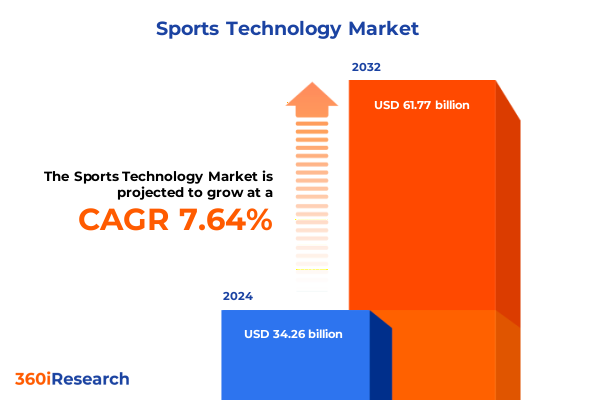

The Sports Technology Market size was estimated at USD 36.58 billion in 2025 and expected to reach USD 39.06 billion in 2026, at a CAGR of 7.77% to reach USD 61.77 billion by 2032.

Unveiling the Driving Forces of Innovation in Sports Technology and Their Influence on Athletic Performance, Fan Engagement, and Industry Dynamics

Over the past decade, the sports industry has witnessed an unprecedented integration of advanced technologies that have fundamentally redefined training methodologies, competition metrics, and fan engagement strategies. Innovations such as wearable biometric sensors, real-time video analytics, and virtual reality training modules have enabled athletes to optimize performance with granularity that was unimaginable a few years ago. Moreover, the confluence of cloud computing and AI-driven analytics platforms has accelerated data-driven decision making across coaching staffs and management teams, creating a feedback loop of continuous improvement.

Simultaneously, the spectator experience has evolved from passive observation to interactive participation, with smart stadium solutions offering personalized navigation, augmented reality overlays, and seamless connectivity that bridges the gap between digital and physical environments. Fans now expect immersive and data-rich interactions whether they attend live events or follow remotely. In essence, the sports technology landscape is characterized by an ecosystem of interdependent innovations that collectively amplify competitive edge, enhance commercial value, and foster deeper engagement.

Building upon this context, this report delves into the transformative forces shaping the market, examines tariff-driven headwinds in the United States, and presents segmentation and regional insights that illuminate strategic pathways for stakeholders. By synthesizing trends across performance monitoring systems, analytics solutions, and emerging distribution channels, the analysis offers a cohesive narrative that informs decision-making for sports organizations, technology providers, and investors alike. Ultimately, the introduction sets the stage for a comprehensive exploration of how these technologies are converging to unlock new dimensions of athletic excellence and fan loyalty.

Identifying Pivotal Disruptions and Emerging Trends Reshaping the Sports Technology Landscape from Training Analytics to Immersive Fan Experiences

Recent years have seen a marked acceleration in the adoption of artificial intelligence and machine learning algorithms that can process vast volumes of performance data in real time, enabling predictive insights that preempt injuries and optimize training regimens. Complementing these capabilities, the proliferation of internet of things devices and sensor networks has generated an unprecedented volume of biomechanical and physiological data points, which are further harnessed by cloud computing infrastructures to deliver scalable analytics solutions. Consequently, sports organizations have transitioned from traditional intuition-based approaches to evidence-driven strategies that enhance athlete safety and longevity.

Concurrently, the industry has embraced immersive technologies such as virtual and augmented reality to reimagine both athlete preparation and fan experiences. VR-driven simulation environments offer teams the ability to conduct risk-free tactical rehearsals, while AR navigation tools within smart stadiums guide spectators through personalized journeys that blend physical and digital interactions. This convergence of digital and physical realms has also catalyzed the democratization of high-quality coaching resources, as mobile fitness apps and virtual coaching platforms bring elite training methodologies to individual athletes and grassroots programs alike.

In addition, the rise of eSports as a mainstream competitive platform has introduced a new dimension of audience engagement and sponsorship opportunities, compelling traditional sports franchises and technology vendors to explore cross-industry collaborations. The integration of advanced video analysis systems, capable of 2D and 3D motion capture as well as live-stream analytics, has created new monetization models centered around real-time content personalization and interactive viewing experiences. Together, these transformative shifts underscore an evolving ecosystem in which technological innovation continues to redefine the boundaries of performance, entertainment, and commercial growth in sports.

