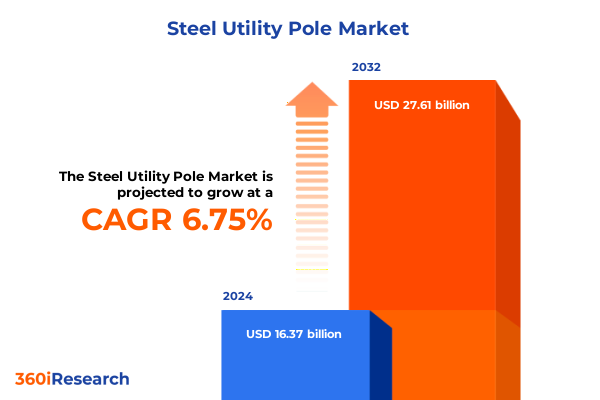

The Steel Utility Pole Market size was estimated at USD 17.40 billion in 2025 and expected to reach USD 18.52 billion in 2026, at a CAGR of 6.81% to reach USD 27.61 billion by 2032.

Unveiling the Strategic Foundations of the Steel Utility Pole Sector Amidst Evolving Infrastructure and Grid Modernization Demands

The steel utility pole sector has emerged as a cornerstone of modern energy and communications infrastructure, driven by unprecedented demand for reliable transmission and distribution networks. As electrification progresses and telecommunications expand to support next-generation connectivity, robust pole structures have become vital to ensuring system resilience and performance. From supporting high-voltage lines that traverse vast distances to anchoring cellular and broadband equipment, steel poles offer durability that meets stringent engineering standards.

In the United States, recent federal initiatives and private investments have catalyzed grid modernization efforts, resulting in a notable rise in capital allocations for transmission and distribution upgrades. According to the American Society of Civil Engineers, U.S. utilities combined to invest $27.7 billion in transmission and $50.9 billion in distribution infrastructure in 2023, up from $20 billion and $44.5 billion respectively the prior year. Complementing this, a Reuters analysis highlights that the surge in data center and renewable energy project demand has spurred substantial commitments to enhance grid capacity through 2028, driving an annual near-term electricity demand increase of approximately 3%.

Amidst this backdrop, steel utility poles have witnessed growing adoption as a sustainable alternative to traditional materials. Life cycle assessments by industry bodies reveal that galvanized steel poles outlast wood counterparts by decades, reduce greenhouse gas emissions, and eliminate hazards associated with chemical treatments. This introduction sets the stage for a deeper exploration of transformative shifts, policy impacts, segmentation dynamics, and strategic actions shaping the steel utility pole market.

How Cutting-Edge Manufacturing Innovations Coupled with Sustainability Imperatives Are Reshaping Steel Utility Pole Design and Deployment

Advancements in manufacturing technologies and evolving sustainability requirements are fundamentally reshaping steel utility pole production and deployment. Automated fabrication lines, powered by robotic welding systems and digital process controls, have enhanced precision and throughput, enabling manufacturers to deliver complex tapered and H-frame structures with greater consistency. Furthermore, developments in computational modeling have facilitated the refinement of pole geometries through digital twins and finite element analysis, resulting in optimized structural performance under varied environmental loads.

Parallel to technological progress, regulatory emphasis on environmental stewardship has catalyzed the adoption of corrosion-resistant alloy steels and weathering steel compositions. Heavy-duty Corten steel solutions, which form self-protecting patina layers that eliminate the need for galvanizing or painting, have gained traction for their lower embedded CO₂ and reduced maintenance requirements. Utilities in wildfire-prone regions such as California are increasingly specifying fire-resistant steel lattice designs in lieu of wooden poles, reflecting heightened resilience expectations after costly liabilities from prior severe weather events.

Moreover, the convergence of smart grid integration and pole infrastructure has led to the embedding of sensors and communications gateways within pole assemblies. These enhancements support real-time line rating, remote condition monitoring, and dynamic loading assessments, enabling utilities to deploy predictive maintenance regimes and improve asset utilization. As these transformative shifts converge, they are redefining the landscape of steel utility poles, ushering in a new era of high-performance, sustainable, and data-driven infrastructure.

