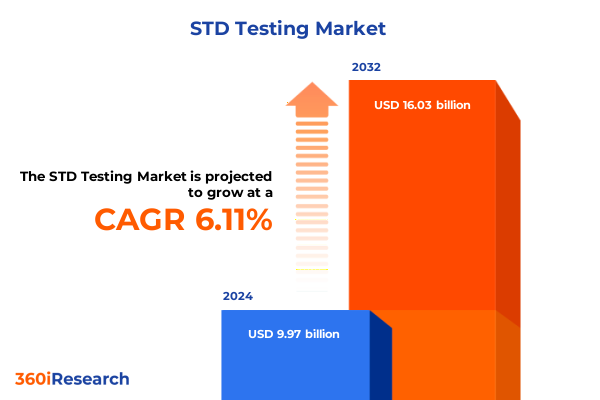

The STD Testing Market size was estimated at USD 10.58 billion in 2025 and expected to reach USD 11.22 billion in 2026, at a CAGR of 6.12% to reach USD 16.03 billion by 2032.

Rising Prevalence and Evolving Diagnostic Needs in the US STD Testing Landscape Demand Strategic Innovation and Collaboration

The United States continues to confront a pressing public health challenge as sexually transmitted infections (STIs) remain persistently prevalent despite recent declines in select diseases. In 2023, the Centers for Disease Control and Prevention (CDC) recorded over 2.4 million combined cases of chlamydia, gonorrhea, and syphilis, underscoring the need for robust diagnostic and surveillance capabilities. These figures, while reflecting a slight 1.8% decrease from the previous year, still represent unacceptably high transmission rates that demand ongoing attention and resource allocation.

Breakthrough Molecular Technologies and Digital Health Platforms Are Reshaping STD Diagnostics and Care Pathways Nationwide

Innovations in molecular and digital diagnostics are rapidly transforming how healthcare systems and patients approach STI screening and treatment. Molecular point-of-care (mPOC) platforms now deliver gold-standard nucleic acid amplification tests outside centralized laboratories, enabling same-visit diagnosis that accelerates treatment decision-making and reduces loss to follow-up. Meanwhile, over-the-counter molecular assays have begun to democratize access, empowering individuals to self-collect samples and obtain results in the privacy of their homes. These advancements are particularly consequential in addressing antimicrobial resistance, such as the growing threat posed by resistant Neisseria gonorrhoeae strains, by facilitating targeted therapy and avoiding broad-spectrum antibiotic misuse.

Recent United States Tariff Expansions Have Strained Global Supply Chains and Elevated Costs Across the STD Testing Diagnostics Market

Trade policy has emerged as a critical factor influencing test availability and pricing, as renewed U.S. tariffs on imported medical devices create cost pressures across the diagnostics supply chain. In July 2025, GlobalData noted that proposed Section 301 duties on Class I and II medical devices, including diagnostic instruments and reagents sourced from China, are poised to disrupt established procurement strategies and compel manufacturers to reassess sourcing models. Concurrently, reciprocal levies on EU imports threaten key components used in assay production, prompting leading firms such as Zimmer Biomet to forecast multimillion-dollar profit reductions due to tariff-related cost increases.

Diverse Diagnostic Modalities and User Profiles Underscore the Complexity and Opportunity in the Evolving STD Testing Market Segmentation Landscape

A nuanced segmentation framework reveals the multifaceted nature of the STD testing ecosystem. Diagnostic modalities span from traditional culture tests, which rely on agar and cell culture techniques, to rapidly evolving molecular methods such as polymerase chain reaction (PCR) and isothermal amplification. Rapid immunoassays, whether lateral flow or point-of-care fluorescence readers, have gained traction for their speed, while serology-based enzyme immunoassays provide crucial insights into historical exposure. Equally important, end users range from high-throughput reference laboratories to decentralized point-of-care sites and hospital systems, each demanding tailored workflows and service models. Product portfolios integrate instruments, test kits, and value-added software and services that support data integration, result interpretation, and compliance with regulatory standards.

This comprehensive research report categorizes the STD Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Product

- Technology

- Disease Type

- Sample Type

- End User

- Distribution Channel

Contrasting Regional Dynamics in STD Testing Highlight How Market Drivers Vary Significantly Across Americas, EMEA, and Asia-Pacific Territories

Regional dynamics shape both the clinical burden and market response to STIs. In the Americas, robust laboratory infrastructure coexists with persistently high syphilis and chlamydia rates, driving investments in decentralized molecular platforms and expansion of telehealth-enabled testing programs. Across Europe, the Middle East, and Africa, diverse regulatory frameworks under the EU In Vitro Diagnostic Regulation and national health systems influence test adoption and reimbursement models, while rising congenital syphilis rates in select European nations highlight ongoing screening gaps. Meanwhile, the Asia-Pacific region confronts a large undiagnosed population, particularly in rural and low-resource settings, spurring the development of cost-sensitive point-of-care assays and public–private partnerships to extend reach via community clinics and mobile health units.

