36 billion in 2026, at a CAGR of 6.62% to reach USD 52.28 billion by 2032.

Exploring Foundational Trends Driving Consumer Preferences and Industry Dynamics in the Modern Spices and Seasonings Landscape Informing Supply Chain Evolution

Exploring the complexities of the spices and seasonings industry begins with understanding how deeply ingrained culinary traditions are intersecting with evolving consumer behaviors. In an era where flavor exploration and health-conscious choices converge, manufacturers are challenged to balance authenticity with innovation. Urbanization and multicultural influences have intensified the demand for diverse flavor portfolios, propelling companies to expand beyond classic pepper and salt varieties. Consumers now seek products that not only enhance taste but also align with wellness values and traceability expectations. As a result, ingredient sourcing, supply chain transparency, and product labeling have become paramount considerations for both producers and end users.

Moreover, digital transformation is reshaping how brands connect with consumers. E-commerce platforms and direct-to-consumer channels enable smaller, niche players to rival established players by offering curated spice collections and personalized recommendations. This shift has heightened competitive pressures and driven traditional manufacturers to rethink channel strategies and invest in digital marketing capabilities. Seamless online experiences, subscription models, and social media engagement are no longer optional but essential components of a robust go-to-market framework. Ultimately, this evolving landscape sets the stage for sustained growth opportunities while demanding agile responses from all stakeholders.

Identifying Disruptive Innovations and Emerging Consumer Movements Reshaping the Future of Spices and Seasonings Across Retail and Foodservice Sectors

Transformative shifts in the spices and seasonings landscape are emerging at the convergence of technological innovation and shifting dietary paradigms. Manufacturers are adopting advanced extraction techniques and clean-label formulations to deliver intensified flavors without artificial additives. Such innovations are not solely product-centric; predictive analytics and machine learning are now being leveraged to optimize inventory management, reduce waste, and forecast emerging flavor trends based on social media and point-of-sale data. As a result, companies can dynamically adjust their offerings to meet real-time market demands.

At the same time, the growing emphasis on personalized nutrition is prompting brands to introduce modular seasoning kits and made-to-order blends. This personalization trend extends beyond retail into foodservice, where chefs collaborate with suppliers to co-create unique seasoning profiles tailored to regional palates or culinary themes. Parallel to these developments is the rise of sustainability-driven sourcing, with firms forging partnerships with smallholder farmers to ensure ethical practices and resilience against climate volatility. By integrating these transformative trends-technological, consumer-centric, and sustainable-the industry is charting a new course toward more connected, responsible, and diversified growth trajectories.

Analyzing the Cascading Effects and Strategic Responses Triggered by Newly Imposed United States Tariffs on Spices and Seasonings in 2025 Fiscal Policies

The imposition of new United States tariffs on imported spices and seasonings in 2025 has introduced a cascade of strategic and operational challenges across the value chain. As import costs escalate, distributors and retailers are confronted with margin compression that pressures profitability at every stage. To mitigate these effects, many buyers are exploring alternative sourcing strategies, including nearshoring to suppliers in Central and South America or negotiating longer-term contracts with established exporters to secure more favorable pricing. In parallel, procurement functions are intensifying due diligence efforts to evaluate the total landed cost of ingredients, factoring in logistics delays and currency fluctuations.

Beyond procurement, the tariff environment is prompting suppliers to reexamine production footprints and consider vertical integration for greater cost control. Some manufacturers are accelerating investment in processing facilities within the United States, thereby circumventing import duties and shortening lead times. However, domestic expansion requires significant upfront capital and entails navigating local regulatory and labor considerations. Consequently, companies are striking a careful balance between reshoring initiatives and maintaining flexibility in global supply networks. This tariff-driven realignment underscores the need for robust financial and risk management frameworks to preserve competitiveness under shifting trade policy conditions.

Uncovering Rich Segment-Level Dynamics Across Product Forms, Natural Classifications, Ingredient Mixes, Culinary Applications, and Distribution Channels

Segment-level dynamics underscore how product characteristics, consumer values, and purchase pathways intersect to shape performance. In the context of personalization and convenience, powdered formats continue to enjoy broad adoption, yet the resurgence of paste and liquid formats signals a preference for ready-to-use, restaurant-quality applications among at-home chefs. Meanwhile, whole forms are sustaining demand among traditionalists who prize authentic textures, and flakes maintain a niche among gourmet purveyors seeking visible product integrity.

Turning to natural classifications, the organic segment is capturing greater consumer attention as shoppers scrutinize ingredient origins and production methods. Conventional products remain foundational, particularly where price sensitivity prevails, but premium organic offerings are witnessing a velocity climb in both retail and foodservice outlets. Examining ingredient categories reveals that while classic salt and pepper varieties are indispensable, growth pockets exist within specialty blends and seasoning mixes such as regional curry profiles and garlic-forward herb combinations. Within these blends, BBQ seasoning motifs are being reimagined with global spice infusions to coalesce smoky, sweet, and savory notes into cohesive flavor statements.

