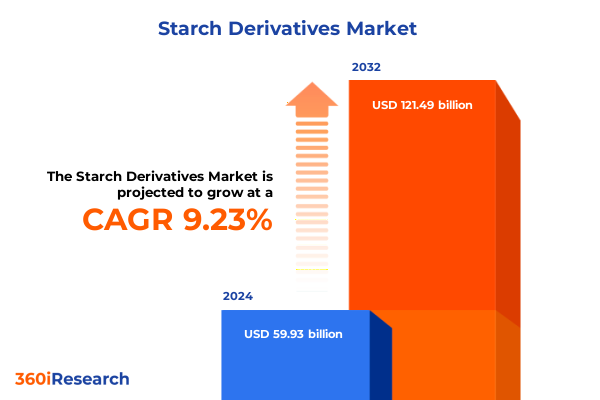

The Starch Derivatives Market size was estimated at USD 65.37 billion in 2025 and expected to reach USD 71.31 billion in 2026, at a CAGR of 9.25% to reach USD 121.49 billion by 2032.

Setting the Stage for Innovation and Growth in the Evolving Starch Derivatives Market as Demand Continues to Diversify Across Industries Worldwide

Since the earliest applications of starch in food and industrial processes, the derivatives landscape has undergone remarkable transformation driven by innovation, regulatory shifts, and evolving consumer demands. In recent years, manufacturers and ingredient suppliers have increasingly prioritized value-added functionalities such as clean labeling, improved mouthfeel, and targeted health benefits. As the market diversifies, starch derivatives have transcended traditional roles, emerging as critical enablers within sectors ranging from food and beverage to pharmaceuticals and personal care.

This executive summary distills the most salient trends and strategic considerations shaping the starch derivatives market today. It begins by outlining the fundamental drivers of change, including technological advancements in enzymatic modification and sustainable extraction techniques. From there, we examine the cumulative impact of tariff policies and trade disputes that have redefined supply chain decisions, particularly within the United States in 2025. Subsequent sections delve into segmentation insights, regional dynamics, competitive landscapes, actionable recommendations for leaders, and the robust research methodology that underpins these findings.

By synthesizing diverse data sources and expert perspectives, this summary equips stakeholders with a concise yet comprehensive overview of market dynamics. Whether your organization is exploring new product formulations, optimizing supply networks, or evaluating acquisition opportunities, these insights will guide informed decision-making and strategy development. As the starch derivatives sector continues to evolve, proactive engagement with emerging trends will be essential for sustaining growth and competitive differentiation.

Uncovering Pivotal Disruptions and Emerging Trends Shaping the Future Dynamics of the Starch Derivatives Landscape on a Global Scale

The starch derivatives landscape is experiencing a period of rapid transformation fueled by shifts in consumer preferences, regulatory mandates, and technological breakthroughs. Clean label initiatives have accelerated the demand for naturally sourced and minimally processed ingredients, prompting businesses to invest in enzyme-based modification processes that reduce chemical inputs while delivering consistent performance. Concurrently, health and wellness trends have elevated resistant starch to prominence as a functional ingredient, with applications expanding into prebiotic formulations and glycemic control solutions.

Alongside these demand-side drivers, advances in digitalization and data analytics are reshaping manufacturing operations. Real-time monitoring of process parameters enables precise control over viscosity, gelling, and stability attributes, while predictive modeling optimizes yield and resource utilization. This integration of Industry 4.0 technologies enhances operational agility and reduces time to market for novel starch-based formulations.

Moreover, sustainability imperatives are catalyzing the adoption of renewable feedstocks and green extraction methods. Innovations in aqueous extraction and membrane separation are lowering energy consumption and minimizing waste streams. As competitive pressures intensify, strategic alliances between ingredient suppliers, equipment manufacturers, and academic institutions are becoming instrumental for co-developing next-generation starch derivatives. These collaborative ecosystems not only accelerate innovation but also distribute risk and share best practices across the value chain.

