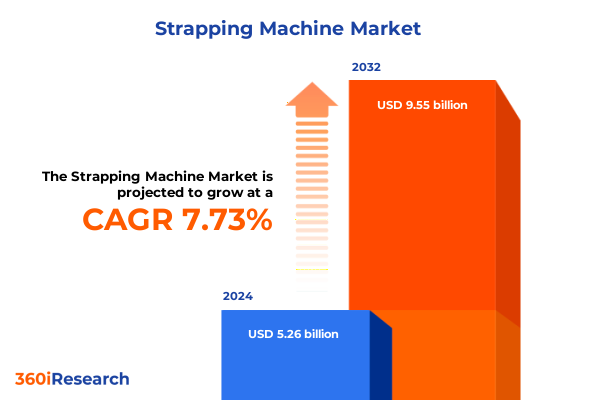

The Strapping Machine Market size was estimated at USD 5.64 billion in 2025 and expected to reach USD 6.05 billion in 2026, at a CAGR of 7.81% to reach USD 9.55 billion by 2032.

Exploring the Strapping Machine Ecosystem Amid Rapid Technological Advancements, Operational Demands, and Evolving Global Market Dynamics Driving Industry Growth

The strapping machine industry operates at the intersection of packaging innovation and material handling efficiency, serving a diverse range of sectors from logistics and warehousing to manufacturing and retail. Recent years have witnessed rapid technology diffusion, as automation capabilities advance in response to growing demands for speed, consistency, and cost control. At the same time, sustainability considerations have emerged as critical drivers, pushing manufacturers to explore recyclable straps, energy-efficient systems, and leaner production workflows. As companies reassess their supply chains in the wake of geopolitical uncertainties and shifting trade policies, the ability to choose the right strapping solution has taken on strategic importance.

This executive summary offers a holistic overview of the current trends shaping the global strapping machine market, highlighting key inflection points and competitive dynamics. By examining the forces that are catalyzing innovation-from digital controls and predictive maintenance features to modular component design-this introduction sets the stage for a deeper exploration of market segmentation, tariff implications, and regional variations. Decision-makers will gain an understanding of how operational priorities are redefining procurement criteria, and where the next wave of growth opportunities is likely to emerge.

Understanding the Major Transformations Shaping Strapping Machine Innovation, Sustainability Imperatives, and Operational Efficiency Requirements Across Industries

Over the past few years, the strapping machine landscape has undergone a series of profound transformations driven by the convergence of evolving customer expectations, digitalization initiatives, and heightened sustainability mandates. Automation has moved beyond simple cycle speed enhancements to encompass advanced sensing, real-time status monitoring, and remote diagnostics. These capabilities allow maintenance teams to preempt failures, optimize spare parts inventory, and reduce downtime. Simultaneously, demand for ergonomic designs has intensified, as organizations prioritize worker safety and compliance with stricter occupational standards.

Sustainability has also emerged as a transformative shift, with end users seeking solutions that minimize material waste and energy consumption. The integration of recyclable strap materials alongside high-efficiency power systems has become a differentiator for leading suppliers. In parallel, modular component architectures now enable rapid line reconfiguration, supporting shorter production runs and greater customization without incurring significant capital expenditures. As the industry adapts, cross-industry partnerships are forming to address shared challenges in circularity and process optimization.

Analyzing the Cumulative Impact of Multifaceted United States Tariffs in 2025 on Strapping Machine Supply Chains, Cost Structures, and Strategic Sourcing Decisions

In 2025, a complex web of tariffs imposed by U.S. authorities has materially altered cost structures for strapping machine importers and raw material suppliers. Under the International Emergency Economic Powers Act, a 10% tariff on certain Chinese imports took effect on February 4, 2025 before rising to 20% on March 4, 2025. These measures immediately increased landed costs for machinery sourced from China, prompting procurement teams to reevaluate sourcing strategies and inventory levels to mitigate margin erosion.

Concurrently, Section 232 tariffs targeting steel and aluminum were reinstated on March 3, 2025, imposing a uniform 25% levy on imported steel and aluminum products. This particularly affected strapping applications that rely on steel strap material and key machine components manufactured from aluminum alloys. Manufacturers faced higher input costs, which were often passed through to end users to preserve profitability while managing cash flow pressures.

