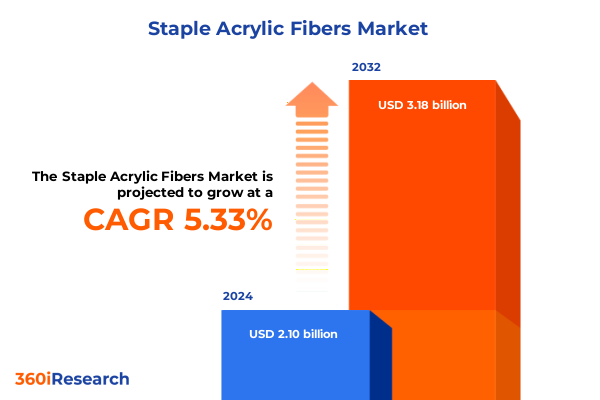

The Staple Acrylic Fibers Market size was estimated at USD 2.19 billion in 2025 and expected to reach USD 2.29 billion in 2026, at a CAGR of 5.47% to reach USD 3.18 billion by 2032.

Forging a Comprehensive Understanding of the Staple Acrylic Fibers Landscape to Empower Strategic Decisions in a Rapidly Evolving Textile Industry

Staple acrylic fibers represent a class of synthetic fibers derived from polyacrylonitrile polymers that are widely utilized across textile and nonwoven sectors. With characteristics that emulate natural wool-such as lightweight softness, thermal insulation and colorfastness-these fibers have become foundational in apparel, home textiles and industrial applications where a balance between performance and affordability is required. Ongoing research has focused on enhancing durability and environmental resistance, positioning staple acrylic fibers as versatile alternatives for both mass-market and technical textiles

As global markets navigate fluctuating raw material costs and evolving trade policies, stakeholders are increasingly seeking comprehensive insights into fiber performance, supply chain resilience and regulatory developments. Demand patterns have demonstrated particular resilience in emerging markets such as India, where domestic production remains robust despite competitive pressure from imports, while European consumption has exhibited signs of moderation as brands diversify into alternative fibers. In this context, a thorough understanding of market dynamics is indispensable for informed strategic planning across the value chain

Against this backdrop, this executive summary synthesizes the pivotal technological innovations, tariff-driven trade realignments, critical segmentation insights and regional performance metrics that define the current landscape of staple acrylic fibers. By integrating evidence-based analysis with expert recommendations, it aims to equip decision-makers with actionable intelligence to capitalize on emerging growth vectors, mitigate risk exposures and chart a path toward sustainable, profitable expansion in 2025 and beyond.

Examining the Transformative Technological Innovations and Sustainable Practices Reshaping the Staple Acrylic Fibers Market for Future Growth

Recent years have witnessed transformative shifts in staple acrylic fiber production driven by advanced polymerization and manufacturing technologies. Next-generation gel spinning techniques have enabled the creation of fibers with superior tenacity and uniform cross-sections, unlocking new applications in high-performance textiles where strength-to-weight ratio is critical. Concurrently, closed-loop solvent recovery systems and ISCC-certified mass balance approaches have emerged as industry benchmarks for reducing environmental impact, facilitating the integration of biomass-derived feedstocks into conventional production without disrupting existing processes

Digitalization has further accelerated innovation, with real-time analytics and automated quality monitoring systems enhancing process consistency and yield. Stakeholders are also leveraging digital textile printing on acrylic substrates to deliver customized designs at scale, responding to consumer demand for rapid product differentiation. Moreover, strategic collaborations between leading producers and academic research institutions are fostering the co-development of smart composites and functional textiles-ranging from antimicrobial healthcare fabrics to energy-harvesting wearables-thereby broadening the scope of staple acrylic fibers well beyond traditional apparel and home furnishings

These technological and sustainability-focused initiatives are reshaping competitive dynamics, as companies that adopt agile R&D frameworks and invest in eco-friendly production not only meet stringent regulatory requirements but also gain early-mover advantages in emerging specialty markets.

