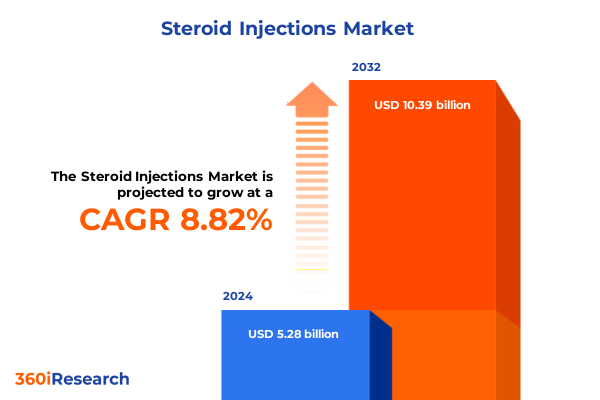

The Steroid Injections Market size was estimated at USD 5.72 billion in 2025 and expected to reach USD 6.20 billion in 2026, at a CAGR of 8.90% to reach USD 10.39 billion by 2032.

Unveiling the Dynamics of the Steroid Injections Market Through an Integrative Overview That Sets the Stage for Informed Decision-Making

Rapid advancements in treatment protocols and a steadily rising prevalence of inflammatory and musculoskeletal disorders have placed steroid injections at the forefront of non-surgical therapeutic interventions. Over the past decade, clinicians have increasingly embraced corticosteroid injections to deliver targeted anti-inflammatory relief directly into affected tissues, reducing systemic side effects and improving patient outcomes. This widespread adoption is fueled by an aging global population, heightened awareness of chronic pain management, and continuous innovations in delivery mechanisms that emphasize precision and safety.

Building on these dynamics, this report presents a holistic view of the steroid injections landscape, capturing the nuances of pharmacological variations, procedural settings, and patient demographics. It encompasses detailed analyses across four core molecule types-spanning dexamethasone’s potent anti-inflammatory profile to triamcinolone’s extended-release formulations-while recognizing the critical role of treatment types ranging from joint and soft tissue to spinal injections. Furthermore, it delves into how patient segmentation based on age cohorts shapes dosing considerations and procedural best practices.

By integrating these perspectives, the introduction establishes the framework for informed decision-making, guiding stakeholders through a landscape characterized by technological progress, regulatory evolution, and shifting clinical preferences. It sets the stage for subsequent sections that explore transformative shifts, tariff impacts, segmentation insights, regional dynamics, leading competitor strategies, and actionable recommendations designed to navigate this highly specialized market.

Mapping the Key Technological, Regulatory, and Clinical Transformations Reshaping the Steroid Injection Landscape and Clinical Practices

The steroid injection landscape is undergoing a series of transformative shifts driven by technological breakthroughs, evolving regulatory environments, and novel clinical practices. In recent years, the advent of extended-release formulations has significantly expanded the therapeutic window, enabling longer intervals between procedures and offering patients sustained relief. Concurrently, the integration of image-guided injection techniques-via ultrasound and fluoroscopy-has enhanced procedural accuracy, minimized adverse events, and increased clinician confidence in targeting complex anatomical structures.

Moreover, regulatory bodies across major markets have accelerated approvals for biosimilar corticosteroid products, intensifying competition and driving the cost-effectiveness of treatment. Digital health platforms have also begun to play a pivotal role, facilitating remote monitoring of patient recovery and enabling data-driven optimization of injection schedules. This digital maturation is expected to harmonize seamlessly with existing electronic health record systems, paving the way for more personalized treatment regimens and real-time outcome tracking.

In parallel, patient demand for minimally invasive solutions has risen sharply, prompting device developers to collaborate closely with pharmaceutical manufacturers on novel delivery systems. As telehealth consultations become more commonplace, streamlined referral pathways and virtual procedural planning are further revolutionizing the way steroid injections are prescribed and administered. Collectively, these shifts are redefining market dynamics and setting new standards for clinical efficacy and patient satisfaction.