Assessing the Broad Repercussions of Restored Section 232 Tariffs on Steel Utility Pole Supply Chains and Cost Structures

The reinstatement of comprehensive Section 232 tariffs on steel imports in March 2025 has introduced new cost considerations across the steel utility pole supply chain. By terminating country exemptions and ending the product exclusion process, the additional ad valorem duties have effectively applied a uniform 25% tariff on steel articles from all trading partners, including Canada, the European Union, and key Asian exporters. This policy action aims to fortify domestic steel production capacity by discouraging transshipment practices and stabilizing price dynamics for foundational inputs.

In practice, the tariff adjustments have prompted manufacturers to reassess procurement strategies and source more steel from U.S.-based mills or tariff-exempt suppliers. Consequently, production lead times for galvanized and weathering steel poles have experienced upward pressure, requiring design and construction teams to factor in extended material delivery schedules. Moreover, domestic steel producers have responded by expanding hot-dip galvanizing capabilities and increasing investment in electric arc furnace technology to meet surging demand for corrosion-protected tubular and tapered pole sections.

Despite these supply chain realignments, industry stakeholders note that the higher effective cost basis for imported steel has incentivized long-term partnerships with domestic suppliers, fostering greater transparency and resilience. Project stakeholders have leveraged bilateral volume agreements and just-in-time inventory models to mitigate short-term cost volatility. As a result, while the immediate impact has been felt through elevated input expenses, the cumulative effect may yield a more robust domestic manufacturing ecosystem for steel utility poles in the years ahead.

Dissecting Segment-Specific Performance: Type, Material, Height, Application, and End User Dimensions That Drive Steel Utility Pole Dynamics

Analyses of segment-specific performance reveal notable distinctions when viewing the steel utility pole arena through various lenses. When examining the market by type, rolled steel joints demonstrate a strong preference in applications requiring compact splice solutions, whereas tubular poles dominate in high-voltage transmission due to their superior bending resilience and uniform load distribution. In material type distinctions, galvanic protection remains critical, driving considerable uptake of galvanized steel, while corrosion-resistant alloys gain prominence in coastal and industrial environments and weathering steel offers a low-maintenance alternative in inland deployments.

Height classifications further elucidate operational dynamics; poles ranging from 30 to 60 feet are the workhorses of urban distribution, balancing ease of installation with adequate clearances, while the 60 to 120 foot range serves both subtransmission and long-span rural distribution corridors. Above 120 foot structures, often reserved for transmission voltage classes or specialized telecommunication towers, require rigorous engineering protocols and expansive logistics, reflecting their bespoke nature. Beyond structural parameters, applications bifurcate demand drivers: electricity transmission and distribution constitute the longstanding core, while lighting and telecommunication networks increasingly leverage steel poles for integrated small cell and fiber deployments.

Finally, distinctions by end user highlight divergent procurement motivations: electric utility companies prioritize reliability and lifecycle maintenance costs, government and municipal agencies emphasize aesthetic considerations and safety standards in populated areas, and telecommunication providers focus on modularity and rapid deployment to support network densification. These segmentation insights underscore the nuanced requirements across use cases and provide a framework for tailoring offerings to specialized customer cohorts.

This comprehensive research report categorizes the Steel Utility Pole market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material Type

- Height

- Application

- End User

Unearthing Distinct Regional Trajectories Across the Americas Europe Middle East & Africa and Asia-Pacific for Steel Utility Pole Adoption

Regional adoption of steel utility poles exhibits pronounced variations across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, an emphasis on grid hardening has accelerated replacement of aging wooden distribution infrastructure with galvanized and weathering steel poles, driven by policy incentives embedded in the Infrastructure Investment and Jobs Act and wildfire mitigation mandates in western U.S. states. North American manufacturers have scaled up production capacities to serve cross-border trade, supported by tariff-induced onshoring of key components.

Across Europe Middle East & Africa, regulatory frameworks such as the EU’s Construction Products Regulation have heightened demand for CE-marked poles that satisfy fire resistance and recyclability criteria. Utilities in the Middle East pursue corrosion-resistant alloys to withstand desert environments, while North African markets explore telescopic weathering steel poles for 380 kV lines traversing sensitive ecological zones. Concurrently, African electrification initiatives are integrating pre-engineered tubular poles for rural grid extensions, aligning with international funding programs.

