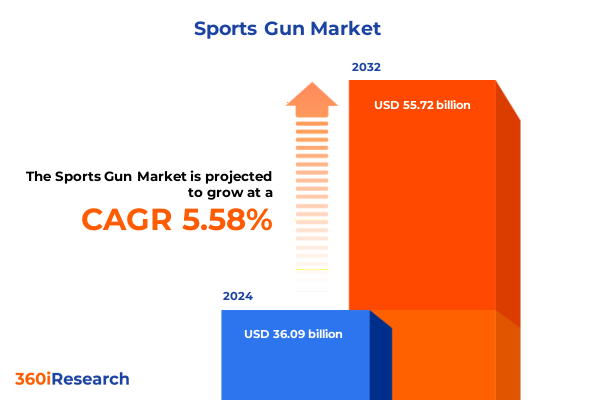

The Sports Gun Market size was estimated at USD 37.89 billion in 2025 and expected to reach USD 39.79 billion in 2026, at a CAGR of 5.66% to reach USD 55.72 billion by 2032.

Launching an In-Depth Overview of Strategic Dynamics and Emerging Opportunities Driving Evolution in the Global Sports Gun Industry

The field of sports guns encompasses a diverse range of firearms tailored for precision, performance, and safety in competitive, recreational, and professional applications. Drawing on comprehensive primary interviews, regulatory analysis, and technology audits, this overview sets the stage for an in-depth exploration of market dynamics that influence product innovation, consumer adoption, and competitive positioning. By framing the discussion around emerging trends, stakeholder priorities, and global influences, this introduction underscores the complexity of a market that must balance evolving demands for customization, reliability, and compliance.

In recent years, shifts in consumer preferences have elevated expectations around modularity, ergonomic design, and digital integration, while regulatory frameworks across key regions introduce both constraints and opportunities for manufacturers and distributors. Supply chain disruption has prompted strategic reassessments of how raw‐material sourcing, production planning, and distribution networks interconnect across international borders. At the same time, technological breakthroughs in materials science, smart‐safety features, and advanced optics are reshaping the feature set that competitive shooters and professional operators value most. In this context, understanding the interplay of these factors is essential for navigating the current environment.

Uncovering Pivotal Technological, Regulatory, and Consumer Preference Shifts Redefining the Competitive Contours of the Sports Gun Market

Innovation continues to redefine the sports gun landscape, driven by the convergence of advanced manufacturing techniques, regulatory recalibrations, and shifting consumer priorities. From additive‐manufacturing processes that enable rapid prototyping and lightweight composites to integrated safety modules offering biometric authentication, the pace of technological enhancement has accelerated performance expectations. Meanwhile, the tightening of import and export controls in certain jurisdictions has prompted manufacturers to localize production, rethink material substitutability, and invest in compliance infrastructures that can streamline cross‐border transactions.

Concurrently, consumer adoption patterns have evolved to prioritize modular platforms that support interchangeability of barrels, stocks, and sighting systems, while also minimizing the learning curve for new end users. In parallel, professional and law-enforcement buyers are demanding solutions that offer both reliability under extreme conditions and simplified maintenance protocols. The introduction of electronic trigger systems, advanced recoil mitigation, and smart feedback capabilities underscores how product differentiation now extends beyond traditional caliber or action type, representing a broader shift toward integrated digital ecosystems.

These intersecting forces highlight that success in the sports gun market no longer hinges solely on mechanical precision or brand legacy; it also depends on agility in responding to regulatory changes, foresight in anticipating consumer desires, and investment in technologies that deliver meaningful performance gains. As these transformative shifts become pervasive, market participants must adapt by fostering cross‐disciplinary innovation and building resilient operational models that can embrace ongoing change.

Assessing the Multifaceted Impacts of Recent United States Tariff Measures on Supply Chains, Costs, and Competitive Dynamics in the Sports Gun Sector

Recent U.S. tariff measures have introduced a new layer of complexity to supply chain management, cost structures, and competitive positioning within the sports gun sector. By imposing duties on key imports such as steel, aluminum, and certain precision‐machined components, these measures have increased landed costs for manufacturers reliant on global sourcing strategies. As a result, organizations have reevaluated supplier portfolios, prioritized alternative materials, and accelerated domestic production initiatives to mitigate cost pressures and maintain lead-time commitments.

