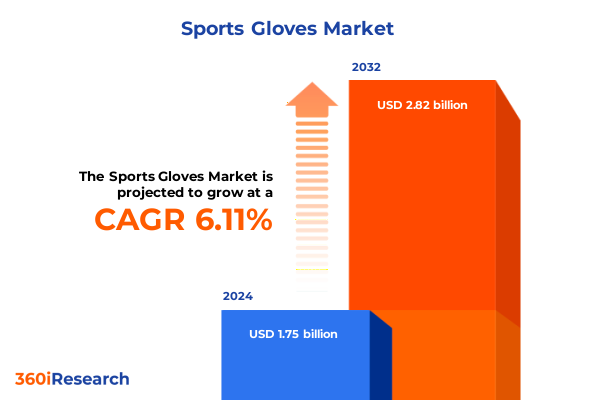

The Sports Gloves Market size was estimated at USD 1.86 billion in 2025 and expected to reach USD 1.97 billion in 2026, at a CAGR of 6.13% to reach USD 2.82 billion by 2032.

Setting the Stage by Outlining the Core Drivers Shaping the Global Sports Gloves Industry and Introducing Key Themes Explored in This Executive Summary

The global sports gloves industry has evolved from a niche protective accessory into a performance-enhancing essential that intersects athletic pursuits, fashion trends and consumer safety priorities. Over the past decade, heightened awareness of injury prevention, coupled with advances in material science, has elevated gloves from simple leather or cloth coverings to multifunctional products engineered for grip, comfort and moisture management. As athletes demand more from their gear, manufacturers have responded with designs that cater to a diverse array of sporting activities, ranging from cycling and goalkeeping to weightlifting and winter sports.

This transformation has been driven by the convergence of several core forces. Technological breakthroughs in knitted fabrics, high-density foam padding and smart textiles have unlocked new opportunities for performance optimization. At the same time, shifting consumer expectations around sustainability and ethical sourcing have prompted brands to innovate with eco-friendly materials and transparent supply chains. Meanwhile, digital channels have democratized access to specialty products, enabling smaller players to reach global audiences and intensifying competitive pressures across every price tier.

Against this backdrop, this executive summary guides decision-makers through a nuanced exploration of the current landscape. We delve into the transformative shifts reshaping production and consumption, assess the cumulative impact of recent US tariff measures, unpack key segmentation and regional insights, and profile leading industry participants. The conclusion crystallizes strategic imperatives and actionable recommendations, while an overview of methodology ensures confidence in the rigor underpinning our findings.

Exploring How Technological Advances, Shifting Consumer Preferences and Sustainability Trends Are Transforming the Landscape of the Sports Gloves Industry

The sports gloves sector is experiencing a wave of transformative shifts driven by the intersection of technology, culture and environmental imperatives. Performance fabrics embedded with phase-change materials and antimicrobial treatments have moved beyond lab concepts to mainstream product lines, offering athletes real-time temperature regulation and hygiene benefits. These innovations not only enhance wearer experience but also provide brands with compelling differentiation in an increasingly commoditized landscape.

Alongside material advances, changes in consumer behavior are influencing design and distribution strategies. Enthusiasts are seeking more customized experiences, from gloves tailored to specific grip preferences to digital platforms that recommend products based on activity profiles. Subscription-based models and virtual fitting tools have emerged as novel engagement channels, allowing companies to build deeper relationships and gather actionable insights into usage patterns.

Sustainability has likewise become a central tenet for market participants, prompting investments in recycled fibers, biodegradable padding and transparent sourcing practices. As regulatory frameworks around waste reduction and chemical use tighten, manufacturers with proactive sustainability roadmaps are gaining brand equity and consumer trust. These shifts collectively signal a new era in which agility, digital integration and environmental stewardship define competitive success.

Analyzing the Broad Economic and Operational Consequences of Recent US Tariff Measures on Supply Chains, Pricing Strategies, and Competitive Positioning in 2025

In 2025, the cumulative impact of United States tariff measures has reverberated across the sports gloves value chain, altering both cost structures and strategic sourcing decisions. Import duties on raw materials such as natural leather and specialized textiles have driven material substitution efforts, with many manufacturers seeking lower-cost alternatives like synthetic microfiber or polyester blends to maintain margin profiles. Consequently, product portfolios are increasingly diversified to balance consumer expectations for premium materials against the financial realities of elevated import costs.

Supply chain disruptions stemming from tariff-related contention have also prompted brands to reassess their manufacturing footprints. Companies are exploring nearshoring options in Mexico and the southern United States to reduce lead times and mitigate exposure to punitive duty rates. This reshoring trend, while offering logistical advantages, necessitates investments in domestic production capabilities and workforce training to achieve the same quality standards formerly obtainable from established international suppliers.

