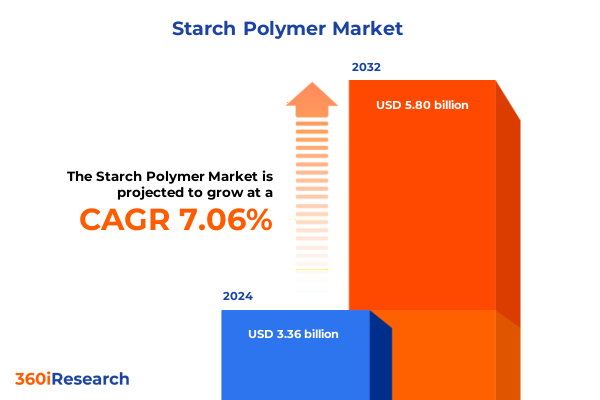

The Starch Polymer Market size was estimated at USD 3.59 billion in 2025 and expected to reach USD 3.86 billion in 2026, at a CAGR of 7.07% to reach USD 5.80 billion by 2032.

Unveiling the Core Significance and Emerging Potential of Starch Polymer Solutions Across Diverse Industrial Sectors and Innovative Applications Driving Sustainable Growth

Starch polymers have emerged as versatile materials that bridge the gap between natural biopolymers and high-performance industrial compounds. Originating from ubiquitous agricultural feedstocks, these materials combine the innate biodegradability of native starches with engineered functionalities tailored to demanding applications. In recent years, advancements in polymer modification techniques and the development of thermoplastic starch variants have elevated these materials from commodity additives to core components in packaging, construction, and textile applications. Consequently, stakeholders across value chains are placing renewed emphasis on understanding the multifaceted roles that starch polymers now play in enabling sustainability commitments and performance requirements.

As businesses and regulatory bodies intensify their focus on environmental impact and resource efficiency, starch polymers have found new relevance. Their capacity for chemical modification-through processes such as cross linking, esterification, and etherification-allows formulators to achieve targeted mechanical properties, thermal stability, and compatibility with other polymeric matrices. Furthermore, the ability to process starch in both granular and powdered forms provides manufacturers with the flexibility to integrate these materials seamlessly into existing production lines. This synthesis of renewability and performance positions starch polymers at the nexus of circular economy initiatives and next-generation product design.

Against this backdrop, this executive summary sets out to map the current landscape of starch polymer solutions by exploring transformative market shifts, dissecting the impact of United States tariff policies in 2025, and revealing segmentation and regional insights. By doing so, it aims to equip industry leaders and decision makers with a holistic perspective on strategic imperatives, competitive dynamics, and growth opportunities in this rapidly evolving sector.

Exploring Major Technological, Regulatory, and Consumer-Driven Transformations Shaping the Global Starch Polymer Landscape and Competitive Dynamics with Unprecedented Innovations

In the last decade, the starch polymer arena has witnessed fundamental shifts propelled by technological breakthroughs, regulatory evolutions, and evolving consumer demands. Innovative chemistries enabling cross linking, esterified, and etherified starch derivatives have unlocked new performance thresholds, rendering these materials suitable for high-stress applications in adhesives, film extrusion, and composite formulations. Meanwhile, digital process controls and advanced compounding techniques have improved reproducibility and scalability, allowing manufacturers to experiment with novel formulations without jeopardizing operational efficiency.

On the regulatory front, tightening environmental standards in leading economies have placed pressure on petrochemical-based polymer producers, creating an opening for biopolymer alternatives. Sustainability mandates and extended producer responsibility policies have driven brands to seek feedstocks with minimal carbon footprints and enhanced end-of-life profiles. Consequently, starch polymers-particularly thermoplastic starch blends-have transitioned from niche bio-entries to mainstream contenders in sectors where biodegradability and recyclability are no longer optional.

Simultaneously, consumer preference for transparency and eco-friendly packaging has spurred brand owners to highlight biopolymer content on product labels, further intensifying demand. The convergence of regulatory incentives, consumer advocacy, and technological readiness has reshaped competitive dynamics, prompting incumbents and new entrants alike to forge collaborative partnerships and launch strategic joint ventures. As a result, the starch polymer landscape today is defined by a blend of rapid innovation cycles, heightened sustainability expectations, and increasingly complex supply chain integrations.

