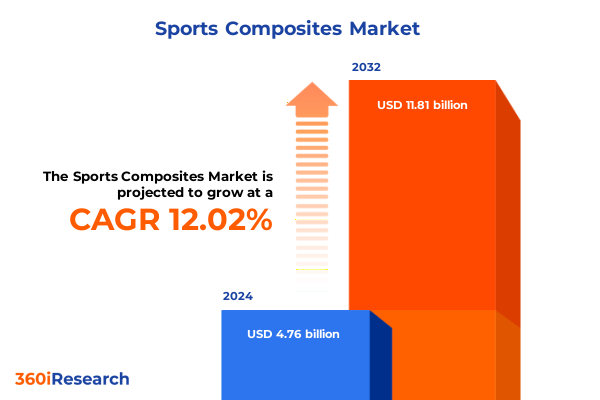

The Sports Composites Market size was estimated at USD 5.27 billion in 2025 and expected to reach USD 5.84 billion in 2026, at a CAGR of 12.21% to reach USD 11.81 billion by 2032.

Exploring How Cutting-Edge Material Science And Sustainable Engineering Practices Are Shaping The Future Of Sports Composite Equipment

The sports composites market stands at an inflection point where advanced material science converges with evolving athletic demands to redefine performance standards. Innovations in composite formulations and processing techniques have accelerated the adoption of lightweight yet robust equipment across multiple disciplines, ranging from endurance cycling to precision racquet sports. As athletes and teams seek marginal gains in speed, strength, and durability, manufacturers are responding with tailored solutions that leverage high-performance fibers, novel resin systems, and automated fabrication processes. This report opens by examining how the convergence of engineering breakthroughs and consumer expectations is driving a paradigm shift that extends well beyond incremental improvements in equipment design.

In parallel with technological advances, sustainability considerations have begun to reshape supplier and OEM strategies, emphasizing recyclability and life-cycle analysis alongside mechanical performance. The integration of bio-derived resins, closed-loop manufacturing workflows, and end-of-life reclamation protocols underscores a growing commitment to environmental stewardship. Together, these forces are crafting a new narrative in the sports composites space-one that marries peak athletic performance with responsible resource utilization. This introductory section lays the foundation for understanding the multifaceted shifts propelling the market forward in 2025 and beyond.

Unprecedented Fusion Of Advanced Fiber Innovations And Digital Manufacturing Transformations Redefining Competitive Dynamics In Sports Composites

The sports composites landscape has undergone a series of transformative shifts driven by rapid advancements in fiber technology, digital manufacturing, and consumer engagement models. Over the past year, the maturation of high-strength carbon fiber grades has enabled a new generation of equipment that delivers exceptional stiffness-to-weight ratios, bolstering athletic performance across competitive and recreational segments alike. At the same time, improvements in filament winding and automated layup techniques have increased production efficiency, enabling smaller batch sizes and greater customization without sacrificing cost competitiveness.

Concurrently, the proliferation of digital twin simulations and in-line quality inspection systems has elevated product reliability while shortening development cycles. Manufacturers can now iterate design prototypes through virtual stress tests, optimizing laminate architectures for specific impact scenarios and load cases. These capabilities have accelerated time to market for specialty products, such as composite hockey sticks and advanced racquet frames, where precision tuning of flex and torsional properties directly influences play dynamics. As a result, industry participants are forging partnerships across material suppliers, software providers, and equipment brands to co-innovate solution suites that span the entire value chain.

Alongside technological evolution, shifting consumer behaviors have introduced new imperatives for market players. The rise of direct-to-consumer channels and digital brand experiences has disrupted traditional retail models, compelling legacy equipment manufacturers to reimagine their distribution and marketing strategies. Enhanced digital engagement tools, including virtual product fitment and performance analytics, are reshaping purchase journeys and deepening customer loyalty. Collectively, these transformative shifts are redefining competitive moats and setting the stage for accelerated growth trajectories in 2025.

Analyzing How 2025 Tariff Measures On Imported Composite Materials Are Driving Cost Pressures And Domestic Supply Chain Restructuring In The US

In 2025, United States tariffs on composite raw materials and manufacturing equipment have introduced complex headwinds and opportunities across the sports equipment ecosystem. Tariffs targeting carbon fiber precursor materials, as well as key technical fabrics imported from Asia, have exerted upward pressure on input costs for Western-based OEMs. These cost increases have been particularly acute for high-performance carbon fiber composites, prompting some manufacturers to adjust laminate schedules or explore alternative aramid and fiberglass blends to mitigate margin erosion.

