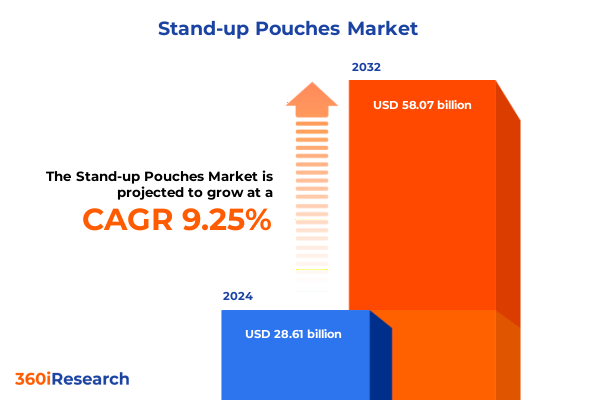

The Stand-up Pouches Market size was estimated at USD 31.03 billion in 2025 and expected to reach USD 33.78 billion in 2026, at a CAGR of 9.36% to reach USD 58.07 billion by 2032.

Revolutionizing Packaging with Stand-Up Pouches by Enhancing Consumer Engagement and Environmental Sustainability at Every Touchpoint

Stand-up pouches have emerged as a pivotal innovation in modern packaging, seamlessly integrating consumer convenience with brand storytelling. Their upright orientation on retail shelves captures shoppers’ attention while maximizing visual impact through expansive printable surfaces. Beyond aesthetics, these flexible containers offer lightweight, durable and reclosable solutions that align with evolving consumer demands for portability and freshness. As brands across food, beverage and personal care categories intensify competition, stand-up pouches serve as a dynamic medium through which to differentiate product offerings and enhance shelf velocity.

Moreover, the broader shift toward sustainability has elevated the role of stand-up pouches as carriers of eco-centric branding messages. With multilayer laminates engineered for material reduction and novel bio-based films under development, these pouches are at the forefront of material innovation. Their lower material footprint compared to rigid containers resonates with environmentally conscious consumers, reinforcing brand commitments to responsible sourcing and waste reduction. Consequently, stand-up pouches occupy a dual role: they amplify brand visibility while underpinning corporate sustainability goals, making them an indispensable element of contemporary packaging strategies.

Unprecedented Technological Innovations and Sustainability Mandates Are Redefining Stand-Up Pouch Performance and Consumer Expectations

A wave of technological advancements and heightened sustainability imperatives has transformed the stand-up pouch landscape in recent years. Innovative barrier materials now deliver shelf-stable performance historically reserved for rigid packaging, allowing perishable products to enjoy extended freshness without sacrificing storage efficiency. Concurrently, digital printing capabilities have matured, enabling shorter runs and vibrant high-resolution graphics that resonate with target audiences. These advances have collectively propelled stand-up pouches from niche applications into mainstream adoption across diverse end-use segments.

At the same time, regulatory and consumer pressure for responsible packaging has catalyzed a strategic pivot toward recyclable and compostable film structures. Collaborative industry initiatives are advancing mono-material designs that streamline recycling processes, while emerging chemical recycling methods promise to reclaim multilayer components. As a result, the marketplace now demands that manufacturers balance performance with a transparent, cradle-to-grave environmental narrative. In this evolving context, brands and converters must navigate a complex interplay of innovation, regulatory compliance and consumer sentiment, redefining success metrics for stand-up pouch solutions.

Exploring the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Raw Materials and Supply Chain Dynamics for Stand-Up Pouches

In 2025, the United States imposed revised tariff measures on key raw materials destined for flexible packaging, exerting pronounced effects on production costs and supply chain resilience. Foil substrates, multilayer laminates and select plastic resins now attract heightened duty rates, compelling manufacturers to reevaluate sourcing strategies and pass through incremental costs. This shift has also prompted an uptick in near-shoring efforts, as converters seek to mitigate exposure to volatile import tariffs by forging new partnerships with domestic and regional suppliers.

Furthermore, the elevated duties on plastic resins such as polyethylene and polypropylene have triggered a renewed emphasis on material optimization and waste reduction. Many industry leaders are accelerating adoption of advanced compounding techniques to minimize resin usage, while exploring alternative feedstocks to alleviate cost pressures. In parallel, heightened logistical expenses have underscored the importance of digital supply chain planning tools and just-in-time inventory models. Taken together, these dynamics have reshaped competitive positioning, incentivizing agility and collaboration across the value chain as essential mechanisms for sustaining profitability under evolving tariff landscapes.

Unveiling Critical Segmentation Insights into Stand-Up Pouches Through Type Material Closure Structure Capacity and End-Use Dimensions

Segmentation insights reveal nuanced growth trajectories across the stand-up pouch spectrum, beginning with type. Doyen Seal Pouches continue to resonate with brands prioritizing tamper evidence and robust barrier performance, while Flat Bottom Pouches have gained traction where shelf stability and premium perception drive consumer preference. K-Seal Pouches cater to tamper-evident applications in pharmaceutical and food safety contexts, whereas Retort Pouches have unlocked new opportunities for shelf-stable meals. Vacuum Pouches round out the portfolio with specialized applications in sous-vide cooking and extended shelf life for perishables.

