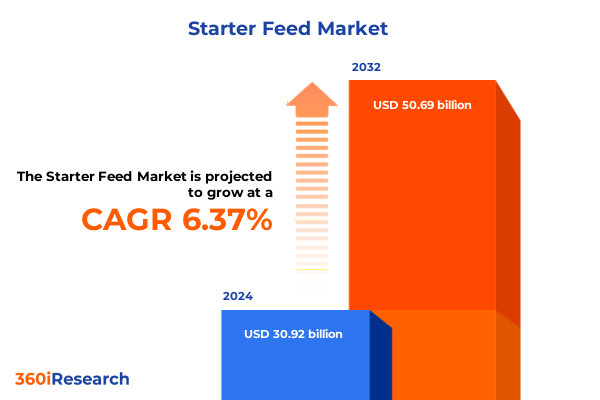

The Starter Feed Market size was estimated at USD 32.89 billion in 2025 and expected to reach USD 34.53 billion in 2026, at a CAGR of 6.37% to reach USD 50.69 billion by 2032.

Unlocking Strategic Insights into the Evolving Animal Feed Market Landscape Amid Trade Policy Shifts, Sustainability Imperatives and Innovation Trends

In an era defined by rapidly shifting trade policies and an escalating emphasis on sustainability, the animal feed market finds itself at a pivotal juncture. Evolving geopolitical dynamics, particularly in the United States, are reshaping import and export flows, compelling stakeholders to reassess historical sourcing routes. Meanwhile, consumer preferences are gravitating toward products that not only meet stringent quality standards but also promise traceability and ethical stewardship of natural resources. These twin forces of policy and preference are intersecting with accelerating innovation, driving breakthroughs in ingredient science and digital feed management techniques.

Against this backdrop, decision-makers must navigate a complex mosaic of regulatory adjustments, environmental imperatives, and cost pressures. The integration of precision nutrition platforms is enabling more accurate formulation that optimizes animal health while mitigating waste. Simultaneously, the race to adopt circular economy principles is catalyzing novel uses for by-products and alternative proteins. As the market landscape evolves, organizations that embrace agility and foresight will be best positioned to thrive. This introduction establishes the foundational context for understanding how strategic alignment with emerging trends can unlock new pathways to competitive advantage in the dynamic feed value chain.

Identifying Pivotal Transformations Driving Feed Industry Evolution Through Technological Breakthroughs, Regulatory Adjustments and Consumer Preference Realignment

Underpinning the market’s transformation are a set of converging trends that extend beyond traditional supply and demand metrics. Foremost among these is the rapid proliferation of digital platforms that facilitate real-time monitoring of feed performance and animal well-being. By leveraging sensors, data analytics, and predictive modeling, producers can adjust formulations on the fly to respond to herd health indicators and environmental variables. Concurrently, regulatory bodies have intensified scrutiny of feed ingredient purity and safety, elevating the importance of robust quality controls and transparent traceability across multi-tiered supply chains.

At the same time, consumer demands are exerting pressure on manufacturers to demonstrate environmental stewardship. This has sparked investment in low-carbon sourcing and lifecycle assessments that quantify ecological footprints. Advances in biotechnology have likewise unlocked alternative protein sources, reducing reliance on traditional cereal grains and oilseed meals. As a result, the feed ecosystem is witnessing a fundamental recalibration of value drivers, where operational efficiency and sustainability credentials hold equal weight. Navigating these transformative shifts requires a holistic approach that integrates technology adoption, regulatory compliance, and consumer-centric innovation to drive resilient growth.

Examining the Aggregate Consequences of 2025 US Tariff Adjustments on Feed Ingredient Sourcing, Cost Volatility and Cross-Border Trade Flows

The cumulative impact of the 2025 United States tariff adjustments has rippled through every facet of the animal feed market, altering long-standing procurement strategies and cost frameworks. Heightened duties on imported oilseed meals and cereals have driven market participants to seek alternative ingredient sources, often leveraging regional supply partners to mitigate price volatility. In turn, this has spurred a wave of domestic processing initiatives aimed at enhancing self-sufficiency, particularly in the Midwest where proximity to raw material producers reduces logistics costs. Nevertheless, these shifts have also introduced new bottlenecks, as local capacity struggles to keep pace with elevated demand for processed feed inputs.

Furthermore, the tariff landscape has challenged conventional distribution models, prompting greater reliance on inland storage facilities and inland rail networks to absorb surges in inventory. These operational adaptations have been accompanied by renegotiations of long-term contracts, with buyers pursuing more flexible terms to accommodate policy-driven uncertainties. Importantly, the tariff-driven cost increases have not been absorbed uniformly; end-user segments such as aquaculture and swine production, which traditionally rely on specialized formulations, have faced steeper margin pressure. Against this backdrop, transparent collaboration between ingredient suppliers and feed formulators has emerged as a critical enabler of supply chain resilience, ensuring that essential feed components remain accessible despite evolving trade constraints.