However, the imposition of tariffs has also catalyzed domestic capacity investments and supply chain realignment. Faced with heightened import duties, industry leaders have accelerated plans for in-country production facilities, leveraging government incentives and public-private partnerships to secure feedstock pipelines. This reshoring trend is fostering localized expertise in advanced material handling and curing processes, reducing lead times and providing greater agility in responding to demand fluctuations.

Furthermore, the tariff landscape has encouraged a deeper collaboration between sports OEMs and end-use customers to co-develop hybrid composite systems that preserve performance attributes while moderating cost volatility. This collaborative approach has spurred innovations in hybrid fiber architectures, resin transfer molding parameters, and in-mold coating technologies. As global trade tensions persist, the cumulative impact of 2025 tariffs will continue to shape capital allocation, procurement strategies, and product roadmaps across the sports composites sector.

In-Depth Assessment Of Product Type Material And Process Variations Reveals Distinct Performance Profiles And Strategic Opportunities

The sports composites market can be navigated through nuanced product type analysis, revealing distinct performance expectations and growth drivers for each category. Within the bicycle and frames segment, electric bicycles demand lightweight yet impact-resistant carbon fiber variants, while mountain bikes prioritize abrasion tolerance and flex control in hybrid composite constructions. Road bikes often feature unidirectional fiber layups tuned for maximum stiffness, whereas hybrid bikes balance cost and resilience through blended aramid-carbon laminates. Transitioning to golf clubs and accessories, drivers and irons benefit from multi-layered carbon-infused crown designs that optimize weight distribution, while putters leverage fiber-backed inserts to dampen vibrations and enhance feel. In hockey equipment, sticks integrate stiffened composite shafts with energy-absorbing resin foams, and helmets employ layered fiberglass and aramid in conjunction with foam liners to achieve superior impact attenuation. Racquet sports equipment has seen a renaissance in composite frame geometries, with badminton, squash, and tennis racquets each utilizing fiber orientation and resin chemistries calibrated to respective swing speeds and impact frequencies.

Material type segmentation underscores the strategic choices available to manufacturers seeking to balance strength, weight, and cost. Aramid composites offer outstanding toughness and fiber–matrix adhesion, making them ideal for protective gear and high-impact applications. Carbon fiber composites remain the gold standard for stiffness and lightweight performance, predominating in premium sporting goods. Fiberglass composites provide an economical solution with good fatigue resistance, frequently deployed in recreational and entry-level equipment. Hybrid composites blend fiber types to capture complementary properties, enabling bespoke performance profiles across product lines.

From a manufacturing process perspective, compression molding continues to serve high-volume applications with consistent cycle times and dimensional accuracy. Filament winding is favored for cylindrical and tubular components, delivering uniform fiber placement under controlled tension. Prepreg molding, whether through autoclave curing or out-of-autoclave processes, offers precise fiber/resin ratios and surface finish quality, albeit at higher capital intensity. Resin transfer molding, including both high-pressure injection and vacuum injection techniques, accommodates complex geometries and large parts with minimal material waste.

End user analysis reveals that amateur sports participants drive volume demand for cost-effective composite products, while commercial facilities prioritize durability and ease of maintenance. Professional sports franchises require cutting-edge customization and rapid deployment, often collaborating closely with material scientists and design engineers. School and collegiate markets seek scalable equipment solutions that satisfy safety standards and budget constraints. Distribution channel dynamics have shifted toward omnichannel fulfillment models, combining direct sales relationships with offline retail networks and online storefronts. Dealer-distributors and specialty stores continue to influence performance-oriented buyers, while brand websites, e-commerce platforms, and online marketplaces enable broad consumer reach and data-driven personalization.

This comprehensive research report categorizes the Sports Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Manufacturing Process

- End User

- Distribution Channel

Comparative Analysis Of Regional Regulatory Incentives End-User Trends And Supply Chain Developments Shaping The Global Sports Composites Landscape

Regional dynamics in the sports composites landscape vary significantly across the Americas, Europe, Middle East & Africa, and Asia-Pacific, each shaped by unique regulatory frameworks, investment climates, and end-user preferences. In the Americas, established cycling and golf markets drive steady demand for high-performance carbon fiber variants, while North American hockey traditions bolster innovation in composite stick and protective gear technologies. Investment incentives in the United States are catalyzing new domestic production hubs, aimed at reducing reliance on imported feedstocks and enhancing supply chain resilience.

