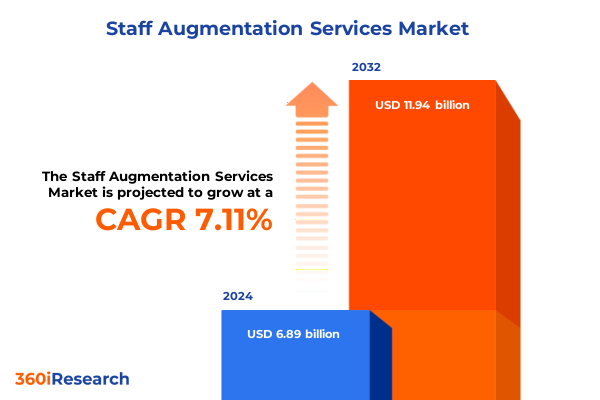

The Staff Augmentation Services Market size was estimated at USD 7.35 billion in 2025 and expected to reach USD 7.85 billion in 2026, at a CAGR of 7.17% to reach USD 11.94 billion by 2032.

Unveiling the Dynamics of Today’s Staff Augmentation Landscape to Equip Decision Makers with Comprehensive Clarity on Market Opportunities and Challenges

Organizations today operate within a fluid talent ecosystem defined by rapid technological change, evolving regulatory frameworks, and shifting client demands. As businesses increasingly embrace flexible staffing solutions to address skill gaps, capacity constraints, and project-based requirements, understanding the contours of this market becomes essential. An executive summary distills complex trends into clear, actionable insights, enabling leaders to navigate the present landscape with confidence and anticipate future developments.

This summary serves as an entry point to the staff augmentation domain, clarifying its fundamental drivers, emerging opportunities, and potential risks. By examining transformative shifts, tariff impacts, segmentation dynamics, regional variations, and key company strategies, readers will gain a holistic perspective. Complemented by evidence-based research and expert validation, these insights provide the strategic foundation necessary for optimizing talent-led initiatives, aligning workforce planning with organizational goals, and sustaining competitive advantage in an increasingly dynamic environment.

Exploring How Technological Advancements and Evolving Workforce Expectations Are Reshaping the Staff Augmentation Model Across Industries

The staff augmentation model has undergone a profound metamorphosis as digital innovation, workforce expectations, and operational paradigms converge. Accelerated adoption of automation and artificial intelligence has not only streamlined routine tasks but also expanded the scope of specialized roles, compelling organizations to rethink talent supply strategies. In parallel, the normalization of remote and hybrid work has dissolved geographic boundaries, enabling access to distributed skill pools and reshaping engagement frameworks.

Concurrently, demographic shifts and generational preferences have elevated demands for career development, inclusive cultures, and flexible arrangements. Consequently, providers have adapted by integrating upskilling programs, digital collaboration platforms, and performance analytics into their offerings. Furthermore, heightened emphasis on compliance and data security has prompted rigorous governance protocols, driving investment in secure infrastructure. These collective forces are redefining how businesses leverage external talent, underscoring the importance of agility, transparency, and strategic partnership.

Analyzing the Cumulative Effects of Recent United States Tariff Policies on Staff Augmentation Strategies and Cost Structures Throughout 2025

In 2025, newly implemented tariff measures ushered in a wave of cost pressures across multiple service categories, prompting both clients and staffing firms to recalibrate engagement models. Elevated import duties on equipment, cross-border IT services, and specialized components have increased operational overheads, translating into higher billing rates for end clients. In response, many organizations have explored nearshore alternatives or hybrid arrangements to mitigate financial impacts while preserving access to critical skills.

Moreover, tariff-induced fluctuations have intensified the need for real-time cost monitoring and scenario planning. Staffing partners are embedding dynamic pricing mechanisms into contracts, enabling clients to adjust scope or duration in line with evolving cost structures. This adaptive approach helps maintain budgetary discipline without sacrificing service quality. As a result, the cumulative effect of tariff policies in 2025 is shaping a more resilient, flexible staffing ecosystem that can withstand regulatory shifts and fiscal volatility.

Unpacking Critical Segmentation Insights That Illuminate Diverse Service Types, Industry Verticals, Engagement Models, Organization Scales and Contract Durations

A nuanced examination of service-type segmentation reveals significant variation in demand and delivery models. Administrative staffing encompasses roles from data entry operators to office assistants and receptionists, each requiring distinct training protocols and performance metrics. Engineering staffing spans chemical, civil, electrical, and mechanical disciplines, demanding compliance with specialized standards and layered credentialing. Meanwhile, finance and accounting professionals-ranging from accountants to bookkeepers and financial analysts-play pivotal roles in ensuring fiscal accuracy and strategic reporting. In the healthcare domain, allied health staff, medical technicians, nursing personnel, and physicians are engaged through rigorous credential verification and compliance tracking. Within IT staffing, functions such as cybersecurity, data analytics, infrastructure management, and network administration coexist alongside software development streams that include back-end, front-end, full-stack, and mobile expertise.