Assessing the Compounding Effects of 2025 United States Tariff Measures on Raw Material Costs and Supply Chains in Steroid Injections Space

In early 2025, the United States introduced additional tariff measures on corticosteroid active pharmaceutical ingredients, primarily affecting imports from major API suppliers in China. This policy adjustment has amplified raw material costs, prompting manufacturers to explore alternative sourcing from emerging API hubs in India and select European nations. As manufacturers have sought to mitigate margin pressures, supply chain diversification has emerged as a strategic imperative, influencing both procurement practices and contractual negotiations.

Furthermore, the tariff-driven cost escalation has stimulated discussions between producers and institutional buyers regarding pricing models and rebate structures. Hospitals and large ambulatory centers are increasingly leveraging long-term supply agreements to stabilize input costs, while independent clinics are examining group purchasing organization partnerships to secure favorable terms. At the same time, the industry is witnessing a renewed focus on onshore manufacturing investments to reduce reliance on imported intermediates.

These compounding effects underscore the need for a resilient supply chain strategy as the market adapts to evolving trade policies. Stakeholders are advised to continuously monitor regulatory announcements, cultivate relationships with multiple API providers, and consider vertical integration opportunities to safeguard against future tariff fluctuations and ensure uninterrupted patient access to critical corticosteroid therapies.

Dissecting the Multifaceted Segmentation Framework That Captures Patient Profiles, Molecule Variants, Treatment Modalities, and End User Dynamics

A multifaceted segmentation framework illuminates the nuanced layers within the steroid injections ecosystem, enabling stakeholders to tailor strategies that resonate with specific clinical and commercial imperatives. Molecule type differentiation remains central, as dexamethasone’s rapid onset contrasts with hydrocortisone’s well-established safety profile, while methylprednisolone and triamcinolone formulations offer varying durations of anti-inflammatory activity and depot release characteristics. These pharmacokinetic distinctions inform both product positioning and procedural protocols.

Treatment type segmentation further refines the analysis, categorizing offerings into joint, soft tissue, and spinal injection modalities. Within joint interventions, the divergent requirements of large versus small joints necessitate specialized training and delivery devices. Soft tissue applications encompass bursae, ligaments, and tendons, each presenting unique anatomical challenges that influence syringe design, needle gauge, and dose concentration. Spinal injections-ranging from epidural to intrathecal-command rigorous imaging support and strict adherence to safety guidelines due to their proximity to the central nervous system.

Patient type segmentation underscores the importance of demographic considerations, with adult cohorts representing the bulk of procedural volume while geriatric populations drive demand for gentler release profiles and reduced systemic exposure. Pediatric use, although more limited, calls for customized dosing regimens and heightened vigilance regarding growth and developmental factors. Therapeutic indication segmentation sheds light on specific clinical needs-whether treating back pain subtypes like lower back pain, sciatica, or upper back pain, or addressing bursitis, osteoarthritis, rheumatoid arthritis, or tendonitis-each requiring tailored injection strategies. End user segmentation delineates the operational contexts of ambulatory surgical centers, outpatient clinics, and hospital settings, with general hospitals and specialty centers differing in resource intensity and procedural throughput. Finally, distribution channel segmentation reveals distributions through hospital pharmacies, online channels, and retail outlets, with chain and independent pharmacies playing distinct roles in accessibility and patient education.

By synthesizing these axes of differentiation, stakeholders can pinpoint high-impact opportunities, refine product portfolios, and align promotional efforts with the precise needs of diverse clinical settings and patient groups.

This comprehensive research report categorizes the Steroid Injections market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Molecule Type

- Treatment Type

- Patient Type

- Therapeutic Indication

- End User

- Distribution Channel

Exploring Regional Market Dynamics Across the Americas, EMEA, and Asia-Pacific Zones to Illuminate Growth Drivers and Operational Nuances

Regional market dynamics in the Americas reflect a mature healthcare infrastructure characterized by advanced procedural reimbursement and widespread adoption of image-guided injections. In this landscape, leading practitioners benefit from well-defined clinical guidelines and robust payer support, while smaller clinics leverage telehealth triage to efficiently funnel patients to appropriate care settings. Additionally, ongoing consolidation among ambulatory surgical centers is driving improvements in operational scalability and driving innovation in treatment protocols.