Assessing the Multidimensional Consequences of 2025 United States Tariffs on Sports Technology Supply Chains, Pricing Structures, and Competitive Advantage

The implementation of a new tranche of tariffs targeting high-value electronic components and assembled devices in 2025 has created several immediate supply chain disruptions for sports technology manufacturers in the United States. Suppliers of biometric sensors, motion trackers, and video processing units have faced increased input costs, prompting them to reevaluate sourcing strategies and to consider regional production hubs outside of traditional Asia-Pacific manufacturing centers. In response, many original equipment manufacturers have begun to explore nearshoring options within Mexico and other North American markets to mitigate the added duty burdens and maintain delivery timelines.

As price pressures have materialized, downstream stakeholders including teams, fitness centers, and end consumers have encountered adjusted pricing structures that reflect the cumulative effect of import duties and logistical realignments. Some providers have absorbed marginal tariff impacts to preserve market competitiveness, while others have passed through cost increases to protect their margin profiles, leading to variable pricing dynamics across different product types and distribution channels. In parallel, the tariff environment has accelerated ongoing discussions around domestic semiconductor fabrication and advanced materials sourcing, positioning government incentives and private-sector investment as critical levers for long-term supply chain resilience.

Deriving Strategic Insights Through Comprehensive Segmentation of Product Types, End User Applications, Technologies, and Distribution Channels in Sports Tech

When evaluating sports technology through the lens of product typologies, performance monitoring systems have emerged as core investments, with GPS trackers and motion sensors enabling granular tracking of athlete biomechanics and location data. Smart stadium solutions meanwhile enhance operational efficiency through augmented reality navigation tools, connectivity systems that improve crowd management, and smart seating that dynamically adapts to comfort and engagement preferences. Within analytics, performance modeling and predictive algorithms are rapidly integrating with video analytics platforms to deliver actionable insights, while virtual reality systems focus on immersive training modules and hybrid event platforms that bridge digital and physical engagement. Wearable devices-ranging from biometric sensors to smart clothing and connected smartwatches-continue to proliferate, catering to both high-performance athletes and everyday fitness enthusiasts.

Across end user segments, fitness centers and gyms remain significant adopters, with boutique studios leveraging specialized equipment to differentiate services and commercial chains integrating comprehensive sensor-based monitoring for member retention. Healthcare providers are deploying diagnostic-grade wearable systems in clinics and hospitals to support remote patient monitoring and sports medicine applications. Individual athletes increasingly rely on personalized analytics platforms to tailor training programs, while schools and universities invest in athlete development through interactive VR and video analysis solutions. Teams and organizations-from amateur clubs to professional basketball and football franchises-utilize integrated technology stacks to optimize recruitment, performance scouting, and fan engagement initiatives.

In application contexts, adventure and outdoor enterprises employ ruggedized sensors and mobile connectivity for real-time safety and performance tracking, whereas the booming eSports ecosystem integrates advanced motion tracking and cloud-based analytics to refine player strategies. Personal fitness applications, including gym training, home-based interactive classes, and virtual coaching delivered via mobile fitness apps, have experienced rapid consumer uptake during periods of remote engagement. Professional sports domains, spanning individual athletics disciplines such as swimming and tennis to team sports like basketball, cricket, and football, increasingly rely on combined video analysis and predictive modeling for tactical planning. Additionally, sports medicine and rehabilitation providers adopt injury prevention algorithms and post-injury recovery protocols powered by sensor networks and AI-driven data visualization tools.

From a technology standpoint, artificial intelligence and machine learning frameworks-encompassing deep learning architectures, neural networks, and predictive analytics algorithms-serve as the computational backbone for performance and health insights. Big data analytics solutions, featuring advanced data visualization and real-time analytics modules, transform raw telemetry into executive-level dashboards. Cloud computing environments-whether hybrid, public, or private-provide scalable infrastructure for compute-intensive simulations and collaborative platforms. Computer vision systems leverage gesture recognition and motion tracking to automate technique analysis, and the internet of things connects disparate sensor networks through wearable integration platforms that deliver end-to-end data capture and processing.

In terms of distribution mechanisms, direct sales models predicated on B2B contracts and corporate partnerships facilitate bespoke technology deployments for major league teams and franchised gym operators. Online retail channels, including company-operated websites and e-commerce marketplaces, expand reach to both commercial purchasers and individual consumers. Specialty stores such as electronics outlets and sporting goods retailers offer curated technology assortments, while third-party distributors-including resellers and wholesalers-play a pivotal role in global distribution frameworks, particularly within regions where direct manufacturer presence is limited.