From a pricing perspective, the inflationary pressures induced by tariffs have been absorbed unevenly across distribution channels. Branded e-commerce platforms have absorbed a greater share of cost increases through value-added services and loyalty incentives, while mass retail partners have resisted significant price escalations to preserve volume-driven relationships. As a result, competitive positioning has shifted in favor of agile, digitally native brands that can flex pricing strategies in real time and optimize promotional offers based on granular demand signals.

Uncovering Segmentation Patterns Across End Users, Distribution Channels, Price Ranges, Material Choices and Product Types Shaping Market Dynamics

Segmentation analysis reveals that consumer demand and product development are deeply influenced by nuanced end-user categories, distribution methodologies, price thresholds, material preferences and equipment types. In the end-user domain, classic adult segments of men and women coexist with a growing children’s demographic divided into youth aged eleven to seventeen and younger children aged five to ten, each group demanding tailored sizing, color palettes and safety features to enhance performance and comfort.

Distribution channels exhibit a dualistic structure where offline retail continues to thrive through department stores, specialty sports outlets and national sports chains, while online retail gains traction via direct brand websites and third-party e-commerce platforms that offer personalized experiences and seamless logistics. These channel distinctions dictate product assortment strategies, promotional dynamics and inventory allocations.

Price segmentation spans economy offerings for entry-level consumers, mid-tier products that balance performance and affordability, and premium lines characterized by advanced materials and feature-rich designs. Companies calibrate their portfolios to ensure clear differentiation across these tiers, leveraging material innovation and brand storytelling to justify premium positioning.

Material-based segmentation highlights the prominence of knitted fabrics for flexibility, neoprene for insulation and both natural and PU leather options for durability and aesthetic appeal. Synthetic alternatives such as microfiber and polyester further diversify offerings, delivering lightweight performance at accessible price points. Finally, type-based segmentation underscores the breadth of applications from cycling gloves-available in full-finger and half-finger variants-to specialized goalkeeping, training, weightlifting and winter gloves designed for distinct sporting contexts.

This comprehensive research report categorizes the Sports Gloves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Price Range

- Material

- End User

- Distribution Channel

Highlighting Regional Market Variations and Growth Drivers within the Americas, EMEA and Asia-Pacific to Inform Strategic Priorities and Investment Decisions

Regional dynamics in the sports gloves market illustrate how localized consumer behaviors, regulatory environments and distribution infrastructures drive divergent growth trajectories. In the Americas, a matured retail ecosystem combines established department stores with a burgeoning direct-to-consumer posture among key brands. North American athletes often gravitate toward high-performance offerings featuring breathable materials and ergonomic fit, while Latin American markets show growing appetite for cost-effective, entry-level gloves with vibrant designs and sturdy construction.

The Europe, Middle East & Africa region presents a multifaceted picture in which Western European markets prioritize sustainable and premium leather goods, leveraging stringent environmental regulations to accelerate adoption of recycled textiles. In contrast, emerging markets in Eastern Europe and Africa emphasize affordability and multifunctionality, with distributors increasingly bundling gloves with complementary sporting equipment to drive volume sales.

Asia-Pacific remains a powerhouse of manufacturing capacity and evolving consumption patterns. East Asian consumers exhibit strong brand loyalty and demand cutting-edge innovations such as smart sensor integration and antimicrobial finishes. Southeast Asian markets, meanwhile, are driven by mobile-first e-commerce platforms that cater to budget-conscious segments, prompting international brands to optimize digital storefronts and localized content strategies to capture share.

This comprehensive research report examines key regions that drive the evolution of the Sports Gloves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Their Strategic Initiatives, Innovations and Competitive Moves Shaping the Future of the Sports Gloves Industry

Leading participants in the sports gloves sector are distinguished by their ability to integrate design innovation, supply chain adaptability and brand elevation strategies. Established global brands have invested heavily in patenting novel materials and manufacturing processes that deliver lightweight durability, responsive grip and climate-responsive performance. Simultaneously, they leverage heritage and athlete partnerships to reinforce brand prestige and justify higher price tiers.

At the same time, agile niche players are capitalizing on digital-first distribution and community-driven marketing, harnessing social media influencers and user-generated content to rapidly test new concepts and scale successful designs. These disruptors often focus on sustainability credentials, introducing recycled foam padding and traceable leather sourcing to meet the expectations of eco-conscious athletes.

Strategic alliances are also redefining competitive dynamics. Collaborations between sports equipment manufacturers and technology firms have yielded prototypes of gloves embedded with biometric sensors capable of tracking grip force and sweat composition. Meanwhile, select companies are forging partnerships with regional distributors to co-create products tailored to local climate conditions and cultural preferences, thereby strengthening market penetration and consumer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sports Gloves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- Black Diamond Equipment, Ltd.

- Burton, Inc.

- Columbia Sportswear Company

- Decathlon S.A.

- Handskfabriken Hestra AB

- Nike, Inc.