Applications across foodservice, household, and industrial settings demonstrate distinct usage patterns and growth levers. In institutional kitchens, bulk ordering and formulation consistency are prioritized, whereas at-home consumers exhibit an appetite for experimentation with single-serve packs and sampler kits. On the distribution front, although brick-and-mortar remains the highest-volume channel, omnichannel strategies are imperative. Online marketplaces are enabling smaller brands to extend reach, while specialty stores and hypermarkets continue to serve as discovery platforms for artisanal and premium offerings.

This comprehensive research report categorizes the Spices & Seasonings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Nature

- Product Type

- Application

- Distribution Channel

Examining Regional Variations and Strategic Imperatives from Americas Growth Drivers to EMEA Market Maturation and Asia-Pacific Innovation Hotspots

Regional nuances play a pivotal role in shaping market strategies and directing investment flows. Within the Americas, the United States and Canada are leading the charge toward innovation in functional spice applications, driven by health and wellness trends that elevate demand for anti-inflammatory turmeric blends and adaptogenic herb infusions. Public awareness campaigns emphasizing clean-label credentials have fueled mainstream acceptance of certified organic offerings, spurring a wave of product introductions that spotlight traceability and fair trade partnerships.

In Europe, Middle East, & Africa, a mature consumer base is characterized by high standards for origin authenticity and artisanal heritage. European markets are increasingly receptive to small-batch, single-origin spice collections, while Middle Eastern regions continue to favor spice blends with deep cultural resonance, such as za’atar and baharat. North African producers are leveraging regional biodiversity to export unique flavor profiles, and joint ventures between local cooperatives and global corporations are enhancing capacity building. Meanwhile, Africa’s industrial segment is investing in large-scale processing to meet export demand, creating new opportunities for public-private collaborations.

Across Asia-Pacific, rapid urbanization and digital commerce infrastructure are fueling a renaissance in indigenous spice varieties. E-commerce platforms in Southeast Asia are extending reach for specialty chili pastes and fermented seasonings, enabling micro-enterprises to secure loyal followings. In South Asia, premium packaging and gift-ready assortments are positioning traditional masala mixes as lifestyle products. At the same time, industrial-scale extraction and blending technologies are being deployed in Australia and China to meet escalating demand from foodservice operators and multinational food manufacturers.

This comprehensive research report examines key regions that drive the evolution of the Spices & Seasonings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies, Portfolio Diversification, and Collaborative Ventures Shaping the Leading Spice and Seasoning Company Ecosystem

Leading companies in the spices and seasonings arena are executing multifaceted strategies to fortify market positions and capture emerging opportunities. Portfolio diversification remains a core focus, with top-tier players expanding beyond primary spice offerings into adjacent categories such as botanical extracts and flavor enhancers. Strategic acquisitions are augmenting capabilities in proprietary extraction processes and fortifying distribution footholds in key geographies. Collaborative research partnerships with ingredient scientists are unlocking novel spice concentrates that deliver intensified aromatic profiles with reduced usage rates, offering cost efficiencies and formulation flexibility.

Simultaneously, private-label programs are gaining traction as retail conglomerates leverage scale to negotiate exclusive flavor assortments and tailor offerings for regional consumer segments. To maintain differentiation, manufacturers are investing in branding narratives that emphasize farm-to-shelf transparency and product provenance. At the manufacturing level, digitalized quality control systems are being implemented to ensure batch consistency and expedite time to market. In parallel, sustainability commitments-from waste reduction in processing plants to support for regenerative agriculture initiatives-are being woven into corporate social responsibility frameworks to resonate with conscientious consumers and institutional buyers alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Spices & Seasonings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Co Inc

- ARIAKE JAPAN Co Ltd

- Associated British Foods plc

- Badia Spices Inc

- Baria Pepper Co Ltd

- Baron Spices Inc

- C H Guenther and Son Inc

- Dharampal Satyapal Limited DS Group

- Döhler GmbH

- EVEREST Food Products Pvt Ltd

- Frontier Co op

- Fuchs North America

- Givaudan S A

- Kerry Group plc

- Mahashian Di Hatti Pvt Ltd

- McCormick & Company Inc

- Olam International Limited

- Organic Spices Inc

- Sensient Technologies Corporation

- SHS Group

- Simply Organic

- Synthite Industries Ltd

- The Kraft Heinz Company

- Unilever PLC

- Worlée-Chemie GmbH

Delivering Practical Roadmaps for Industry Leaders to Harness Market Dynamics, Elevate Brand Resonance, and Drive Sustainable Growth in Spices Sector

Industry leaders ready to accelerate growth must adopt a comprehensive approach that aligns innovation, sustainability, and customer intimacy. First, investing in clean-label product platforms and certification programs will not only meet regulatory expectations but also enhance brand credibility among discerning consumers. By integrating digital traceability solutions, companies can offer transparency from farm origin to retail shelf, reinforcing consumer trust and unlocking premium positioning.

