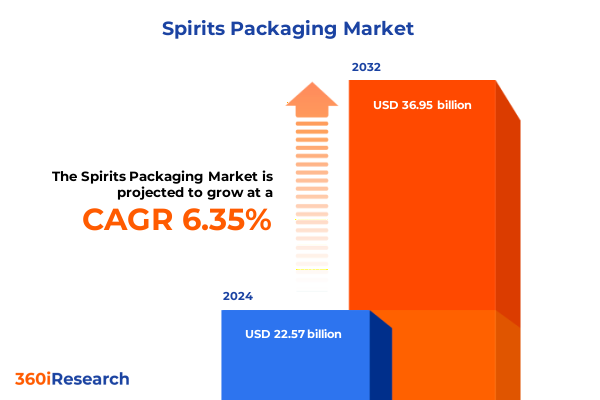

The Spirits Packaging Market size was estimated at USD 23.96 billion in 2025 and expected to reach USD 25.43 billion in 2026, at a CAGR of 6.38% to reach USD 36.95 billion by 2032.

Unveiling the dynamic evolution of spirits packaging and its pivotal role in shaping consumer perceptions and supply chain efficiencies

The spirits packaging arena has undergone a profound transformation in recent years, driven by escalating consumer expectations and an intensified focus on brand storytelling. Packaging is no longer a mere vessel for protecting and containing premium spirits; it has evolved into a dynamic touchpoint that conveys authenticity, heritage, and sustainability credentials. As discerning consumers increasingly prioritize experiential value, packaging design has become a critical differentiator, influencing purchasing decisions on crowded retail shelves and online platforms. Consequently, manufacturers and brand owners are exploring novel materials, innovative formats, and differentiated closures to capture attention, elevate perceived quality, and reinforce brand narratives.

Against this backdrop, the spirits packaging industry faces mounting pressure to balance aesthetic appeal with functional performance and environmental stewardship. The rise of e-commerce channels has compelled companies to rethink protective packaging solutions, optimize supply chain efficiency, and ensure product integrity during last-mile delivery. At the same time, evolving regulatory landscapes and heightened scrutiny around single-use plastics have spurred accelerated adoption of recyclable, refillable, and bio-based materials. In this rapidly shifting context, stakeholders must stay ahead of design trends, material innovations, and logistical imperatives to maintain market relevance and support sustainable growth.

Exploring how sustainability demands, digital innovation, and personalization are revolutionizing spirits packaging design and functionality

The spirits packaging landscape is experiencing transformative shifts fueled by rising sustainability expectations, digital integration, and design personalization. Consumers now demand packaging solutions that not only reflect premium craftsmanship but also align with their environmental values. As a result, the industry is witnessing a surge in eco-friendly alternatives, from glass weight reduction innovations to paperboard and bio-plastic trials, all aimed at lowering carbon footprints and facilitating circularity. Concurrently, closures equipped with smart technologies, such as NFC-enabled caps, are enhancing the consumer experience by enabling product authentication and interactive brand engagements.

Furthermore, personalization has emerged as a powerful trend, with limited-edition labels, customizable sleeves, and on-demand printing empowering brands to forge deeper emotional connections. These shifts are amplified by omnichannel retail imperatives, where packaging must perform seamlessly across in-store displays, direct-to-consumer shipments, and subscription platforms. As logistics complexities intensify, packaging engineers are optimizing structural designs to reduce material use, streamline pallet configurations, and improve stacking stability. These converging trends herald a new era of adaptive, intelligence-driven packaging systems that elevate brand equity while addressing practical challenges across the value chain.

Analyzing the ripple effects of 2025 U.S. tariff revisions on sourcing, production footprints, and strategic supply chain realignments

The imposition of new United States tariffs in early 2025 has reshaped procurement strategies, sourcing decisions, and overall cost structures across the spirits packaging sector. Suppliers of imported glass bottles and metal closures have reassessed production footprints, selectively relocating certain manufacturing processes closer to end markets to mitigate duty impacts. In parallel, domestic manufacturers have increased capacity investments to capitalize on cost advantages, leading to intensified competition and updated supply agreements. Although the tariff adjustments have introduced short-term pricing pressures for brand owners, these changes have also accelerated near-shoring initiatives and fostered closer collaboration between beverage companies and packaging partners.

Despite initial concerns regarding supply chain disruptions, many stakeholders have leveraged this period to optimize logistics networks, negotiate multi-year contracts with global vendors, and enhance inventory planning capabilities. Innovative financing mechanisms, such as duty-drawback programs and bonded warehouses, have been employed to alleviate cash flow constraints and maintain competitive pricing. Overall, the United States tariff revisions have acted as a catalyst for structural realignments within the packaging ecosystem, prompting a strategic pivot toward greater resilience, cost transparency, and diversified sourcing models.

