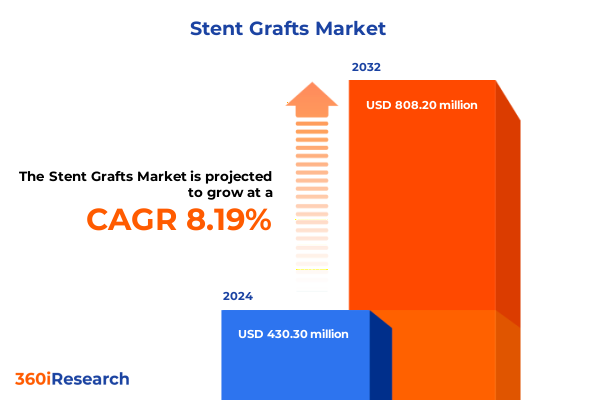

The Stent Grafts Market size was estimated at USD 459.20 million in 2025 and expected to reach USD 495.01 million in 2026, at a CAGR of 8.41% to reach USD 808.20 million by 2032.

Stent Grafts Are Revolutionizing Vascular Repair with Minimally Invasive Precision to Address the Growing Global Burden of Aneurysms and Peripheral Vascular Disease

Stent grafts have emerged as a critical advancement in endovascular therapies, enabling the minimally invasive treatment of aortic aneurysms and peripheral vascular conditions. These devices integrate a metallic scaffold with a synthetic sheath to reinforce weakened vessel walls while preserving blood flow. With the demographic shift toward aging societies, the prevalence of abdominal aortic aneurysms has reached approximately 1.4 percent among screened populations in the United States, underscoring the urgent need for durable endovascular solutions.

Endovascular aneurysm repair (EVAR) and thoracic endovascular aneurysm repair (TEVAR) have largely supplanted open surgical approaches due to reduced hospitalization times, lower morbidity, and faster recovery trajectories. This paradigm shift supports a more patient-centric model of care and enables clinicians to address complex aortic pathology through percutaneous access under imaging guidance.

Moreover, the application of stent grafts for peripheral interventions continues to grow in parallel with the rising incidence of peripheral artery disease, which affects an estimated 6.5 million adults over 40 in the United States. This trend reflects broader shifts toward minimally invasive revascularization methods that limit patient trauma and accelerate the return to ambulatory care.

Recent clinical data, such as polymer-sealed endografts presented at VIVA 2024, have demonstrated significant reductions in Type I endoleaks compared to legacy designs, reinforcing confidence in next-generation graft technologies. Looking ahead, the convergence of sophisticated imaging platforms, artificial intelligence-driven sizing algorithms, and hybrid operating room capabilities is set to further refine device selection and procedural accuracy.

Cutting Edge Innovations in Imaging, Materials, and Delivery Mechanisms Are Redefining Stent Graft Performance and Clinical Outcomes Globally

The stent graft landscape is undergoing a profound transformation powered by breakthroughs in device architecture and imaging integration. Next-generation polymer-sealed stent grafts incorporate low-profile delivery systems and on-graft radiopaque markers, enabling precision deployment in anatomies once deemed inoperable. These innovations have expanded treatment eligibility to patients with short necks, tortuous iliac vessels, and complex visceral branch involvement.

Simultaneously, regulatory frameworks have become stronger catalysts for innovation. The European Union’s Medical Device Regulation (MDR) now mandates extended post-market surveillance for up to ten years, prompting manufacturers to embed AI-enabled tracking tools into graft designs. In the United States, the FDA’s Early Feasibility Study pathway has accelerated first-in-human evaluations of branched and fenestrated systems, bringing bespoke thoracoabdominal endografts into clinical practice more rapidly than traditional approval routes.

Innovation in material science continues to expand the performance envelope of stent grafts. Bioresorbable polymers and drug-eluting fabric coatings promise to minimize long-term device interactions, while self-expanding nitinol frameworks deliver superior conformability in tortuous vasculature. As these technologies converge, the ability to engineer fully customized grafts via additive manufacturing and patient-specific computational modeling is no longer a distant prospect but an emerging reality.

