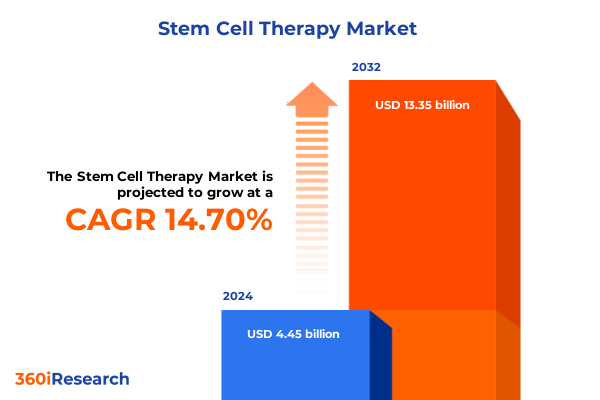

The Stem Cell Therapy Market size was estimated at USD 5.08 billion in 2025 and expected to reach USD 5.79 billion in 2026, at a CAGR of 14.79% to reach USD 13.35 billion by 2032.

Exploring the Rapid Evolution of Stem Cell Therapy as Clinical Trials Surge and Novel Biotechnologies Transform Regenerative Medicine

The field of stem cell therapy has undergone remarkable transformation over the past decade, emerging from theoretical models to practical clinical applications. As of early 2025, more than 4,700 registered clinical trials are investigating the therapeutic utility of diverse stem cell platforms, with 116 ongoing trials exploring 83 human pluripotent stem cell–derived products worldwide. These efforts span ophthalmological conditions such as age-related macular degeneration, neurological disorders including Parkinson’s disease and spinal cord injury, and immuno-oncology protocols integrating stem cell–based immunotherapies into cancer treatment regimens. In parallel, over 1,200 patients have received hPSC-based therapies, demonstrating encouraging safety profiles and setting the stage for broader adoption across specialty centers.

Unprecedented Technological and Regulatory Milestones Are Redefining the Future of Stem Cell Therapy in Regenerative Healthcare Paradigms

Parallel to the clinical expansion, pivotal technological and regulatory advancements are redefining the landscape of regenerative healthcare. The FDA’s December 2023 approvals of Lyfgenia and Casgevy for sickle cell disease marked the first applications of CRISPR/Cas9 genome editing in an approved therapy, underscoring the marriage of precision gene editing with cell therapy platforms. This regulatory milestone has catalyzed an unprecedented level of collaboration between therapeutic developers and agencies; international regulators are sharing frameworks and harmonizing guidelines to accelerate approvals in rare diseases and oncology indications.

Assessing How Comprehensive 2025 Trade Tariffs on Pharmaceuticals and Biotech Inputs Are Shaping the Economics of Stem Cell Therapies in the US

In 2025, the United States has enacted a series of trade measures that bear significant implications for the economics of cell therapy development. Tariffs of 20–25% on active pharmaceutical ingredients and key drug intermediates sourced from China and India have driven up the cost of producing growth factors, viral vectors, and media formulations essential to ex vivo expansion protocols. Simultaneously, a 15% levy on medical packaging, lab consumables, and single-use bioprocessing equipment has introduced new budgetary pressures on clinical site operations. Furthermore, a 25% duty on imported pharmaceutical machinery-from fluid bed dryers to lyophilizers-has slowed the procurement timelines for facility upgrades and capacity expansion.

Deep Dive into Multi dimensional Segmentation Reveals Insights into Therapy Types, Cell Sources, Technologies, Administration Modes, and Applications

Detailed segmentation analysis elucidates how distinct therapeutic approaches and end-use categories are evolving in parallel. Therapies are differentiated by cell sourcing strategy, with autologous products leveraging patient-derived specimens and allogeneic platforms offering off-the-shelf consistency. The sourcing of cells encompasses adult stem cells-hematopoietic, mesenchymal, and neural lineages-alongside embryonic lines, induced pluripotent cells, and perinatal fractions such as amniotic fluid and umbilical cord cells. Technological enablers range from biomaterial scaffolds supporting three-dimensional tissue formation to gene-edited constructs and scaffold-based delivery systems, each influencing manufacturing scale-up and regulatory pathways. Modes of administration span direct intra-articular injections to systemic intravenous infusions, tailored to therapeutic target and biodistribution requirements. Clinical and industrial applications of these modalities drive innovation in drug discovery and development, regenerative medicine initiatives, and tissue engineering programs. Within this ecosystem, therapeutic areas such as cardiovascular disease, hematology, musculoskeletal disorders, neurological conditions, and oncology guide pipeline prioritization. Finally, the demand for these solutions arises from academic and research institutes, biopharmaceutical enterprises, hospital networks, and dedicated stem cell banks, each stakeholder shaping investment patterns and service models.