Unpacking critical segmentation dimensions that reveal targeted innovation pockets and demand drivers across product types and channels

The spirits packaging market is dissected through multiple lenses that uncover distinct value pools and innovation pathways. When examining product types, can formats have surged ahead, driven by slim and standard variants that cater to on-the-go consumption and outdoor events, while carton solutions featuring gable top and Tetra Pak configurations offer lightweight, recyclable alternatives. Flat and standing pouch technologies further extend convenience and portability, targeting new consumer occasions. Shifting focus to packaging materials reveals the enduring prestige of glass bottles alongside the cost-effective allure of metal cans, paperboard boxes, and plastic bottles, the latter subdivided into HDPE and PET grades optimized for durability or clarity. Closure types such as corks, plastic stoppers, and screw caps continue to serve as brand signatures, balancing heritage appeal with functional performance.

Size segmentation highlights strategic differentiation across core formats: the iconic 750 ml format remains a benchmark for standard releases, while above-and-below variants enable premium and sampling strategies. End-user channels, spanning bars, pubs, and liquor stores, demand tailored configurations that address serving size, storage constraints, and presentation requirements. Finally, packaging size segmentation, differentiating bulk and single-serve formats, underscores the need for flexible distribution models, particularly in hospitality and direct-to-consumer sales. By integrating these segmentation insights, industry participants can identify targeted investment areas, enhance product positioning, and refine portfolio mix strategies.

This comprehensive research report categorizes the Spirits Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Material

- Closure Type

- Size

- End-User

- Packaging Size

Examining how distinct regulatory regimes, consumer tastes, and supply infrastructures are shaping spirits packaging trends across major regions

Regional dynamics in the spirits packaging industry reflect diverse regulatory landscapes, consumer preferences, and logistical infrastructures. In the Americas, strong heritage brands coexist with nimble craft distillers seeking lightweight, sustainable solutions to comply with evolving state-level environmental mandates. Collaborative initiatives between U.S. and Canadian packaging suppliers are fostering cross-border synergies, while Latin American markets are embracing cost-effective carton and pouch formats to reduce import dependencies and support local production. Consumer affinity for bold design and premium finishes in North America drives adoption of advanced printing techniques and premium closures.

Across Europe, the Middle East, and Africa, stringent regulations on single-use plastics have prompted accelerated transitions to refillable systems and mono-material packaging that streamlines recycling. The Middle East’s burgeoning hospitality sector elevates demand for durable yet visually impactful formats, whereas African markets prioritize affordability and supply chain simplicity, often favoring lightweight cartons and pouches. In the Asia-Pacific region, rapidly expanding middle classes in key economies are fueling demand for single-serve formats and craft-inspired premium packaging. Regional trade agreements and port infrastructure developments support efficient distribution, and local material innovation hubs are piloting bio-based plastics and locally sourced glass compositions.

This comprehensive research report examines key regions that drive the evolution of the Spirits Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting how leading packaging innovators employ sustainability roadmaps, strategic alliances, and agile capabilities to drive differentiation

Leading packaging companies are continuously redefining industry benchmarks through strategic partnerships, sustainability roadmaps, and design innovation. Global glass manufacturers are investing in furnace modernization projects that reduce energy consumption and carbon emissions, while metal can producers are expanding capacity to meet surging demand for slim-can formats. Specialized converters of paperboard are forging alliances with horticultural fiber suppliers to develop compostable cartons, and advanced pouch manufacturers are integrating barrier films that extend shelf life without compromising recyclability. At the same time, closure specialists are rolling out proprietary coatings and seal technologies designed to enhance preservation and tamper evidence.

Across these segments, companies are differentiating through end-to-end service offerings, combining design consultancy, rapid prototyping, and digital supply chain tools that enable transparent traceability. Several players have launched closed-loop recycling programs and takeback schemes that engage consumers and trade partners, further reinforcing brand sustainability claims. In an increasingly competitive landscape, these leaders are deploying data-driven insights, agile manufacturing techniques, and co-development frameworks to accelerate time-to-market and capture emerging white-space opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Spirits Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor PLC

- Ardagh Group S.A.,

- AstraPouch

- Ball Corporation

- Berry Global Inc.

- Gerresheimer AG

- Glassworks International

- Hunter Worldwide Limited

- ITW Hartness by Illinois Tool Works Inc.