This comprehensive research report categorizes the Sports Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

- Application

- Distribution Channel

Illuminating Regional Variances and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia Pacific Sports Technology Markets

Within the Americas, the United States and Canada serve as principal innovation hubs, driven by strong private-sector investment in AI-driven analytics and government-backed initiatives for domestic manufacturing of sensors and semiconductor components. Latin American markets, while nascent, demonstrate growing adoption of mobile fitness applications and smart stadium pilot programs, particularly in Brazil and Mexico, where infrastructure modernization projects enable digital fan engagement.

Europe, Middle East and Africa present a diverse landscape shaped by varying regulatory environments and investment appetites. Western European countries lead in deploying cloud-based analytics platforms and computer vision systems, integrating sustainability-driven smart stadium designs. The Middle East has rapidly embraced immersive fan experiences through large-scale VR-enabled arenas, while North African nations are exploring post-injury rehabilitation technologies in partnership with academic medical centers.

Asia Pacific continues to be a dominant growth frontier, propelled by large-scale consumer electronics manufacturers in East Asia and supportive policies in Southeast Asia. Japan and South Korea excel in wearable device innovation, leveraging domestic supply chains for sensor fabrication. Meanwhile, India and Australia show robust uptake of performance monitoring solutions in professional leagues and fitness chains. Across the region, distribution networks are evolving to accommodate direct-to-consumer online retail channels alongside traditional specialty store presence.

This comprehensive research report examines key regions that drive the evolution of the Sports Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies, Innovation Pipelines, and Collaborative Partnerships Among Key Market Players in the Evolving Sports Technology Ecosystem

Leading providers of performance monitoring systems have continued to expand their R&D pipelines, with companies such as Catapult and STATSports unveiling next-generation GPS trackers integrated with advanced heart rate variability metrics. These firms have also pursued strategic alliances with professional sports franchises to co-develop custom data platforms that leverage AI-driven injury prediction algorithms. Simultaneously, video analysis specialists like Hawk-Eye have enhanced their offerings by integrating 3D motion capture capabilities and live-stream analytics to enable real-time decision support during matches.

Smart stadium innovators and immersive technology vendors have prioritized the development of scalable AR navigation solutions and fan engagement platforms. Partnerships between major cloud service providers and stadium operators have facilitated the deployment of private 5G networks to support ubiquitous connectivity and dynamic content delivery. Virtual reality companies continue to refine immersive training solutions, collaborating closely with elite training academies to validate efficacy and expand use cases beyond professional environments.

Within the wearable segment, established consumer electronics brands and niche sensor startups are converging through M&A activity and cross-licensing agreements. Emerging market entrants are disrupting traditional channels by offering lightweight smart clothing embedded with biometric sensors at competitive price points. Across distribution channels, leading technology firms are diversifying go-to-market strategies, blending direct B2B contracts with omnichannel retail approaches to reach diverse end users ranging from amateur athletes to major league teams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sports Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alphabet Inc.

- Apple Inc.

- Catapult Group International Limited

- Cisco Systems, Inc.

- Fitbit, Inc.

- Garmin Ltd.

- Genius Sports Limited

- Huawei Technologies Co., Ltd.

- Hudl Holdings, Inc.

- International Business Machines Corporation

- Oracle Corporation

- Polar Electro Oy

- Samsung Electronics Co., Ltd.

- SAP SE

- Sportradar AG

- STATS Perform Group Limited

- Telefonaktiebolaget LM Ericsson

- Whoop, Inc.

- Zebra Technologies Corporation

Outlining Pragmatic Strategic Imperatives for Industry Leaders to Capitalize on Technological Advancements and Strengthen Market Position in Sports Tech

In order to harness the full potential of data-driven performance insights, organizations should prioritize the development of integrated data ecosystems that unify telemetry from wearable devices, video analytics platforms, and IoT sensor networks. Establishing robust API standards and investing in scalable cloud architectures will enable seamless data flow and facilitate advanced predictive modeling. This integrated approach will support more accurate decision-making and unlock new revenue streams through value-added analytics services.

To mitigate the impact of evolving trade policies and tariff environments, industry leaders must adopt diversified supply chain strategies that include regional manufacturing partnerships and nearshoring initiatives. Engaging with domestic fabrication facilities for key electronic components not only reduces exposure to import duties, but also accelerates product iteration cycles and enhances transparency around quality control. Proactive collaboration with government agencies on incentive programs can further strengthen supply chain resilience.