Deciphering Critical Differentiators in Feed Market Segmentation Across Animal Types, Feed Forms, Ingredient Profiles, Distribution Paths and Application Drivers

Dissecting the feed market through a multidimensional segmentation lens reveals nuanced opportunities and strategic inflection points. When considering animal types such as aquaculture, poultry, ruminants and swine, it becomes clear that each category exhibits distinct nutrient requirements and operational constraints, thereby influencing formulation complexity and sourcing preferences. Similarly, the physical form of feed-whether delivered as extruded feed, granules, liquid feed, mash or pellets-dictates handling logistics, storage protocols and in-barn dispensing methodologies, with implications for both manufacturing investments and end-user adoption.

Ingredient type further differentiates market dynamics. Core components like animal protein sources, cereals and grains, oilseed meals and plant-based protein concentrates form the nutritional backbone, while additives and supplements-including amino acids, enzymes, probiotics, prebiotics, vitamins and minerals-enable precise customization of nutrient profiles. Distribution channels, spanning offline wholesale networks and emerging online platforms, play a pivotal role in shaping buyer accessibility, with digital marketplaces gaining traction among smaller producers seeking direct procurement options. Finally, applications such as feed conversion optimization, growth promotion, gut health and digestion support and immune system enhancement underscore the evolving performance benchmarks that drive formulation innovation. By weaving these segmentation dimensions together, stakeholders can pinpoint high-value niches and tailor their strategic roadmaps accordingly.

This comprehensive research report categorizes the Starter Feed market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Form

- Ingredient Type

- Distribution Channel

- Applications

Unveiling Regional Market Nuances in the Americas, Europe, Middle East & Africa, and Asia-Pacific Highlighting Growth Catalysts and Risk Exposures

Regional dynamics are reshaping competitive positioning as stakeholders navigate disparate growth vectors and risk environments. In the Americas, robust livestock populations and a strong emphasis on value-added protein production have fueled investments in advanced feed technologies and integrated supply chain platforms. Conversely, Europe, the Middle East and Africa present a more complex tapestry of regulatory regimes and market maturity levels, with sustainability mandates driving adoption of low-carbon feed solutions while import dependence varies significantly by sub-region. In many EMEA markets, the confluence of stringent environmental directives and heightened consumer scrutiny has catalyzed a shift toward locally sourced ingredients and circular production models.

Across Asia-Pacific, rapid expansion of aquaculture and intensive poultry farming has generated significant demand for optimized feed formulations, prompting global ingredient suppliers to establish regional manufacturing footholds. Government incentives in key markets have accelerated the deployment of digital feed management systems, enabling producers to achieve higher conversion efficiencies amid resource constraints. As capital flows into these diverse geographies, understanding the interplay between policy landscapes, infrastructure readiness and cultural preferences proves essential for companies seeking to scale operations and mitigate exposure to regional headwinds.

This comprehensive research report examines key regions that drive the evolution of the Starter Feed market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leading Enterprises Shaping Feed Industry Innovation, Sustainability Progress and Strategic Partnership Models in a Competitive Environment

Leading enterprises are redefining competitive benchmarks through strategic partnerships, targeted M&A activity and intensive R&D pipelines. Industry stalwarts are directing capital toward sustainable feed technologies, integrating circular economy principles and leveraging advanced analytics to optimize end-to-end supply chain performance. Collaboration between multinational ingredient producers and local feed mill operators has emerged as a central theme, facilitating knowledge transfer and co-development of region-specific formulations. Meanwhile, innovative start-ups specializing in alternative proteins and precision nutrition are forging alliances with feed integrators to accelerate commercialization timelines.

Major players are also strengthening their market positions by investing in digital platforms that offer feed formulation as a service, delivering real-time insights on ingredient quality and cost drivers. This shift toward data-driven engagement not only deepens customer relationships but also enhances forecasting accuracy and operational agility. As consolidation continues to reshape the competitive landscape, the ability to align technical expertise with strategic partnership models will determine which organizations capture the lion’s share of emerging opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Starter Feed market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Al Kabeer Group

- Albers Animal Feed

- Aliphos Belgium NV

- Alltech Inc.

- Archer Daniels Midland Company

- Bagdad Feed Mills LLC

- Cargill Incorporated

- De Heus Animal Nutrition

- Hi-Pro Feeds

- Hubbard Feeds Inc.

- J. D. Heiskell & Co.

- Kapila Krishi Udyog Limited

- Kent Nutrition Group Inc.

- Masterfeeds Inc.

- Molesworth Feed Company

- New Life Mills

- Nutreco N.V.