Assessing the Compounding Effects of Recent United States Tariffs on the Operational and Strategic Posture of Starch Derivatives Producers in 2025

In 2025, a series of tariff adjustments enacted by the United States government significantly influenced the cost structures and sourcing strategies of starch derivatives producers. Increased import duties on key raw materials, notably native starches and modified granules, led manufacturers to reevaluate traditional procurement channels. This shift prompted a marked uptick in domestic sourcing initiatives, as well as exploration of alternative supply regions that offer preferential trade agreements and lower shipping costs.

The cumulative effect of these tariffs manifested in tighter margins for companies reliant on imported inputs, compelling some to invest in backward integration and strategic partnerships with agricultural cooperatives. Others opted to localize value-added processing closer to feedstock origins, thus mitigating cross-border tariff risks and transportation delays. Concurrently, downstream customers in food, paper, and personal care sectors faced elevated ingredient prices, which accelerated reformulation efforts to optimize starch usage and explore cost-efficient blends.

Although the tariffs introduced near-term volatility, they also served as a catalyst for supply chain resilience. Companies with diversified sourcing portfolios and flexible manufacturing footprints were better positioned to absorb the increased duties without disrupting production schedules. As trade policies remain a variable in the operating environment, market participants are prioritizing scenario planning and dynamic hedging strategies to safeguard against future policy shifts.

Illuminating Core Segmentation Frameworks Revealing Distinct Application, Product Type, Source, Functionality, and Physical Form Insights

A deep understanding of segmentation frameworks is crucial to identify growth pockets and tailor value propositions across diverse end-use applications. Based on application, the market encompasses sectors such as animal feed, where derivatized starches enhance pellet stability and nutrient delivery. Within food and beverage, specialized ingredients address functionality needs across baking, beverages, confectionery, dairy, and sauces and dressings, delivering targeted viscosity, mouthfeel, and shelf-life performance. The paper and packaging segment leverages starch derivatives to improve dry strength and printability, while personal care formulations benefit from biodegradable thickeners and film-forming agents. In pharmaceuticals, tailored release profiles for active compounds are achieved through resistant starch matrices, and the textile industry exploits binder and sizing properties to enhance dye uptake and durability.

When examining product type, dextrin varieties such as white and yellow dextrin are utilized for their solubility and crisp texture enhancement, while maltodextrin grades segmented by dextrose equivalence-from 5–10 DE to above 20 DE-provide versatility in sweetness, bulking, and stabilization functions. Modified starch subtypes including acid modified, cross-linked, and oxidized grades offer a range of viscosities and shear stability profiles. Resistant starch categories RS1 through RS4 deliver health-oriented functionalities, serving as dietary fiber or encapsulation matrices for sensitive nutraceuticals.

Source differentiation underscores the importance of feedstock selection, with cassava, corn, potato, and wheat each presenting unique amylose-amylopectin ratios that influence gelatinization and retrogradation behavior. Functionality-driven segmentation reveals roles as binders, emulsifiers, fat replacers, stabilizers, and thickeners, enabling formulators to address product-specific textural and sensorial requirements. Finally, physical form-whether liquid or powder-determines handling characteristics, dispersion kinetics, and storage considerations, influencing both manufacturing efficiency and final product attributes.

This comprehensive research report categorizes the Starch Derivatives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Functionality

- Physical Form

- Application

Deciphering Regional Growth Patterns and Market Nuances Across the Americas, EMEA, and AsiaPacific Starch Derivatives Ecosystems

Regional dynamics within the starch derivatives market exhibit distinct growth patterns driven by economic structures, regulatory environments, and consumption habits. In the Americas, the convergence of advanced food processing industries and substantial agricultural output fosters robust demand for both native and modified starch derivatives. Innovations in functional ingredients, particularly for clean label and high-protein bakery products, continue to push formulators toward specialized grades with enhanced performance and minimal processing aids.