Next, prioritizing strategic partnerships within the value chain-whether through joint ventures with regional growers or alliances with technology providers-will facilitate access to novel ingredients and processing efficiencies. Equally important is the development of flexible production models that can switch seamlessly between conventional and organic lines, enabling swift responses to demand fluctuations without compromising cost structures. Furthermore, optimizing omnichannel distribution by harmonizing in-store merchandising with personalized e-commerce experiences will deepen customer engagement and broaden market reach. Finally, embedding environmental and social governance principles into core strategies will strengthen stakeholder relationships and secure long-term license to operate in diverse regions.

Outlining Rigorous Mixed-Method Research Approaches Integrating Primary Field Studies, Expert Interviews, and Comprehensive Secondary Analysis

The research underpinning these insights combines rigorous primary and secondary methodologies to ensure comprehensive coverage and analytical depth. Primary data was collected through in-person and virtual interviews with key stakeholders across the supply chain, including raw material growers, processing facility managers, distribution executives, and culinary professionals. These dialogues provided qualitative context around production challenges, regulatory landscapes, and emerging end-user preferences. Supplementing this, surveys of trade buyers and consumer focus groups in major markets captured quantitative measures of purchase drivers and usage patterns.

Secondary research entailed systematic review of industry publications, trade association reports, regulatory filings, and academic studies to establish historical baselines and validate observed trends. Advanced analytical techniques, including cluster analysis and correlation testing, were applied to identify interdependencies among segmentation variables and regional factors. Furthermore, a pan-regional expert panel convened to scrutinize preliminary findings, ensuring that conclusions reflect on-the-ground realities and strategic imperatives. This mixed-method approach guarantees that recommendations are both evidence-based and attuned to the dynamic nature of the global spices and seasonings marketplace.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Spices & Seasonings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Spices & Seasonings Market, by Form

- Spices & Seasonings Market, by Nature

- Spices & Seasonings Market, by Product Type

- Spices & Seasonings Market, by Application

- Spices & Seasonings Market, by Distribution Channel

- Spices & Seasonings Market, by Region

- Spices & Seasonings Market, by Group

- Spices & Seasonings Market, by Country

- United States Spices & Seasonings Market

- China Spices & Seasonings Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Consolidating Key Learnings and Strategic Imperatives That Will Guide Stakeholders Through Complexities of the Evolving Spices and Seasonings Marketplace

In summary, the spices and seasonings industry is at a pivotal juncture characterized by rapid innovation, evolving trade dynamics, and nuanced consumer expectations. Stakeholders must navigate a complex web of tariff adjustments, segmentation opportunities, and regional idiosyncrasies to stay ahead of the curve. The convergence of clean-label formulation, digital commerce expansion, and sustainability commitments offers a fertile ground for differentiation. Yet success will hinge on the ability to execute agile sourcing strategies, harness advanced analytics for trend forecasting, and forge collaborative partnerships that drive value across the value chain.

Looking ahead, those who integrate consumer-centric innovation with resilient supply chain architectures and transparent business practices will be best positioned to capitalize on emerging growth pockets. Whether optimizing product portfolios to address both conventional and organic demand or tailoring regional approaches from the Americas to Asia-Pacific, the capacity to translate insight into action will determine market leadership. By synthesizing these strategic imperatives, executives and decision makers can chart a course toward sustainable expansion in the dynamic and flavorful realm of spices and seasonings.

Inviting Decision Makers to Engage with Associate Director Ketan Rohom for Exclusive Insights and Customized Spices and Seasonings Market Intelligence Offerings

To gain unparalleled clarity on emerging consumer demands, supply chain resilience, and transformative product innovations, reach out directly to Associate Director Ketan Rohom. By engaging with his specialized insights, decision makers can secure customized market research intelligence tailored to strategic priorities across product portfolios, channel strategies, and sustainability goals. Through a collaborative consultation, Ketan will guide you through a detailed overview of the report’s methodologies, highlight the most pertinent regional and segmentation analyses, and recommend bespoke pathways for maximizing competitive advantage. Don’t miss the opportunity to partner with a leading expert to navigate the complexities of the global spices and seasonings ecosystem and drive lasting growth.

- How big is the Spices & Seasonings Market?

- What is the Spices & Seasonings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?