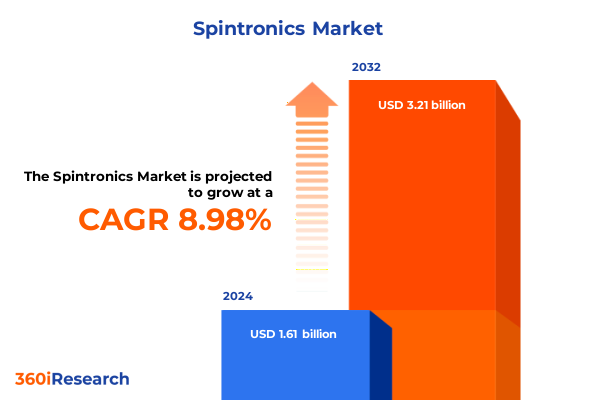

The Spintronics Market size was estimated at USD 1.75 billion in 2025 and expected to reach USD 1.90 billion in 2026, at a CAGR of 9.06% to reach USD 3.21 billion by 2032.

Exploring the Transformative Potential of Electron Spin Control in Revolutionizing Magnetoelectronic Applications Across Diverse Industries

The field of spintronics emerges at the intersection of magnetic phenomena and emerging electronics, harnessing the intrinsic spin of electrons alongside their charge to create devices with remarkable efficiency and novel functionalities. As traditional semiconductor scaling approaches physical limits, spin-based mechanisms open pathways to lower energy consumption, faster switching speeds, and enhanced data integrity. In this context, spin diodes enable rectification through spin polarization, spin filters refine electron currents based on magnetic orientation, and spin oscillators generate high-frequency signals through controlled precession of spin states.

Against this backdrop, spin random access memory offers nonvolatile storage with ultra-low power requirements, while spin transistors promise gates that switch through spin transfer torque rather than charge accumulation. Such innovations are redefining the boundaries of data storage, sensing, and signal processing. Equally significant, the integration of spintronics aligns with broader industry imperatives for sustainable, high-performance computing platforms. Transitioning from proof-of-concept demonstrations to scalable production poses challenges, yet the momentum behind spin Hall effect research, spin injection techniques, and spin–orbit interaction exploitation underscores a clear trajectory toward commercialization. As a result, stakeholders across development, manufacturing, and deployment phases are repositioning their roadmaps to incorporate spintronics at the heart of next-generation electronics.

Understanding the Major Technological and Market Shifts Driving the Evolution of Spin-Based Electronic Systems in the Current Era

Recent years have witnessed several paradigm shifts that fundamentally alter how spintronics interfaces with existing technology ecosystems. Breakthroughs in giant magnetoresistance structures, once confined to magnetic hard drives, have now permeated novel sensor arrays for industrial and automotive applications. Parallel developments in metal-based and semiconductor-based spintronic materials have bridged the gap between laboratory-scale thin films and wafer-level integration processes, enabling research on spin transfer torque devices to scale beyond academic settings.

Furthermore, convergence with quantum computing initiatives has redefined spintronics as a platform not only for classical memory but also for qubit manipulation. Pioneering studies on spin qubits leverage the coherence properties of electron spin states to serve as foundational elements in quantum architectures. Concurrently, the proliferation of connected devices in the internet of things (IoT) demands ultra-low-power sensors and memory modules-a requirement that spin Hall effect devices and spin-based sensors are uniquely positioned to fulfill. Collectively, these technological shifts, supported by advancements in advanced lithography and materials deposition techniques, have reshaped the research and market landscapes. As a result, the industry’s strategic focus has expanded from niche applications to broad-based adoption across consumer electronics, healthcare diagnostics, and beyond.

Assessing the Aggregate Economic and Strategic Consequences of Newly Imposed United States Tariffs on Spintronics Components in 2025

In 2025, the United States implemented a series of tariffs on semiconductor and magnetoelectronic imports, with specific duties applied to critical spintronics components. These measures, part of a broader protectionist policy, aim to bolster domestic manufacturing but have introduced notable supply chain complexities. Initially, the tariffs increased the landed cost of key materials such as heavy metal targets used for spin Hall layers and specialized wafers employed in spin filter fabrication. Consequently, some suppliers have adjusted their pricing structures, passing incremental costs onto device manufacturers.

Over time, firms have responded by diversifying their sourcing strategies, seeking alternate suppliers in regions not subject to new duties. This strategic realignment has, in part, offset direct cost impacts; however, lead times have extended, especially for advanced metal-based spintronics materials. Manufacturers of spin oscillators and spin transistors, which rely on high-purity ferromagnetic alloys, have reconfigured production schedules to accommodate fluctuating input availability. Meanwhile, research centers focused on spin transfer torque and spin injection techniques have experienced budgetary pressure for prototyping and testing. Despite these challenges, a gradual reorientation toward domestic capacity building and collaborative ventures with allied nations suggests a resilient adaptation trajectory that may yield long-term benefits for the national spintronics ecosystem.