In the Asia-Pacific, rapid urbanization and 5G rollout imperatives have elevated steel monopoles for telecommunications, with Japan enforcing seismic resilience requirements and coastal states in India specifying heavy-gauge hot-dip galvanizing beyond 600 g/m². Australia’s stringent wind load codes have prompted hybrid steel-concrete designs for enhanced service life. These regional dynamics illustrate how localized regulations, environmental factors, and infrastructure priorities shape the steel utility pole landscape, necessitating differentiated strategies for manufacturers and end users alike.

This comprehensive research report examines key regions that drive the evolution of the Steel Utility Pole market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing Leading Innovators and Strategic Moves of Defining Steel Utility Pole Manufacturers in North America and Beyond

Leading entities in the steel utility pole domain have distinguished themselves through vertical integration, sustainable innovation, and strategic capacity expansions. Valmont Industries, for example, recently opened a Bristol, Indiana facility that leverages an eco-concrete mix incorporating steel slag to reduce CO₂ emissions by an estimated 400 tons annually, while powering operations with a 900,000 kWh solar array designed to offset 100% of onsite energy demand. This initiative underscores Valmont’s commitment to net-zero ambitions and reinforces its position as a pioneer in combining steel and concrete structural solutions.

Similarly, Sabre Industries has established itself as a full-service provider of engineered tubular steel poles through a network of 31 U.S. manufacturing and galvanizing facilities, bolstered by in-house testing capabilities from its Sabre/Brametal joint venture. The company’s production capacity of over 100,000 tons annually, AISC and ISO 9001 certifications, and rapid‐delivery offerings for both power distribution and 5G networks demonstrate how scale and precision engineering can meet diverse end-user requirements.

Hubbell Power Systems, a key player in power grid hardware, has also intensified its focus on steel pole applications amid surging demand for grid upgrades. The company reported an 11% rise in utility segment sales driven by transmission and distribution hardware sales, reflecting its ability to capture opportunities in modernizing energy infrastructure. In aggregate, these organizations exemplify the strategic maneuvers-ranging from sustainability investments to expanded galvanizing capacity and robust testing frameworks-that define competitiveness in the steel utility pole marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Steel Utility Pole market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Al Babtain Group

- ArcelorMittal S.A.

- Arcosa, Inc.

- Browning Enterprise, Inc.

- Changshu Fengfan Power Equipment Co., Ltd.

- Elsewedy Electric Company

- FUCHS Europoles GmbH

- Hill & Smith Holdings PLC

- Ignite Electronics

- India Electric Poles Manufacturing Co.

- Jiangsu Hongguang Steel Pole Co., Ltd.

- JIANGSU XINJINLEI STEEL INDUSTRY CO.,LTD

- JSW Steel Limited

- KEC International Limited

- Nello Corporation

- Nippon Steel Corporation

- Nova Pole International Inc.

- Nucor Corporation

- Omega Company

- Pelco Structural

- PMF Steel Poles

- Qingdao Megatro Mechanical and Electrical Equipment Co., Ltd.

- Qingdao Wuxiao Group Co.,Ltd.

- Ramboll Group A/S

- RS Technologies Inc.

- Sabre Industries, Inc.

- Skipper Limited

- Steel Dynamics, Inc.

- TAPP

- Techno Pole Industries

- Utkarsh India Limited

- Valmont Industries, Inc.

- Wisconsin Lighting Lab, Inc.

- Xenel

- Yixing Futao Metal Structural Unit Co. Ltd.

- Yoshimoto Pole Co., Ltd.

- Zhejiang Debao Tower Manufacturing Co.,Ltd.

Strategic Imperatives and Operational Best Practices for Industry Leaders to Navigate Shifting Dynamics in the Steel Utility Pole Sector

To thrive amidst evolving regulatory, material, and policy landscapes, industry leaders should solidify collaborative partnerships with domestic steel producers to secure preferential supply agreements that buffer against tariff-induced cost fluctuations. By jointly investing in corrosion-protection advancements-such as dual‐coating systems or novel alloy formulations-manufacturers can deliver differentiated pole solutions that align with municipality aesthetic guidelines and durability benchmarks.