- Puma SE

- Rawlings Sporting Goods Company, Inc.

- Reusch International GmbH

- Under Armour, Inc.

- VF Corporation

- Wilson Sporting Goods Co.

Delivering Targeted Strategic Recommendations to Enable Industry Leaders to Capitalize on Emerging Trends, Overcome Challenges and Drive Sustainable Growth

To thrive amid intensifying competition and evolving market forces, industry leaders must adopt a series of targeted strategic initiatives. Prioritizing supply chain resilience through a mix of nearshoring and multi-sourcing strategies will mitigate tariff-related risks and ensure consistent material availability. Concurrent investments in workforce training and advanced manufacturing technologies will further enhance production flexibility and quality control.

Sustainability should remain central to product development roadmaps, with dedicated programs to incorporate recycled and biodegradable materials while transparent reporting on environmental impact fosters consumer trust. Innovating through cross-functional collaborations-such as alliances with tech startups to embed smart features-can unlock new value propositions and justify premium pricing models.

In the distribution arena, strengthening direct-to-consumer channels via branded e-commerce platforms and immersive virtual try-on experiences will deepen customer relationships and provide rich data for personalized marketing. Simultaneously, forging strategic partnerships with specialty sports retailers and digital marketplaces will expand reach across demographic and geographic segments. By coupling these efforts with agile pricing strategies that reflect real-time cost inputs and consumer sentiment, companies can sustain profitability and secure long-term market leadership.

Detailing the Comprehensive Research Framework, Data Collection Processes and Analytical Techniques Employed to Deliver Robust Insights and Ensure Rigor

This research employs a rigorous, multi-phase methodology to ensure robust and actionable insights. The process commenced with an extensive secondary research phase, encompassing an exhaustive review of industry publications, trade journals, patent filings and regulatory databases to establish baseline knowledge of historical trends and emerging innovations.

Primary research followed, featuring in-depth interviews with senior executives from manufacturing firms, distributors and athletic associations to capture firsthand perspectives on supply chain dynamics, competitive strategies and consumer preferences. These qualitative inputs were augmented by quantitative data collection through structured surveys targeting end users across key demographic cohorts, enabling correlation of product attributes with purchase intent and usage behavior.

Data triangulation techniques blended these diverse inputs to validate findings and identify convergent patterns, while expert panel reviews provided critical peer validation and ensured methodological rigor. Advanced analytical tools such as clustering algorithms and sentiment analysis were applied to segment consumer responses and uncover latent demand drivers. The resulting framework balances statistical confidence with practical relevance, equipping stakeholders with a clear pathway from insight to strategic execution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sports Gloves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sports Gloves Market, by Type

- Sports Gloves Market, by Price Range

- Sports Gloves Market, by Material

- Sports Gloves Market, by End User

- Sports Gloves Market, by Distribution Channel

- Sports Gloves Market, by Region

- Sports Gloves Market, by Group

- Sports Gloves Market, by Country

- United States Sports Gloves Market

- China Sports Gloves Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing Key Takeaways and Underscoring the Imperatives That Will Shape Competitive Success and Inform Strategic Decisions Across the Sports Gloves Industry

The evolution of the sports gloves market underscores the critical interplay between material innovation, consumer expectations and geopolitical influences. As athletes and enthusiasts seek ever-greater performance and sustainability, manufacturers that excel in agile R&D, transparent sourcing and digital engagement will forge enduring competitive advantages. The tariff-induced supply chain shifts highlight the importance of operational flexibility and underscore the strategic imperative of diversified sourcing.

Segmentation analysis reveals that nuanced end-user requirements, distribution channel preferences, price sensitivities, material affinities and sport-specific functionalities collectively inform successful product portfolios. Regional insights emphasize that localized strategies-whether addressing North America’s appetite for high-performance gear or EMEA’s focus on eco-friendly credentials-are essential for maximizing market penetration.

Looking ahead, industry leaders must balance innovation with pragmatism, leveraging advanced materials, smart technologies and data-driven marketing while maintaining cost discipline in the face of regulatory and economic headwinds. Companies that integrate these imperatives into coherent strategic roadmaps will be well positioned to navigate uncertainties and capitalize on growth opportunities across the global sports gloves landscape.

Encouraging the Reader to Take Immediate Action by Contacting Ketan Rohom to Secure Exclusive Access to In-Depth Market Research Insights for Competitive Advantage

I appreciate your interest in gaining a deeper understanding of the dynamic sports gloves market. To unlock comprehensive insights into industry trends, segmentation analysis, regional performance, company strategies and actionable recommendations, please connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise ensures you receive personalized guidance and immediate access to proprietary research findings that will empower your organization’s strategic decisions. Reach out today to secure your copy of the full market research report and position your business for sustainable competitive advantage

- How big is the Sports Gloves Market?

- What is the Sports Gloves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?