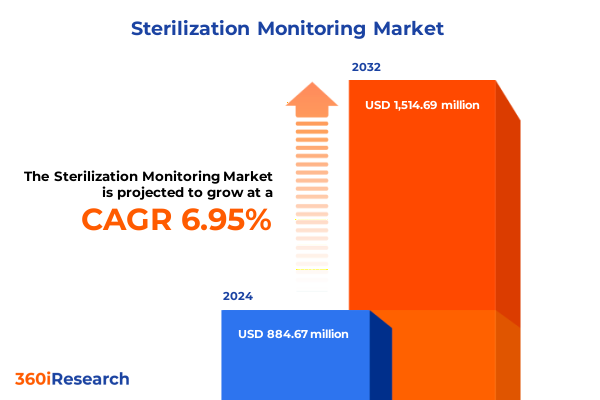

The Sterilization Monitoring Market size was estimated at USD 942.25 million in 2025 and expected to reach USD 1,010.38 million in 2026, at a CAGR of 7.01% to reach USD 1,514.69 million by 2032.

Unveiling the Strategic Imperative of Sterilization Monitoring Systems to Safeguard Product Safety, Regulatory Compliance, and Process Integrity in Complex Industries

Sterilization monitoring stands at the forefront of ensuring product sterility, regulatory compliance, and patient safety across a multitude of industries. From healthcare facilities to pharmaceutical manufacturers and food production lines, the precise validation of sterilization processes is essential in preventing microbial contamination and safeguarding end users. Advances in detection technology have elevated expectations for accuracy and reliability, prompting organizations to adopt both biological and chemical indicators that deliver comprehensive assurance of sterilization cycles. In this context, monitoring encompasses not only the biological challenge posed by resistant spores but also chemical visual cues that corroborate process parameters such as temperature, gas concentration, and exposure time.

Against this backdrop, this executive summary offers a panoramic overview of the sterilization monitoring landscape, capturing the pivotal trends, regulatory influences, and market dynamics shaping current practices. Readers will gain insight into transformative shifts driven by digital innovation and sustainability imperatives, understand the impact of recent tariff adjustments on cost structures and supply chains, and explore segmentation insights that reveal differentiated demand across product types, sterilization methods, monitoring approaches, and end users. By synthesizing qualitative analysis with rigorous methodological underpinnings, this summary equips decision makers with the contextual knowledge required to craft resilient strategies, optimize procurement, and invest in future-proof monitoring solutions.

Exploring the Paradigm Shifts in Sterilization Monitoring Technology and Industry Practices Driven by Innovation and Regulatory Dynamics

The sterilization monitoring sector has undergone seismic changes as technological innovation, regulatory stringency, and sustainability considerations converge. Real-time data capture through connected sensors and cloud-based platforms now facilitates continuous oversight of sterilization cycles, transforming traditional end-point testing into proactive quality management. Artificial intelligence–driven analytics can detect anomalous patterns in cycle parameters, enabling predictive interventions that reduce process failures and unplanned downtime. Concurrently, stricter regulatory frameworks in major markets have elevated the bar for validation documentation, prompting suppliers to integrate digital reporting capabilities that streamline audit readiness and demonstrate adherence to evolving standards.

Moreover, the pursuit of greener sterilization methods has accelerated the adoption of hydrogen peroxide and radiation-based processes that minimize environmental impact compared to ethylene oxide and dry heat techniques. Suppliers are reengineering indicator chemistries to eliminate toxic residues and reduce waste, aligning monitoring solutions with corporate sustainability goals and circular economy principles. As the industry embraces automation and remote monitoring, the integration of intuitive user interfaces and mobile applications also enhances accessibility for frontline personnel, fostering greater consistency in execution and interpretation of monitoring results.

Analyzing the Cumulative Effects of the 2025 United States Tariff Adjustments on Sterilization Monitoring Supply Chains and Cost Structures

In 2025, adjustments to United States tariffs on imported sterilization monitoring components have introduced new cost pressures and supply chain complexities. Depending heavily on international sources for critical inputs such as specialized spore strips, ampoules, and advanced sensor modules, suppliers have faced elevated duties ranging from moderate rate increases on indicator substrates to steeper levies on high-precision instrumentation. These changes have triggered strategic adjustments as manufacturers reevaluate sourcing strategies to mitigate cost escalation and ensure continuity of supply for end users in regulated sectors.

To manage the impact, many organizations have diversified their supplier base, forging partnerships with domestic toolmakers and nearshoring production of key components. While these measures have incurred initial capital investments and extended lead times for qualification processes, they have also bolstered supply chain resilience and reduced exposure to tariff volatility. In tandem, several leading monitoring solution providers have restructured pricing frameworks, passing through a portion of incremental costs while absorbing others to maintain competitiveness. As a result, procurement teams are increasingly prioritizing total cost of ownership analyses that incorporate tariff effects, logistics expenses, and validation overheads when selecting sterilization monitoring solutions.