Furthermore, the ripple effects of tariff‐induced price adjustments have influenced downstream distribution channels. Retailers have faced margin compression when passing costs to consumers, which in turn has affected consumer demand elasticity for higher-performance, premium-priced offerings. Some manufacturers have responded by redesigning products to reduce exposure to tariff-sensitive inputs or by negotiating longer-term procurement contracts that hedge against further rate escalations. This proactive approach underscores a broader industry need to integrate trade-policy risk into strategic planning cycles and operational forecasting.

In parallel, the broader competitive landscape has adapted as new entrants leverage localized production capabilities to gain cost advantages, while established players strengthen partnerships with domestic suppliers to safeguard continuity. Taken together, these multifaceted impacts demonstrate that tariff policy is more than a fiscal instrument; it represents a critical factor shaping sourcing decisions, innovation roadmaps, and ultimately, the market positioning of sports gun manufacturers and distributors.

Illuminating Critical Insights Across Product, Action, Application, and Distribution Channel Segmentation for Comprehensive Market Understanding

A nuanced segmentation analysis reveals how demand patterns diverge across product offerings, action mechanisms, application areas, and distribution channels. When considering product type, handguns-encompassing both revolvers and semi-automatic pistols-remain central to self-defense and sports shooting communities, driven by compact form factors and expanding accessory ecosystems. Bolt-action, lever-action, and semi-automatic rifles capture the attention of hunting enthusiasts and precision marksmen, with each subcategory responding to unique performance criteria such as range accuracy, rate of fire, and user interface. Shotguns-whether break-action, pump-action, or semi-automatic-continue to serve versatile roles from clay‐target sports to law-enforcement breaching operations, appealing to users seeking reliability in challenging environments.

Shifting focus to action type, bolt-action platforms command respect for their precision under high‐pressure applications, while lever-action systems evoke historical appeal and user simplicity. Pump-action configurations offer robust reliability and ease of maintenance, whereas semi-automatic mechanisms cater to users prioritizing rapid follow-up shots and configurable ergonomics. Each action type carries distinct adoption curves, maintenance requirements, and aftermarket support structures.

In application terms, hunting continues to generate stable demand across regions with rich game traditions, while military and law enforcement procurement cycles drive bulk orders and shape R&D priorities around ruggedization and modularity. Self-defense consumers seek compact, concealable options that integrate modern safety features, and sports shooters demand customizable platforms optimized for competitive precision. Finally, the distribution channel landscape underscores the importance of omnichannel strategies: direct sales foster deeper user engagement and customized offerings, while online channels accelerate order fulfillment and broaden market reach. This comprehensive segmentation framework enables market participants to tailor value propositions and channel strategies with pinpoint accuracy.

This comprehensive research report categorizes the Sports Gun market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Action Type

- Application

- Distribution Channel

Highlighting Distinct Regional Dynamics and Growth Catalysts Shaping the Sports Gun Market across Americas, EMEA, and Asia-Pacific Territories

Regional dynamics in the sports gun market reflect the interplay of cultural norms, regulatory environments, and economic development levels across the Americas, EMEA, and Asia-Pacific. In the Americas, the United States and Canada lead with established sporting traditions, robust distributor networks, and mature aftermarket services. Consumer advocacy groups and state-level regulations continuously shape product design, particularly around safety mechanisms and permitted features. Meanwhile, Latin American markets are characterized by emerging recreational shooting communities, nascent manufacturing capabilities in select countries, and evolving regulatory frameworks that seek to balance civilian access with public-safety priorities.

In EMEA, Europe’s stringent import controls and comprehensive certification requirements have prompted manufacturers to invest in compliance testing and localized assembly operations. This focus on regulatory alignment extends to traceability systems and end-user accountability protocols. The Middle East presents a compelling demand profile driven by affluent consumer segments seeking premium performance firearms, coupled with significant defense and law-enforcement procurement volumes. In Africa, select markets exhibit growing interest in sport shooting disciplines, but inconsistent regulatory enforcement and limited distribution infrastructure have constrained broader adoption.