Examining material composition sheds light on evolving sustainability and performance trade-offs. Foil remains indispensable where oxygen and moisture barriers are critical, yet Multilayer Laminates now offer comparable protection with thinner profiles. Paper structures address zero-plastic mandates in select markets, while Plastic films-spanning Polyethylene, Polyethylene Terephthalate and Polypropylene-balance flexibility, clarity and cost. Closure innovations further differentiate offerings: heat sealed variants dominate high-volume segments, while screw caps and spouts facilitate pourable formulations. Tear notches and zipper closures enhance consumer convenience and reclosability.

Structure and capacity considerations play pivotal roles in consumer acquisition and logistics optimization. Multi-layer constructs deliver tailored barrier properties for specialty applications, while single-layer designs support lightweight, recyclable streams. Packages ranging from below 100 grams to above 500 grams address a spectrum of use cases, from single-serve snacks to family-size staples. Across end-use sectors-beverage, cosmetics and personal care, food, pet food and pharmaceutical-distinct performance and regulatory requirements drive targeted material and form factor selections, underscoring the imperative for holistic segmentation strategies.

This comprehensive research report categorizes the Stand-up Pouches market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Closure Type

- Structure

- Capacity

- End Use

Illuminating Regional Dynamics and Growth Drivers across the Americas Europe Middle East Africa and Asia-Pacific Markets for Stand-Up Pouches

Regional dynamics in the stand-up pouch arena exhibit considerable variation, influenced by consumer preferences, regulatory frameworks and manufacturing infrastructures. In the Americas, sustainability certifications and lightweighting initiatives have elevated demand for recyclable pouch solutions. Brands in North America are increasingly embracing post-consumer recycled content, while Latin American markets favor cost-effective materials that withstand warm climates and extended logistics routes.

Conversely, the Europe, Middle East and Africa region is characterized by stringent regulatory mandates targeting single-use plastics and packaging waste. This environment has incentivized rapid deployment of mono-polymer pouches compatible with existing recycling streams and pilot compostable films. Market growth is further supported by cross-border e-commerce, where compact form factors and reduced shipping weights deliver tangible logistical savings.

In Asia-Pacific, burgeoning middle-class consumption and rising demand for convenience have propelled stand-up pouch adoption, particularly in the food and beverage sectors. Rapid urbanization underscores the need for on-the-go packaging, while strong manufacturing capabilities in China and Southeast Asia ensure cost-competitive production. Across these regions, local market requirements and distribution models shape the evolution of pouch designs, materials and closure systems, highlighting the necessity of region-specific strategies.

This comprehensive research report examines key regions that drive the evolution of the Stand-up Pouches market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players and Their Strategic Endeavors Shaping Competitive Landscapes in the Stand-Up Pouch Industry Through Evolving Collaborations and Technological Investments

Leading packaging converters and material suppliers are actively shaping the competitive field through strategic collaborations, capacity expansions and sustainability investments. Key players such as Amcor have intensified focus on mono-material pouch solutions, collaborating with chemical recyclers to advance circular design principles. Similarly, Berry Global has unveiled high-barrier, digitally printable films that streamline supply chains and reduce lead times for short-run customizations. Sealed Air has leveraged its global footprint to introduce ultra-lightweight formulations in food packaging, while Mondi has pioneered paper-based pouches engineered for recycling in established waste management streams.

Beyond material innovation, these companies are pursuing integrated service offerings. Packaging technology providers are embedding digital safety features such as QR code traceability and anti-counterfeit inks to meet evolving regulatory and brand protection requirements. Contract packagers and co-packers are investing in end-of-line automation to deliver scalable solutions that address seasonal demand fluctuations. Collectively, this wave of strategic initiatives underscores an industry in motion, where performance, speed-to-market and environmental stewardship drive competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Stand-up Pouches market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- American Packaging Corporation

- Bischof+Klein SE & Co. KG

- Bryce Corporation

- Cascades Inc.

- CCL Industries Inc.

- Clondalkin Group

- Constantia Flexibles GmbH

- Coveris GmbH

- FLAIR Flexible Packaging Corporation

- Glenroy Inc.

- Gualapack S.P.A.

- Huhtamaki Oyj

- Interflex Group

- Mondi plc

- Printpack, Inc.

- ProAmpac Holdings Inc.

- Sealed Air Corporation

- Shako Flexipack Private Limited

- SIG Group AG

- Smurfit Kappa Group

- Sonoco Products Company

- Swiss PAC USA

- Uflex Limited

- Winpak Ltd.