Dissecting Market Segmentation Across Products, Types, Spin Technologies, Applications, and End-User Verticals to Reveal Hidden Growth Drivers

Examining spintronics market segmentation reveals distinct growth vectors across diverse product categories, functional types, underlying technologies, application domains, and end-user sectors. Based on Product, spin diodes are gaining traction in energy-efficient logic circuits while spin filters find applications in high-sensitivity magnetic imaging tools. At the same time, spin oscillators are being explored for next-generation wireless communication modules, and spin random access memory is emerging as a candidate for ultra-fast buffer storage. Spin transistors, in turn, promise a paradigm shift in digital logic by leveraging spin transfer torque for gate switching.

From a Type perspective, giant magnetoresistance devices benefit from well-established fabrication processes, whereas metal-based spintronics accessories capitalize on mature sputtering techniques to yield robust, large-area films. Semiconductor-based spintronics are advancing through efforts to integrate spin injection mechanisms into complementary metal-oxide-semiconductor workflows. Spin transfer torque, meanwhile, remains at the forefront of research due to its ability to perform nonvolatile write operations with minimal current densities.

Regarding Spin Technology, the spin Hall effect is instrumental in enabling efficient spin current generation, spin injection enhances interface coupling to conventional semiconductors, and spin–orbit interaction research drives novel device concepts for logic and memory functions. In Application terms, data storage systems leverage spintronic sensors for read heads, magnetic memory modules offer nonvolatile and radiation-hard solutions, magnetic sensors support precision healthcare instrumentation, and quantum computing initiatives explore spin-based qubit platforms. Finally, when viewed through the lens of End-User Industry, automotive manufacturers integrate spin-based sensors for advanced driver assistance, consumer electronics companies adopt MRAM for mobile devices, healthcare providers deploy spintronic biosensors for diagnostics, and IT & telecom operators pursue spin logic to overcome energy constraints in data centers.

This comprehensive research report categorizes the Spintronics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Type

- Spin Technology

- Applications

- End-User Industry

Uncovering Distinct Regional Dynamics and Adoption Patterns in the Americas, EMEA, and Asia-Pacific Driving the Spintronics Revolution

Regional dynamics in the Americas reflect substantial investments in domestic research facilities and public–private partnerships aimed at establishing comprehensive spintronics supply chains. Government incentives have spurred pilot production lines for spin filter materials, while collaborations between national laboratories and regional manufacturers accelerate the transition from prototyping to commercial-scale device fabrication.

In Europe, the Middle East & Africa, policy frameworks emphasize cross-border research consortia, uniting academic institutions with technology firms to pursue long-term spin Hall effect and spin–orbit interaction studies. Regulatory alignment efforts, particularly within the European Union, facilitate standardized testing protocols for spin random access memory modules and magnetic sensors, thereby mitigating technical barriers and expediting market entry.

Asia-Pacific continues to dominate global production capacity for semiconductor substrates, with several regional powerhouses investing heavily in metal-based spintronics and semiconductor-based spin injection research. National flagship programs in countries such as Japan, South Korea, and China channel funding into spin transfer torque memory demonstrations and next-generation spin oscillator prototypes. Meanwhile, emerging hubs across Southeast Asia are fostering startup ecosystems focused on quantum computing applications, leveraging regional strengths in advanced lithography and materials science.

This comprehensive research report examines key regions that drive the evolution of the Spintronics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies, Collaborative Ventures, and Innovation Trajectories Among Leading Players in the Spintronics Domain

Leading corporations in the spintronics domain are deploying differentiated strategies to sustain competitive advantage. Certain legacy semiconductor manufacturers have diversified their product portfolios to include nonvolatile spin random access memory modules, leveraging existing fabrication lines to accelerate time to market. Others have forged joint ventures with specialized materials suppliers to secure priority access to high-purity ferromagnetic targets and heavy metal layers essential for spin Hall effect research.

Strategic partnerships between electronics giants and academic spintronics centers have resulted in co-development agreements focusing on spin–orbit interaction devices, while select pure-play technology firms have pursued merger and acquisition routes to broaden their patent holdings in spin injection and spin transfer torque mechanisms. Additionally, coalition-based alliances are emerging, wherein multiple stakeholders collaborate on precompetitive research, establishing common fabrication protocols and benchmarking standards. Collectively, these initiatives underscore an industry-wide commitment to both innovation and scalability, setting the stage for next-generation applications in data-intensive and energy-constrained environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Spintronics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced MicroSensors Corp

- Avalanche Technology, Inc.

- Crocus Technology Inc. by Allegro Microsystems, Inc.

- Dow Chemical Company

- DuPont de Nemours, Inc.

- Everspin Technologies, Inc.

- Guangzhou Aurora Technologies Co., Ltd.

- Hitachi, Ltd.