Asia-Pacific remains highly diverse, with strict civilian ownership regulations in countries such as Japan and Australia juxtaposed against rapidly expanding hunting and sports shooting communities in South Korea and India. Import tariffs and licensing regimes in China have incentivized both local manufacturing ventures and parallel import strategies. Across the region, digital sales platforms are gaining traction, enabling manufacturers to engage niche customer segments directly and to pilot region-specific configurations. These regional insights reveal the critical importance of adaptive market entry strategies that address unique compliance landscapes, consumer preferences, and channel structures.

This comprehensive research report examines key regions that drive the evolution of the Sports Gun market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Initiatives That Define Competitive Leadership in the Sports Gun Market Landscape

Competitive leadership in the sports gun sector is defined by a blend of legacy brand strength, continuous innovation, and strategic partnerships. Established manufacturers have leveraged decades of expertise to build trust among shooting enthusiasts and professional operators, yet they face pressure to modernize product portfolios and distribution models. By integrating advanced materials, modular assembly processes, and digital feature sets, leading companies are reinforcing their reputations for precision and reliability while appealing to tech-savvy younger consumers.

In addition to product innovation, strategic collaborations have emerged as a cornerstone of competitive differentiation. Partnerships between firearm OEMs and optics integrators are creating cohesive solutions that combine ballistic performance with advanced sighting technology. Similarly, alliances with ammunition manufacturers, accessory suppliers, and technology providers are advancing ecosystem playbooks that enhance user experiences from purchase through maintenance cycles. This collaborative approach also extends to distribution; established firms are forging exclusive agreements with online retail platforms and sporting goods chains to secure premium shelf space and to accelerate market penetration.

Parallel to these initiatives, some industry leaders have expanded geographic footprints through joint ventures and licensing agreements, enabling them to navigate local regulatory regimes more effectively and to tailor offerings to regional consumer segments. These multifaceted strategies-spanning R&D, partnerships, and distribution-underscore the evolving nature of competition, where agility, ecosystem orchestration, and a commitment to safety and compliance are as crucial as mechanical performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sports Gun market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Carl Walther GmbH Sportwaffen

- Fabbrica d’Armi Pietro Beretta S.p.A.

- FN Herstal S.A.

- Glock Ges.m.b.H.

- Heckler & Koch GmbH

- SIG Sauer GmbH & Co. KG

- Smith & Wesson Brands, Inc.

- Sturm, Ruger & Company, Inc.

- Taurus Armas S.A.

- Česká zbrojovka Group SE

Delivering Strategic and Operational Recommendations to Empower Industry Leaders in Navigating Challenges and Seizing Opportunities in the Sports Gun Market

To thrive amid intensifying competition and regulatory scrutiny, industry leaders must adopt a multifaceted approach that balances innovation, risk management, and operational resilience. First, investing in modular design platforms will enable faster product iteration, smoother upgrades, and personalized configurations that resonate with diverse user segments. By prioritizing adaptability at the product architecture level, companies can reduce time-to-market and align more closely with evolving customer preferences.

Second, enhancing direct-to-consumer digital channels will create opportunities for richer user engagement and data-driven marketing strategies. Leveraging e-commerce platforms for pre-launch campaigns, virtual product demonstrations, and after-sales support can deepen brand loyalty and generate actionable insights on usage patterns. Third, diversifying the supplier base-particularly for critical materials such as high-grade alloys and composite polymers-will bolster supply chain resilience in the face of tariff volatility and geopolitical disruptions. Adopting dual-sourcing strategies and maintaining strategic inventory buffers can mitigate risk while preserving cost stability.

Moreover, active participation in policymaking discussions and standard-setting bodies will equip organizations to anticipate regulatory shifts and to advocate for balanced frameworks that safeguard both public safety and market vitality. Finally, investing in training and certification programs for end users and distributors ensures that product performance is optimized and compliant, thereby reducing reputational and legal risks. Collectively, these strategic and operational recommendations will empower companies to navigate complex market dynamics while capturing value in a rapidly evolving landscape.