Strategic Roadmap for Industry Leaders to Drive Innovation Operational Efficiency Sustainability and Market Expansion in Stand-Up Pouch Manufacturing

Industry leaders should embark on targeted innovation roadmaps that prioritize both material optimization and consumer experience. By investing in advanced resin blends and barrier coatings, manufacturers can reconcile performance demands with sustainability mandates, thereby unlocking new value propositions. In parallel, brands are advised to integrate digitally enabled packaging features that foster traceability and deepen consumer engagement, such as tamper-evident seals linked to smartphone applications.

Operational excellence remains paramount: companies must streamline supply chain networks through near-shoring partnerships and dynamic inventory management systems. This approach mitigates exposure to fluctuating tariff regimes and logistical disruptions. Cross-functional teams should also integrate lifecycle assessment tools to quantify environmental impacts, ensuring that design decisions align with corporate responsibility goals.

Finally, forging alliances across the value chain-from resin producers to waste management stakeholders-will be essential for scaling circular packaging models. Collaborative pilot programs can validate emerging recycling technologies and establish infrastructure for collection and reclamation. By executing on these strategic imperatives, industry leaders will drive cost efficiencies, brand differentiation and long-term resilience in the evolving stand-up pouch marketplace.

Robust Research Methodology Integrating Primary Secondary Data Qualitative Quantitative Analyses and Rigorous Validation Techniques for Stand-Up Pouch Study

The research methodology underpinning this study integrates rigorous primary and secondary data collection to ensure robust, actionable insights. Primary research involved in-depth interviews with packaging executives, material scientists and sustainability experts, supplemented by site visits to converter facilities and recycling centers. Qualitative data from these discussions provided nuanced understanding of emerging technologies, regulatory hurdles and consumer preferences across global markets.

Secondary research encompassed a comprehensive review of industry publications, patent databases and peer-reviewed journals, enabling triangulation of market trends and technological breakthroughs. Data validation techniques included cross-referencing shipment volumes, import-export records and trade association reports to corroborate material flow analyses. Statistical methods were applied to synthesize findings, while scenario analysis assessed the implications of tariff changes and regulatory shifts.

Analytical rigor was further enhanced through iterative stakeholder workshops, where preliminary conclusions were tested and refined. This multi-phase approach ensures that the final report reflects a holistic perspective on competitive dynamics, technological innovation and sustainability trajectories, equipping decision-makers with a credible foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Stand-up Pouches market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Stand-up Pouches Market, by Type

- Stand-up Pouches Market, by Material

- Stand-up Pouches Market, by Closure Type

- Stand-up Pouches Market, by Structure

- Stand-up Pouches Market, by Capacity

- Stand-up Pouches Market, by End Use

- Stand-up Pouches Market, by Region

- Stand-up Pouches Market, by Group

- Stand-up Pouches Market, by Country

- United States Stand-up Pouches Market

- China Stand-up Pouches Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Comprehensive Conclusion Synthesizing Key Insights Strategic Imperatives Market Dynamics and Future Pathways for Stand-Up Pouch Growth and Innovation

This comprehensive analysis synthesizes the multifaceted dynamics shaping the stand-up pouch market, from segmentation nuances to the evolving tariff environment and regional growth drivers. Key insights underscore the critical interplay of material innovation, regulatory compliance and consumer engagement as determinants of competitive advantage. Strategic collaborations and digital enablement emerge as pivotal enablers for differentiation, while circular design principles and lifecycle assessments guide environmental stewardship.

As supply chains adjust to 2025 tariff realignments, agility and near-shoring strategies become indispensable for maintaining cost competitiveness. Simultaneously, the ascent of mono-polymer solutions and advanced barrier materials reflects the sector’s commitment to balancing performance with sustainability imperatives. Regional variations-from recycled content mandates in the Americas to single-use plastics regulations in Europe, Middle East and Africa, and rapid convenience uptake in Asia-Pacific-highlight the imperative for tailored market approaches.

Collectively, these findings paint a picture of an industry at a pivotal juncture, where the convergence of technological breakthroughs, policy shifts and evolving consumer values will define the future trajectory of stand-up pouches. Stakeholders equipped with these insights are better positioned to innovate responsibly, optimize supply chains and capture new growth opportunities in this dynamic packaging segment.

Energizing Partnerships and Unlocking Exclusive Market Intelligence with Ketan Rohom Associate Director Sales & Marketing for Immediate Report Access

For forward-thinking organizations seeking to capitalize on comprehensive market insights, engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, offers a strategic advantage. By securing the full stand-up pouch market research report today, stakeholders gain immediate access to in-depth analyses, competitive intelligence and exclusive strategic recommendations tailored to their business objectives. This personalized engagement ensures that decision-makers are equipped with the precise tools required to innovate packaging portfolios, optimize supply chains and drive sustainable growth. Reach out now to unlock a differentiated perspective and accelerate your organization’s journey toward market leadership in the dynamic stand-up pouch landscape.

- How big is the Stand-up Pouches Market?

- What is the Stand-up Pouches Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?