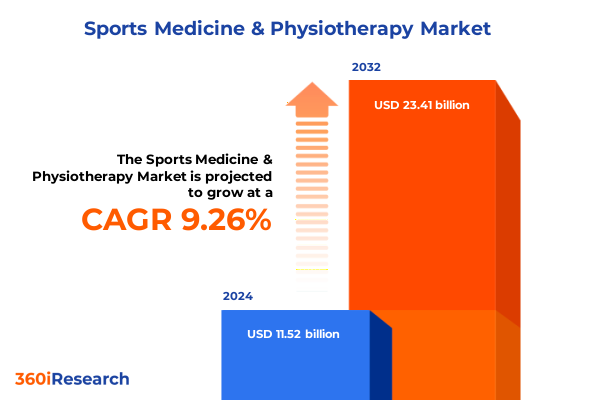

The Sports Medicine & Physiotherapy Market size was estimated at USD 12.58 billion in 2025 and expected to reach USD 13.68 billion in 2026, at a CAGR of 9.27% to reach USD 23.41 billion by 2032.

Pioneering a Holistic Approach to Sports Medicine and Physiotherapy Through Innovative Trends and Patient-Centric Care

The realm of sports medicine and physiotherapy has witnessed a remarkable evolution as stakeholders increasingly prioritize holistic, patient-centric approaches that blend clinical expertise with cutting-edge technologies. This executive summary offers a concise yet thorough overview of the forces driving change across the sector, setting the stage for a deeper exploration of current trends and strategic opportunities. By contextualizing the shifts in technology adoption, regulatory environments, and market dynamics, the introduction aims to frame the broader narrative of how providers, manufacturers, and researchers are collaborating to enhance outcomes for athletes and patients alike.

Drawing on insights from industry thought leaders and emerging case studies, the introduction underscores the critical role of innovation in shaping future care pathways. From preventive rehabilitation protocols to telehealth-enabled monitoring, the sector is moving toward seamless integration of digital and physical therapies. Through this high-level lens, readers are invited to consider how interconnected elements-from supply chain resilience to segmentation strategies-collectively influence market trajectories and competitive positioning. Ultimately, this section lays the foundation for a deeper dive into the transformative trends and actionable recommendations that will follow.

Unveiling the Transformative Shifts Reshaping the Sports Medicine and Physiotherapy Landscape Towards Integrated Solutions and Technologies

Over the past several years, the landscape of sports medicine and physiotherapy has undergone significant transformation, driven by technological breakthroughs and a growing focus on personalized care. Traditional treatment paradigms have expanded to encompass integrated digital platforms, wearable sensors, and data-driven analytics that inform individualized rehabilitation programs. As a result, stakeholders across the value chain are reimagining service delivery models-shifting from reactive, episodic interventions to proactive, continuum-based care that spans prehabilitation, injury management, and long-term wellness.

Moreover, the integration of telehealth platforms with rehab management software has facilitated remote monitoring and virtual consultations, thereby extending provider reach and improving patient adherence. Simultaneously, the emergence of advanced therapies-including targeted laser treatments, cryotherapy devices, and electrotherapy solutions-has enabled clinicians to offer more precise, minimally invasive modalities. These advancements are further complemented by supportive accessories and consumables, such as compression garments and conductive gels, which enhance treatment efficacy. Taken together, these transformative shifts are redefining competitive dynamics and establishing new benchmarks for quality and efficiency across the sector.

Analyzing the Cumulative Impact of United States 2025 Tariffs on Equipment Supply Chains and Cost Structures in Sports Medicine

The implementation of United States tariffs in early 2025 has exerted a multifaceted impact on equipment supply chains and cost structures within the sports medicine and physiotherapy sector. Import duties on key devices and consumables have increased procurement costs, compelling manufacturers and distributors to reassess sourcing strategies. Consequently, many providers have explored alternative supply origins, including nearshoring and regional partnerships, to mitigate expense inflation and ensure consistent availability of critical items such as electrotherapy devices and ultrasound equipment.

