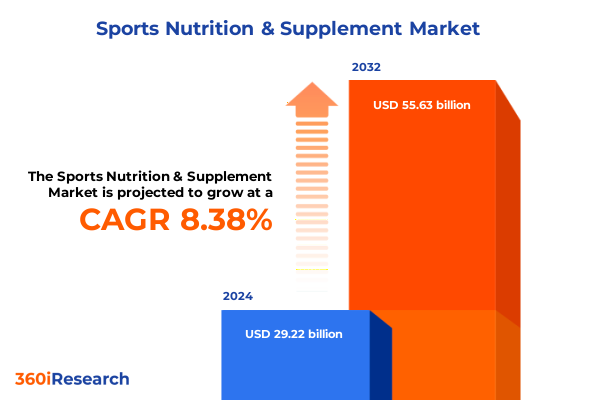

The Sports Nutrition & Supplement Market size was estimated at USD 31.53 billion in 2025 and expected to reach USD 34.03 billion in 2026, at a CAGR of 8.44% to reach USD 55.63 billion by 2032.

Unveiling the High-Stakes World of Sports Nutrition and Supplements Amid Evolving Consumer Health Aspirations and Performance Demands

The sports nutrition and supplement landscape has emerged as a critical component of modern health and performance strategies, reflecting deep shifts in how individuals approach exercise and wellness. As consumer lifestyles increasingly emphasize holistic well-being and active living, the market for specialized nutritional products has expanded beyond traditional athlete segments to embrace a broad spectrum of enthusiasts and everyday users. This introduction sets the stage for a detailed exploration of the dynamic factors driving demand, innovation, and competitive activity within this vibrant industry.

Within this context, an intricate interplay of scientific advancements, digital transformation, and shifting regulatory frameworks has propelled market evolution. From breakthroughs in ingredient research that optimize recovery and performance to the ascent of digital platforms that personalize nutrition guidance, brands have seized the opportunity to differentiate through targeted formulations and immersive consumer experiences. Importantly, the industry’s focus has evolved from mere muscle building to encompass comprehensive support for endurance, cognitive acuity, immune resilience, and weight management.

Moreover, environmental and ethical considerations have reshaped product development priorities, driving a surge in plant-based and clean-label solutions. As a result, the market has transcended a narrow performance-oriented paradigm to become a broad ecosystem where innovation addresses diverse health goals and ethical imperatives. This introduction provides the foundation for an in-depth examination of transformative shifts, tariff impacts, segmentation nuances, regional dynamics, leading corporate strategies, and actionable recommendations that follow in the subsequent sections.

Navigating Digital Disruption and Ethical Innovation as Pillars of Modern Sports Nutrition Evolution

Over the past few years, the sports nutrition and supplement sector has witnessed seismic transformations driven by evolving consumer behaviors and technological innovation. Personalized nutrition protocols, once the purview of elite athletes, now shape mainstream product development as brands harness data analytics and wearable device integration to tailor ingredient profiles. By leveraging insights from digital tracking tools, manufacturers can deliver custom dosage regimens that align with individual workout intensity, recovery cycles, and metabolic responses.

Simultaneously, the proliferation of direct-to-consumer platforms has disrupted traditional distribution paradigms. Brands increasingly cultivate proprietary e-commerce channels to engage consumers with subscription models, virtual coaching services, and community-driven content. This shift empowers companies to gather real-time feedback, iterate formulations rapidly, and foster brand loyalty through immersive digital experiences. As a result, the conventional retail shelf no longer serves as the sole battleground for consumer attention.

Another transformative shift emerges from heightened scrutiny of ingredient transparency and sustainability. Consumers demand full disclosure of source origins, manufacturing practices, and ecological footprints, prompting suppliers to adopt blockchain-enabled traceability systems and partner with certified ethical farms. Clean-label certification and third-party testing now function as essential credibility markers in product marketing, compelling companies to elevate quality assurance protocols.

Taken together, these transformative dynamics underscore an industry in pursuit of hyper-personalization, direct engagement, and ethical innovation. The cumulative impact of these shifts has set the stage for substantive strategic recalibrations and underscores the urgency of understanding and capitalizing on evolving market imperatives.

Assessing How 2025 United States Trade Tariffs Are Reconfiguring Supply Chains and Fueling Ingredient Innovation

The advent of new United States tariff measures in 2025 has reshaped the economics of raw material procurement, prompting supply chain recalibrations across the sports nutrition sector. Ingredients historically sourced from international suppliers-ranging from specialized amino acid blends to plant-derived protein isolates-now command higher landed costs, compelling manufacturers to reevaluate supplier portfolios. In response, many companies have accelerated domestic partnership initiatives, forging relationships with local extractors and bioprocessors to mitigate tariff-induced cost pressures and logistical complexities.