Within Europe, Middle East & Africa, stringent safety and environmental regulations are accelerating the adoption of recyclable resin systems and closed-loop manufacturing practices. European ski and cycling heritage underpins strong OEM capabilities in composite engineering, with regional clusters in Germany, France, and Italy serving as centers of excellence. Meanwhile, Gulf Cooperation Council nations are emerging as growth markets for premium sports infrastructure and high-performance equipment imports, influenced by expanding professional leagues and international sporting events.

In Asia-Pacific, rapid urbanization and rising disposable incomes are fueling recreational sports participation, driving demand for both premium and value-driven composite products. China and India are witnessing a surge in domestic composite fiber capacity, supported by government-backed industrial policies aimed at technological self-sufficiency. Additionally, Australian research institutions are leading in sustainable composite innovations, particularly in bio-based resins and recyclable fiber technologies, positioning the region as a hotbed for next-generation material breakthroughs.

This comprehensive research report examines key regions that drive the evolution of the Sports Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating How Strategic Alliances R&D Leadership And Vertical Integration Are Driving Competitive Differentiation Among Key Market Players

Several market participants have emerged as pivotal players in advancing composite solutions for sports equipment, driven by strategic partnerships, robust R&D portfolios, and integrated supply chain models. Leading material suppliers have broadened their product ecosystems through investments in novel fiber tow configurations and resin chemistries tailored specifically for athletic applications. Likewise, prominent sports OEMs have deepened collaboration with technology providers, co-developing proprietary composite systems that deliver performance differentiation in key verticals such as cycling, racquet sports, and protective gear.

In addition to global conglomerates, a cadre of specialized innovators has disrupted traditional value chains by focusing on niche performance attributes. These agile firms leverage digital manufacturing platforms and lean production methodologies to offer rapid prototyping services and highly customized component runs. Their ability to iterate designs through advanced simulation tools and rapid cure technologies has attracted strategic investments from larger industry players looking to augment their product portfolios.

Moreover, several vertically integrated companies are capitalizing on synergies between raw material production, composite fabrication, and final assembly. By controlling multiple stages of the value chain, these organizations achieve tighter quality control, reduced lead times, and enhanced cost management. Their success underscores the competitive advantage inherent in end-to-end integration, particularly as tariffs and trade complexities introduce greater uncertainty for standalone manufacturers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sports Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amer Sports Corporation

- Arkema S.A.

- Callaway Golf Company

- COBRA INTERNATIONAL Co., Ltd.

- Connova Deutschland GmbH

- DuPont de Nemours, Inc.

- Exel Composites PLC

- Fischer Sports GmbH

- Fujikura Composites Inc.

- Hexcel Corporation

- Lanxess AG

- Mitsubishi Chemical Group Corporation

- Owens Corning

- Rockwood Composites Limited

- Saint-Gobain Group

- SGL Carbon SE

- Silverstone Composites Ltd.

- Solvay S.A.

- Sportsmatik.com

- Teijin Limited

- Topkey Corporation

- Toray Industries, Inc.

- TPT Golf Inc.

- True Temper Sports

- United States Ski Pole Company

- Völkl Int. GmbH

- Zhongfu Shenying Carbon Fiber Co., Ltd.

Implementing Resilient Sourcing Digital Transformation And Sustainability Partnerships Is Crucial For Navigating Cost And Performance Challenges

Industry leaders should prioritize the diversification of their raw material sourcing strategies to mitigate tariff-driven cost pressures and supply chain disruptions. By establishing multi-geographic partnerships and qualifying secondary suppliers for critical fiber and resin feedstocks, organizations can achieve greater purchasing flexibility and negotiate more favorable terms. In parallel, investment in localized production capabilities-whether through joint ventures or greenfield facilities-will enhance resilience and reduce lead times for high-performance composite components.

In addition, companies must intensify their focus on digitalization across the product development lifecycle. Integrating advanced simulation tools, digital twin platforms, and in-line quality monitoring systems will streamline design iterations, accelerate validation processes, and optimize material utilization. These measures not only shorten time to market but also enable deeper customization and predictive maintenance services for end customers.

