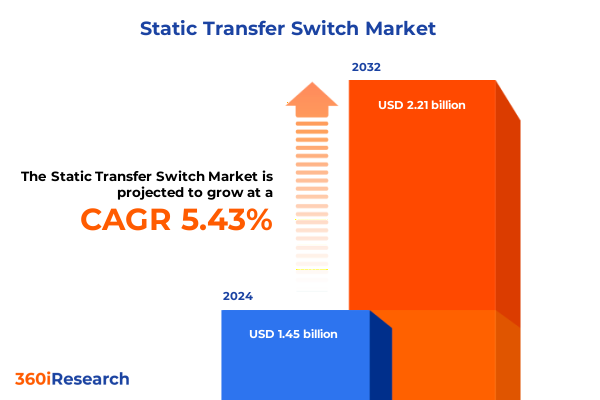

The Static Transfer Switch Market size was estimated at USD 1.48 billion in 2025 and expected to reach USD 1.56 billion in 2026, at a CAGR of 5.43% to reach USD 2.15 billion by 2032.

Understanding the Role and Evolution of Static Transfer Switches Within Modern Power Infrastructure and Their Emerging Strategic Importance

Static transfer switches (STS) have become indispensable components in modern electrical power systems, ensuring continuous and reliable power supply by seamlessly transferring loads between primary and secondary energy sources. As businesses and critical facilities demand ever-higher levels of uptime, these solid-state devices have evolved from basic two-source transfer mechanisms into intelligent platforms capable of real-time diagnostics and automated decision making. Transitioning from legacy mechanical systems, STS solutions now leverage advanced semiconductor architectures to achieve sub-cycle switching speeds, drastically reducing the risk of operational disruptions.

The importance of STS extends across multiple industries, from data centers safeguarding mission-critical servers to healthcare institutions powering life-saving medical equipment. Rapid digitalization, coupled with burgeoning renewable energy integration, has elevated the role of STS beyond mere standby switches into dynamic elements of energy management architectures. This section introduces the fundamentals of static transfer switch technology, outlines key functional principles, and highlights the growing strategic importance of failure-free automatic switching in today’s complex power ecosystems.

Examining the Disruptive Technological Advancements and Shifting Paradigms That Are Reshaping the Static Transfer Switch Market Landscape Worldwide

The landscape of static transfer switch technology is undergoing a profound transformation driven by breakthroughs in power electronics, data analytics, and connectivity. Emerging innovations in wide-bandgap semiconductors such as silicon carbide and gallium nitride have dramatically enhanced switch efficiency and thermal performance, enabling STS units to operate reliably at higher voltages and temperatures. Simultaneously, the integration of IoT sensors and cloud-based monitoring platforms has given rise to predictive maintenance capabilities. These digital mechanisms allow facility managers and service providers to anticipate component fatigue and schedule proactive interventions, thereby minimizing unplanned downtime.

Moreover, the convergence of STS with microgrid architectures is reshaping power distribution paradigms. Modern installations embed static transfer switches as critical nodes within hybrid systems, coordinating energy flows among solar, battery storage, and conventional generators. Coupled with AI-driven control algorithms, they facilitate seamless islanding and reconnection sequences in response to grid instabilities. As a result, power resilience has shifted from reactive manual protocols toward fully automated, self-healing networks. This shift underscores a broader industry trend: the fusion of hardware innovation and digital orchestration to deliver more robust, adaptable, and efficient power systems.

Assessing the Comprehensive Effects of Newly Implemented United States Tariffs in 2025 on Supply Chains Pricing Dynamics and Market Viability

In 2025, the United States implemented a new wave of tariffs targeting critical components and raw materials integral to static transfer switch production, including semiconductor substrates and specialty metal alloys. These measures have reverberated across the global supply chain, driving component costs upward and compelling STS manufacturers to reassess sourcing strategies. Many suppliers have accelerated efforts to localize production of key elements or diversify their procurement footprint to mitigate tariff risks.

The immediate consequence has been a recalibration of price structures, with end users in data centers and heavy industry observing notable increases in procurement budgets. To preserve margins, some manufacturers introduced value-engineered product tiers that blend core STS functionality with simplified diagnostic features. Meanwhile, the tariffs have catalyzed a broader push toward domestic capacity expansion. Several leading producers have announced plans to establish or enlarge manufacturing facilities in North America, aiming to circumvent import duties and strengthen regional resilience.

These developments underscore the need for stakeholders to monitor ongoing policy changes and adjust their strategic road maps accordingly. Organizations that engage early with domestic suppliers and explore collaborative ventures will be better positioned to navigate cost pressures while sustaining innovation investments. As tariff frameworks evolve, proactive supply chain management will remain a vital component of sustainable STS deployment.

Uncovering Segmentation Insights to Drive Strategic Decision Making Across Diverse Applications and Verticals Within the Static Transfer Switch Market

Deep dives into market segmentation reveal important distinctions across application sectors that influence product requirements and buying behaviors. In commercial settings such as hospitality venues, office complexes, and retail outlets, the priority tends toward compact STS designs with seamless integration into building management systems. These environments emphasize cost-effective reliability and aesthetic adaptability. Data center operators, whether in colocation facilities, enterprise-owned deployments, or hyperscale campuses, demand ultra-fast transfer times and advanced power quality management. The need for uninterrupted server uptime has spawned STS variants with multi-level redundancy and embedded EMS compatibility.