Evolving Tariff Policies in 2025 Are Reshaping Supply Chains and Cost Structures for Stent Grafts in the United States and Beyond

In 2025, renewed Section 301 tariffs have reintroduced duties on imported medical devices, including Class II endovascular products such as stent grafts, elevating cost pressures across the U.S. supply chain. Initially announced in September 2024, these measures increased existing rates by an additional 10 percent on Chinese and select external manufacturing hubs, reshaping traditional sourcing strategies.

Industry leaders anticipate that these levy impacts will ripple through device pricing, procurement strategies, and hospital budgeting. Analysis by GlobalData indicates that anticipated tariff-related cost increases could exceed $80 million for major device makers, forcing firms to reassess their reliance on offshore suppliers and accelerate diversification into North American and Mexican manufacturing sites.

Notwithstanding these headwinds, some hospital systems have mitigated exposure through long-term supply contracts and proactive inventory management. HCA reported that fixed-price agreements and a shift toward domestic sourcing rendered the overall tariff impact manageable in its Q2 2025 financials, highlighting the value of strategic procurement resilience.

Meanwhile, the American Hospital Association has publicly lobbied for exemptions on life-saving surgical devices, warning that unmitigated disruptions could impair patient access to critical therapies. This advocacy underscores the delicate balance between national policy objectives and the imperative to maintain uninterrupted device availability for high-risk vascular procedures.

Deep Dive into Product, Indication, End User, Delivery, Material, and Configuration Segments Exposing Critical Insights for Stent Graft Markets

When evaluating stent graft product categories, aortic applications dominate due to the high incidence of abdominal and thoracic aneurysms. Within the aortic segment, procedures focused on abdominal aneurysm repair remain most prevalent, while thoracic repairs have seen accelerated growth thanks to branched and fenestrated graft designs that address complex arch anatomies.

In the indication spectrum, aneurysm repair continues to account for the majority of endovascular graft procedures, fueled by comprehensive screening programs for abdominal aneurysms in high-risk populations. Conversely, peripheral vascular disease interventions are gaining momentum, driven by treatment protocols for lower extremity ischemia that leverage drug-coated and covered stent grafts to maintain patency in narrowed peripheral arteries.

As for end users, the distribution channel bifurcates between hospitals, which perform the bulk of complex thoracic and infrainguinal interventions, and ambulatory surgical centers, where increasingly routine abdominal and peripheral graft placements benefit from streamlined pathways and cost efficiencies associated with same-day discharge.

Delivery mechanisms further distinguish device selection, with balloon-expandable grafts offering precise radial support in short-neck anatomies, while self-expanding configurations provide enhanced conformability across tortuous vasculature. Material choices, typically between expanded polytetrafluoroethylene and woven polyester, reflect trade-offs between biocompatibility, durability, and profile size. Configuration options range from straight tubular grafts for focal lesions to bifurcated and branched modules designed for aortoiliac and visceral vessel preservation, ensuring clinical versatility across patient anatomies.

This comprehensive research report categorizes the Stent Grafts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Indication

- Delivery Mechanism

- Material

- Configuration

- End User

Regional Dynamics in the Stent Graft Market Reveal Distinct Drivers and Opportunities across the Americas, Europe Middle East Africa, and Asia Pacific

The Americas represent the largest regional market for stent grafts, anchored by robust aneurysm screening initiatives, widespread adoption of EVAR and TEVAR, and favorable reimbursement frameworks. The United States leads this segment, with coordinated center-of-excellence networks streamlining patient referral and procedural standardization, while Canada and Brazil are expanding infrastructure to support endovascular training programs.