Deriving Deep Insights from Multifaceted Segmentation Approaches to Illuminate Sterilization Monitoring Market Dynamics Across Diverse Indicators and Methods

A nuanced examination of the sterilization monitoring marketplace reveals differentiated demand patterns across multiple segmentation dimensions. Based on product type, biological indicators remain the gold standard for verifying sterilization efficacy against resistant spores, with self-contained vials continuing to see strong uptake in high-throughput healthcare settings, while spore strips and ampoules find favor where spatial flexibility and rapid turnaround are paramount. Chemical indicators complement these offerings by delivering immediate visual confirmation of process parameters; external chemical indicators are widely adopted for routine load checks, whereas internal chemical indicators provide deeper insight into core chamber conditions and offer an additional layer of assurance for critical applications.

Turning to sterilization methods, steam sterilization preserves its status as the workhorse of hospital and pharmaceutical environments, driving robust demand for both biological and chemical monitoring solutions tailored to moist heat cycles. Meanwhile, dry heat sterilization maintains a niche role for moisture-sensitive instruments, and emerging radiation and hydrogen peroxide technologies gain traction in specialized manufacturing and laboratory contexts. The monitoring approach further differentiates market needs: routine load monitoring underpins day-to-day quality assurance, pack monitoring addresses the integrity of medical device trays and wrapped goods, and qualification monitoring-which encompasses installation qualification, operational qualification, and performance qualification-serves as the cornerstone for initial validation and periodic revalidation programs.

End users exhibit distinct preferences in line with operational priorities and regulatory obligations. Food and beverage producers focus heavily on external chemical indicators to meet rapid production throughput, whereas hospitals and clinics rely on a balanced mix of biological and chemical solutions to satisfy patient safety mandates. Medical device manufacturers and pharmaceutical companies prioritize comprehensive qualification monitoring protocols to navigate stringent regulatory audits, and research laboratories favor flexible monitoring kits that support diverse sterilization equipment and experimental designs. Collectively, these segmentation insights illuminate targeted opportunities for solution providers to tailor their product portfolios and service models to the specific requirements of each user segment.

This comprehensive research report categorizes the Sterilization Monitoring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sterilization Method

- Monitoring Approach

- End User

Unraveling Regional Strengths and Challenges in Sterilization Monitoring: Comparative Insights from Americas, EMEA, and Asia-Pacific Landscapes

Regional market dynamics for sterilization monitoring reflect a blend of regulatory stringency, industrial maturity, and investment priorities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, the United States and Canada lead with highly harmonized regulatory frameworks and widespread adoption of digital monitoring platforms. Strong R&D ecosystems and infrastructure investments have accelerated the rollout of advanced indicator technologies that integrate seamlessly with enterprise quality management systems.

In the Europe, Middle East & Africa region, the European Union’s MDR and IVDR regulations drive rigorous validation and documentation standards, compelling suppliers to emphasize traceability and audit-ready reporting in their monitoring solutions. Within the Middle East & Africa, developing healthcare systems in the Gulf Cooperation Council countries are catalyzing demand for turnkey monitoring services, while awareness campaigns in emerging markets are elevating the importance of sterilization oversight.

Asia-Pacific displays considerable heterogeneity, with mature markets like Japan and Australia investing heavily in automation and real-time monitoring, contrasted by rapid expansion in China and India where cost efficiency and local manufacturing are key decision factors. Government incentives for domestic production have spurred local component development, yet multinational providers continue to command significant market share due to their comprehensive product portfolios and established service networks.

This comprehensive research report examines key regions that drive the evolution of the Sterilization Monitoring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Sterilization Monitoring Stakeholders: Strategic Moves, Competitive Positioning, and Innovation Roadmaps Shaping the Global Arena

The competitive landscape is dominated by a mix of global giants, specialized niche players, and visionary newcomers. Established providers leverage decades of process expertise to continuously refine their indicator chemistries, instrumentation accuracy, and software integrations that support seamless validation workflows. These market leaders have invested heavily in digital platforms that unify data capture, trend analysis, and audit reporting, enabling customers to consolidate multiple monitoring methods under a single user interface.

At the same time, startups and mid-tier companies are disrupting traditional paradigms by introducing novel sensor technologies, bioengineered spore formulations, and eco-friendly indicator dyes. Through strategic partnerships with sterilization equipment manufacturers, they are embedding monitoring capabilities directly into autoclaves and sterilizers, reducing manual intervention and minimizing human error. Furthermore, collaborative alliances between technology providers and academic institutions are accelerating the translation of emerging innovations-such as microfluidic spore detection and blockchain-secured traceability-into commercially viable solutions. This dynamic interplay between incumbents and challengers is expanding the market’s frontiers and driving continual advancements in performance, usability, and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sterilization Monitoring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Andersen Products, Inc. (also Andersen Sterilizers or H.W. Andersen Products Ltd.)