Within Europe, the Middle East, and Africa, stringent regulatory frameworks and cost-containment pressures shape the market in distinctive ways. European markets prioritize health technology assessments and real-world evidence to secure reimbursement approvals for novel corticosteroid formulations. Meanwhile, Middle Eastern nations are making strategic investments in specialized medical centers to address growing chronic disease burdens, and select African regions are collaborating with international NGOs to expand access and training for minimally invasive injection procedures.

Asia-Pacific markets exhibit a dynamic growth trajectory fueled by demographic shifts and rising healthcare expenditure. Rapid urbanization and an expanding geriatric population have spurred demand for non-surgical pain management solutions, prompting local manufacturers to scale volumes and improve quality standards. Governments across the region are also bolstering domestic API production capabilities, reducing dependency on imports while fostering public-private partnerships that support infrastructure development and clinician training.

These regional insights highlight how macroeconomic factors, regulatory landscapes, and healthcare delivery models converge to influence steroid injection adoption patterns and investment priorities across the globe.

This comprehensive research report examines key regions that drive the evolution of the Steroid Injections market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Pharmaceutical and Biotechnology Stakeholders Driving Innovation, Strategic Partnerships, and Competitive Positioning in Steroid Injections

The competitive landscape of steroid injections is marked by established multinational pharmaceutical corporations, nimble specialty players, and a rising cohort of biosimilar developers. Leading innovators have invested heavily in extended-release formulations and device co-development, partnering with medical device manufacturers to enhance precision delivery and patient comfort. Meanwhile, biosimilar entrants are capitalizing on patent expirations to introduce cost-effective alternatives that broaden access, particularly in price-sensitive markets.

Strategic collaborations between drug developers and imaging technology firms are also reshaping procedural protocols, as integrated delivery systems streamline workflows and augment clinician capabilities. Several contract manufacturers have expanded capacities to accommodate surge demand for injectable APIs, while regional producers in India and Europe are strengthening their quality standards to meet stringent regulatory requirements in major markets.

Moreover, leading stakeholders are pursuing mergers and acquisitions to consolidate R&D pipelines and extend geographic footprints. These moves often focus on acquiring complementary technologies-such as novel needle designs or pre-filled injection systems-that can be seamlessly integrated into existing distribution channels. Through these competitive maneuvers, companies are positioning themselves to serve a diverse set of end users, from high-volume ambulatory centers to niche specialty hospitals, ensuring they remain at the forefront of innovation and market responsiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Steroid Injections market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Bayer AG

- Bristol-Myers Squibb Company

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Roche Holding AG

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Formulating Actionable Strategic Recommendations to Enable Industry Leaders to Navigate Market Complexities and Capitalize on Emerging Steroid Injection Opportunities

Industry leaders should prioritize investment in next-generation corticosteroid formulations that offer extended efficacy and improved safety profiles. By accelerating R&D efforts in depot release technologies and collaborating with device innovators, companies can strengthen clinical differentiation and secure favorable reimbursement pathways. In parallel, building resilient supply chains through strategic partnerships with multiple API suppliers and exploring onshore manufacturing options will mitigate the impact of future tariff fluctuations and trade policy shifts.

Additionally, organizations can enhance market penetration by tailoring solutions to specific demographic segments. Developing low-volume pediatric formulations or geriatric-friendly delivery systems addresses unmet needs, while co-marketing agreements with ambulatory surgical center networks can streamline procedural adoption. Digital platforms focused on physician education and patient engagement will further support clinical uptake and foster long-term adherence to treatment protocols.

Finally, forging alliances with imaging technology providers and telehealth facilitators can broaden access to steroid injections in remote or underserved areas. By leveraging real-time outcome analytics and virtual procedural planning, stakeholders can demonstrate value to payers and healthcare institutions alike, cementing their leadership in a rapidly evolving therapeutic domain.