This comprehensive research report categorizes the Stem Cell Therapy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Cell Source

- Technology

- Mode of Administration

- Application

- Therapeutic Areas

- End User

Global Regional Dynamics Spotlight Growing Stem Cell Therapy Opportunities from the Americas to Europe, Middle East, Africa, and Thriving Asia-Pacific

Regional dynamics underscore that geography continues to shape both innovation ecosystems and market access pathways. In the Americas, North American centers of excellence benefit from a mature regulatory infrastructure, deep investment capital pools, and established manufacturing networks supporting both autologous and allogeneic platforms. Moving across to Europe, the Middle East, and Africa, a mosaic of regulatory sophistication is emerging; European Union member states provide centralized guidance through the European Medicines Agency, while Gulf Cooperation Council nations are establishing purpose-built biotech hubs fostering public-private partnerships and regulatory sandboxes. Meanwhile, the Asia-Pacific region has accelerated stem cell research activities through government incentives, robust academic-industry collaborations, and rapidly growing contract development and manufacturing organization capacity, particularly in China, Japan, India, and Australia. These regional variations influence access to talent, regulatory timelines, and reimbursement frameworks, collectively informing global commercialization strategies.

This comprehensive research report examines key regions that drive the evolution of the Stem Cell Therapy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leading Entities and Emerging Innovators Driving Breakthroughs in Stem Cell Therapy Pipelines, Partnerships, and Strategic Collaborations

Leading companies and emerging innovators alike are shaping the competitive contours of the stem cell therapy space. Large biopharmaceutical corporations have forged strategic alliances with cell therapy pioneers to co-develop allogeneic MSC products and gene-edited HSC pipelines. Concurrently, dedicated cell therapy companies are expanding through milestone-linked licensing deals, platform acquisitions, and cross-sector collaborations with biomaterials and digital health firms. Venture-backed startups are focusing on niche indications-ranging from orthopedic repair to neurodegenerative treatment-leveraging proprietary differentiation protocols and automated manufacturing systems. Contract development and manufacturing organizations are scaling modular cleanroom solutions to serve the growing demand for GMP-compliant cell processing, while technology providers are integrating AI-driven analytics and real-time monitoring into bioprocess control. Together, these efforts reflect a dynamic ecosystem in which innovation partnerships and capability expansions define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Stem Cell Therapy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Animal Cell Therapies, Inc.

- Anterogen Co., Ltd.

- Arthrex Vet Systems by Arthrex Inc.

- Astellas Pharma Inc.

- Beike Biotechnology Co., Ltd.

- BrainStorm Cell Therapeutics Inc.

- Bristol-Myers Squibb Company

- Celavet Inc.

- Cell Therapy Sciences

- CellProthera SAS

- Elanco Animal Health

- Fate Therapeutics, Inc.

- Gamida Cell Ltd.

- Garuda Therapeutics

- Holostem Terapie Avanzate S.r.l.

- Jasper Therapeutics, Inc.

- JCR Pharmaceuticals Co., Ltd.

- Juvena Therapeutics Inc.

- Kangstem Biotech Co., Ltd.

- Kintaro Cells Power

- Kite Pharma, Inc. by Gilead Sciences, Inc.

- Lonza Group AG

- Magellan Stem Cells

- Medeze Group

- Medivet Biologics LLC

- Merck KGaA

- Mesoblast Ltd.

- Molecare Pet Vets

- Novo Nordisk A/S

- Okyanos Global Health

- PetVet Care Centers

- Plasticell

- Redstone Veterinary Hospital.

- Regeneus Ltd.

- ReNeuron Group PLC

- SQZ Biotechnologies Company by Stemcell Technologies

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

- U.S. Stem Cell Inc

- Umoja Biopharma

- Vericel Corporation

- Vetbiologics

- VetCell Therapeutics

- VetStem Biopharma

- Zoetis Inc.