In addition, pricing pressures have spurred innovation in local manufacturing and prompted suppliers to optimize product portfolios for cost efficiency. For example, certain accessory and consumable producers have introduced hybrid distribution models that combine bulk procurement with just-in-time delivery, balancing inventory management with financial prudence. At the same time, service providers are adapting reimbursement practices to reflect adjusted margin expectations, negotiating more favorable contracts with payers. As the market recalibrates to tariff-induced cost elevations, stakeholders who proactively embrace supply chain resilience and collaborative procurement will be best positioned to sustain growth and deliver uninterrupted patient care.

Unlocking Deep-Dive Perspectives Across Product, Sports Category, Application, and End User Segments Driving Market Differentiation

A detailed examination of product-based segmentation reveals diverse trajectories across accessories, consumables, devices, and software. Within the accessories category, braces and supports are achieving heightened demand among clinicians who prioritize customizable stabilization solutions, while compression garments are increasingly prescribed for both performance enhancement and edema control. Meanwhile, consumable segments such as conductive gels and electrodes remain indispensable for electrotherapy protocols, complemented by ultrasound gels that facilitate high-fidelity imaging and therapeutic delivery. In parallel, the devices segment, encompassing cryotherapy units, electrotherapy systems, laser therapy tools, and ultrasound devices, continues to benefit from incremental technological refinements that improve portability, energy efficiency, and user interfaces.

Turning to the software domain, rehab management platforms and telehealth systems are unlocking new efficiencies in care coordination and outcome tracking, fostering data interoperability across multidisciplinary teams. Sports category segmentation underscores the differential needs of individual athletes versus team-based programs: solo practitioners often favor portable, versatile equipment for diverse body areas, whereas team sports applications demand scalable solutions that can manage high patient volumes and collective treatment protocols.

Application-focused segmentation further emphasizes distinct therapeutic use cases. Chronic pain management initiatives are bifurcated into back pain and joint pain pathways, each reliant on specialized modalities and multidisciplinary collaborations. Postoperative rehabilitation segments-encompassing orthopedic surgery and soft tissue surgery-leverage targeted protocols combining device-based interventions with manual therapies. Preventive care strategies are gaining traction as stakeholders seek to minimize injury incidence through early assessment tools and exercise regimens. Lastly, end-user segmentation highlights heterogeneous adoption patterns across clinics, home care facilities, hospitals, and sports centers. Within hospital settings, general hospitals and specialty orthopedic clinics exhibit divergent procurement priorities, while home care environments necessitate user-friendly solutions and remote monitoring capabilities. Taken together, these nuanced segmentation insights enable stakeholders to tailor offerings and optimize patient outcomes along the continuum of care.

This comprehensive research report categorizes the Sports Medicine & Physiotherapy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Sports Category

- Application

- End User

Regional Dynamics Shaping Growth Trajectories Across the Americas, Europe Middle East & Africa and Asia Pacific in Physiotherapy Markets

Across the Americas, growth is fueled by robust private and public investments in cutting-edge rehabilitation infrastructure, especially in the United States where favorable reimbursement policies and widespread adoption of digital health solutions are accelerating market uptake. Clinics and hospitals are expanding their service portfolios to include advanced laser therapy and tele-rehab offerings, while sports centers are outfitting high-performance training facilities with state-of-the-art cryotherapy and ultrasound devices. In Latin America, rising sports participation rates and government-led wellness initiatives are catalyzing demand for cost-effective consumables and portable devices that can serve underserved regions.

Meanwhile, the Europe, Middle East & Africa region is characterized by regulatory harmonization under the European Medical Device Regulation, which has elevated product quality standards and spurred innovation among manufacturers. Key markets in Western Europe are witnessing strategic collaborations between device makers and digital health firms to integrate outcome-tracking software with traditional therapies. In the Middle East, growing sports tourism and investments in flagship medical centers are driving demand for premium accessories and regenerative technologies, while African markets are gradually building capacity through partnerships that enhance local manufacturing and distribute essential consumables.