Europe, the Middle East, and Africa (EMEA) present a multifaceted landscape where stringent regulatory standards and consumer health awareness drive growth in resistant and modified starch segments. Investments in biorefinery projects and bio-based material initiatives underscore regional priorities for circular economy integration. Meanwhile, emerging markets within the Middle East and Africa are beginning to adopt starch derivatives in personal care and industrial applications, signaling an opportunity for market expansion despite infrastructural constraints.

In the Asia-Pacific region, rapid urbanization and rising disposable incomes underpin escalating consumption of convenience foods and ready-to-drink beverages, boosting demand for maltodextrin and cross-linked starch grades. Cassava remains a dominant feedstock in Southeast Asia, while government incentives in China and India support capacity expansions and technology upgrades. Across all regions, sustainability imperatives and resource efficiency strategies are converging to shape future investment decisions and drive cross-border collaboration among ingredient suppliers, end-users, and policymakers.

This comprehensive research report examines key regions that drive the evolution of the Starch Derivatives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Imperatives and Competitive Positioning of Leading Starch Derivatives Companies Driving Innovation and Market Excellence

Leading companies in the starch derivatives arena are reinforcing their market positions through targeted R&D investments, strategic partnerships, and capacity enhancements. A number of global players have accelerated development of sustainable extraction technologies, focusing on enzyme-driven processes that reduce energy requirements and eliminate harsh chemicals. Concurrently, collaborations with biotech firms and academic research centers are facilitating the creation of novel resistant starch formulations tailored for gut health and low-glycemic nutrition.

In addition to technological innovation, top companies are refining their geographic footprints to align with key demand centers and tariff landscapes. Many have established regional application laboratories to offer localized technical support and expedite product customization for food and beverage, paper, and personal care industries. This customer-centric approach enhances responsiveness to emerging trends and regulatory changes, particularly in markets with evolving clean label and bio-based material mandates.

Moreover, strategic acquisitions of specialty ingredient firms have bolstered portfolios with complementary functionalities such as plant-based proteins and hydrocolloids, enabling comprehensive solution platforms. Through integrated offerings, these companies are strengthening customer relationships and capturing share in adjacent categories. As competitive intensity heightens, differentiation through service excellence, sustainability credentials, and application expertise will remain critical success factors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Starch Derivatives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGRANA Beteiligungs-AG

- Archer-Daniels-Midland Company

- Cargill, Incorporated

- Emsland-Stärke GmbH

- Grain Processing Corporation

- Gujarat Ambuja Exports Limited

- Ingredion Incorporated

- Manildra Group

- Matsutani Chemical Industry Co., Ltd.

- Roquette Frères S.A.

- Royal Avebe U.A.

- Tate & Lyle PLC

- Tereos SCA

- Universal Starch-Chem Allied Ltd.

Delivering Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Emerging Challenges and Capitalize on Opportunities

To thrive in this dynamic environment, industry leaders should prioritize development of enzyme-based modification platforms that support clean label objectives while delivering consistent performance. By investing in modular, flexible manufacturing assets, companies can quickly adapt production lines to accommodate emerging starch grades and pivot in response to tariff fluctuations or raw material constraints. Concurrently, fostering partnerships with feedstock suppliers and agricultural cooperatives will secure reliable, traceable raw material streams and enhance resilience against supply disruptions.

Innovation pipelines should incorporate health-driven starch derivatives such as resistant starch and prebiotic blends, enabling formulators to address growing consumer interest in gut health and metabolic wellness. Leveraging digital process automation and advanced analytics will further optimize quality control and reduce waste, unlocking cost efficiencies that can be reinvested in R&D and sustainability initiatives. Furthermore, alignment with circular economy principles-through waste valorization and renewable energy integration-will bolster environmental credentials and meet escalating regulatory requirements, particularly in Europe and North America.

Finally, cross-functional collaboration between sales, marketing, and technical teams is essential for translating laboratory advances into commercially viable solutions. By engaging end-users early in co-creation exercises, companies can ensure that new starch derivatives deliver targeted sensory and functional benefits, driving adoption and reinforcing long-term partnerships.