Actionable Strategic Imperatives for Industry Leaders to Capitalize on Advancements, Optimize Operations, and Enhance Competitive Positioning in Stem Cell Markets

To capitalize on the unfolding potential of stem cell therapies, industry leaders should prioritize diversification of raw material supply chains, investing in domestic reagent and consumable manufacturing to mitigate tariff-induced cost pressures. Establishing strategic alliances with academic centers and contract service providers can accelerate clinical translation of emerging modalities while optimizing resource allocation. Integrating gene editing and scaffold technologies into development roadmaps will differentiate product efficacy and streamline regulatory approval. Moreover, adopting modular and flexible manufacturing infrastructures enables rapid scaling in response to clinical demand fluctuations. Stakeholders should also engage proactively with regulatory agencies to shape adaptive frameworks and leverage accelerated pathways for breakthrough therapies. Finally, targeted expansion into high-growth Asia-Pacific and EMEA markets, while maintaining compliance with local frameworks, will diversify revenue streams and reinforce global competitiveness.

Rigorous and Transparent Research Methodology Underpinning Comprehensive Analysis of the Stem Cell Therapy Landscape Using Primary and Secondary Data Sources

This analysis synthesizes insights derived from a robust research methodology combining both primary and secondary data sources. Primary research encompassed structured interviews with key opinion leaders, regulatory experts, manufacturing specialists, and end-user representatives across academic, clinical, and industrial settings. Secondary research involved comprehensive review of peer-reviewed literature, regulatory filings, company disclosures, and reputable trade publications. Data triangulation was applied to validate emerging trends and reconcile divergent viewpoints. Market intelligence tools and bibliometric analyses supplemented the qualitative insights, while scenario modeling assessed potential shifts in supply chain dynamics under varying trade policy conditions. Throughout, adherence to rigorous data integrity standards and transparency protocols ensured the credibility and reproducibility of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Stem Cell Therapy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Stem Cell Therapy Market, by Therapy Type

- Stem Cell Therapy Market, by Cell Source

- Stem Cell Therapy Market, by Technology

- Stem Cell Therapy Market, by Mode of Administration

- Stem Cell Therapy Market, by Application

- Stem Cell Therapy Market, by Therapeutic Areas

- Stem Cell Therapy Market, by End User

- Stem Cell Therapy Market, by Region

- Stem Cell Therapy Market, by Group

- Stem Cell Therapy Market, by Country

- United States Stem Cell Therapy Market

- China Stem Cell Therapy Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Transformative Impact of Stem Cell Therapy, Highlighting Strategic Priorities and Pathways to Commercial and Clinical Success

In closing, stem cell therapy stands at an inflection point where scientific breakthroughs, regulatory facilitation, and strategic partnerships converge to accelerate clinical impact. The maturation of allogeneic platforms, refinement of autologous processes, and integration of gene editing technologies collectively herald a new era in personalized and regenerative medicine. Yet, navigating trade headwinds and regional regulatory nuances will require proactive planning and agile operational models. By embracing collaborative innovation, optimizing supply chains, and aligning development strategies with emerging regulatory pathways, organizations can solidify their position in this high-potential domain. As the landscape evolves, continuous monitoring of technological and policy developments will be essential for sustaining momentum towards transformative patient outcomes.

Connect with Ketan Rohom to Access Exclusive Insights and Secure Your Comprehensive Stem Cell Therapy Market Research Report Tailored to Your Objectives

Are you ready to leverage granular market intelligence and position your organization at the forefront of the stem cell therapy revolution? Reach out to Associate Director of Sales & Marketing, Ketan Rohom, to explore how this comprehensive report can inform strategic partnerships, product development roadmaps, and investment decisions. Engage in a tailored consultation to discuss key insights, receive a customized executive briefing, and secure priority access to emerging opportunities in autologous and allogeneic therapies, cutting-edge gene editing platforms, and high-growth regional markets. Take action today to ensure your team has the data-driven guidance necessary to outpace competitors and maximize value across the full therapeutic development lifecycle.

- How big is the Stem Cell Therapy Market?

- What is the Stem Cell Therapy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?