User adoption and retention will increasingly hinge on intuitive, interoperable solutions that seamlessly integrate with existing training and event management systems. Companies should invest in user experience research and co-creation workshops to ensure that hardware ergonomics and software interfaces address end user needs across athlete, coaching staff, and spectator personas. Leveraging modular system architectures will facilitate incremental upgrades and cross-platform compatibility.

Finally, fostering open innovation through strategic partnerships with academic institutions, technology incubators, and sports organizations will drive the next wave of product differentiation. Co-development initiatives and pilot deployments can accelerate time to market for emerging use cases, while collaborative research efforts in areas such as biomechanics and AI ethics will safeguard data integrity and promote responsible technology adoption across the sports ecosystem.

Detailing the Robust Primary and Secondary Research Frameworks Employed to Ensure Credibility, Reliability, and Depth of Analysis in Sports Technology Insights

This report synthesizes insights from a structured primary and secondary research framework designed to ensure depth, accuracy, and contextual relevance. The secondary research phase encompassed an extensive review of industry publications, patent filings, regulatory filings, and academic journals to map key technological advancements and competitive activities. Publicly available financial reports and corporate announcements were also analyzed to contextualize market dynamics and stakeholder strategies.

For primary research, expert interviews were conducted with over 30 industry veterans, including technology vendors, sports franchise executives, athletic trainers, and equipment manufacturers. These qualitative discussions provided forward-looking perspectives on innovation roadmaps, adoption barriers, and evolving business models. In parallel, quantitative surveys were distributed to a broad spectrum of end users, from professional athletes to fitness center operators, to validate market priorities and technology preferences across different segments.

To enhance the credibility of findings, data triangulation methods were employed by cross-referencing insights from primary interviews and surveys with secondary data points. Consensus among multiple sources was prioritized to mitigate individual biases. Finally, all information was subjected to rigorous quality assurance protocols, including peer reviews by domain experts, to confirm factual validity and analytical consistency before finalizing the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sports Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sports Technology Market, by Product Type

- Sports Technology Market, by Technology

- Sports Technology Market, by End User

- Sports Technology Market, by Application

- Sports Technology Market, by Distribution Channel

- Sports Technology Market, by Region

- Sports Technology Market, by Group

- Sports Technology Market, by Country

- United States Sports Technology Market

- China Sports Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 5406 ]

Synthesizing Core Findings and Stakeholder Implications to Provide a Cohesive Overview of Opportunities and Challenges in Sports Technology Adoption

As the sports industry continues its evolution into a data-centric ecosystem, the convergence of cutting-edge technologies is redefining how athletes train, franchises strategize, and fans engage. Key transformative trends-ranging from AI-driven predictive analytics and immersive reality environments to resilient supply chain realignments-are driving stakeholders to adapt their operational and commercial models. Understanding the nuanced impacts of 2025 tariff policies underscores the importance of supply chain agility and regional manufacturing collaborations.

Detailed segmentation analysis reveals that performance monitoring systems, analytics platforms, and immersive training solutions each command unique value propositions across varied end user and application contexts. Regional insights from the Americas to Asia Pacific highlight differentiated adoption curves and infrastructure readiness, suggesting that tailored go-to-market strategies will be crucial for capturing growth opportunities. Furthermore, the landscape of key players illustrates a dynamic interplay of innovation pipelines, strategic alliances, and distribution advancements.

Looking ahead, industry decision-makers who embrace integrated data ecosystems, prioritize user experience, and foster open innovation networks will be positioned to navigate the complexities of technological disruption and emerging regulatory landscapes. The actionable recommendations outlined herein offer a pragmatic roadmap for stakeholders to not only respond to current market dynamics, but to shape the next frontier of sports technology innovation and performance excellence.

Inviting Collaboration with Associate Director of Sales and Marketing to Secure a Comprehensive Report on Emerging Trends and Competitive Landscape in Sports Tech

To gain comprehensive, data-driven insights into the evolving sports technology landscape, connect with Associate Director of Sales and Marketing, Ketan Rohom. Access in-depth analyses covering transformative market shifts, tariff impacts, segmentation intelligence, regional nuances, and competitive strategies. This report will equip your organization with the strategic knowledge needed to accelerate innovation, optimize supply chains, and enhance stakeholder engagement across the sports ecosystem. Reach out today to secure your copy and unlock actionable intelligence that will drive your competitive advantage forward.

- How big is the Sports Technology Market?

- What is the Sports Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?