- LiDestri Food and Drink

- Mondi plc

- Nampak Limited

- Neenah, Inc.

- Owens-Illinois, Inc.

- Saxco International LLC

- Smurfit Kappa Group

- Stoelzle Oberglas GmbH

- United Bottles & Packaging

- Vetropack Holding Ltd.

- Vidrala, S.A.

- WestRock Company

- Wildpack Beverage Inc.'s

Empowering packaging leaders with actionable strategies to embed circularity, digital engagement, and resilient supply chain frameworks

Industry leaders should prioritize integrating circularity principles into core packaging strategies, focusing on mono-material designs and closed-loop programs that resonate with eco-conscious consumers. Collaborative ventures with material science startups and academic institutions can yield breakthrough bio-based substrates and high-performance coatings, unlocking first-mover advantages. Moreover, embedding digital functionalities within closures and labels will enrich consumer engagement, reduce counterfeiting risks, and provide valuable consumption analytics to inform future innovations.

In addition, stakeholders must reassess supply chain architectures by pursuing near-shoring opportunities and diversifying supplier bases to mitigate geopolitical risks and tariff exposures. Aligning procurement practices with flexible contract terms and leveraging duty-drawback mechanisms will optimize cost management. Finally, adopting dynamic design platforms and rapid prototyping capabilities will enable real-time responsiveness to emerging trends and seasonal demands, ensuring that brands remain at the forefront of product launches and limited-edition campaigns.

Outlining a robust multi-phase methodology that blends expert interviews, secondary research, and data validation to underpin strategic insights

The research underpinning this analysis relied on a multi-phase approach combining primary interviews, secondary literature review, and quantitative data triangulation. A series of in-depth discussions were conducted with packaging engineers, brand marketing executives, and supply chain professionals to capture firsthand perspectives on emerging challenges and innovation priorities. These qualitative insights were supplemented by a comprehensive review of industry publications, patent filings, regulatory directives, and sustainability white papers to map technological advancements and compliance trajectories.

Quantitative rigor was achieved through cross-referencing trade statistics, tariff schedules, and production capacity reports to validate supply chain realignment trends. Material cost indices and logistics benchmarks were analyzed to assess the economic impact of 2025 tariff modifications. Throughout the process, findings were iteratively refined and stress-tested against multiple scenarios to ensure robustness. This holistic methodology ensures that the conclusions and recommendations presented herein accurately reflect the current industry landscape and anticipated strategic inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Spirits Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Spirits Packaging Market, by Product Type

- Spirits Packaging Market, by Packaging Material

- Spirits Packaging Market, by Closure Type

- Spirits Packaging Market, by Size

- Spirits Packaging Market, by End-User

- Spirits Packaging Market, by Packaging Size

- Spirits Packaging Market, by Region

- Spirits Packaging Market, by Group

- Spirits Packaging Market, by Country

- United States Spirits Packaging Market

- China Spirits Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing the convergence of consumer, regulatory, and supply chain forces that will define the next frontier of spirits packaging excellence

The spirits packaging sector stands at a pivotal juncture, where consumer expectations, sustainability imperatives, and regulatory shifts converge to redefine industry norms. Throughout this summary, we have examined how eco-friendly materials, digital enhancements, and personalized designs are reshaping brand experiences, while tariff adjustments have catalyzed structural supply chain realignments. Segmentation analysis illuminated critical value pools across product types, materials, closures, and end-user channels, and regional studies underscored the nuanced dynamics driving demand across the Americas, EMEA, and Asia-Pacific.

As market stakeholders navigate this evolving ecosystem, success will hinge on their ability to anticipate change, embrace circular innovation, and foster collaborative partnerships. By leveraging the strategic frameworks and actionable recommendations herein, decision-makers can position their organizations to thrive amid both challenges and opportunities. This confluence of creative design, operational resilience, and forward-looking strategy will ultimately define the next era of spirits packaging excellence.

Take decisive action now to secure your tailored spirits packaging market report and empower your strategic initiatives with expert insights

Ready to elevate your spirits packaging strategy and gain a competitive advantage with in-depth analysis tailored to your needs? Reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your comprehensive market research report on the evolving spirits packaging landscape. Unlock actionable intelligence and detailed insights that will empower your team to navigate transformative shifts, regulatory impacts, and emerging opportunities in the coming years. Contact Ketan Rohom today to explore customized consultation options, request sample chapters, or discuss enterprise licensing for your organization’s strategic roadmap.

- How big is the Spirits Packaging Market?

- What is the Spirits Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?