- Intel Corporation

- International Business Machines Corporation

- Merck KGaA

- NEURANICS LAB PRIVATE LIMITED

- NVE Corporation

- Organic Spintronics Srl

- Qnami AG

- Samsung SDI Co., Ltd.

- Seagate Technology Holdings PLC

- SK Hynix Inc.

- Synopsys, Inc.

- TDK Corporation

- TOSHIBA CORPORATION

- Western Digital Corporation

Prescriptive Strategies and Tactical Roadmaps for Industry Stakeholders to Capitalize on Emerging Spintronics Opportunities and Navigate Market Shifts

Industry leaders should prioritize the establishment of cross-functional innovation hubs that unite experts in materials science, quantum engineering, and semiconductor fabrication to drive accelerated spintronics development. By adopting a modular investment approach, organizations can allocate resources dynamically across spin Hall effect, spin transfer torque, and spin–orbit interaction research streams, optimizing ROI based on evolving technical milestones.

Furthermore, firms must diversify supply chain networks by qualifying alternative sources for critical spintronics materials, thereby mitigating the impact of external tariffs and geopolitical volatility. Engaging in consortium-based standardization initiatives will reduce integration risks and foster broader interoperability among devices, amplifying market adoption. Leaders should also explore strategic equity partnerships with emerging startups to capture disruptive innovations around spin random access memory and quantum computing qubit prototypes.

Finally, embedding predictive analytics into R&D pipeline decisions can guide project prioritization, ensuring that investments align with both near-term commercialization opportunities and long-term technology roadmaps. By taking these tactical steps, stakeholders will be well positioned to capitalize on the transformative potential of spintronics and navigate forthcoming market shifts with agility and confidence.

Detailing Rigorous Research Frameworks, Data Collection Techniques, and Analytical Approaches Underpinning the Spintronics Market Evaluation

This analysis integrates a multi-tiered research framework, beginning with comprehensive secondary research to chart the technological evolution of spintronics from its origins in magnetoresistive sensors to contemporary quantum applications. Publicly available patent databases and technical white papers were systematically reviewed to identify prevailing innovation clusters in spin Hall effect and spin–orbit interaction research.

Primary interviews were conducted with senior R&D executives and materials scientists at leading fabrication facilities to validate emerging trends and assess real-world integration challenges. In parallel, a proprietary database of financial filings was analyzed to gauge investment trajectories in spintronic memory startups and strategic collaborations among established semiconductor firms. Quantitative data was further triangulated through cross-verification with import/export statistics and tariff schedules, ensuring a robust understanding of fiscal impacts on supply chains.

Finally, expert panels comprising academic researchers, industry technologists, and policy advisors convened to refine actionable insights and stress-test recommendations. This rigorous methodological approach, combining qualitative insights with quantitative analysis, provides a holistic perspective on the spintronics ecosystem, from foundational science to market execution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Spintronics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Spintronics Market, by Product

- Spintronics Market, by Type

- Spintronics Market, by Spin Technology

- Spintronics Market, by Applications

- Spintronics Market, by End-User Industry

- Spintronics Market, by Region

- Spintronics Market, by Group

- Spintronics Market, by Country

- United States Spintronics Market

- China Spintronics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Critical Findings and Strategic Imperatives to Illuminate the Future Trajectory of Spintronics Technologies and Market Dynamics

The consolidation of key findings highlights spintronics as a transformative force reshaping the landscape of magnetoelectronic devices and advanced computing architectures. Core technologies such as giant magnetoresistance, spin transfer torque, and spin–orbit interaction are converging to deliver unprecedented performance gains and energy efficiencies. While newly imposed tariffs introduce short-term cost pressures, adaptive supply chain strategies and domestic capacity-building initiatives signal resilience in the ecosystem.

Segmentation analysis underscores that product categories from spin diodes to spin transistors each possess unique value propositions, with application domains spanning data storage, magnetic sensing, and quantum computing. Region-specific dynamics reveal that the Americas leverage public–private innovation hubs, EMEA focuses on regulatory harmonization, and Asia-Pacific continues to lead in fabrication capacity and large-scale deployments.

Ultimately, organizations that align their strategic priorities with the modular research and collaboration imperatives outlined here will be best positioned to harness spintronics’ potential. By integrating these insights into executive-level decision-making, stakeholders can anticipate market shifts, optimize technology roadmaps, and secure competitive advantage in an era defined by electron spin control.

Engage with Our Associate Director to Secure Unparalleled Spintronics Market Insights and Propel Your Strategic Decision Making to New Heights

To secure your comprehensive spintronics market research report and gain tailored insights that drive strategic advantage, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. He will guide you through the acquisition process, discuss customized service options, and ensure your organization can act decisively on emerging trends. Connect with Ketan to explore flexible licensing arrangements and unlock the data-driven recommendations that will shape your competitive roadmap.

- How big is the Spintronics Market?

- What is the Spintronics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?