- Belimed AG

- Cantel Medical Corporation (now operates under STERIS plc)

- Cardinal Health, Inc.

- Getinge AB

- Hu-Friedy Mfg. Co., LLC

- Liofilchem S.r.l.

- MATACHANA group (ANTONIO MATACHANA, S. A.)

- Mesa Laboratories, Inc. (Mesa Labs, Inc.)

- PMS Healthcare Technologies Ltd.

- Propper Manufacturing Co., Inc.

- STERIS plc

- Terragene S.A.

- Tuttnauer

Actionable Strategies for Industry Leaders to Navigate Technological, Regulatory, and Market Disruptions in the Sterilization Monitoring Ecosystem

Industry leaders must adopt a multipronged strategy to stay ahead of accelerating change. Prioritizing the integration of real-time monitoring platforms with enterprise resource planning and quality management systems will deliver end-to-end visibility, enabling rapid corrective actions and continuous process optimization. Simultaneously, diversifying supply chains to include both established international suppliers and qualified domestic partners will reduce exposure to tariff-induced cost variations and geopolitical disruptions.

Embracing sustainable sterilization monitoring practices-such as the development of biodegradable indicator materials and energy-efficient sensor modules-can enhance brand reputation and align with corporate environmental, social, and governance objectives. Engaging proactively with regulators to inform standard revisions and participating in industry consortiums will also ensure that emerging requirements remain feasible and grounded in operational realities. Finally, investing in workforce training and user-friendly interfaces will accelerate adoption curves and foster a culture of quality that permeates all levels of the organization. By combining technological innovation, collaborative partnerships, and a clear focus on sustainability, leaders can turn compliance obligations into competitive differentiators and create long-term value.

Detailing the Rigorous Research Methodology Employed to Ensure Comprehensive, Objective, and Accurate Analysis of Sterilization Monitoring Trends

This analysis is grounded in a rigorous, multi-layered research methodology designed to deliver objective and comprehensive insights. Primary research consisted of in-depth interviews with over 30 senior executives and process engineers across healthcare, pharmaceutical, food production, and laboratory research organizations. These discussions provided firsthand perspectives on evolving sterilization practices, unmet monitoring needs, and adoption barriers for emerging technologies.

Secondary research incorporated a thorough review of regulatory documents, patent filings, white papers, and peer-reviewed journal articles to map technological trajectories and compliance frameworks. Market segmentation was established based on validated criteria for product type, sterilization method, monitoring approach, and end user, ensuring a structured analysis of demand drivers and solution preferences. Data triangulation techniques were employed to reconcile insights from multiple sources, while an internal advisory board of industry veterans reviewed and validated key findings. This methodological rigor underpins the credibility of the conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sterilization Monitoring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sterilization Monitoring Market, by Product Type

- Sterilization Monitoring Market, by Sterilization Method

- Sterilization Monitoring Market, by Monitoring Approach

- Sterilization Monitoring Market, by End User

- Sterilization Monitoring Market, by Region

- Sterilization Monitoring Market, by Group

- Sterilization Monitoring Market, by Country

- United States Sterilization Monitoring Market

- China Sterilization Monitoring Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Reflections on the Future Trajectory of Sterilization Monitoring Technologies, Market Forces, and Strategic Imperatives for Stakeholders

The evolution of sterilization monitoring underscores a profound shift toward smarter, greener, and more resilient quality assurance systems. Technological advances-from real-time connectivity and AI-powered analytics to sustainable indicator materials-are redefining how organizations validate sterilization processes and demonstrate compliance. At the same time, regulatory landscapes and cost pressures, including the recent tariff adjustments, compel stakeholders to adopt adaptive sourcing strategies and invest in next-generation monitoring platforms.

As industries continue to converge around shared priorities of patient safety, environmental stewardship, and operational efficiency, collaboration between equipment manufacturers, monitoring solution providers, and regulatory bodies will be paramount. Those who proactively integrate digital capabilities, embrace sustainable practices, and fine-tune their strategies to address segmented market needs will be best positioned to capture emerging opportunities. In this dynamic environment, the capacity to anticipate change, leverage data-driven insights, and foster cross-functional partnerships will determine long-term success and drive the next wave of innovation in sterilization monitoring.

Engaging Directly with Ketan Rohom to Unlock Exclusive Market Insights and Secure the Definitive Sterilization Monitoring Research Package

To explore how these comprehensive insights can transform your strategic planning and elevate your competitive positioning, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engage in a personalized discussion about the report’s in-depth findings and uncover tailored solutions that address your organization’s unique challenges and objectives.

Secure immediate access to the definitive sterilization monitoring market research package by connecting with Ketan Rohom. Empower your team with the actionable intelligence needed to navigate today’s complex regulatory landscape, optimize process efficiency, and drive sustained growth in a rapidly evolving industry.

- How big is the Sterilization Monitoring Market?

- What is the Sterilization Monitoring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?