Across Europe, Middle East, and Africa, market growth is shaped by stringent compliance under the EU Medical Device Regulation, which incentivizes long-term device surveillance and novel graft durability features. Nations such as Germany, France, and the United Kingdom drive high-value complex EVAR and branched graft volumes, whereas emerging markets in the Middle East and North Africa are investing in capacity building for vascular surgery programs.

The Asia-Pacific region is the fastest-growing market, propelled by expanding healthcare infrastructure in China and India and policy measures such as volume-based procurement to lower device costs. Domestic manufacturers are gaining traction through region-specific graft designs, and governmental screening initiatives are accelerating early aneurysm detection, particularly in urban centers across East and Southeast Asia.

Collectively, regional distinctions in regulatory dynamics, reimbursement environments, and infrastructure maturity underscore the need for tailored market entry strategies and adaptive product portfolios that align with local clinical practices and policy frameworks.

This comprehensive research report examines key regions that drive the evolution of the Stent Grafts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dominant Market Players Are Leveraging Advanced Graft Designs, Strategic Partnerships, and Clinical Evidence to Cement Leadership in Stent Graft Innovation

Medtronic maintains leadership through its broad portfolio of endografts, combining polymer-seal technology with low-profile delivery systems to address a wide range of aortic and peripheral anatomies. Its recent product launches underscore an emphasis on customizable fenestrated and branched solutions for complex thoracoabdominal repairs, supported by multi-center clinical trials that validate improved procedural outcomes.

Abbott Laboratories has secured regulatory clearances for its next-generation EVAR platform featuring a repositionable delivery mechanism, significantly reducing deployment time and enabling precise proximal sealing in hostile neck anatomies. Abbott’s investment in AI-enabled sizing software has enhanced pre-operative planning accuracy, resulting in lower rates of secondary interventions.

Boston Scientific and Terumo are fast followers, respectively expanding self-expanding stent graft offerings optimized for peripheral applications and integrating AI-driven imaging tools to refine intraoperative guidance. Boston Scientific’s recent portfolio expansion in the superficial femoral artery has demonstrated a notable reduction in restenosis, while Terumo’s AI-assisted platforms have been rapidly adopted in large hospitals, particularly across Asia-Pacific centers of excellence.

Emerging players such as Penumbra and Endologix complement the competitive landscape with niche thrombectomy adjuncts and next-generation branched thoracoabdominal devices, leveraging strategic partnerships with research institutions to accelerate innovation. The sector’s dynamic has also been influenced by tariff-driven supply chain decisions, prompting manufacturers to localize production and fortify global distribution networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Stent Grafts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Bentley InnoMed GmbH

- Boston Scientific Corporation

- Braile Biomédica

- Cardinal Health, Inc.

- Cook Medical LLC

- CORCYM, Inc.

- Cryolife Inc.

- Edwards Lifesciences Corporation

- Endospan Ltd.

- InSitu Technologies Inc.

- Jotec GmbH

- Kawasumi Laboratories, Inc.

- LeMaitre Vascular, Inc.

- Lifetech Scientific (Shenzhen) Co., Ltd.

- Medtronic PLC

- MicroPort Scientific Corporation

- Terumo Corporation

- W. L. Gore & Associates, Inc.

Actionable Strategic Priorities for Industry Leaders to Navigate Regulatory Complexities, Supply Chain Risks, and Accelerate Innovation in Stent Grafts

Leaders should prioritize supply chain resilience by diversifying manufacturing footprints beyond traditional hubs, engaging contract makers in Mexico and Europe, and negotiating multi-year purchasing agreements to mitigate tariff volatility. This approach will safeguard continuity of supply and protect margin integrity amid evolving trade policies.

Ongoing investment in advanced materials research-particularly in bioresorbable polymers and drug-eluting fabric coatings-will differentiate product pipelines and align with emerging clinical preferences for “leave nothing behind” solutions that enhance patient safety and long-term outcomes.