Analyzing the Ripple Effects of the 2025 United States Tariff Adjustments on Starch Polymer Supply Chains, Trade Dynamics, Cost Structures, and Industry Competitiveness

The implementation of new tariff structures by United States authorities in early 2025 has reverberated across starch polymer supply chains, influencing cost bases, sourcing strategies, and trade flows. Import duties targeting specific starch derivative categories have increased landed costs for raw materials, compelling manufacturers to reassess vendor agreements and explore alternative feedstock origins. This shift has put pressure on procurement teams to negotiate volume discounts or transition toward regions with more favorable trade relationships.

As import premiums rose, domestic producers found themselves in a stronger negotiating position, able to justify price improvements to end users. However, the cost pass-through effect has varied across applications: high-value adhesives and specialty films witnessed only modest price adjustments due to competitive pressures, while more commoditized uses in paper sizing and general packaging experienced steeper margin squeezes. In some instances, manufacturers have absorbed a portion of the tariff burden to maintain market share, triggering a reevaluation of product portfolios and pricing architectures.

Moreover, the cumulative impact of these tariffs has led to strategic relocation of production assets closer to feedstock sources in North America. Investments in local starch modification facilities have accelerated, enabling greater control over supply continuity and cost volatility. In parallel, research and development efforts are increasingly focused on hybrid formulations that blend native starches with other biopolymers to circumvent tariff classifications. Through these adaptive measures, industry players are navigating the new trade environment while safeguarding their competitive positioning in a fluctuating cost landscape.

Uncovering Deep Market Segmentation Insights Revealing How Type, Form, and Application Variations Influence Demand, Performance, and Strategic Positioning in Starch Polymers for Stakeholders

A granular examination of starch polymer market segmentation reveals how product type, form factor, and end-application intricacies dictate performance profiles and commercial potential. Within the type dimension, native starch maintains strong relevance in markets focused on biodegradability, whereas thermoplastic starch has gained traction as a direct replacement for conventional plastics in extrusion and injection molding processes. Modified starches-subcategorized into cross linked, esterified, and etherified variants-offer enhanced thermal resilience, water resistance, and mechanical strength, catering to demanding adhesives and packaging film applications.

Turning to physical attributes, form factor plays an equally critical role. Granular starch platforms deliver consistent flow properties and dosing accuracy, making them ideal for large-scale food and beverage formulations as well as paper treatments. Conversely, powdered starch provides rapid hydration and high surface area interaction, driving its adoption in cosmetic powders, pharmaceutical excipients, and pressure-sensitive adhesive systems. The choice between granules and powder often hinges on processing equipment compatibility and end-use performance requirements.

Application-specific segmentation further illuminates market trajectories. Within adhesives, hot melt systems leverage modified starches for robust bond strength, while water-based formulations exploit native and lightly modified variants for eco-sensitive packaging. Packaging film trends differentiate between blown and cast film processes, each demanding tailored starch compositions to balance clarity, strength, and biodegradability. In the pharmaceuticals and cosmetics arena, starch powders dominate as flow agents and binders in both tablets and loose formulations. Finally, sectors such as construction, textiles, and food and beverages continue to expand utilization, underlining the material’s versatility across diverse industrial ecosystems.

This comprehensive research report categorizes the Starch Polymer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

Highlighting Critical Regional Dynamics, Demand Drivers, and Growth Opportunities Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Starch Polymer Markets with Strategic Outlook

Regional dynamics in the starch polymer industry are shaped by distinct socio-economic drivers, policy landscapes, and infrastructure capabilities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, strong domestic agricultural production underpins a robust starch supply chain, enabling local manufacturers to capitalize on favorable raw material availability. Demand in this region is driven by the packaging sector’s pivot toward sustainable films and the adhesives market’s need for high-performance bonding agents.

Across Europe, Middle East & Africa, stringent regulatory frameworks and heightened environmental advocacy have elevated starch polymers’ profile as sustainable alternatives to traditional plastics. Manufacturers in this region are investing in advanced processing technologies to meet strict biodegradability and compostability standards, while collaborative platforms between industry consortia and research institutes facilitate innovation in modified starch chemistries. Policy incentives and green procurement mandates have therefore become catalysts for accelerated adoption.