This comprehensive research report examines key regions that drive the evolution of the STD Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Product Diversification by Leading Diagnostics Companies Accelerates Adoption of Next-Generation STD Testing Solutions

Industry leaders are driving rapid innovation to meet growing demand for accurate, timely detection. Roche’s cobas® liat system recently secured FDA 510(k) clearance and a CLIA waiver for multiplex assays detecting chlamydia, gonorrhea, and Mycoplasma genitalium, enabling results in under 20 minutes at point-of-care settings and exemplifying a test-to-treat paradigm. Abbott’s Simpli COLLECT self-collection kit further extends accessibility, combining at-home sampling with centralized molecular analysis to enhance patient convenience and lab throughput. Becton Dickinson is advancing its BD Elience point-of-care molecular platform through clinical trials, aiming to bring rapid CT/NG detection into urgent care and retail clinics, while Hologic continues to expand its Aptima series on the Panther system, maintaining leadership in high-sensitivity molecular assays.

This comprehensive research report delivers an in-depth overview of the principal market players in the STD Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Access Medical Laboratories Inc.

- ARCpoint Labs

- Becton Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche AG

- Hologic, Inc.

- Laboratory Corporation of America Holdings

- OraSure Technologies, Inc.

- Quest Diagnostics Incorporated

- Quidel Corporation

Collaborative Supply Chain Management and Digital Integration Are Imperative for Sustained Growth and Equitable STD Testing Access

Industry stakeholders should prioritize collaborative initiatives to safeguard supply chains and maintain price stability. Engaging with policymakers to secure exemptions for critical diagnostic components under Section 301 tariffs can mitigate short-term cost impacts while supporting retooling investments for domestic production. Providers and manufacturers must also invest in integrated digital health solutions that link electronic health records with POCT devices, improving test utilization insights and fostering adherence to treatment protocols. Furthermore, expanding community-based and telehealth-driven screening programs will be essential to reach underserved populations, reduce stigma, and enhance equitable access. By forming cross-sector consortia with public health agencies, payers, and patient advocacy groups, leaders can drive standardization of test performance metrics and accelerate adoption of innovative assays.

Methodology Integrating Public Health Surveillance, Regulatory Filings, Industry Statements, and Expert Interviews Ensures Comprehensive and Validated Insights

This analysis synthesized data from multiple reputable sources, beginning with secondary research of CDC national surveillance reports and WHO global and regional incidence estimates to anchor epidemiological context and identify priority areas. An extensive review of regulatory filings, FDA 510(k) notices, and CLIA waiver approvals provided current insights into test authorizations and performance criteria. Trade association communications, including statements from MGMA and AdvaMed, informed assessment of tariff implications and supply chain vulnerabilities. Primary research included structured interviews with laboratory directors, infectious disease specialists, and procurement managers to validate emerging trends and capture real-world implementation challenges. Data were triangulated through expert panel discussions, ensuring methodological rigor, and findings were reviewed by industry veterans to confirm accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our STD Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- STD Testing Market, by Test Type

- STD Testing Market, by Product

- STD Testing Market, by Technology

- STD Testing Market, by Disease Type

- STD Testing Market, by Sample Type

- STD Testing Market, by End User

- STD Testing Market, by Distribution Channel

- STD Testing Market, by Region

- STD Testing Market, by Group

- STD Testing Market, by Country

- United States STD Testing Market

- China STD Testing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Synthesizing Epidemiological Urgency, Technological Advancements, and Policy Dynamics Underlines the Strategic Path Forward for STD Testing Stakeholders

The confluence of rising STI incidence, transformative diagnostic technologies, and evolving trade policies presents both challenges and opportunities for market participants. Persistent public health needs, underscored by over two million annual cases in the United States alone, demand continued expansion of rapid, sensitive, and accessible testing solutions. Molecular point-of-care and home-based assays are poised to redefine care pathways, while tariff-induced cost pressures necessitate proactive supply chain strategies. Segmentation analysis highlights the importance of tailoring offerings across diverse test types, end-user settings, and regional nuances. Leading companies are well-positioned to capture growth through strategic product portfolios, regulatory agility, and digital health integration. Stakeholders who embrace collaborative frameworks and data-driven decision-making will be best equipped to improve patient outcomes and achieve sustainable market expansion in this critical healthcare domain.

Unlock Exclusive STD Testing Market Insights and Strategic Guidance by Connecting with Ketan Rohom at 360iResearch

To explore the comprehensive findings, unparalleled market insights, and strategic frameworks detailed in this report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engaging directly with Ketan will grant your team access to tailored briefings, customized data sets, and expert guidance to ensure you leverage these insights for maximum impact. Whether you represent diagnostics manufacturers, healthcare providers, or investment stakeholders, this collaboration will empower your organization to navigate regulatory changes, optimize supply chain strategies, and capitalize on emerging opportunities in the U.S. STD testing market. Secure your competitive advantage today by partnering with Ketan Rohom to obtain the full market research report and unlock actionable intelligence that drives growth and innovation.

- How big is the STD Testing Market?

- What is the STD Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?