Evaluating the Far-Reaching Consequences of New United States Tariffs on Staple Acrylic Fiber Trade Dynamics and Cost Structures

Beginning in early 2025, the United States government introduced additional duties on imports of staple acrylic fibers as part of a broader trade policy aimed at strengthening domestic manufacturing capacities. While the intent was to safeguard local producers, the practical outcome has been a notable increase in material costs, as importers and downstream processing companies absorb the added financial burden. This shift has translated into margin compression across the value chain, compelling brands and converters to renegotiate contract terms and explore alternative sourcing strategies to preserve profitability

In response to these cost pressures, a growing number of textile and industrial fabric manufacturers are nearshoring their supply chains, prioritizing proximity to reduce lead times and mitigate exposure to external tariff fluctuations. Simultaneously, international suppliers-particularly in Asia and Europe-have intensified efforts to redirect their export flows to markets with more favorable trade terms, thereby offsetting volume declines in the United States. These newly established trade corridors are reshaping global logistics networks and prompting a reevaluation of long-standing supplier relationships

Industry leaders are countering the uncertainties introduced by the tariff regime through enhanced scenario planning and the formation of dedicated cross-functional trade compliance teams. By integrating detailed cost-benefit analyses and investing in localized polymerization and finishing facilities, companies aim to secure more predictable supply channels and position themselves to capitalize on both domestic and international growth opportunities.

Moreover, distributors and wholesalers are consolidating vendor portfolios to leverage scale efficiencies and negotiate more favorable terms with fiber producers, a trend driven by the need to maintain competitive agility in a policy-driven marketplace

Unpacking Critical Market Segmentation Insights to Illuminate Diverse Application and Distribution Dynamics in Staple Acrylic Fibers

Understanding the diverse pathways through which staple acrylic fibers reach end-use markets requires an analysis of multiple segmentation layers that influence product performance and commercial strategies. In terms of application, fibers destined for engineering textiles are further differentiated by their use in filtration and insulation media, while nonwoven segments encompass meltblown, needlepunch and spunbond materials. The realm of textile goods divides into apparel and home furnishing outlets, and yarn offerings are uniquely tailored as knitting or weaving yarns

Technological preferences in polymerization dictate product characteristics, with bulk continuous, dry spun, gel spun and wet spun methods each delivering distinct molecular alignments and fiber morphologies suited to specific applications. End-use segmentation underscores the versatility of staple acrylic fibers, which serve apparel, automotive, home furnishing, industrial and medical markets, reflecting their adaptability to both functional and aesthetic requirements. Cut length variations-categorized as under 38 millimeters, between 38 and 51 millimeters, and above 51 millimeters-further refine fiber choice by balancing processing efficiency against end-product hand feel and mechanical resilience. Finally, distribution channels span direct sales relationships, traditional distributor networks and online platforms, shaping how market participants engage with customers and manage inventory flexibility

These interrelated segmentation dimensions enable manufacturers and suppliers to optimize product portfolios, tailor marketing strategies and align production investments with emerging demand pockets across global markets.

This comprehensive research report categorizes the Staple Acrylic Fibers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Polymerization Type

- Cut Length

- Distribution Channel

- Application

- End Use

Revealing Key Regional Performance Patterns Highlighting Growth Hotspots in Americas, EMEA and Asia-Pacific Acrylic Fibers Markets

Regional dynamics play a pivotal role in shaping the global outlook for staple acrylic fibers. In the Americas, a combination of policy incentives and renewed investment in domestic polymerization capacity has reinforced production stability, even as rising raw material costs and the 2025 tariff adjustments compel manufacturers to adopt more nimble supply chain arrangements. Major end markets in North America continue to rely on acrylic fibers for thermal insulation in apparel and home textiles, while industrial fabrics find application in filtration and geotextile projects

