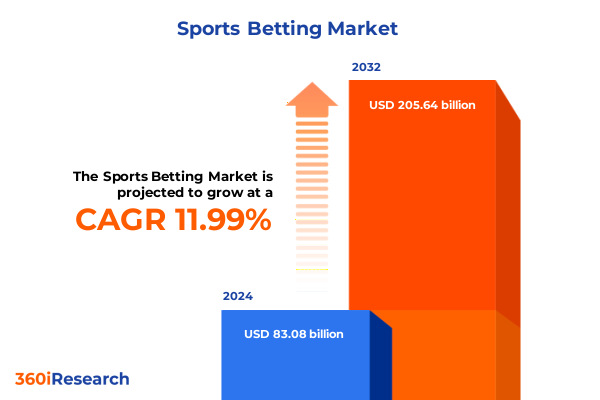

The Sports Betting Market size was estimated at USD 91.97 billion in 2025 and expected to reach USD 102.16 billion in 2026, at a CAGR of 12.18% to reach USD 205.64 billion by 2032.

Exploring the current sports betting ecosystem and unveiling the core drivers fueling dynamic growth and stakeholder engagement across the industry

The sports betting industry has entered a phase of accelerated evolution, driven by a convergence of technological innovation, shifting regulatory frameworks, and changing consumer expectations. In recent years, the proliferation of digital platforms has redefined how bettors interact with sportsbooks, creating an ecosystem where seamless user interfaces and real-time data analytics are table stakes. Moreover, advances in artificial intelligence and machine learning have enabled personalized betting experiences, catering to a diverse audience ranging from casual fans to seasoned professionals. As we delve into this Executive Summary, it becomes clear that the interplay between innovation and regulation will shape the trajectory of sports wagering for years to come.

Furthermore, economic conditions and consumer spending patterns continue to influence market dynamics, underscoring the need for operators to balance risk management with growth ambitions. The rise of mobile-first engagement has also transcended traditional desktop usage, reinforcing the importance of omnichannel strategies that integrate cloud-based platforms, web solutions, and mobile applications. In this context, stakeholder collaboration-spanning technology providers, regulatory bodies, and sports franchises-is critical in establishing trust and maintaining the integrity of competitive events. Transitioning from an introductory overview to a detailed analysis, the following sections will unpack transformative shifts, tariff impacts, segmentation nuances, and regional perspectives that collectively inform strategic decision-making in this vibrant market.

Revolutionary shifts redefining sports wagering through emerging technologies, evolving regulations, and transformative consumer behavior dynamics

The sports betting landscape has undergone transformative shifts over the past several years, with emerging technologies reshaping operational models and user experiences. Blockchain implementations are enhancing transparency and security in financial transactions, while AI-driven predictive analytics are empowering operators to refine odds in real time. Consequently, traditional bookmakers are forging partnerships with technology start-ups, integrating cloud-based solutions that scale elastically with demand and reduce latency during high-traffic events.

Regulatory developments have also played an instrumental role in redefining competitive boundaries. As jurisdictions adopt more nuanced frameworks, operators must navigate a patchwork of compliance requirements-from consumer protection mandates to data privacy regulations. In response, several platforms have implemented geofencing and robust identity verification processes to meet the highest standards of integrity. Meanwhile, evolving consumer behavior, marked by a growing appetite for in-play wagering and social betting features, is compelling the industry to innovate rapidly. Live streaming integrations and immersive interfaces are becoming prevalent, offering bettors a cohesive viewing and wagering environment. Altogether, these shifts are converging to establish a more agile, secure, and consumer-centric sports betting ecosystem.

Evaluating the overarching effects of 2025 United States tariffs on sports betting platform operations, technology supply chains, and market competitiveness

In 2025, wave after wave of United States tariff adjustments have created ripples throughout the sports betting supply chain, with implications for platform providers, hardware vendors, and service partners. Tariffs on imported semiconductors and server components have increased the cost of data center expansions, compelling operators to reassess infrastructure investments. As a result, some firms have accelerated migrations to cloud service providers headquartered domestically, mitigating the impact of import levies while ensuring scalability and compliance with local data residency mandates.

Moreover, tariffs on mobile device components have had a downstream effect on smartphone-enabled betting, as device manufacturers pass additional costs onto consumers. This tendency has prompted sportsbook operators to diversify device support, optimizing platforms for a range of tablets and desktop environments to sustain engagement. Simultaneously, higher import duties on data analytics tools and peripheral technologies have reinforced the importance of in-house development and open-source software adoption. Together, these tariff-driven dynamics are reshaping capital allocation strategies, operational partnerships, and technological roadmaps across the sports betting ecosystem, reinforcing the imperative to remain nimble in a shifting policy landscape.