In healthcare applications spanning clinics, hospitals, and diagnostic laboratories, life safety considerations drive rigorous compliance with electrical standards, resulting in STS solutions that offer enhanced monitoring, alarm integration, and redundant control logic. Industrial users in automotive plants, manufacturing lines, and oil and gas operations favor robust, ruggedized switches capable of enduring harsh ambient conditions and electrical transients. Finally, telecom networks supporting satellite uplinks, wireless cell sites, and wireline exchanges rely on STS units engineered for remote site autonomy, often paired with renewable generation and battery energy storage to assure persistent connectivity during outages.

Understanding these nuanced application profiles enables manufacturers and system integrators to tailor product road maps, channel strategies, and value propositions that align with the distinct operational priorities of each vertical segment.

This comprehensive research report categorizes the Static Transfer Switch market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Phase

- Mounting Type

- Power Rating

- Application

- End-User

- Sales Channel

Harnessing Regional Market Intelligence to Reveal Strategic Opportunities and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific

Regional market dynamics for static transfer switches vary distinctly between the Americas, Europe Middle East Africa, and Asia Pacific, driven by differences in infrastructure maturity, regulatory frameworks, and investment patterns. In the Americas, the momentum is propelled by rapid data center development and revitalization of aging power grids. Significant capital expenditure in hyperscale facilities and renewable energy projects has amplified demand for STS solutions capable of supporting grid-interactive microgrids and distributed energy assets.

Across Europe Middle East Africa, stringent energy efficiency directives and decarbonization targets are accelerating the adoption of intelligent transfer switches that interface with demand response programs and smart grid platforms. Governments in this region have prioritized resilience in critical infrastructures such as hospitals and transportation hubs, leading to heightened procurement of advanced STS systems featuring predictive analytics and remote management.

In the Asia Pacific territory, expansive industrial growth in Southeast Asia and China’s ongoing investment in next-generation manufacturing underscore a strong appetite for high-reliability power switching. Telecom network densification and the emergence of edge data centers also fuel demand for compact, modular STS units. Simultaneously, Japan and South Korea place heightened emphasis on disaster resilience, driving the specification of robust, multilingual control interfaces and seismic-rated enclosures.

This comprehensive research report examines key regions that drive the evolution of the Static Transfer Switch market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Industry Players Propelling Advancement and Competitive Dynamics Within the Global Static Transfer Switch Sphere

The static transfer switch landscape is characterized by a roster of well-established global players alongside agile niche specialists. Leading power management conglomerates have expanded their STS portfolios through targeted acquisitions and internal R&D to offer end-to-end energy continuity solutions. Simultaneously, technology-driven startups are differentiating through software-defined switching architectures and embedded intelligence, aiming to capture high-growth pockets such as edge computing and renewable microgrids.

Major incumbents have focused on forging alliances with system integrators and cloud service providers to embed STS functionality within broader digital infrastructure offerings. This ecosystem approach has enabled them to deliver turnkey solutions that blend hardware, firmware, and cloud analytics under unified service agreements. Meanwhile, mid-tier regional suppliers leverage local manufacturing footprints and service networks to address tariff-induced supply chain frictions, emphasizing rapid lead times and customizable configurations.

Competitive dynamics are also being shaped by investments in cybersecurity hardening and open protocol support. As STS units transition into more connected roles within industrial IoT frameworks, vendors that demonstrate robust firmware update mechanisms, network segmentation capabilities, and third-party validation certifications are gaining a strategic edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Static Transfer Switch market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Legrand Group

- Delta Electronics, Inc.

- Emerson Electric Co.

- Schneider Electric SE

- Honeywell International Inc.

- Siemens AG

- Mitsubishi Electric Corporation

- Fuji Electric Co., Ltd.

- Eaton Corporation plc

- Cummins Inc.

- AEG Power Solutions B.V.

- BPC ENERGY LTD

- Cetronic Power Solutions Ltd

- General Electric Company

- GUANGZHOU NASN POWER CO., LTD.

- Hefei Shuyi Digital Power Co.,Ltd.

- L3Harris Technologies, Inc.

- LayerZero Power Systems, Inc.

- Piller UK Limited by Langley Holdings plc

- Riello Elettronica Group

- SINY NEW ENERGY CO., LTD

- SOCOMEC SAS

- Toshiba Corporation

- Vertiv Holdings Co.

- Wenzhou Modern Group Co., Ltd

- Zhejiang HIITIO New Energy Co., Ltd.

Targeted Strategic Recommendations to Empower Industry Leaders to Enhance Operational Efficiency and Resilience in the Transforming Static Transfer Switch Market

Industry leaders should prioritize the integration of predictive analytics and condition-based maintenance features into their STS offerings. By embedding IoT sensors and AI-driven diagnostic engines, organizations can achieve deeper visibility into switch health and optimize service schedules to reduce lifecycle costs. Concurrently, diversifying the supplier base through partnerships with regional manufacturers can mitigate tariff exposure and shorten delivery cycles, reinforcing supply chain resilience.

