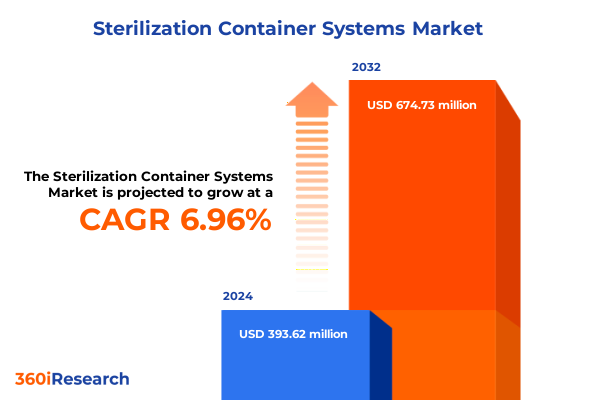

The Sterilization Container Systems Market size was estimated at USD 420.03 million in 2025 and expected to reach USD 448.83 million in 2026, at a CAGR of 7.00% to reach USD 674.72 million by 2032.

Introducing the Evolving Imperative of Advanced Sterilization Container Systems in Contemporary Healthcare Facilities to Protect Patient Safety

An era of heightened awareness around infection control has propelled sterilization container systems from operational afterthoughts to strategic assets within healthcare ecosystems. Modern facilities recognize that efficient and secure instrument sterilization underpins patient safety, clinical workflow optimization, and compliance with stringent regulatory frameworks. Therefore, understanding the role of container systems in ensuring sterile instrument delivery has become a core consideration for healthcare decision-makers seeking to minimize procedural delays and cross-contamination risks.

Furthermore, technological advancements in materials science and digital tracking capabilities have redefined expectations for container performance. As healthcare providers increasingly demand solutions that offer rapid turnaround, robust durability, and seamless integration with sterilization protocols, the container market has responded with innovations that promise to streamline processes and elevate safety standards. Consequently, the imperative to adopt the most effective sterilization container systems now aligns closely with broader organizational goals of operational excellence and quality care delivery.

Navigating the Convergence of Technological Innovation and Evolving Care Models Reshaping Sterilization Container System Requirements

Market dynamics for sterilization container systems are undergoing transformative shifts driven by converging forces of technological innovation, regulatory evolution, and shifting care models. On one front, emerging sterilization methods-such as plasma and low-temperature processes-have necessitated containers capable of withstanding varied conditions while ensuring consistent sterility assurance levels. At the same time, integration of RFID-enabled tracking and data analytics platforms has expanded the role of containers beyond passive storage, positioning them as active nodes within holistic sterilization ecosystems.

In addition, regulatory bodies around the world have tightened requirements for traceability and sterilization validation, prompting manufacturers to invest in advanced sealing mechanisms and compliance-centric designs. The shift toward ambulatory surgical centers and decentralized care models further underscores the need for portable, lightweight, yet resilient container solutions. Through these converging trends, the landscape of sterilization container systems has evolved to meet the complex demands of modern healthcare, driving a wave of innovation and competitive differentiation.

Assessing Critical Impacts of 2025 United States Import Tariffs on Sterilization Container System Supply Chains and Cost Structures

In 2025, the United States implemented a series of tariffs that have materially affected the cost structures of sterilization container systems imported from major manufacturing hubs. As raw material levies on aluminum, stainless steel, and composite imports increased, manufacturers have absorbed and passed through these additional costs, sparking a strategic reevaluation of sourcing and production footprints.

Consequently, domestic production capacity has attracted renewed investment, as original equipment manufacturers and suppliers seek to mitigate tariff-induced margin pressures. Simultaneously, a growing number of end users are exploring contract manufacturing within North America to secure supply chain resiliency and maintain compliance with Buy American provisions. These shifts underscore the broader ripple effects of tariff policies, prompting industry stakeholders to balance cost optimization against the imperatives of reliability, regulatory adherence, and long-term strategic partnerships.

Uncovering Critical Market Dynamics Through Layered Analysis of Sterilization Methods Product Types End Users Distribution Channels and Materials

The sterilization container systems market can be dissected through multiple lenses to uncover nuanced growth opportunities and areas of competitive focus. Based on sterilization method, ethylene oxide remains a mainstay for heat-sensitive instruments, while hydrogen peroxide plasma and radiation modalities cater to specialized applications requiring rapid cycle times and minimal environmental residues. In parallel, steam sterilization retains its prominence in high-volume settings, and formaldehyde finds niche use for complex assemblies that demand extended exposure.

