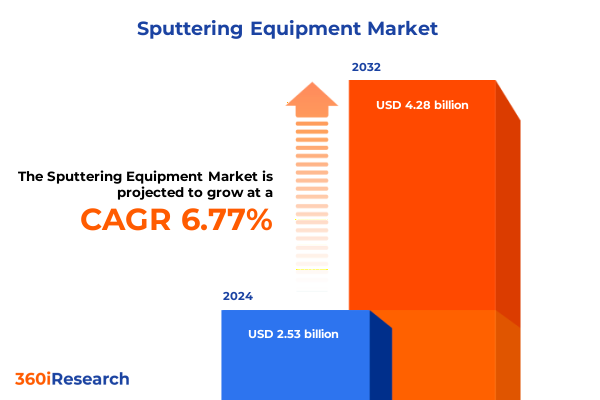

The Sputtering Equipment Market size was estimated at USD 2.69 billion in 2025 and expected to reach USD 2.87 billion in 2026, at a CAGR of 6.84% to reach USD 4.28 billion by 2032.

Sputtering Equipment Landscape Unveiled: Strategic Importance, Technological Foundations, and Industry Catalysts Shaping Thin Film Manufacturing

Sputtering equipment represents a cornerstone of modern thin film manufacturing, serving as the primary platform for depositing intricate, uniform coatings across a wide variety of substrates. This physical vapor deposition method dislodges atoms from a source target using energetic plasma, facilitating the formation of defect-free thin films that are essential for semiconductor device layers, optical coatings, and protective surfaces. As industries demand ever-tighter control over layer thickness and composition, sputtering processes-including magnetron, direct current, and ion beam approaches-have evolved to offer unparalleled precision and repeatability.

Beyond basic deposition, the sputtering landscape has expanded to include advanced high power impulse magnetron sputtering systems, pulsed DC configurations, and radio frequency solutions, each tailored to specific material chemistries and substrate sensitivities. These diverse equipment types are instrumental in enabling next-generation applications, from wear-resistant coatings in aerospace components to transparent conductive films in flexible displays. Consequently, sputtering equipment remains a critical enabler of technological innovation across semiconductor fabrication, consumer electronics manufacturing, and high-performance surface engineering.

Transformative Dynamics in Sputtering Technology: Digitalization, Advanced Plasma Methods, and Eco-Conscious Innovations Reshaping Deposition Processes

The sputtering equipment sector is experiencing a period of rapid transformation, driven by the infusion of digitalization and smart manufacturing paradigms. Industry leaders are embedding advanced sensors and real-time monitoring systems into vacuum chambers, enabling precise control over plasma characteristics, film growth rates, and deposition uniformity. This integration not only optimizes process stability but also unlocks predictive maintenance capabilities, reducing unplanned downtime and maximizing throughput.

Simultaneously, next-generation plasma techniques such as high power impulse magnetron sputtering are redefining performance benchmarks by achieving ultra-dense films with superior adhesion and tailored crystallinity. Hybrid processes combining reactive sputtering with in situ metrology-spanning optical emission spectroscopy to ellipsometry-are empowering manufacturers to fine-tune compositions at the atomic scale, facilitating the development of complex oxides, nanolaminate structures, and high-entropy coatings for advanced semiconductor and flexible electronics applications.

Environmental considerations have also accelerated innovation, with a pronounced shift toward sustainable practices. Companies are pioneering enhanced target utilization techniques that minimize waste, optimizing plasma source energy efficiency, and exploring eco-friendly materials such as aluminum-doped zinc oxide. As global regulatory frameworks tighten around energy consumption and emissions, sustainability is emerging as both a competitive differentiator and a strategic imperative for sputtering equipment vendors.

United States Tariff Escalations and Their Cumulative Effects on Sputtering Equipment Supply Chains, Cost Structures, and Strategic Sourcing Decisions

Rising trade tensions and tariff escalations have introduced new complexities to the procurement and deployment of sputtering equipment in the United States. In 2025, tariffs on Chinese-origin semiconductors and critical manufacturing components doubled from 25% to 50%, significantly increasing the landed cost of advanced sputtering tools and supplies imported from key Asian markets. As a result, equipment vendors are recalibrating their global supply chains, exploring tariff-exempt regional sourcing alternatives, and reassessing pricing strategies to mitigate margin pressures.

These measures have catalyzed a broader shift toward onshoring and nearshoring of sputtering equipment production. Domestic manufacturers and partner ecosystems are benefiting from government incentives designed to reduce dependence on foreign technology and bolster national security in foundational semiconductor manufacturing. At the same time, heightened import costs have prompted some end-users to extend equipment utilization lifecycles through retrofits and preventive maintenance, delaying capital investments in new toolsets amid uncertain trade conditions.

Looking ahead, the potential for further tariff adjustments-such as region-specific levies on electronic goods containing sputtered layers or proposed duties targeting EU-sourced equipment-underscores the importance of strategic agility. Organizations that proactively diversify supplier portfolios, leverage alternative sourcing regions, and engage in stakeholder advocacy are best positioned to navigate the evolving tariff landscape and maintain uninterrupted access to critical sputtering technologies.