Uncovering nuanced insights across bet types, platform modalities, device preferences, event categories, sport verticals, payment channels, and end-user profiles

An in-depth view of market segmentation reveals that bet type preferences, platform deployment strategies, device usage patterns, event categories, sport verticals, payment channels, and end-user profiles each contribute unique performance drivers. When examining bet types such as Double Chance Bet, Money Line Bet, Parlays, Point Spread Bet, Teasers, and Totals Betting (Over/Under), there is a clear trend toward multi-leg and parlays wagering as bettors seek enhanced engagement and higher potential returns. Platform deployment strategies further underscore this complexity; offline avenues such as casino sportsbooks and retail betting shops coexist alongside online channels, including cloud-based platforms, mobile apps, and web-based interfaces, each catering to distinct user needs.

Device usage patterns continue to evolve, with desktop, smartphone, and tablet interfaces all playing critical roles in shaping user journeys. Notably, smartphone engagement, split between Android and iOS users, has surpassed traditional desktop traffic, emphasizing the need for responsive design and optimized network performance. Event categories also demonstrate differentiation, as in-play events capitalize on real-time data feeds, pre-match events drive early season momentum, and virtual events cater to off-peak engagement windows. Sport verticals ranging from basketball, cricket, and esports to football, horse racing, and tennis reveal geographical and demographic biases, while payment channel preferences-bank transfers, credit cards, cryptocurrency, debit cards, and ewallets-highlight the balance between speed, convenience, and security. Finally, the spectrum of end-users, from casual bettors to novice enthusiasts and professional high-rollers, demands tiered service models that address varying risk appetites and loyalty incentives.

This comprehensive research report categorizes the Sports Betting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Bet Type

- Platform Type

- Device Type

- Event Type

- Sport Type

- Payment Method

- End-User

Decoding regional sports betting landscapes by examining Americas, Europe Middle East & Africa, and Asia-Pacific market trends and regulatory environments

Regional dynamics underscore how regulatory environments, cultural factors, and technological readiness inform sports betting growth. In the Americas, North America’s maturing US and Canadian markets continue to drive high per-capita wagering through mobile-first adoption and integrated iGaming offerings, while Latin American markets accelerate legalization efforts, focusing on consumer protection frameworks and tax structures. The Europe, Middle East & Africa region presents a diverse tapestry where established European markets refine compliance regimes and data privacy legislation, Middle Eastern jurisdictions explore controlled launches often tied to tourism strategies, and emerging African markets leverage mobile money ecosystems to onboard underbanked bettors.

Turning to Asia-Pacific, regulatory openness in Australia and select Southeast Asian markets coexists with restrictive policies in certain jurisdictions, prompting operators to innovate through licensing partnerships and white-label solutions. High smartphone penetration rates facilitate in-play and mobile-only wagering, and rapid digital payment adoption underscores the critical role of ewallets and mobile wallets in this region. Collectively, these regional insights reinforce the strategic imperative for operators to tailor offerings, partnership models, and go-to-market approaches to align with local regulatory contours and consumer preferences.

This comprehensive research report examines key regions that drive the evolution of the Sports Betting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading sportsbook operators and technology providers with strategic initiatives, partnerships, and innovations shaping the competitive battleground

A closer look at leading operators illustrates how strategic partnerships, technology investments, and brand differentiation shape the competitive landscape. Major North American sportsbooks are deepening alliances with professional leagues, broadcasters, and data providers to secure exclusive content rights and enhance live-betting experiences. These collaborations extend beyond traditional sponsorships, encompassing co-developed interactive features and integrated loyalty programs that drive cross-sell opportunities across iGaming verticals.

Global platform providers are also expanding their footprints through targeted acquisitions of niche technology firms, bolstering capabilities in areas such as risk management, advanced odds compilation, and artificial intelligence–powered personalization. Simultaneously, emerging fintech startups are introducing innovative payment solutions, from instant crypto settlements to frictionless ewallet integrations, challenging incumbents to elevate their transaction ecosystems. Technology vendors supplying turnkey sportsbook engines and managed services are differentiating through modular architectures, enabling rapid feature deployment and regional compliance customization. Together, these company-level insights highlight the diverse strategies employed by both legacy operators and digital disruptors to capture market share and foster long-term customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sports Betting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 888 by Evoke PLC

- Action Network, Inc.

- Aristocrat Leisure Ltd.

- Bet365 Group Ltd.

- Betway Group

- Caesars Entertainment, Inc.

- Canadian Bank Note Suriname

- Entain PLC

- EveryMatrix Group

- Flutter Entertainment

- Fortuna Entertainment Group A.S.

- Gamesys Group PLC

- GAN Limited

- Genius Sports Group

- Inspired Entertainment, Inc.