Detailing Rigorous Research Methodology and Analytical Framework Employed to Derive Accurate Insights and Ensure Data Integrity in Market Analysis

This analysis is built on a rigorous, multi-phased research methodology designed to ensure data integrity, comprehensive coverage, and actionable insights. The primary research phase involved structured interviews with senior executives across firearms manufacturers, distributors, and industry associations, complemented by targeted surveys of end-user segments including competitive shooters, hunters, and law-enforcement professionals. This direct engagement surfaced qualitative insights into product preferences, compliance challenges, and purchasing drivers.

In parallel, secondary research encompassed an extensive review of regulatory filings, trade association publications, technical white papers, and proprietary databases covering materials science innovations and patent activity. Supply chain mapping exercises identified critical input points, logistical bottlenecks, and alternative sourcing pathways. Segmentation and competitive analyses were conducted using advanced statistical techniques to delineate product, action, application, and distribution channel dynamics with precision.

Data triangulation served as a cornerstone of the analytical framework, cross-verifying quantitative findings from industry databases with qualitative interview feedback. Key metrics and themes were subjected to expert validation panels to refine interpretations and to challenge potential biases. This structured approach to data collection, validation, and synthesis underpins the report’s authoritative stance and ensures that conclusions are both robust and grounded in verifiable evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sports Gun market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sports Gun Market, by Product Type

- Sports Gun Market, by Action Type

- Sports Gun Market, by Application

- Sports Gun Market, by Distribution Channel

- Sports Gun Market, by Region

- Sports Gun Market, by Group

- Sports Gun Market, by Country

- United States Sports Gun Market

- China Sports Gun Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Forward-Looking Perspectives to Articulate the Evolving Narrative of the Global Sports Gun Market

As the sports gun industry navigates an era defined by technological breakthroughs, complex policy landscapes, and evolving consumer demands, several core themes stand out. The integration of digital safety features and modular design principles is transitioning firearms from purely mechanical instruments to configurable platforms that deliver improved performance and user experiences. Trade policy developments, particularly in the United States, are reshaping cost structures and prompting enhanced supply chain strategies. These changes are driving manufacturers to localize production, diversify supplier relationships, and embed regulatory risk into strategic planning processes.

Segmentation and regional analyses reveal that success hinges on nuanced understanding of end-user priorities, whether for hunting, competitive shooting, self-defense, or professional applications. Regional variations in regulation, distribution infrastructure, and cultural engagement underscore the need for tailored market entry and growth strategies. Meanwhile, competitive leadership is increasingly determined by the ability to orchestrate cross-industry partnerships, leverage data from digital channels, and engage proactively with policymakers.

Looking ahead, sustained agility will be critical. Organizations that can rapidly adapt product roadmaps, optimize supply chains in response to trade shifts, and foster data-driven customer relationships will capture the greatest share of emerging opportunities. By weaving together innovation, compliance, and strategic foresight, industry participants will shape the future trajectory of the global sports gun market.

Engage with Ketan Rohom to Access Comprehensive Market Intelligence and Drive Strategic Decisions in the Sports Gun Industry Today

To gain a deeper understanding of the forces shaping the sports gun market, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through the data and strategic insights contained in the full research report. His expertise in aligning market intelligence with your organizational objectives ensures that you receive tailored recommendations, actionable strategies, and expert commentary to support your decision-making process. Whether you are evaluating new product introductions, planning supply chain adaptations, or refining your go-to-market approach, Ketan Rohom can connect you with the comprehensive analysis and proprietary data that empower confident, forward-looking strategies. Initiating a conversation today will unlock access to exclusive content, including detailed competitive benchmarking, granular segmentation analyses, and vendor partnership frameworks. This collaboration will equip your team with the essential evidence base to navigate regulatory complexities, capitalize on emerging technological advancements, and optimize regional market entry plans. Contact Ketan Rohom to request your copy of the report, arrange a personalized briefing, and discuss how these findings can be operationalized within your organization’s growth roadmap. Elevate your market positioning and ensure that your strategic decisions are backed by the most authoritative and up-to-date sports gun market intelligence available.

- How big is the Sports Gun Market?

- What is the Sports Gun Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?