- Purina Animal Nutrition LLC

- Ridley Corporation Limited

- Southern States Cooperative Inc.

Outlining Pragmatic Action Paths to Strengthen Supply Resilience, Optimize Cost Structures and Foster Collaborative Growth Across the Feed Ecosystem

Industry leaders should first prioritize diversification of their raw material portfolios, negotiating multi-source agreements to buffer against tariff-induced price swings and supply disruptions. Parallel to this, investing in localized processing and storage infrastructure will shorten lead times and reduce reliance on volatile international shipments. A strategic focus on digitalization, including implementation of integrated ERP systems and predictive analytics, will enable real-time decision-making that safeguards margins while improving feed efficiency. Moreover, forging horizontal collaborations with aligned stakeholders-such as co-ops, technology providers and logistics partners-can unlock economies of scale while fostering innovation ecosystems.

Concurrently, organizations must elevate their sustainability narratives by embedding circular practices into product development and supply chain operations. This entails exploring by-product valorization and enhancing traceability frameworks to satisfy evolving regulatory requirements and stakeholder expectations. Finally, adopting an agile contracting approach with flexible pricing structures and performance-based incentives will mitigate exposure to policy volatility and align incentives with end-user outcomes. By executing these actionable steps, industry leaders can strengthen downstream resilience, enhance value delivery and sustain growth amid an increasingly complex market environment.

Clarifying the Rigorous Research Framework Employed for Data Integrity, Triangulation and Expert Validation in Comprehensive Feed Market Analysis

This analysis is grounded in a rigorous, multi-tiered research design combining both primary and secondary methodologies to ensure data integrity and comprehensive coverage. Primary research included in-depth interviews with senior executives from leading ingredient suppliers, feed mill operators and end-user enterprises, facilitating direct insights into operational challenges and strategic imperatives. These qualitative findings were complemented by extensive secondary research, encompassing regulatory filings, trade data, scientific publications and public disclosures, thereby establishing a broad empirical foundation.

To validate and refine emerging themes, the research team employed data triangulation techniques, cross-referencing disparate information sources to eliminate inconsistencies. Expert panels comprising veterinary nutritionists, supply chain specialists and policy analysts provided iterative feedback, bolstering the robustness of key conclusions. Finally, advanced analytical tools were leveraged to model supply scenarios and sensitivity analyses, ensuring that the final deliverable offers both depth and fidelity. This meticulous approach underpins the credibility of the insights and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Starter Feed market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Starter Feed Market, by Animal Type

- Starter Feed Market, by Form

- Starter Feed Market, by Ingredient Type

- Starter Feed Market, by Distribution Channel

- Starter Feed Market, by Applications

- Starter Feed Market, by Region

- Starter Feed Market, by Group

- Starter Feed Market, by Country

- United States Starter Feed Market

- China Starter Feed Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Illuminate Strategic Industry Implications and Opportunity Areas for Stakeholders in an Evolving Feed Value Chain

In synthesizing the core findings, it becomes evident that the animal feed market in the United States is being redefined by a nexus of policy shifts, technological innovation and evolving stakeholder expectations. The 2025 tariff adjustments have prompted a recalibration of sourcing strategies, compelling market participants to embrace localized processing and collaborative supply chain models. Concurrently, the acceleration of digital feed management tools and the emergence of alternative protein ingredients are catalyzing new value propositions, reshaping how performance and sustainability are measured.

Moreover, segmentation insights underscore the importance of tailoring approaches to distinct animal types, feed forms and functional applications, enabling targeted solutions that address specific operational bottlenecks. Regional analysis highlights the divergent imperatives across the Americas, EMEA and Asia-Pacific, suggesting that a one-size-fits-all strategy is untenable in a fragmented landscape. Looking ahead, industry leaders who leverage data-driven decision-making, strategic partnerships and circular value chains will be best positioned to convert these transformative shifts into sustainable growth trajectories. This conclusion serves as the strategic compass for executives seeking to navigate an increasingly complex feed ecosystem.

Connect Directly with Our Associate Director to Secure Personalized Consultations and Exclusive Purchase Options for the Comprehensive Feed Market Intelligence Report

We invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored insights that align precisely with your strategic imperatives. By engaging in a personalized consultation, you will gain exclusive visibility into nuanced market dynamics, competitive positioning, and emerging supply chain considerations. This interaction will enable you to evaluate how the latest feed innovations and tariff shifts can be leveraged to reinforce your organizational resilience and capitalize on evolving consumer priorities. Seize the opportunity to secure your comprehensive feed market intelligence report, complete with actionable recommendations and deep-dive analysis, ensuring your leadership team is empowered to make data-driven decisions that drive sustainable growth and operational excellence.

- How big is the Starter Feed Market?

- What is the Starter Feed Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?