In the Asia-Pacific region, burgeoning industrialization and expanding consumer markets have resulted in rapid year-on-year growth in end-use sectors, including textiles, construction, and food and beverages. Here, low-cost feedstock production, combined with increasing automation in processing facilities, supports competitive manufacturing of both native and modified starch polymers. Strategic government initiatives aimed at reducing plastic pollution have further bolstered demand, prompting leading players to establish local research centers and production capacities to serve a dynamic and high-volume market.

This comprehensive research report examines key regions that drive the evolution of the Starch Polymer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players’ Strategic Initiatives, Collaborative Partnerships, and Innovation Pipelines Driving Competitive Advantages in the Starch Polymer Sector

Leading companies in the starch polymer domain are distinguishing themselves through strategic investments in sustainable product lines, the formation of cross-sector partnerships, and the expansion of localized production footprints. Many top-tier manufacturers are channeling resources into next-generation modification platforms that reduce energy consumption and enable higher starch loading levels, thereby optimizing cost-to-performance ratios. This innovation focus extends to the development of proprietary biopolymer blends that combine starch with complementary natural polymers, addressing emerging needs for enhanced barrier properties and thermal stability.

Collaborative efforts with downstream customers have also become a key competitive lever. By embedding technical teams within customer R&D functions, forward-thinking starch polymer suppliers are accelerating time-to-market for novel applications in packaging films, textiles, and adhesives. In parallel, strategic joint ventures with regional starch millers and specialty chemical producers are facilitating the establishment of just-in-time supply networks, reducing lead times and mitigating tariff impacts.

A growing number of companies are also aligning their sustainability commitments with broader corporate environmental, social, and governance (ESG) objectives. This is reflected in the rollout of carbon labeling initiatives, investment in renewable energy for manufacturing sites, and participation in circular economy coalitions. By integrating sustainability into their core strategies, these enterprises are not only enhancing brand reputation but also unlocking preferential access to green procurement contracts and incentive programs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Starch Polymer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrana Beteiligungs-Aktiengesellschaft

- Angel Starch & Food Pvt. Ltd.

- Archer Daniels Midland Company

- AVEBE U.A.

- BASF SE

- Biome Bioplastics Limited

- Cargill, Incorporated

- Corbion N.V.

- Ingredion Incorporated

- Japan Corn Starch Co., Ltd.

- Mitsubishi Chemical Corporation

- Novamont S.p.A.

- Plantic Technologies Limited

- Rodenburg Biopolymers B.V.

- Roquette Frères S.A.

- Shree Ram Bio Starch Polymers Pvt. Ltd.

- Sukhjit Starch & Chemicals Ltd.

- Tate & Lyle PLC

- Tereos S.A.

- Universal Starch Chem Allied Ltd.

Presenting Targeted, Implementable Recommendations to Guide Industry Leaders Toward Sustainable Growth, Operational Efficiency, and Competitive Resilience in Starch Polymer Markets

Industry leaders aiming to capitalize on the evolving starch polymer landscape should prioritize a multifaceted approach that balances innovation, sustainability, and operational resilience. First, organizations must invest in feedstock diversification by exploring non-traditional starch sources and leveraging co-product streams from agricultural processing to mitigate raw material risks. Concurrently, strengthening R&D capabilities in advanced modification techniques, such as enzymatic cross linking and green esterification processes, will yield next-generation formulations with superior performance characteristics.

Moreover, establishing strategic alliances across the value chain-from starch producers to end-users-can unlock synergies in product development and supply chain optimization. These collaborations should be underpinned by data-driven insights, facilitated through digital platforms that enable real-time visibility into inventory levels, production schedules, and regulatory compliance status. In addition, embedding sustainability at the core of product roadmaps by pursuing certifications, participating in circular economy pilots, and aligning with evolving environmental legislation will be critical for differentiation.

Finally, companies should adopt agile pricing and portfolio management strategies to navigate cost volatility stemming from tariff changes and feedstock fluctuations. By employing scenario modeling and robust risk management frameworks, decision makers can anticipate market oscillations and calibrate their commercial approach. Through this holistic set of actions, industry stakeholders will be better positioned to drive profitable growth and maintain competitive resilience.