Alongside sourcing realignments, the tariffs have sparked a wave of ingredient innovation. To adapt, research teams have intensified efforts to identify alternative functional compounds that maintain efficacy while benefiting from favorable tariff classifications. This shift has, in some cases, catalyzed novel collaborations between ingredient startups and established brand formulators, enabling the rapid commercialization of proprietary derivatives engineered to avoid higher-duty brackets.

Furthermore, the imposition of duties has influenced pricing strategies and promotional planning. Brands now factor in variable cost structures linked to tariff fluctuations, fine-tuning pack sizes and promotional cycles to preserve margin thresholds without compromising accessibility. These adjustments have fostered greater agility in product lifecycle management, as companies pivot quickly between premium and value offerings based on evolving trade policy signals.

Overall, the cumulative impact of the 2025 tariff landscape extends beyond cost considerations, driving a wave of supply chain diversification, ingredient innovation, and strategic pricing flexibility. Understanding these ripple effects remains critical for stakeholders seeking to sustain competitive differentiation while navigating an increasingly complex international trade environment.

Unpacking the Complex Segmentation Matrix That Underlies Consumer Choices Across Functionality, Format, Channel and Ingredient Streams

The sports nutrition market exhibits a rich tapestry of product typologies that cater to distinct performance objectives and wellness goals. On one end, performance enhancers harness ergogenic compounds such as Beta Alanine, branched chain amino acids, caffeine, and creatine to support power output and endurance, while protein supplements draw on diverse sources-including casein, pea, soy, and whey-to optimize muscle synthesis and recovery. Vitamins and minerals encompass comprehensive multivitamins as well as targeted single vitamins and individual minerals, delivering essential micronutrient support across training regimens. Meanwhile, the weight management sphere engages through appetite suppressants, thermogenic fat burners, and nutrient-dense meal replacement formulations designed to facilitate healthy body composition transitions.

Form innovations further diversify consumer access and consumption convenience. Traditional powders coexist alongside ready-to-drink beverages, compact bars and chews, and precisely dosed capsules and tablets, each format calibrated to distinct usage occasions and lifestyle preferences. Such versatility enables end users to integrate nutritional interventions seamlessly into pre-workout rituals, on-the-go routines, and post-exercise recovery windows.

Channels for distribution span broad-reach hypermarkets and supermarkets, digital storefronts that include manufacturer direct sites and third-party online marketplaces, pharmacies, drug stores, and niche specialty retailers. This multifaceted channel landscape empowers brands to tailor both messaging and packaging to the unique shopper behaviors characteristic of each environment. Athletes and fitness aficionados remain core adopters, leveraging advanced formulations to drive performance benchmarks, while the wider general population increasingly adopts targeted supplements to support holistic health and active lifestyles.

Ingredient sourcing philosophies have also grown more nuanced, with animal-based proteins coexisting alongside plant-based isolates and synthetic analogues. Price tier positioning ranges from value-oriented mass offerings to premium formulations featuring proprietary blends, clinical validation, and high-end packaging aesthetics. The intersection of these segmentation dimensions underpins a market defined by unprecedented choice and underscores the imperative for brands to align portfolio strategies with precise consumer archetypes and channel dynamics.

This comprehensive research report categorizes the Sports Nutrition & Supplement market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Ingredient Source

- Price Tier

- Distribution Channel

- End User

Analyzing How Distinct Regional Dynamics Shape Regulatory Frameworks, Consumer Preferences and Channel Maturity

Regional dynamics significantly influence product innovation trajectories, regulatory frameworks, and consumer preferences within the global sports nutrition ecosystem. Throughout the Americas, the established penetration of advanced performance supplements in the United States coexists with accelerating adoption curves in Latin American markets, where rising fitness culture and improved distribution infrastructure enable brands to extend reach. North America’s mature e-commerce platforms and health-driven retail formats serve as launch pads for novel formulations, while South America’s expanding urban centers present high-growth opportunities informed by local flavor preferences and regional supply logistics.

In Europe, Middle East & Africa, stringent regulatory oversight and robust clinical substantiation requirements shape product claims and formula transparency. Western European consumers prioritize scientifically validated ingredients and eco-friendly sourcing, while Middle Eastern markets exhibit burgeoning demand for halal-certified supplements and nutritional blends tailored to lifestyle fasting periods. Across sub-Saharan Africa, the interplay of informal distribution networks and evolving consumer awareness creates a uniquely dynamic terrain for brands willing to invest in education campaigns and localized formulations.