Industry vertical segmentation further nuances market approaches, as banking and insurance within the BFSI sector adhere to stringent regulatory oversight, while government and public sector engagements necessitate deep familiarity with procurement cycles and security clearances. Healthcare and life sciences partnerships extend across hospitals and pharmaceutical enterprises, each demanding precise credentialing and audit readiness. IT and telecom collaborations span IT services and telecom operators, requiring robust service-level agreements. Manufacturing engagements prioritize onsite technical support and compliance with safety protocols. In retail and ecommerce, staffing extends to both brick-and-mortar operations and online retail platforms, where peak-season scalability and omnichannel integration become critical factors.

This comprehensive research report categorizes the Staff Augmentation Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Staffing Type

- Employment Model

- Contract Duration

- Service Provider

- Industry Vertical

- Enterprise Size

Deciphering Regional Nuances in Staff Augmentation Across Americas, Europe Middle East and Africa, and Asia Pacific to Inform Targeted Market Approaches

Geographic distribution of staffing demand underscores distinct regional characteristics. In the Americas, talent availability often aligns with urban centers but is increasingly complemented by remote engagement from secondary and tertiary markets, offering cost efficiencies and expanded candidate pools. Economic policies and labor regulations in North and South America shape the contractual structures and benefits models that providers must navigate, driving innovation in compliance services and workforce analytics.

In Europe, Middle East and Africa, regulatory complexity and diverse labor laws create both challenges and opportunities for staffing partners. GDPR and local data privacy frameworks necessitate rigorous process controls, while cultural and linguistic diversity require localized talent management strategies. Economic recovery initiatives and public sector digitization projects offer fertile ground for specialized augmentations. The Asia-Pacific region, characterized by rapid digital transformation and competitive labor rates, presents a vast reservoir of tech talent. However, shifting geopolitical dynamics and evolving labor policies demand agile engagement models that can rapidly adjust between onshore oversight, nearshore collaboration, and offshore execution.

This comprehensive research report examines key regions that drive the evolution of the Staff Augmentation Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Staffing Providers to Highlight Strategic Capabilities Innovation Pillars and Competitive Differentiators Driving Success in Staff Augmentation

Market leadership in staff augmentation is defined by a blend of scale, specialization, and technological integration. Global providers leverage extensive delivery networks, proprietary platforms, and predictive analytics to optimize talent sourcing and deployment. Specialized firms carve out niche segments, whether in cybersecurity, life sciences, or civil engineering, by offering domain-specific expertise and compliance capabilities. Regional champions combine deep local market knowledge with an ability to mobilize talent across borders, often excelling in hybrid and nearshore models.

Emerging disruptors are gaining traction through novel approaches, such as talent marketplaces that match candidates to project requirements via algorithmic assessments and gamified evaluations. These innovative platforms emphasize speed of placement and cultural fit, while established firms counter with value-added services including upskilling programs, workforce analytics dashboards, and seamless vendor management systems. Understanding these diverse competitive archetypes enables clients to align with partners whose capabilities best match their strategic priorities and operational requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Staff Augmentation Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akkodis

- Allegis Group

- Andela, Inc.

- Ansi ByteCode LLP

- APEX Systems, LLC

- BairesDev LLC

- Cheesecake Labs Inc.

- Coderland LLC

- Collabera Inc.

- Density Labs LLC

- Digis sp. z o.o.

- Forte Group LLC

- GoodWorkLabs

- Hays plc

- Innowise Group

- Insight Global, LLC

- InveritaSoft LLC

- IPIX Tech Services Pvt. Ltd.

- Kelly Services, Inc.

- Kforce Inc.

- Korn Ferry Inc.

- Locuz by SHI group

- ManpowerGroup Inc.

- Miquido sp. z o.o.

- N-iX LLC

- On Assignment, Inc.

- Proxify, Inc.

- Randstad Holding N.V.

- RapidValue Solutions Pvt. Ltd.

- Robert Half International Inc.

- Robert Half Technology Inc.

- ScienceSoft USA Corporation

- SevenPro

- Smartbridge LLC

- SoftSages Technology

- Sophilabs LLC

- Spiral Scout, Inc.