In parallel, executives should prioritize integrated digitalization roadmaps that embed sensor networks within pole systems, enabling real-time asset health insights and condition-based maintenance planning. Leveraging these capabilities will reduce unplanned outages, optimize inspection cycles, and enhance life cycle cost outcomes. Furthermore, firms can capitalize on emerging funding streams, including grid resilience grants and clean energy tax credits, to underwrite facility upgrades and deploy sustainable manufacturing technologies that reduce the carbon footprint of steel pole production.

Finally, market participants are advised to adopt a regionally tailored approach by aligning product portfolios with localized standards-such as CE marking in Europe, seismic compliance in Japan, and fire-resistant certifications in North America-and by collaborating with engineering consultancies to co-develop turnkey infrastructure packages. These strategic imperatives will position leaders to navigate competitive pressures, regulatory shifts, and customer expectations in 2025 and beyond.

Detailing the Rigorous Analytical Framework Data Sources and Qualitative-Quantitative Techniques Underpinning This Steel Utility Pole Analysis

This analysis combines qualitative expert interviews, primary stakeholder surveys, and secondary data aggregation to ensure a comprehensive approach to evaluating the steel utility pole landscape. Experts from leading utility operators, pole fabricators, and regulatory agencies provided insights into material selection criteria, supply chain bottlenecks, and emerging performance requirements. These perspectives were synthesized with survey responses from over sixty end users representing electric utilities, municipal split- shed agencies, and telecommunications providers to capture decision drivers and procurement patterns.

On the quantitative side, tariff schedules, import-export statistics, and domestic production volumes were sourced from official government releases and trade databases. Policy documents, including the February 2025 presidential proclamations on Section 232 adjustments, were reviewed to assess the evolving tariff environment and its operational ramifications. Regional infrastructure investment data were drawn from the U.S. Department of Energy, American Society for Civil Engineers, and similar bodies in Europe and Asia-Pacific.

Finally, advanced data visualization techniques were employed to correlate material-type adoption with regional regulatory frameworks, while scenario analysis explored the supply chain impacts of tariff permutations. This hybrid research methodology ensures that findings are grounded in rigorous empirical evidence and reflect the multifaceted nature of the steel utility pole market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Steel Utility Pole market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Steel Utility Pole Market, by Type

- Steel Utility Pole Market, by Material Type

- Steel Utility Pole Market, by Height

- Steel Utility Pole Market, by Application

- Steel Utility Pole Market, by End User

- Steel Utility Pole Market, by Region

- Steel Utility Pole Market, by Group

- Steel Utility Pole Market, by Country

- United States Steel Utility Pole Market

- China Steel Utility Pole Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Critical Takeaways and a Forward-Looking Perspective for Stakeholders in the Steel Utility Pole Ecosystem

In summary, the steel utility pole sector stands at an inflection point characterized by robust infrastructural investments, heightened sustainability expectations, and intricate policy influences. The confluence of advanced manufacturing technologies and eco-conscious material innovations is fostering unprecedented resilience and performance standards across transmission, distribution, lighting, and telecommunications applications.

The reinstatement of comprehensive steel tariffs has underscored the importance of domestic supply chain resilience, prompting strategic alignments that mitigate cost volatility while nurturing onshore capacity. Concurrently, segmentation analyses reveal that tailored solutions across type, material composition, height class, application, and end user imperatives are critical to capturing nuanced demand signals and delivering fit-for-purpose offerings.

Looking ahead, stakeholders who embrace data-driven asset management practices, secure collaborative partnerships with integrated steel producers, and navigate localized regulatory frameworks will unlock competitive advantage in this evolving landscape. These conclusions underscore the strategic necessity of aligning operational priorities with the transformative trends, policy dynamics, and segmentation insights outlined in this executive summary.

Connect with Ketan Rohom to Unlock Comprehensive Steel Utility Pole Market Research and Drive Informed Strategic Decisions

Elevate your strategic positioning in the dynamic steel utility pole sector by securing access to the full market research report through Associate Director Ketan Rohom. With deep expertise in infrastructure markets, he can guide you to insights that empower decision-making on material selection, supplier partnerships, and regulatory navigation. Reach out to engage in a one-on-one consultation that will propel your organization’s growth, enhance your competitive intelligence, and align your long-term capital planning with industry-leading data and analysis. Act now to transform market intelligence into actionable strategy and secure your copy today

- How big is the Steel Utility Pole Market?

- What is the Steel Utility Pole Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?