Describing a Robust, Multi-Phased Research Methodology Incorporating Qualitative and Quantitative Analyses to Deliver Comprehensive Insights on the Starch Polymer Industry

The research underpinning this analysis followed a rigorous, multi-phased methodology designed to ensure the depth and reliability of insights into the starch polymer industry. The initial phase involved extensive secondary research, encompassing trade journals, patent databases, and regulatory publications, to map out prevailing trends, emerging technologies, and policy developments. This groundwork was complemented by a series of primary interviews with key stakeholders, including manufacturing executives, formulation scientists, and supply chain managers, to validate hypotheses and uncover nuanced market dynamics.

Building on these qualitative inputs, the study employed quantitative techniques such as data triangulation, demand-supply mapping, and tariff impact analysis to quantify cost structures and trade flow shifts. Advanced statistical models were utilized to assess historical performance patterns and stress-test potential future scenarios under varying regulatory and economic conditions. In addition, a comprehensive competitive landscape assessment was conducted through company benchmarking, patent landscaping, and partnership analysis.

Throughout the process, stringent data validation protocols were applied to ensure accuracy and minimize bias. Insights were subject to peer review by an internal advisory panel of industry veterans, and all findings were cross-referenced with publicly available financial reports and sustainability disclosures. This methodological framework guarantees that the conclusions drawn are both robust and actionable for decision makers seeking to navigate the transforming starch polymer ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Starch Polymer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Starch Polymer Market, by Type

- Starch Polymer Market, by Form

- Starch Polymer Market, by Application

- Starch Polymer Market, by Region

- Starch Polymer Market, by Group

- Starch Polymer Market, by Country

- United States Starch Polymer Market

- China Starch Polymer Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Summarizing Key Takeaways, Strategic Imperatives, and Future Outlook Conclusions to Empower Decision Makers in the Evolving Starch Polymer Landscape

The evolving starch polymer landscape presents a confluence of opportunities and challenges that demand strategic foresight. Key takeaways highlight the material’s transition from basic commodity roles to engineered solutions that meet demanding performance specifications and sustainability criteria. As tariffs reshape supply chains, companies that proactively restructure their sourcing and production footprints will secure competitive advantages, while those embracing advanced modification techniques and form factor innovations will capture emerging application niches.

Strategic imperatives for decision makers include deepening collaboration across the ecosystem, embedding sustainability within product development roadmaps, and leveraging digital tools to gain real-time market intelligence. These actions will be instrumental in navigating cost volatility, regulatory shifts, and intensifying competition. Furthermore, monitoring regional dynamics-where varying policy frameworks and end-user requirements create differentiated growth pockets-will enable organizations to align investments with the most promising markets.

Looking ahead, stakeholders should maintain vigilance on breakthrough technologies such as bio-inspired cross linking and enzymatic processing pathways, as well as evolving consumer expectations around circularity and material transparency. By integrating these insights into corporate strategies, industry participants can position themselves at the forefront of the starch polymer sector, driving value creation and sustainable impact across global value chains.

Take Immediate Action to Secure Access to Detailed Starch Polymer Market Research Insights Direct from an Industry Sales and Marketing Authority

To explore the depths of this comprehensive market intelligence report and gain unparalleled clarity on global starch polymer trends, reach out today to Ketan Rohom, the Associate Director of Sales & Marketing. His deep expertise and consultative approach will ensure that your strategic questions are answered with precision and that you receive tailored guidance on navigating supply chain nuances, competitive landscapes, and emerging applications. By contacting Ketan, you will unlock exclusive access to detailed analyses, proprietary insights, and forward-looking scenarios designed to empower decision making across research and development, procurement, and commercial strategy functions. Whether you require a bespoke briefing, pricing details, or customized data extracts, his direct engagement will streamline the process of securing the full report and supporting materials that align with your business objectives. Take advantage of this opportunity to partner with an industry authority committed to delivering actionable intelligence that drives growth and innovation in the starch polymer domain. Your next strategic advantage in this evolving market begins with a conversation-initiate that dialogue with Ketan Rohom today.

- How big is the Starch Polymer Market?

- What is the Starch Polymer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?