Collaboration with regulatory bodies and standards organizations is also essential to influence the evolution of grid interconnection guidelines and performance benchmarks. Active participation in working groups will enable companies to anticipate compliance shifts and shape interoperability requirements. Furthermore, focusing R&D on wide-bandgap semiconductor adoption can yield higher efficiency and smaller form factors, opening new markets within edge data centers and compact telecom shelters.

Lastly, embedding sustainability metrics within product development road maps will resonate with end users under growing environmental mandates. Designing recyclable enclosures, optimizing energy consumption profiles, and securing third-party ecolabel certifications will strengthen value propositions and help industry leaders capture emerging green procurement budgets.

Detailing Rigorous Research Methodology and Analytical Frameworks Underpinning Robust Data Collection and Insight in the Static Transfer Switch Market Analysis

This study leverages a multi-staged research methodology combining primary and secondary intelligence gathering. Initial desk research encompassed analysis of industry journals, technical whitepapers, patent filings, and regulatory publications to develop a comprehensive data foundation. This was complemented by in-depth interviews with engineers, facility managers, and procurement executives across key end-user verticals to validate functional requirements and purchasing criteria.

Quantitative insights were derived from a proprietary survey of STS buyers and specification calloffs, coupled with shipment data analysis from leading power equipment distributors. These datasets underwent rigorous triangulation with publicly available corporate filings and financial statements to ensure accuracy and consistency. Expert panel workshops convened domain specialists to challenge assumptions, refine segmentation frameworks, and stress-test scenario forecasts.

Finally, all findings were synthesized within structured analytical models to identify growth drivers, technology adoption curves, and risk vectors. This robust methodology underpins the reliability of the insights presented throughout the report and ensures that strategic recommendations are grounded in empirical evidence and market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Static Transfer Switch market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Static Transfer Switch Market, by Type

- Static Transfer Switch Market, by Phase

- Static Transfer Switch Market, by Mounting Type

- Static Transfer Switch Market, by Power Rating

- Static Transfer Switch Market, by Application

- Static Transfer Switch Market, by End-User

- Static Transfer Switch Market, by Sales Channel

- Static Transfer Switch Market, by Region

- Static Transfer Switch Market, by Group

- Static Transfer Switch Market, by Country

- United States Static Transfer Switch Market

- China Static Transfer Switch Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Conclusions to Illuminate Future Directions Opportunities and Challenges in the Static Transfer Switch Arena

The analysis reveals that static transfer switches are transitioning from passive components to intelligent linchpins of resilient power infrastructures. Technological advances in semiconductors and connectivity have expanded their role within microgrid orchestration and automated energy management systems. At the same time, evolving regulatory landscapes and tariff policies have reshaped supply chains and cost models, prompting a recalibration of sourcing strategies and product portfolios.

Segmentation insights show distinct application-driven requirements, from modular designs in commercial buildings to ultra-reliable configurations in data centers and ruggedized systems for industrial sites. Regional perspectives highlight divergent growth trajectories, with the Americas focused on hyperscale data centers, EMEA prioritizing grid efficiency and resilience programs, and Asia Pacific driven by industrial expansion and disaster-ready infrastructure.

Looking ahead, future opportunities will cluster around edge computing deployments, renewable microgrid integrations, and enhanced cybersecurity for connected STS units. Companies that harness predictive maintenance, embrace sustainable design practices, and cultivate collaborative ecosystems with utilities and technology partners will emerge as market leaders. The static transfer switch arena is poised for continued innovation, and stakeholders who act strategically today will secure a decisive advantage tomorrow.

Driving Strategic Engagement With Ketan Rohom Associate Director Sales and Marketing to Unlock the Strategic Value of the Static Transfer Switch Market Report

Driving strategic engagement with Ketan Rohom Associate Director Sales and Marketing to unlock the strategic value of the Static Transfer Switch Market Report will give your organization a competitive advantage. By reaching out directly, you can tailor a comprehensive briefing that aligns precisely with your business objectives and technology road map. Ketan Rohom brings deep domain expertise in power reliability solutions, enabling him to guide you through the report’s rich insights on emerging applications and advanced supplier strategies.

Through this personalized engagement, you will gain exclusive access to detailed market intelligence on transformational technology trends, supplier innovations, and tariff impacts specific to 2025 and beyond. You can leverage his guidance to develop procurement strategies, identify high-potential partnerships, and assess regional growth hotspots. Engaging with Ketan Rohom ensures a seamless procurement process and provides ongoing support to maximize your return on investment in this critical research.

Act now to secure your copy of the Static Transfer Switch Market Report and begin a dialogue with Ketan Rohom. Harness the full spectrum of data-driven insights to accelerate your organization’s operational resilience, optimize supplier negotiations, and drive long-term value creation. Contact Ketan today to schedule a customized consultation and take the first step toward informed, strategic decision making.

- How big is the Static Transfer Switch Market?

- What is the Static Transfer Switch Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?