In Asia-Pacific, rapid urbanization and a burgeoning middle class are underpinning investments in physiotherapy services and rehabilitation centers. Countries such as Japan and South Korea lead in adopting robotics-assisted therapeutic devices, while emerging markets in Southeast Asia emphasize telehealth platforms and mobile-based rehabilitation apps. The confluence of escalating sports participation, expanding healthcare infrastructure, and digital literacy is shaping a dynamic landscape where regional players are collaborating with global innovators to deliver tailored solutions.

This comprehensive research report examines key regions that drive the evolution of the Sports Medicine & Physiotherapy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Revolutionizing the Sports Medicine and Physiotherapy Ecosystem

Leading corporations in the sports medicine and physiotherapy domain are pursuing strategic imperatives that blend organic innovation with targeted acquisitions. Key device manufacturers are expanding their portfolios to include digital health components, forging partnerships with telehealth startups and rehab software developers to offer integrated care ecosystems. Some incumbents are entering licensing agreements to incorporate advanced materials and smart textiles into their accessory lines, thereby enhancing product differentiation.

Moreover, companies are leveraging data analytics and machine learning to refine treatment algorithms and support evidence-based care plans. This trend is particularly pronounced among entities that offer both hardware and software, enabling closed-loop feedback systems that monitor patient progress in real time. As competition intensifies, market leaders are also broadening their geographic footprints through distributor agreements and joint ventures, ensuring rapid market access in high-growth regions. Through these concerted efforts, industry frontrunners are setting the bar for innovation, while simultaneously shaping standards for interoperability, patient engagement, and clinical validation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sports Medicine & Physiotherapy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arthrex, Inc.

- Athletico Physical Therapy, LLC

- ATI Holdings, LLC

- Breg, Inc.

- CONMED Corporation

- CORA Health Services, Inc.

- Encompass Health Corporation

- Enovis Corporation

- Hanger, Inc.

- Johnson & Johnson Services, Inc.

- Medtronic plc

- Mueller Sports Medicine, Inc.

- Performance Health Holdings, Inc.

- RTI Surgical Holdings, Inc.

- Select Medical Corporation

- Smith & Nephew plc

- Stryker Corporation

- U.S. Physical Therapy, Inc.

- Zimmer Biomet Holdings, Inc.

- Össur hf.

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Trends and Strengthen Competitive Advantage in Sports Medicine

To thrive amid evolving market dynamics, industry leaders should prioritize the integration of digital health solutions within existing service offerings. By embedding telehealth platforms and rehab management software into multichannel care pathways, providers can elevate patient engagement, streamline workflows, and unlock new revenue streams. At the same time, diversifying supply chains through regional manufacturing partnerships and just-in-time distribution models will mitigate the impact of tariff fluctuations and logistical disruptions.

Furthermore, decision-makers are advised to foster cross-sector collaborations that drive co-development of advanced materials and therapy protocols. Aligning with academic institutions and clinical research centers can expedite validation cycles and accelerate regulatory approval processes. Additionally, investing in robust data analytics infrastructure will enable continuous performance measurement, supporting adaptive treatment regimens and population health initiatives.

From a market perspective, expanding preventative care offerings-such as wearable sensor–based risk assessments and early-intervention rehab programs-will position organizations to capture value at multiple stages of the therapeutic continuum. Finally, leaders should champion workforce upskilling, ensuring that clinicians, technicians, and support staff are proficient in emerging modalities and digital platforms, thereby maximizing return on technology investments.