Furthermore, fostering cross-industry collaborations can catalyze breakthrough innovations in sustainable composite chemistries and circular economy models. By partnering with academic institutions, recycling specialists, and regulatory bodies, market participants can co-develop recyclable resin systems and closed-loop manufacturing protocols that resonate with environmentally conscious consumers and comply with evolving global standards.

Finally, refining go-to-market approaches through omnichannel integration will be essential for capturing diverse end-user segments. Leveraging data analytics to personalize digital storefront experiences, while maintaining strong relationships with traditional retail partners, will create a balanced distribution network capable of serving both professional athletes and recreational enthusiasts.

Employing A Comprehensive Blend Of Secondary Analysis Primary Executive Interviews And Rigorous Data Triangulation To Ensure Analytical Robustness

This research leverages a blended methodology combining extensive secondary research with targeted primary insights to ensure comprehensive coverage and analytical rigor. Secondary sources include public filings, industry association publications, patent databases, and regulatory documents that establish the foundational understanding of material technologies, manufacturing processes, and tariff policies. These insights were synthesized to map key trends, competitive dynamics, and regional market drivers across the sports composites sector.

Primary research was conducted through in-depth interviews with senior executives, product design engineers, and supply chain managers from leading equipment manufacturers, material suppliers, and specialist converters. These conversations provided firsthand perspectives on emerging performance requirements, cost management strategies, and the practical implications of 2025 tariff measures. Supplementary surveys gathered quantitative data on production volumes, lead times, and material preferences, enabling triangulation of findings and validation of qualitative observations.

Data collected from these sources was subjected to a rigorous triangulation process, cross-referencing multiple inputs to ensure consistency and accuracy. The research team applied an iterative review framework, incorporating peer feedback and expert validation at each stage. Visual mapping techniques and statistical analysis tools were utilized to uncover correlations between material innovations, process optimizations, and end-user adoption patterns. This structured approach ensures that the report’s conclusions and recommendations are grounded in robust evidence and industry expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sports Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sports Composites Market, by Product Type

- Sports Composites Market, by Material Type

- Sports Composites Market, by Manufacturing Process

- Sports Composites Market, by End User

- Sports Composites Market, by Distribution Channel

- Sports Composites Market, by Region

- Sports Composites Market, by Group

- Sports Composites Market, by Country

- United States Sports Composites Market

- China Sports Composites Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Insights On Innovation Tariff Dynamics And Regional Variations To Chart A Strategic Path Forward In Sports Composites

In summary, the sports composites market is entering a new era defined by material innovation, supply chain transformation, and evolving end-user expectations. Technological advancements in fiber chemistries and digital manufacturing are unlocking unprecedented performance capabilities, while sustainability and tariff considerations are reshaping strategic priorities. Segmentation analysis highlights the diverse performance requirements across product types, materials, and manufacturing processes, underscoring the importance of tailored solutions for distinct end-user segments.

Regional variations reveal both challenges and opportunities, from reshoring initiatives in the Americas to regulatory-driven sustainability adoption in Europe, and rapid demand growth in Asia-Pacific. Key players are distinguishing themselves through strategic alliances, vertical integration, and agile innovation models that accelerate time to market. To navigate the complex interplay of cost pressures, performance imperatives, and market dynamics, industry leaders must adopt resilient sourcing, digital integration, and collaborative sustainability programs.

This executive summary provides a holistic view of the current landscape, delivering insights that equip decision-makers with the knowledge to refine product roadmaps, optimize operational efficiency, and secure competitive advantage. As the sports composites sector continues its dynamic evolution, stakeholders prepared to act on these recommendations will be best positioned to harness the full potential of high-performance composite technologies.

Empower Your Strategic Decisions With Direct Access To Proprietary Sports Composites Market Analysis By Connecting With Ketan Rohom Today

To delve deeper into the dynamics of the sports composites sector and uncover actionable intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By connecting with Ketan Rohom, you will gain direct access to the full suite of proprietary insights, granular data tables, and expert commentary that underpin this executive summary. Position your organization at the forefront of innovation by leveraging detailed breakdowns of material performance, tariff implications, and regional market drivers that are critical for strategic decision making. Engage with Ketan Rohom to secure your comprehensive copy of the market research report and empower your leadership team with the nuanced analysis essential for capitalizing on emerging opportunities within this rapidly evolving landscape

- How big is the Sports Composites Market?

- What is the Sports Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?