The Europe, Middle East and Africa region is characterized by subdued consumption trends in traditional textile hubs, driven in part by economic headwinds and a growing pivot toward sustainable and recycled materials. European producers are accelerating the deployment of low-energy processes and circular recycling initiatives to address stringent environmental regulations and evolving consumer preferences. In the Middle East and Africa, infrastructure development and nonwoven applications-particularly in hygiene and filtration sectors-are emerging as key catalysts for fiber demand

Asia-Pacific remains the most dynamic region, underpinned by rapid industrialization, urbanization and robust production growth in China, India and Southeast Asia. Aggregate output volumes of artificial staple fibers in the region increased by approximately 5% in 2024, with China alone accounting for a third of the total production, demonstrating the scale and efficiency of its manufacturing base. These factors, combined with favorable trade agreements and expanding end-use industries, underscore the strategic importance of the region in global supply chain realignment

This comprehensive research report examines key regions that drive the evolution of the Staple Acrylic Fibers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Staple Acrylic Fiber Manufacturers Driving Innovation, Capacity Expansion and Sustainability Leadership Strategies Globally

Leading players in the staple acrylic fiber market have adopted differentiated strategies to capture value across the expanding product landscape. Toray Industries has pioneered the adoption of ISCC-certified mass balance production for its TORAYLON™ lineup, blending biomass-derived feedstocks with conventional polymers to meet sustainability targets while preserving fiber performance characteristics. This eco-centric approach not only advances Toray’s 2050 resource management vision but also sets a new benchmark for environmental traceability in acrylic fiber production

Aksa Akrilik, a major Turkish producer, has significantly expanded its capacity and introduced antimicrobial "Everfresh" fibers that address hygiene expectations in home textiles and medical nonwovens. Jilin Qifeng Chemical Fiber has invested in large-scale fiber projects integrating traditional acrylic manufacturing with carbon precursor technologies, reflecting a broader industry push toward multifunctional composites. Meanwhile, emerging suppliers such as Cedaar Textile in India are leveraging innovative spinning techniques and sustainable sourcing practices to meet rising domestic demand and compete on cost-performance metrics

These competitive moves illustrate the market’s oligopolistic structure, where incumbents and ambitious newcomers alike channel R&D investments into high-value innovations, capacity enhancements and sustainability initiatives to solidify market positions and address the nuanced requirements of evolving end-use applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Staple Acrylic Fibers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABC Polymer Industries, LLC

- Aksa Akrilik Kimya Sanayii A.Ş.

- Chemtex Global Corporation

- China Petrochemical Corporation

- Formosa Plastics Corporation

- Grupo Kaltex, S.A. de C.V.

- Indian Acrylics Ltd.

- Japan Exlan Co.,Ltd.

- Jiangsu Zhongxin Resources Group

- Kaneka Corporation

- Leigh Fibers Inc

- Mitsubishi Chemical Corporation

- Ningbo Zhongxin Acrylic Fibers Co.,Ltd.

- Pasupati Acrylon Ltd.

- PetroChina Company Limited

- Polyacryl Iran Corporation

- Polymir

- SDF Group

- SGL Carbon SE

- Taekwang Industrial Co, Ltd.

- Thai Acrylic Fibre Co.,Ltd. by Aditya Birla Group company

- Toray Industries, Inc.

- Vardhman Acrylics Limited

- Yousuf Dewan Companies

Actionable Strategic Recommendations for Industry Leaders to Navigate Tariff Shifts, Embrace Sustainability and Accelerate Competitive Advantage

In light of evolving trade dynamics, technological advances and sustainability imperatives, industry leaders should prioritize a multi-pronged strategic approach to fortify market positions. First, accelerating investments in advanced polymerization methods-such as gel and dry spun technologies-will enhance fiber tenacity and enable entry into high-performance application segments. Simultaneously, integrating mass balance and closed-loop recycling systems into production workflows can deliver both compliance with environmental regulations and differentiation in an increasingly eco-conscious marketplace.

Second, supply chain resilience must be reinforced through geographic diversification and nearshoring initiatives. Establishing modular production hubs in key end-use regions will mitigate tariff exposure and reduce lead time vulnerabilities. Collaboration with logistics partners to implement real-time tracking and scenario planning will further safeguard against disruption.