Comprehensive Research Framework Integrating Primary Insights and Secondary Analysis to Unearth Actionable Market Intelligence

This research employs a mixed-methods approach, combining primary qualitative interviews with industry stakeholders-including clinicians, procurement specialists, device manufacturers, and software developers-and rigorous secondary analysis of regulatory filings, clinical publications, and association reports. The primary research phase involved in-depth discussions to uncover firsthand perspectives on unmet needs, adoption barriers, and competitive differentiators. These insights were augmented by secondary data triangulation, drawing on publicly available literature and expert analyses to validate emerging trends and contextualize regional variations.

Furthermore, a structured framework was applied to segment the market across product categories, sports disciplines, therapeutic applications, and end-user channels. Each segment was assessed for growth drivers, technological maturity, and stakeholder priorities. The methodology also incorporated a political, economic, social, and technological (PEST) review to evaluate external influences such as tariff policies and regulatory shifts. By synthesizing quantitative and qualitative evidence, this research delivers a holistic view of the sports medicine and physiotherapy landscape, equipping decision-makers with actionable market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sports Medicine & Physiotherapy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sports Medicine & Physiotherapy Market, by Product

- Sports Medicine & Physiotherapy Market, by Sports Category

- Sports Medicine & Physiotherapy Market, by Application

- Sports Medicine & Physiotherapy Market, by End User

- Sports Medicine & Physiotherapy Market, by Region

- Sports Medicine & Physiotherapy Market, by Group

- Sports Medicine & Physiotherapy Market, by Country

- United States Sports Medicine & Physiotherapy Market

- China Sports Medicine & Physiotherapy Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Concluding Reflections on the Evolving Landscape of Sports Medicine and Physiotherapy and Future Strategic Pathways

In conclusion, the sports medicine and physiotherapy sector stands at a pivotal juncture where technological innovation, regulatory evolution, and shifting consumer expectations are collectively shaping future growth pathways. The interplay between product diversification and digital integration underscores the necessity for stakeholders to embrace adaptable strategies that align with patient-centric care models. Although tariff-induced cost pressures have introduced complexity into supply chains, they have also stimulated greater resilience and efficiency across procurement and manufacturing.

As regional dynamics continue to diversify market opportunities, segmentation insights highlight the importance of targeted approaches that resonate with distinct end-user needs. Concurrently, leading companies are demonstrating the value of integrated hardware and software offerings, while collaborative research paradigms are accelerating validation cycles. Ultimately, organizations that strategically adopt these insights-coupled with robust data analytics and workforce development-will secure sustainable competitive advantage and deliver superior therapeutic outcomes. These learnings serve as a blueprint for navigating an increasingly interconnected ecosystem and unlocking new avenues of value creation.

Connect with Ketan Rohom to Explore the Full Market Research and Empower Your Strategic Decisions in Sports Medicine

Engaging with Ketan Rohom opens the door to an in-depth exploration of market intelligence tailored to your strategic objectives in sports medicine and physiotherapy. As Associate Director of Sales & Marketing, Ketan offers personalized guidance on how this comprehensive report can address your organization’s unique challenges-from navigating evolving tariffs and regulatory shifts to capitalizing on segmentation and regional opportunities. Through a collaborative discussion, you will gain clarity on which aspects of the research align most closely with your growth initiatives, whether expanding product portfolios, enhancing patient engagement platforms, or optimizing supply chains.

Moreover, Ketan will walk you through the deliverables included in the full market research report, demonstrating how each section provides actionable insights to inform investment decisions and innovative product development. By securing access to the report, you obtain a strategic roadmap supported by qualitative expertise and quantitative analysis, facilitating confident decision-making. To initiate the process, simply reach out to Ketan with a brief overview of your interests, and he will coordinate a tailored briefing session to showcase how this research can empower your team. Don’t miss this opportunity to partner with a thought leader dedicated to your success in the dynamic sports medicine and physiotherapy landscape.

- How big is the Sports Medicine & Physiotherapy Market?

- What is the Sports Medicine & Physiotherapy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?