Adding further complexity, reciprocal tariff measures announced in April 2025 introduced a 10% baseline tariff on most imported goods, with higher country-specific rates that were subsequently rolled back to the baseline. For companies operating under bilateral trade agreements, uncertainty around tariff reinstatements and potential exclusions led to increased hedging activities and more conservative capital allocation for U.S.-based capital equipment investments. The cumulative impact of these overlapping measures has underscored the critical need for supply chain visibility, agile procurement frameworks, and proactive engagement with trade compliance specialists.

Deriving Strategic Insights from Detailed Segmentation of Strapping Machines by Machine Type, Components, Materials, Power Sources, User Demographics, Applications, and End Use Industries

A detailed examination of machine type reveals that fully automatic strapping systems have gained traction in high-volume production environments, where throughput requirements justify the upfront investment and deliver rapid payback through labor savings. Manual and semi-automatic machines continue to hold sway in lower-volume applications and facilities with variable batch sizes, providing a cost-effective alternative for small and medium enterprises. Pallet-oriented solutions remain indispensable for logistics operators, who rely on these specialized configurations to secure unitized loads for transportation.

Component-level trends indicate a shift toward more integrated tool bodies and dispenser modules that facilitate quick maintenance and reduce downtime. Tensioners and sealing tools are being optimized for durability under repetitive cycles, delivering consistent strap tension and seal integrity in diverse conditions. Material preferences are evolving, with polypropylene maintaining broad adoption for general cargo, polyester gaining favor for heavier or irregular loads, and steel straps reserved for high-strength requirements. The emergence of new composite straps has begun to influence machine calibration parameters and sealing mechanisms.

When it comes to power sources, electric systems are ubiquitous in fixed installations, while battery-powered units are finding expanded use in mobile or field applications. Pneumatic machines continue to serve niche environments, particularly where intrinsic safety is required or compressed-air infrastructure is already in place. User segmentation highlights a divergence between large enterprises-focused on throughput optimization and data integration-and smaller organizations, which prioritize flexibility and capital efficiency. Finally, application-based insights underscore that unitizing and bundling remain the backbone of many operations, though specialized sealing and packaging use cases are driving pockets of innovation in industries such as pharmaceuticals and food and beverage.

This comprehensive research report categorizes the Strapping Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Machine Type

- Components

- Power Source

- Users

- Application

- End Use Industry

Examining the Distinct Regional Characteristics Influencing Strapping Machine Adoption, Regulatory Environments, and Market Opportunities Across the Americas, EMEA, and Asia-Pacific

Across the Americas, investment in automation and infrastructure modernization continues to fuel demand for advanced strapping solutions. North America, in particular, has seen heightened adoption of integrated systems that tie machine performance data into enterprise planning platforms, while Latin American markets are gradually following suit as manufacturing capabilities evolve. In the United States, regulatory incentives and infrastructure spending initiatives have further stimulated capital equipment upgrades, driving a preference for machines with proven uptime records.

Meanwhile, in Europe, the Middle East, and Africa, stringent sustainability regulations and energy efficiency targets have become pivotal purchase criteria. European end users are leading the way in trialing recyclable strap materials and energy-recovery features, and government-backed decarbonization programs are incentivizing the adoption of ultra-efficient electric drives. In the Middle East and Africa, logistics and e-commerce investments are accelerating warehouse automation projects, creating new opportunities for pallet strapping and turnkey packaging lines.

Asia-Pacific remains the fastest-growing region, with China, India, and Southeast Asia driving volume growth for both manual and automatic strapping machines. Capacity expansion in e-commerce fulfillment and consumer electronics manufacturing is underpinning sustained demand for high-speed, high-precision systems. Local manufacturers are also scaling up to meet regional needs, combining competitive pricing with service networks tailored to diverse regulatory environments and connectivity requirements.

This comprehensive research report examines key regions that drive the evolution of the Strapping Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Strapping Machine Manufacturers and Suppliers to Illuminate Competitive Positioning, Product Innovation, and Strategic Partnerships

Signode Industrial Group stands out as a market leader, offering a broad product portfolio that spans manual, semi-automatic, and fully automatic machines complemented by global service capabilities. Its long-standing reputation for reliability and innovative sealing technologies has cemented its position across logistics, construction, and manufacturing applications. MJ Maillis, another key player, leverages its expertise in tensioning and dispensers to deliver integrated packaging lines, while Cyklop focuses on modular architectures that enable rapid reconfiguration and easy maintenance. Fromm distinguishes itself through high-precision tooling and robust handheld systems, carving out a niche among small-to medium-scale operators seeking flexible solutions.