Nuanced Market Segmentation Perspectives Highlighting the Diverse Product Technologies, Material Classes, Applications, and Industry Verticals Driving Sputtering Equipment Demand

In examining the market through multiple segmentation lenses, it becomes apparent that each category influences demand dynamics and technology adoption in distinct ways. The spectrum of product types encompasses direct current sputtering equipment renowned for high deposition rates, high power impulse magnetron sputtering units that deliver ultra-dense films, ion beam sputtering systems offering high directional control, magnetron sputtering tools favored for uniform coatings, pulsed DC sputtering equipment engineered for dielectric materials, and radio frequency sputtering machines optimized for insulating layers. These varied configurations enable manufacturers to select the ideal process for their unique material and performance requirements.

Similarly, materials used in sputtering span metal, dielectric, and compound classes, each presenting different demands in terms of target chemistry, plasma control, and process parameters. Metal sputtering targets facilitate the deposition of conductive layers, dielectric sputtering enables high-quality insulating coatings, and compound sputtering expands possibilities for complex oxides and multi-element films. This material diversity underpins applications ranging from functional coatings in consumer electronics to protective films in industrial machinery.

Application segmentation highlights the importance of functional coatings across composites, with markets such as coatings for wear resistance and corrosion protection; magnetic storage where precise thin films support data density; semiconductor device fabrication requiring atomic-scale uniformity; and general thin film deposition serving optical and decorative purposes. Across end-user industries, aerospace and defense demand coatings for extreme environments, automotive seeks durable surface treatments for lightweight materials, consumer electronics requires transparent conductive films for displays, and medical and healthcare applications rely on biocompatible sputtered layers for diagnostic and therapeutic devices.

This comprehensive research report categorizes the Sputtering Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Application

- End-user Industry

Regional Market Nuances Examining the Americas, EMEA, and Asia-Pacific Dynamics Influencing Adoption, Production, and Investment Trends in Sputtering Equipment

The Americas region has emerged as a strategic hub for sputtering equipment adoption, buoyed by significant governmental support through initiatives such as the U.S. CHIPS and Science Act. This has fueled expansion of domestic fabrication facilities and encouraged investments in localized tooling capabilities. In particular, the United States has seen growth in capacity for advanced magnetron systems and reactive sputtering platforms to meet the burgeoning demand for semiconductor devices and specialty coatings in aerospace and defense sectors.

Across Europe, the Middle East, and Africa, innovation ecosystems in countries like Germany, France, and the United Kingdom are driving interest in high-precision sputtering techniques for automotive sensor coatings, renewable energy applications, and advanced optics. These markets benefit from strong collaborations between research institutions and equipment suppliers, focusing on sustainable manufacturing processes and the integration of hybrid PVD/ALD clusters to minimize contamination and maximize throughput.

Asia-Pacific remains the largest market for sputtering equipment, with China, Japan, and South Korea leading in both consumption and production of advanced PVD systems. Elevated semiconductor production capacity in Taiwan and mainland China, combined with robust solar photovoltaic manufacturing in Japan, underpins substantial investments in high power impulse magnetron sputtering and large-area sputter coater installations. As regional supply chains mature, Asia-Pacific continues to set the pace for technology adoption and process innovation in the global sputtering landscape.

This comprehensive research report examines key regions that drive the evolution of the Sputtering Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Profile Summarizing Key Industry Players, Technological Differentiators, and Strategic Positioning in the Global Sputtering Equipment Market

The competitive landscape for sputtering equipment is defined by a combination of global leaders and specialized innovators. Applied Materials commands a leading position with its comprehensive PVD portfolio and a reported near-30% market share driven by its Endura® PVD systems and aggressive R&D investments to support advanced node wafer processing. Meanwhile, ULVAC and KLA Corporation together represent roughly a quarter of the global market, leveraging strengths in high power impulse magnetron sputtering technology and integrated inspection solutions that address both process and yield challenges.

Chinese manufacturers such as NAURA Technology have captured approximately 15% of the Asia-Pacific market by focusing on cost-effective equipment offerings for mature node fabrication, although they continue to enhance their technological capabilities to compete on innovation. On the European front, Evatec Ltd has differentiated itself through modular cluster tool architectures and strategic partnerships, such as its collaboration with STMicroelectronics to develop specialized PVD solutions for power semiconductor devices.

Additional players including Von Ardenne, Leybold Optics, and Kurt J. Lesker Company contribute to the market through specialized vacuum DC sputtering systems, advanced energy-efficient plasma sources, and material science innovations that optimize target utilization. These firms command significant R&D pipelines and are integrating industry 4.0 capabilities to maintain competitiveness in a market defined by rapid technological advancement and evolving customer requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sputtering Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AJA International, Inc.

- Alliance Concept

- Angstrom Engineering Inc.

- Applied Materials Inc.

- AVACO Co., Ltd.

- Blue Wave Semiconductors, Inc.

- Buhler AG

- Canon Inc.