From a product type standpoint, container seals and accessories have garnered attention for their role in ensuring airtight closures and facilitating real-time monitoring, whereas container tracking systems leverage barcoding and RFID to enhance traceability. Container washers optimize cleaning cycles to uphold instrument integrity, and rigid sterilization containers provide durable housing capable of withstanding repeated sterilization cycles. Examining end user segments reveals that hospitals and ambulatory surgical centers drive demand for high-throughput solutions, whereas clinics and research laboratories prioritize modularity and flexibility.

In terms of distribution, direct sales channels enable close collaboration between manufacturers and key accounts, distributors extend market reach through established networks, and online channels provide rapid access to standardized configurations. Lastly, material segmentation highlights aluminum’s balance of weight and strength, stainless steel’s durability, composite constructs’ design versatility, and plastic’s cost efficiency in select, low-thermal-demand scenarios.

This comprehensive research report categorizes the Sterilization Container Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sterilization Method

- Product Type

- Material

- End User

- Distribution Channel

Examining Divergent Regional Dynamics and Adoption Drivers Shaping Global Sterilization Container System Demand

Regional analysis of sterilization container systems reveals distinct adoption patterns and strategic imperatives across the globe. In the Americas, stringent regulatory frameworks and high procedural volumes have accelerated the uptake of advanced container technologies, with an emphasis on integration of tracking solutions to bolster patient safety. Conversely, Europe, Middle East & Africa exhibit a mix of mature markets eager to adopt eco-friendly materials and emerging regions prioritizing basic compliance and cost-effective designs.

Meanwhile, Asia-Pacific stands out for its combination of rapid healthcare infrastructure expansion and growing medical tourism hubs, driving demand for scalable container systems that can support high turnover and diverse sterilization modalities. In these markets, partnerships with local distributors and adaptation to regional standards have proven instrumental in capturing share. Together, these regional insights underscore the importance of tailoring product offerings and go-to-market strategies to the unique regulatory, economic, and operational landscapes of each territory.

This comprehensive research report examines key regions that drive the evolution of the Sterilization Container Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Collaborations Innovations and Alliances That Empower Leading Sterilization Container System Manufacturers

Analysis of leading industry participants highlights a competitive environment characterized by continuous innovation and strategic collaboration. Key companies leverage their global manufacturing footprints and R&D capabilities to introduce container systems that meet evolving sterilization challenges, such as low-temperature methods and digital traceability. In addition, partnerships with healthcare institutions and independent evaluation laboratories bolster credibility and accelerate product adoption.

Furthermore, acquisitions and joint ventures have emerged as pivotal strategies, enabling companies to expand their product portfolios and access complementary technologies, including smart sensor integrations and next-generation seal materials. Strategic alliances with distribution partners and third-party logistics providers also play a critical role in optimizing delivery times and after-sales support, ensuring that end users receive timely service and maintenance. Collectively, these efforts underscore a market landscape in which agility, innovation, and customer-centric collaboration define competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sterilization Container Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Ackermann Instrumente GmbH

- AMNOTEC International Medical GmbH

- Asel Tıbbi Aletler A.Ş.

- Astell AG

- Aygun Surgical Instruments Co., Inc.

- Aysam Orthopaedics & Medical Devices

- B. Braun Melsungen AG

- Becton, Dickinson, and Company

- Belintra NV

- Boston Scientific Corporation

- C.B.M. S.r.l. Medical Equipment

- Cantel Medical Corp.

- Case Medical, Inc.

- Changzhou Meditech Technology Co., Ltd.

- De Soutter Medical

- Elcon Medical Instruments GmbH

- erbrich instrumente GmbH

- Getinge AB

- GPC Medical Ltd.

- Integra LifeSciences Corporation

- Jewel Precision Limited

- Johnson & Johnson Services Inc.

- Karl Storz SE

- KLS Martin Group

- Medline Industries, Inc.

- NICHROMINOX

- Olympus Corporation

- PH Orthcom

- Ruhof Corporation

- SHARPLINE Surgical Technologies GmbH

- Sklar Corporation

- Steriline S.r.l.