Outlining Rigorous Research Methodology Encompassing Data Collection, Validation, and Analytical Techniques Underpinning the Insights

This research draws upon a rigorous, multi-phase methodology designed to ensure the validity and reliability of insights. The initial phase involved comprehensive secondary research, encompassing industry reports, academic publications, patent filings, and regulatory documents to establish a foundational understanding of starch derivative technologies, feedstock sourcing, and market drivers.

Building on this desk research, a structured primary research program was conducted through in-depth interviews with C-level executives, technical specialists, procurement leads, and application development managers across both supplier and end-user organizations. These qualitative engagements provided nuanced perspectives on operational challenges, innovation bottlenecks, and evolving application requirements.

Quantitative data collection was executed via targeted surveys distributed to a representative sample of ingredient manufacturers and food processors. Responses were triangulated against historical data sets and financial disclosures to identify trends and validate key findings. Analytical techniques such as SWOT analysis, Porter’s Five Forces, and scenario modeling were employed to evaluate competitive dynamics and assess the potential impact of tariff scenarios and sustainability regulations.

All data were subjected to rigorous validation protocols, including cross-verification with publicly available trade statistics and corroborative feedback from industry associations. The culmination of these phases delivers a holistic, actionable view of the starch derivatives market underpinned by robust methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Starch Derivatives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Starch Derivatives Market, by Product Type

- Starch Derivatives Market, by Source

- Starch Derivatives Market, by Functionality

- Starch Derivatives Market, by Physical Form

- Starch Derivatives Market, by Application

- Starch Derivatives Market, by Region

- Starch Derivatives Market, by Group

- Starch Derivatives Market, by Country

- United States Starch Derivatives Market

- China Starch Derivatives Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Critical Takeaways Emphasizing Future Imperatives and Strategic Outlook for Stakeholders in the Starch Derivatives Sphere

The analysis presented herein underscores several critical takeaways. First, clean label and health-driven functionalities will continue to steer innovation trajectories, particularly in food and beverage and nutraceutical applications. Second, trade policies and tariffs are reshaping supply chain configurations, making resilience and flexibility non-negotiable strategic imperatives. Third, regional dynamics reveal distinct opportunities, with emerging markets in Asia-Pacific and EMEA poised for rapid uptake of advanced starch derivatives.

Looking ahead, companies that invest in enzymatic modification technologies, circular economy initiatives, and digital manufacturing capabilities will be best positioned to outpace competitors. Moreover, cultivating collaborative ecosystems that link ingredient developers, academic researchers, and end-users can accelerate product development and reduce time to market. By integrating these imperatives into corporate strategy, stakeholders can navigate volatility while capturing value from evolving consumer preferences and regulatory landscapes.

In conclusion, the starch derivatives market is at a pivotal juncture where innovation, sustainability, and resilience intersect. Organizations that adopt a proactive, data-driven approach-grounded in the insights contained in this report-will unlock new pathways to growth and competitive distinction.

Engage with Ketan Rohom to Secure Your Comprehensive Market Research Report and Propel Your Starch Derivatives Strategy to New Heights

For professionals and decision-makers seeking an in-depth exploration of emerging trends, strategic drivers, and competitive dynamics within the starch derivatives market, engaging with Ketan Rohom provides direct access to tailored expertise and comprehensive analysis. Leveraging years of experience in sales and marketing research, this collaboration ensures that your organization will receive a bespoke report equipped with actionable insights, detailed segmentation breakdowns, and an objective assessment of regional and global developments. Reach out today to secure your copy of the full market research report and gain the strategic clarity needed to refine product roadmaps, optimize supply chains, and capitalize on growth opportunities. Take the next step toward elevating your starch derivatives strategy by collaborating with an established industry expert who is dedicated to empowering your business success.

- How big is the Starch Derivatives Market?

- What is the Starch Derivatives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?