- Jackpocket LLC

- Kambi Group Plc

- Kindred Group PLC

- MGM Resorts International

- OB Global Holdings LLC

- PENN Entertainment, Inc.

- Pinnacle Sports Limited

- PointsBet Holdings Ltd

- Rush Street group

- SBTech

- Scientific Games, LLC

- Score Media and Gaming Inc.

- Soft2Bet

- Sportradar AG

Delivering pragmatic recommendations for industry leaders to capitalize on emerging opportunities, mitigate risks, and drive sustainable market leadership

To thrive amid intensifying competition and regulatory complexity, industry leaders must prioritize several key initiatives. First, investing in scalable cloud infrastructure and microservices architectures will ensure platforms can withstand peak wagering volumes while maintaining high availability. Coupled with real-time analytics and machine learning models, this approach empowers operators to optimize odds, personalize promotions, and detect fraud proactively. Second, fostering multichannel engagement is essential; integrating web, mobile, and in-venue experiences through seamless account management and unified wallets will enhance retention and cross-sell potential.

Furthermore, building strategic alliances with sports franchises, data providers, and payment innovators can unlock exclusive content, real-time insights, and diversified payment offerings. In parallel, a robust compliance framework-combining automated geolocation, identity verification, and responsible gambling features-will mitigate regulatory risks while reinforcing consumer trust. Operators should also develop tiered loyalty programs aligned with distinct end-user segments, from casual participants to professional bettors, to drive lifetime value. Finally, scenario-planning for policy shifts, technology disruptions, and macroeconomic fluctuations will equip leaders with the agility needed to navigate future uncertainties.

Detailing the robust research methodology underpinning the analysis, including primary interviews, extensive secondary research, and rigorous data validation

The insights presented in this summary result from a rigorous research methodology combining primary and secondary data sources. Primary research included in-depth interviews with C-level executives at leading sportsbooks, technology providers, and regulatory bodies, as well as surveys of active bettors across diverse demographic cohorts. This qualitative input was triangulated with quantitative data obtained from industry databases, public financial disclosures, and anonymized transaction logs to ensure representativeness and depth of analysis.

Secondary research encompassed an exhaustive review of regulatory filings, scholarly publications, and proprietary datasets tracking market developments and consumer behavior patterns. Data validation protocols included cross-referencing information with multiple independent sources and performing sanity checks on outlier data points. Analytical frameworks such as PESTLE, SWOT, and Porter’s Five Forces were employed to structure the evaluation of macro-environmental factors, competitive dynamics, and risk variables. Altogether, this multifaceted methodology underpins the credibility and actionable value of the strategic insights provided herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sports Betting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sports Betting Market, by Bet Type

- Sports Betting Market, by Platform Type

- Sports Betting Market, by Device Type

- Sports Betting Market, by Event Type

- Sports Betting Market, by Sport Type

- Sports Betting Market, by Payment Method

- Sports Betting Market, by End-User

- Sports Betting Market, by Region

- Sports Betting Market, by Group

- Sports Betting Market, by Country

- United States Sports Betting Market

- China Sports Betting Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesis of key findings and strategic implications to guide decision makers in navigating the evolving sports betting domain with confidence

In synthesizing the key findings, it is evident that the sports betting industry stands at a crossroads defined by innovation, regulation, and evolving consumer demands. Technological advancements-from AI-powered personalization to cloud-native scalability-offer pathways to enhanced user engagement and operational efficiency. Simultaneously, tariff-induced cost pressures and complex regional regulations necessitate adaptable infrastructure strategies and localized compliance solutions.

Segmentation and regional analyses underscore the heterogeneity of market drivers, revealing that success hinges on tailoring offerings across bet types, platforms, devices, events, sports, payment methods, and user profiles. Leading operators are distinguishing themselves through strategic partnerships, proprietary technology investments, and diversified payment ecosystems. As the competitive landscape intensifies, stakeholders must embrace agile governance frameworks, forge collaborative alliances, and leverage data-driven decision making to maintain momentum. Ultimately, the convergence of these factors will determine which players ascend to market leadership in the coming years.

Engage with our expert Associate Director to access the comprehensive sports betting market research report and empower your strategic roadmap

To secure unparalleled insights that drive confident strategic decisions, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan’s expertise in sports betting market dynamics ensures you receive tailored guidance and access to the comprehensive market research report. Engage with Ketan to explore custom data solutions, detailed competitive benchmarking, and in-depth regional analyses that support your organization’s growth trajectory. Partnering with Ketan opens the door to actionable intelligence, helping you identify emergent trends, capitalize on new revenue streams, and fortify your market position. Seize this opportunity to elevate your strategic roadmap by connecting with Ketan Rohom today

- How big is the Sports Betting Market?

- What is the Sports Betting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?