Asia-Pacific emerges as a focal growth frontier, where foundational shifts in urbanization, disposable income, and sports participation are driving heightened interest in specialized nutrition. East Asian markets display strong affinity for functional ingredients backed by traditional medicine heritage, and Southeast Asian nations are witnessing a surge in digitally native brands that bridge social commerce and community engagement. South Asia’s young demographic cohort increasingly equates supplement usage with aspirational wellness, providing fertile ground for both global incumbents and homegrown enterprises.

Collectively, these regional contours underscore the necessity of nuanced go-to-market strategies that account for regulatory heterogeneity, cultural preferences, and channel maturity, thereby enabling brands to harness localized insights and achieve scalable success.

This comprehensive research report examines key regions that drive the evolution of the Sports Nutrition & Supplement market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Top Sports Nutrition Players Integrate Scientific Rigor, Digital Engagement, and Supply Chain Transparency

Leading companies in the sports nutrition and supplement arena consistently distinguish themselves through integrated strategies that blend scientific rigor, consumer engagement, and supply chain excellence. Industry front-runners have invested heavily in R&D partnerships with academic institutions and specialized research firms to unlock novel bioactives, while forging alliances with technology platforms to deliver personalized nutrition solutions at scale. These collaborations have yielded proprietary ingredient blends that carry robust clinical validation, enhancing brand credibility and competitive moat.

Simultaneously, innovative marketing frameworks have emerged, encompassing immersive digital experiences that fuse interactive content, gamified fitness challenges, and loyalty ecosystems. Companies that excel in this domain leverage multi-channel storytelling-across social media, mobile applications, and experiential events-to deepen brand affinity and drive trial. Strategic sponsorships of high-visibility athletic events and partnerships with elite sports teams further amplify brand reach and reinforce performance associations.

On the supply chain front, best-in-class organizations have instituted end-to-end traceability protocols, from farm to factory to final shelf. By integrating blockchain tracking and rigorous third-party audits, they guarantee ingredient provenance and uphold stringent quality standards. This transparency not only mitigates regulatory risk but also resonates with discerning consumers who prioritize ethical sourcing.

Overall, the most successful entities exhibit agility in portfolio management, swiftly retiring underperforming SKUs and scaling promising innovations. Their strategic playbooks underscore the importance of cross-functional integration-uniting R&D, marketing, operations, and compliance-to navigate competitive pressures and deliver sustained growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sports Nutrition & Supplement market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Amway Corp.

- By‑Health Co., Ltd.

- CytoSport, Inc.

- Enervit S.p.A.

- Glanbia PLC

- GNC Holdings LLC

- Herbalife Nutrition Ltd.

- Iovate Health Sciences International Inc.

- MaxiNutrition Australia Ltd.

- MusclePharm Corp.

- MusclePharm Corporation

- MyProtein‑‑The Hut Group

- Nestlé S.A.

- NOW Foods, Inc.

- Reckitt Benckiser Group PLC

- Redcon1 LLC

- RSP Nutrition LLC

- The Hut Group Ltd.

- The Nature's Bounty Co.

- USANA Health Sciences, Inc.

Implementing an Agile, Data-Driven Innovation and Supply Chain Framework to Seize Emerging Market Opportunities

To capitalize on emerging opportunities, industry leaders should prioritize an agile innovation architecture that seamlessly connects consumer intelligence with product development pipelines. By embedding advanced analytics and machine learning into consumer preference platforms, companies can anticipate demand shifts and refine formulations before competitors. This proactive posture will enable rapid iteration of clean-label and functional products aligned with evolving wellness trends.

Diversifying the supply chain remains essential in an environment marked by trade policy uncertainties and fluctuating raw material availability. Organizations should formalize strategic alliances with both domestic and international ingredient partners, thereby balancing cost optimization with agility. Incorporating alternative ingredient validation pathways will ensure continuity of supply while maintaining transparency and compliance with evolving regulations.

Strengthening direct-to-consumer and omnichannel capabilities is equally critical. Brands must invest in proprietary e-commerce infrastructure, augmented by data-driven personalization engines and robust subscription offerings. At the same time, curated partnerships with specialist retailers and digital health platforms can extend reach and reinforce brand authority among key end-user segments.

Finally, fostering a culture of continuous learning and cross-functional collaboration will underpin sustained competitiveness. By instituting cross-disciplinary innovation councils that bring together R&D, marketing, and regulatory teams, companies can accelerate time-to-market and ensure that product narratives resonate with consumer priorities. This holistic approach will deliver a strategic foundation for growth in a market defined by rapid transformation.