Detailing the Comprehensive Research Methodology Underpinning the Analysis, Including Data Collection, Validation, and Sampling for Credible Insights

This research employed a mixed-methods approach to ensure depth and reliability of insights. The study began with extensive secondary research, including a review of peer-reviewed clinical journals, regulatory agency filings, patent landscapes, and publicly available corporate disclosures. Trade data and tariff notices were analyzed to understand supply chain exposures, while clinical guidelines and payer policy documents provided context on procedural reimbursement and adoption barriers.

Concurrently, primary research was conducted through structured interviews with key opinion leaders, including interventional pain specialists, orthopedic surgeons, procurement managers from major medical centers, and procurement experts in distribution channels. These conversations yielded qualitative perspectives on clinical preferences, device usability, and pricing negotiations. Quantitative data points, such as procedure volumes and dosage trends, were cross-validated using anonymized hospital records and distributor shipment reports to enhance accuracy.

Data triangulation methods were applied throughout, and all findings were reviewed in a collaborative validation workshop involving industry experts and internal analysts. Segmentation frameworks were refined iteratively to reflect real-world practice patterns, while regional analyses incorporated macroeconomic indicators and healthcare spending data to capture market maturity differences. The result is a robust, multi-dimensional examination of the steroid injection domain, grounded in both empirical evidence and frontline practitioner insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Steroid Injections market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Steroid Injections Market, by Molecule Type

- Steroid Injections Market, by Treatment Type

- Steroid Injections Market, by Patient Type

- Steroid Injections Market, by Therapeutic Indication

- Steroid Injections Market, by End User

- Steroid Injections Market, by Distribution Channel

- Steroid Injections Market, by Region

- Steroid Injections Market, by Group

- Steroid Injections Market, by Country

- United States Steroid Injections Market

- China Steroid Injections Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Summarizing Critical Takeaways From the Steroid Injections Analysis to Reinforce Strategic Imperatives and Future Outlook for Stakeholders

Through a systematic exploration of pharmacological innovations, procedural advancements, and trade policy dynamics, this analysis has illuminated the critical factors shaping the steroid injections market. Key takeaways include the growing significance of extended-release formulations, the imperative for supply chain resilience amid tariff pressures, and the diverse segmentation opportunities that align with specific clinical and patient needs. Regionally, mature markets prioritize reimbursement and technology integration, whereas emerging economies focus on infrastructure build-out and localized manufacturing capacity.

Competitive pressures are intensifying as established pharmaceutical leaders enhance their pipelines and biosimilar developers vie for market share following patent expirations. The convergence of drug-device partnerships, telehealth integration, and real-time outcome monitoring is setting new benchmarks for clinical efficacy and patient engagement. Stakeholders equipped with these insights can refine product portfolios, optimize distribution strategies, and proactively engage with regulatory bodies to expedite approvals.

In summary, the steroid injections space presents a compelling nexus of opportunity and complexity. By synthesizing empirical data with frontline practitioner perspectives, stakeholders are empowered to make informed strategic choices that drive sustainable growth and improved patient outcomes in this dynamic therapeutic arena.

Engage With Our Specialist to Unlock Deeper Steroid Injection Market Insights and Secure Comprehensive Intelligence for Strategic Advantages

If you are seeking to gain unparalleled depth and precision in your strategic planning for steroid injections, engaging with our Associate Director of Sales & Marketing, Ketan Rohom, will ensure you access the full breadth of our comprehensive market intelligence. By partnering directly with Ketan, you can unlock tailored insights on evolving regulatory landscapes, anticipate shifts driven by trade policies, and leverage our robust segmentation analyses to refine your product development and go-to-market strategies. Ketan’s deep understanding of both the clinical and commercial dimensions of steroid injections means he can guide you to the specific data and actionable guidance your organization needs to outmaneuver competitors and drive sustainable growth. To capitalize on early-stage opportunities and secure a competitive edge, connect with Ketan Rohom and invest in the definitive market research report that will empower your leadership team with the clarity and confidence to make swift, informed decisions.

- How big is the Steroid Injections Market?

- What is the Steroid Injections Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?