Manufacturers should deepen collaboration with payers and regulatory authorities by establishing real-world evidence registries that demonstrate long-term clinical and economic value. Such initiatives can expedite reimbursement pathways for premium graft designs, ensuring broader access and adoption in value-based care environments.

Embracing digital health integration, including AI-supported sizing, robotic deployment platforms, and remote monitoring capabilities, will enhance procedural accuracy and foster greater adoption in both hospitals and ambulatory surgical centers. Early engagement with clinical champions to pilot these technologies can accelerate acceptance and generate critical usage data for broader rollout.

Comprehensive Research Approach Integrating Primary Expert Interviews, Secondary Data Analysis, and Multi-Layered Validation for Accurate Market Insights

This research draws upon a rigorous primary and secondary methodology framework to ensure comprehensive and unbiased insights. Primary research included detailed interviews with leading vascular surgeons, interventional radiologists, procurement specialists, and healthcare policy experts. These in-depth discussions provided frontline perspectives on unmet clinical needs, technology adoption barriers, and purchasing priorities.

Secondary research encompassed an extensive review of peer-reviewed journals, clinical trial registries, regulatory approvals, patent filings, and publicly available company financial statements. Data triangulation techniques were applied to reconcile discrepancies across sources and validate emerging trends, ensuring a robust evidence base.

Market segmentation and regional analyses leveraged proprietary databases, reimbursement schedules, and government health agency publications. Custom models were developed to map device classifications, procedural volumes, and reimbursement rates across major markets, enabling granular comparisons of demand drivers and adoption patterns.

Findings were further refined through iterative validation with an expert advisory panel comprising senior industry executives, health economist consultants, and key opinion leaders. This collaborative validation process enhanced the interpretive accuracy of strategic recommendations and market outlook narratives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Stent Grafts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Stent Grafts Market, by Product Type

- Stent Grafts Market, by Indication

- Stent Grafts Market, by Delivery Mechanism

- Stent Grafts Market, by Material

- Stent Grafts Market, by Configuration

- Stent Grafts Market, by End User

- Stent Grafts Market, by Region

- Stent Grafts Market, by Group

- Stent Grafts Market, by Country

- United States Stent Grafts Market

- China Stent Grafts Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Executive Conclusions Highlighting Key Findings and Strategic Imperatives to Harness the Full Potential of the Evolving Stent Graft Landscape

In conclusion, the stent graft market stands at an inflection point where clinical demand, technological innovation, and regulatory evolution converge to unlock new opportunities in vascular care. The shift toward minimally invasive endovascular therapies is firmly established, and the emergence of polymer-sealed, bioresorbable, and AI-integrated grafts promises to elevate procedural success and patient safety.

Regional and segmentation nuances highlight the importance of adaptive strategies that align product development with local clinical protocols and policy frameworks. Furthermore, the 2025 tariff landscape underscores the critical need for supply chain diversification and proactive engagement with trade policymakers.

By harnessing advanced materials science, digital health tools, and real-world evidence generation, industry leaders can secure sustainable growth and reinforce their competitive positioning. The actionable recommendations herein serve as a blueprint for navigating market complexities and catalyzing the next wave of transformative advancements in stent graft technology.

Secure Your Exclusive Access to In-Depth Stent Graft Market Intelligence with a Personalized Consultation from Associate Director Ketan Rohom

To explore the full depth of granular data, strategic analysis, and forward-looking insights on the stent graft landscape, reach out today to schedule your personalized consultation with Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through the key deliverables, customization options, and licensing structures available to align the research with your unique strategic objectives.

Act now to secure an exclusive discussion that will equip your organization with actionable intelligence on emerging technologies, regulatory shifts, competitive dynamics, and growth opportunities across product, indication, and regional segments. Elevate your decision-making with a tailored briefing and access to the comprehensive market research report.

Contact Ketan Rohom to arrange your briefing and take the next step toward informed strategic planning in the evolving stent graft market.

- How big is the Stent Grafts Market?

- What is the Stent Grafts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?