Leveraging a Rigorous Mixed-Method Research Framework to Ensure Depth, Credibility and Actionable Insights

This analysis is underpinned by a rigorous mixed-method research framework designed to deliver both breadth and depth of insight. Primary data were gathered through in-depth interviews with senior executives across leading sports nutrition brands, ingredient suppliers, channel operators, and regulatory authorities. These stakeholders provided first-hand perspectives on innovation pipelines, trade policy impacts, and consumer engagement strategies. Complementing these dialogues, a structured survey of sports nutrition consumers captured usage patterns, purchase drivers, and format preferences across diverse demographic cohorts.

Secondary research included a systematic review of peer-reviewed scientific journals, industry white papers, regulatory filings, and trusted trade publications. This foundational work ensured that the analysis was grounded in the latest empirical evidence and reflected emerging best practices in formulation science, supply chain management, and digital integration.

Data triangulation techniques were employed to cross-validate findings from primary and secondary sources, enhancing the reliability of insights. Quantitative outputs were analyzed using advanced statistical models to uncover underlying trends, while qualitative data underwent thematic coding to identify strategic imperatives. Competitive benchmarking exercises mapped leading companies’ innovation, marketing, and operational profiles, illuminating differentiators and areas of convergence.

The combination of stakeholder engagement, comprehensive literature synthesis, robust statistical modeling, and qualitative analysis has produced a holistic view of the sports nutrition and supplement landscape. This methodological rigor supports actionable recommendations and ensures the credibility of the conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sports Nutrition & Supplement market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sports Nutrition & Supplement Market, by Product Type

- Sports Nutrition & Supplement Market, by Form

- Sports Nutrition & Supplement Market, by Ingredient Source

- Sports Nutrition & Supplement Market, by Price Tier

- Sports Nutrition & Supplement Market, by Distribution Channel

- Sports Nutrition & Supplement Market, by End User

- Sports Nutrition & Supplement Market, by Region

- Sports Nutrition & Supplement Market, by Group

- Sports Nutrition & Supplement Market, by Country

- United States Sports Nutrition & Supplement Market

- China Sports Nutrition & Supplement Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Key Insights to Chart a Future-Focused Strategic Roadmap for Lasting Competitive Advantage

In an industry characterized by rapid innovation, shifting trade landscapes, and evolving consumer expectations, the sports nutrition and supplement market stands at an inflection point. The convergence of personalized digital engagement, ethical sourcing imperatives, and agile supply chain strategies has created a dynamic environment where differentiation hinges on scientific validation and seamless consumer experiences. Companies that embrace data-driven product development, diversify ingredient sourcing, and lead digital commerce initiatives will be positioned to seize growth opportunities.

Regional variances underscore the importance of tailored approaches, whether addressing regulatory complexity in Europe, capitalizing on e-commerce sophistication in North America, or tapping nascent demand in Asia-Pacific. Equally, segmentation insights reveal that success demands an integrated portfolio spanning performance enhancers, foundational nutrition, and lifestyle-oriented supplements, delivered through formats and channels that align with distinct user needs.

The cumulative impact of the 2025 tariffs has reinforced the imperative for supply chain resilience and ingredient innovation, while the ongoing digital revolution continues to redefine consumer engagement models. As the market matures, differentiation will derive from the capacity to anticipate and respond to these dynamics with agility and scientific credibility.

Ultimately, the insights and recommendations presented in this report offer a strategic roadmap for industry leaders intent on sustaining competitive advantage. By aligning innovation with consumer priorities and operational excellence, organizations can chart a course toward robust, future-proof growth.

Connect Directly with Ketan Rohom to Leverage Exclusive Sports Nutrition and Supplement Research Insights Tailored to Your Strategic Needs

To secure a competitive edge in this rapidly evolving sports nutrition and supplement market, we invite you to engage with Associate Director, Sales & Marketing, Ketan Rohom. His expertise will guide you through the unmatched depth and actionable insights contained in our comprehensive report. Reach out to Ketan today to discover how our research can inform your strategic decisions, fuel targeted innovation initiatives, and navigate the complexities of tariffs, channel dynamics, regional variations, and consumer segmentation. By partnering with him to acquire the full analysis, you will gain privileged access to bespoke recommendations, detailed methodologies, and forward-looking perspectives that will empower your organization to thrive in a landscape defined by constant transformation and opportunity.

- How big is the Sports Nutrition & Supplement Market?

- What is the Sports Nutrition & Supplement Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?