- SThree plc

- Synergo Group Ltd.

- Tata Consultancy Services

- Technoforte Software Private Limited

- TEKsystems, Inc.

- The Adecco Group

- Toptal, LLC

- TrueBlue, Inc.

- ValueCoders Pvt. Ltd.

- Vention, Inc.

- VentureDive Pvt. Ltd.

Delivering Actionable Recommendations to Empower Industry Leaders with Practical Strategies for Optimizing Staff Augmentation and Navigating Market Disruptions

To thrive in a landscape defined by rapid change and regulatory uncertainty, industry leaders should prioritize strategic investments in technology and talent development. Implementation of advanced talent intelligence platforms will enable real-time visibility into resource availability, utilization rates, and skill gaps, fostering proactive workforce planning. Additionally, fostering partnerships with educational institutions and certification bodies creates pipelines for in-demand skill sets, strengthening employer value propositions and reducing time-to-deployment.

Furthermore, diversification of engagement models can buffer against external shocks such as tariff fluctuations and geopolitical shifts. By balancing onshore, nearshore, and offshore capabilities, organizations can optimize cost structures while maintaining service continuity. Tailoring contract durations and flexibility options to project life cycles enhances alignment with business imperatives. Finally, deepening regional footprints through localized compliance and language support will ensure seamless integration with client ecosystems and unlock new growth corridors.

Detailing the Rigorous Research Methodology That Underpins Insights Including Data Collection Techniques Triangulation Approaches and Expert Engagement Processes

This research is grounded in a multi-faceted methodology that integrates comprehensive secondary research, primary expert interviews, and rigorous data validation. Initially, publicly available reports, industry publications, regulatory documents, and corporate filings were analyzed to map the macroeconomic and regulatory landscape influencing staff augmentation. Concurrently, a series of in-depth interviews with executives, talent acquisition specialists, and compliance officers provided nuanced perspectives on emerging trends and operational best practices.

Data triangulation ensured consistency across sources, with quantitative insights cross-checked against qualitative observations. Segmentation frameworks were applied to categorize market dynamics by service type, industry vertical, engagement model, organization size, and contract duration. Finally, findings underwent iterative review by an advisory panel of market practitioners to ensure accuracy, relevance, and strategic applicability. This layered approach underpins the credibility and actionability of the report’s insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Staff Augmentation Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Staff Augmentation Services Market, by Staffing Type

- Staff Augmentation Services Market, by Employment Model

- Staff Augmentation Services Market, by Contract Duration

- Staff Augmentation Services Market, by Service Provider

- Staff Augmentation Services Market, by Industry Vertical

- Staff Augmentation Services Market, by Enterprise Size

- Staff Augmentation Services Market, by Region

- Staff Augmentation Services Market, by Group

- Staff Augmentation Services Market, by Country

- United States Staff Augmentation Services Market

- China Staff Augmentation Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing Key Takeaways on the Evolution Challenges and Strategic Imperatives Shaping the Staff Augmentation Market in Today’s Dynamic Business Environment

The staff augmentation market stands at the intersection of technological innovation, regulatory evolution, and workforce transformation. As organizations navigate a landscape marked by digital disruption and shifting cost structures, the ability to swiftly mobilize talent has become a strategic imperative. This report’s insights reveal how tariff policies, segmentation nuances, regional dynamics, and competitive strategies coalesce to shape market opportunities and risks.

Leaders who embrace agile engagement models, invest in talent intelligence, and cultivate strategic partnerships will be best positioned to harness the full potential of staff augmentation. By grounding workforce decisions in detailed segmentation analysis and regional understanding, organizations can mitigate external headwinds and drive sustained performance. Ultimately, the insights presented here offer a roadmap for navigating complexity and achieving a resilient, future-ready talent ecosystem.

Encouraging Decision Makers to Connect with Ketan Rohom to Access the Complete Staff Augmentation Report Offering In-Depth Insights and Strategic Guidance

Decision makers seeking a deeper understanding of staff augmentation dynamics are invited to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Drawing on extensive industry experience and hands-on knowledge of market intricacies, Ketan serves as the ideal partner to guide procurement of the complete report.

By reaching out, professionals gain personalized insights into report highlights, tailored licensing options, and strategic value propositions designed to accelerate talent strategies. Whether exploring custom data extracts, requesting enterprise-wide access, or arranging a briefing session, Ketan stands ready to facilitate a seamless acquisition process. Initiate a conversation today to empower your organization with actionable intelligence that drives competitive differentiation and fuels sustainable growth.

- How big is the Staff Augmentation Services Market?

- What is the Staff Augmentation Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?