- Denton Vacuum

- Intevac Inc.

- Kenosistec Srl

- Kolzer Srl

- Kurt J Lesker Co.

- Milman Thin Film Systems Pvt. Ltd.

- Nano Vacuum Pty Ltd

- NBM Design, Inc.

- OC Oerlikon Corp. AG

- Omicron Scientific Equipment Co.

- Prevac Sp. z o.o.

- PVD Products, Inc.

- Sputtering Components

- ULVAC, Inc.

- Vapor Technologies, Inc. by Masco BU

- Veeco Instruments Inc.

- VST Service Ltd.

Actionable Strategic Imperatives for Industry Leaders to Capitalize on Technological Advances, Mitigate Trade Risks, and Accelerate Sustainable Growth Trajectories

Industry leaders seeking to capitalize on emerging opportunities in sputtering equipment should prioritize the integration of artificial intelligence and machine learning into process controls. By deploying advanced analytics and feedback-driven algorithms, organizations can achieve tighter control over plasma parameters, reduce defect rates, and optimize operational efficiency.

Concurrently, diversifying supply chains to include both tariff-exempt regions and domestic manufacturing partners will mitigate exposure to evolving trade policies. Strategic partnerships with localized equipment producers can unlock incentive programs and strengthen business continuity in the face of tariff escalations that impact landed costs and component availability.

Furthermore, accelerating investments in sustainable target materials and energy-efficient sputtering sources will address both regulatory pressures and customer demands for environmentally responsible production. By innovating in recyclable targets, reducing gas consumption, and incorporating renewable energy solutions for vacuum systems, companies can enhance their value proposition while lowering operational expenditures. Finally, cultivating collaborative R&D initiatives with end-users and academic institutions will facilitate rapid prototyping of specialized film stacks, ensuring that next-generation sputtering processes align with evolving application requirements.

Comprehensive and Rigorous Research Methodology Outlining Primary Data Collection, Analytical Frameworks, and Validation Processes Underpinning Market Insights

The research underpinning this market analysis was conducted through a rigorous, multi-stream methodology combining both primary and secondary data sources. In the primary phase, in-depth interviews were carried out with senior executives, process engineers, and procurement leaders at leading sputtering equipment manufacturers and end-user organizations. These discussions provided qualitative insights into technology adoption drivers, competitive positioning, and strategic priorities.

Complementing these interviews, comprehensive secondary research involved examining company financial reports, white papers, trade association publications, and technical journals. High-resolution equipment catalogs and patent filings were analyzed to assess the pace of innovation in advanced plasma techniques and digital integration. Trade data, import-export records, and tariff schedules were reviewed to quantify the impact of geopolitical and regulatory developments.

Data triangulation was employed to cross-verify findings, utilizing both top-down market sizing approaches and bottom-up analysis based on unit shipments, average selling prices, and installed base metrics. The final insights were validated through a review panel comprising industry experts and independent consultants, ensuring robustness and impartiality in the conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sputtering Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sputtering Equipment Market, by Product Type

- Sputtering Equipment Market, by Material

- Sputtering Equipment Market, by Application

- Sputtering Equipment Market, by End-user Industry

- Sputtering Equipment Market, by Region

- Sputtering Equipment Market, by Group

- Sputtering Equipment Market, by Country

- United States Sputtering Equipment Market

- China Sputtering Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Conclusion Emphasizing the Critical Role of Sputtering Equipment Innovations, Strategic Investments, and Collaborative Ecosystems in Future Market Leadership

As the sputtering equipment market evolves at an accelerated pace, the convergence of digitalization, advanced plasma technologies, and sustainability initiatives is redefining the competitive landscape. Precision deposition techniques such as high power impulse magnetron sputtering and hybrid reactive processes are unlocking new material possibilities, while integrated AI-driven controls are enhancing yield and process consistency.

Meanwhile, trade policy dynamics and tariff escalations are reshaping supply chains, prompting a shift toward regional manufacturing ecosystems and supply chain diversification. This environment underscores the importance of strategic agility, collaborative innovation, and targeted investments in state-of-the-art equipment and materials.

Moving forward, organizations that harness the synergy of technological leadership, sustainable practices, and adaptive sourcing strategies will secure a competitive edge in the journey toward next-generation thin film solutions. By aligning R&D priorities with market needs and navigating evolving regulatory frameworks, industry participants can drive sustained growth and reinforce their leadership in the global sputtering equipment arena.

Embark on Enhanced Market Intelligence Engagement: Connect with Ketan Rohom to Secure Your Comprehensive Sputtering Equipment Market Research Report Today

Don’t miss the opportunity to deepen your understanding of market dynamics and position your organization for success in the sputtering equipment industry. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, for personalized guidance on how this comprehensive report can address your specific strategic objectives. By securing this research, you will gain exclusive insights, data-driven analyses, and expert recommendations tailored to the evolving sputtering equipment landscape. Contact Ketan Rohom today to take the next step toward transformative market intelligence and accelerated growth in this critical technology sector.

- How big is the Sputtering Equipment Market?

- What is the Sputtering Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?