- STERIS PLC

- TEKNO-MEDICAL Optik-Chirurgie GmbH

- Tuttnauer (US) Co., Ltd.

Implementing Innovation Driven Modular Designs Supply Chain Resilience and Digital Traceability to Cement Market Leadership

Industry leaders seeking to excel in the competitive realm of sterilization container systems should adopt a multi-pronged approach anchored in innovation, supply chain resilience, and customer engagement. By prioritizing development of modular container designs compatible with diverse sterilization methods, organizations can address the specific requirements of heat-sensitive instruments, rapid-cycle processes, and regulatory compliance.

Simultaneously, investing in vertical integration or strategic partnerships for key raw materials-such as aluminum and stainless steel-can help mitigate tariff impacts and secure stable input costs. Furthermore, expanding digital capabilities through partnerships or in-house development of RFID and IoT tracking platforms will empower customers with real-time visibility into instrument location, cycle completions, and maintenance schedules. Ultimately, fostering robust after-sales service networks and tailored training programs will differentiate offerings, reinforcing brand trust and supporting long-term customer relationships.

Detailing a Multifaceted Research Approach Integrating Primary Stakeholder Engagement Secondary Data and Strategic Patent Analysis

Our research methodology combines primary and secondary sources to deliver a comprehensive analysis of the sterilization container systems market. Initially, we conducted in-depth interviews and surveys with key stakeholders across OEMs, distributors, and end users to capture firsthand insights on usage patterns, pain points, and emerging requirements. These qualitative data points formed the backbone of our understanding of technology adoption and customer priorities.

In parallel, we analyzed regulatory documents, industry whitepapers, and manufacturer technical specifications to triangulate product innovations and compliance trends. Finally, our team performed a meticulous review of patent filings and strategic partnership announcements to identify early signals of future developments. By integrating these layers of evidence through a structured framework of thematic coding and comparative analysis, we ensured a rigorous, objective foundation for our findings and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sterilization Container Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sterilization Container Systems Market, by Sterilization Method

- Sterilization Container Systems Market, by Product Type

- Sterilization Container Systems Market, by Material

- Sterilization Container Systems Market, by End User

- Sterilization Container Systems Market, by Distribution Channel

- Sterilization Container Systems Market, by Region

- Sterilization Container Systems Market, by Group

- Sterilization Container Systems Market, by Country

- United States Sterilization Container Systems Market

- China Sterilization Container Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesis of Key Insights on Innovation Digital Integration and Strategic Imperatives Driving the Future of Sterilization Container Systems

The evolution of sterilization container systems underscores their critical role as enablers of patient safety, operational efficiency, and regulatory compliance. From transformative shifts in sterilization modalities and digital traceability to the ripple effects of tariff policies, the landscape demands that manufacturers and healthcare providers alike remain agile and forward-looking. By leveraging nuanced segmentation insights and regional dynamics, stakeholders can pinpoint growth opportunities and tailor strategies to meet evolving market needs.

Looking ahead, the convergence of materials innovation, digital integration, and supply chain optimization will continue to define competitive advantage. Decision-makers who embrace a holistic perspective-one that balances technological advancement with pragmatic considerations of cost, compliance, and user experience-will be best positioned to shape the future of sterilization container solutions and deliver measurable impact across the care continuum.

Act Now to Secure Exclusive Access to Definitive Sterilization Container Systems Market Insights Tailored to Your Strategic Objectives

We appreciate your interest in leveraging our comprehensive market research report on Sterilization Container Systems to drive informed strategic decisions within your organization. To explore deeper insights, detailed analysis, and customized data sets, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, who can guide you through the report’s value proposition and subscription options.

By engaging with Ketan, you will gain direct access to premium deliverables, including executive briefings and tailored workshops designed to translate market intelligence into actionable business strategies. His expertise in facilitating consultative discussions ensures that the investment returns clear outcomes aligned with your objectives.

Reach out today to secure your copy of the report and unlock the strategic advantages of understanding the latest trends, emerging challenges, and growth opportunities within the sterilization container systems market. Partner with us to turn insights into impactful initiatives that safeguard patient safety, optimize operational efficiency, and fuel innovation within your sterilization processes

- How big is the Sterilization Container Systems Market?

- What is the Sterilization Container Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?