Third, fostering cross-sector partnerships with downstream fabricators, technology providers and research institutions can catalyze the co-development of functional textiles-such as antimicrobial, flame-retardant or energy-harvesting variants-that command premium pricing. Finally, deploying data-driven demand forecasting and dynamic pricing models will empower stakeholders to react swiftly to market fluctuations, optimize inventory levels and sustain profitable growth in the face of uncertainty.

Outlining a Rigorous Research Methodology Combining Primary Interviews and Secondary Data Triangulation to Ensure Robust Market Intelligence

To ensure the integrity and robustness of this market analysis, a structured research framework was employed. The process commenced with an extensive secondary research phase, encompassing regulatory filings, patent databases, trade association publications and peer-reviewed journals. These sources provided foundational insights into polymerization technologies, environmental certifications and global trade policies.

Concurrently, a series of primary interviews were conducted with key stakeholders, including fiber producers, textile converters, trade compliance experts and end-use brand managers. These qualitative consultations validated secondary data, clarified industry challenges and captured forward-looking perspectives on innovation trajectories.

Subsequently, a data triangulation methodology synthesized quantitative inputs from multiple research streams to reconcile discrepancies and enhance confidence levels. The segmentation and regional analyses were further refined through cross-referencing company disclosures, logistics reports and country-specific trade statistics. Finally, iterative reviews by subject matter experts ensured alignment with emerging trends and regulatory developments, resulting in a comprehensive and actionable market intelligence deliverable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Staple Acrylic Fibers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Staple Acrylic Fibers Market, by Polymerization Type

- Staple Acrylic Fibers Market, by Cut Length

- Staple Acrylic Fibers Market, by Distribution Channel

- Staple Acrylic Fibers Market, by Application

- Staple Acrylic Fibers Market, by End Use

- Staple Acrylic Fibers Market, by Region

- Staple Acrylic Fibers Market, by Group

- Staple Acrylic Fibers Market, by Country

- United States Staple Acrylic Fibers Market

- China Staple Acrylic Fibers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Conclusive Perspectives on Market Dynamics, Policy Impacts and Technological Trends to Illuminate the Path Forward for Acrylic Fibers

Through a synthesis of technological progress, policy shifts and segmentation dynamics, this executive summary underscores the evolving complexity of the staple acrylic fiber market. While new tariff measures have introduced cost challenges, they have also stimulated supply chain ingenuity and propelled investments in localized manufacturing capacities. At the same time, advancements in polymerization and sustainable production methods are redefining performance benchmarks and expanding application frontiers beyond traditional textiles.

Regional performance patterns highlight the outsized role of Asia-Pacific in driving volume growth, alongside nascent opportunities in EMEA nonwoven applications and resilient demand pockets in the Americas. Major producers are responding with differentiated strategies-including capacity expansions, eco-centric product lines and digital integration-to capitalize on these emerging pockets of growth.

Looking ahead, companies that embrace a data-driven, sustainability-focused ethos and foster collaborative innovation will be best positioned to navigate uncertainties, capture high-value market segments and secure long-term competitive advantage in the staple acrylic fiber landscape.

Engage with Ketan Rohom to Secure Comprehensive Staple Acrylic Fibers Market Intelligence and Empower Data-Driven Business Decisions

As you consider the strategic implications of tariffs, sustainability expectations and technological breakthroughs in the staple acrylic fiber arena, obtaining comprehensive data and in-depth analysis is essential. You are invited to connect with Ketan Rohom, Associate Director of Sales and Marketing, to explore tailored insights and secure your copy of the full market research report. His expertise will guide you through the report’s rich findings, segmentation breakdowns and actionable recommendations, ensuring you have the intelligence required to drive informed decisions and stay ahead of market dynamics.

- How big is the Staple Acrylic Fibers Market?

- What is the Staple Acrylic Fibers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?