Mosca GmbH continues to drive advancements in energy-efficient welding and high-frequency strapping technologies, targeting high-volume environments such as e-commerce fulfillment and food packaging. StraPack and Orgapack are notable for their specialization in compact, portable solutions that cater to field operations and nontraditional manufacturing settings. Companies such as Samuel Strapping Systems and Transpak complement these offerings by providing custom-engineered systems for unique end-use scenarios, while Polychem and Yongsun focus on material innovations that optimize strap performance under specific load conditions. The competitive landscape is characterized by ongoing product differentiation, regional partnerships, and strategic expansions of service footprints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Strapping Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allespack Systems Private Limited

- Avi International Packaging Company

- Cyklop International

- DG Jingduan Packaging Technology Co., Ltd.

- Dongguan Xutian Packing Machine Co., Ltd.

- FEIFER-kovovýroba, spol. s r.o.

- FROMM Holding AG

- Greenbridge

- Hangzhou Youngsun Intelligent Equipment Co., Ltd.

- Humboldt Verpackungstechnik GmbH

- Itipack S.R.L.

- Join Pack Machines (Pvt.) Ltd.

- Lantech, LLC

- LINDER GmbH

- Messersì Packaging S.r.l.

- Mosca GmbH

- Packmaster Machinery Private Limited

- Packway Inc.

- Samuel, Son & Co., Ltd.

- Sepack India Private Limited

- Shri Vinayak Packaging Machine Pvt. Ltd.

- Signode Industrial Group LLC

- SORSA Strapping Systems

- StraPack, Corp.

- TART, s.r.o.

- Venus Packaging

- Yongchuang Packing Machine Co., Ltd.

Formulating Targeted Strategic Recommendations for Industry Leaders to Navigate Market Disruptions, Enhance Competitiveness, and Capitalize on Emerging Opportunities

Industry leaders should prioritize the deployment of advanced data analytics and connectivity frameworks to transform strapping machinery from stand-alone assets into integral components of smart factory ecosystems. By leveraging IoT-enabled sensors and cloud-based dashboards, organizations can move from reactive maintenance to predictive models, reducing unplanned downtime and extending equipment lifecycles. Investing in modular, upgradeable platforms will also provide flexibility to adapt to emerging material types and evolving application requirements without necessitating full system replacements.

To navigate the evolving tariff environment, procurement and finance teams must collaborate closely to develop dynamic sourcing strategies that incorporate multi-country supplier networks, dual-sourcing protocols, and just-in-time inventory buffers. Engaging with trade compliance experts and exploring available exclusion processes can offer relief on specific machinery categories subject to Section 301 duties. In parallel, forming strategic alliances with key component manufacturers can secure favorable terms and improve resilience against raw material cost fluctuations.

Finally, sustainability should be embedded into product roadmaps and customer value propositions. Manufacturers that demonstrate reduced energy consumption, lower carbon footprints, and circular material pathways will not only meet regulatory demands but also capture premium contracts and preferred supplier statuses. Cross-functional teams encompassing engineering, supply chain, and sustainability professionals will be essential to translate environmental commitments into tangible operational improvements.

Detailing the Comprehensive Mixed-Method Research Methodology Combining Secondary Analysis, Expert Interviews, and Data Triangulation to Ensure Robust Market Insights

This research leverages a mixed-method approach combining extensive secondary data collection and primary expert validation. Secondary sources included publicly available trade statistics, tariff schedules, and regulatory filings, supplemented by industry white papers and corporate disclosures. To enrich these findings, in-depth interviews were conducted with packaging engineers, supply chain managers, and trade compliance specialists, ensuring that perspectives from both end users and equipment providers were integrated into the analysis.

Quantitative data sets were triangulated using cross-comparisons between import/export databases, machinery shipment volumes, and tariff impact analyses. Qualitative insights were coded thematically to identify recurring patterns in technology adoption, sustainability initiatives, and procurement behaviors. A peer review process involving independent subject matter experts was employed to validate key interpretations and ensure the robustness of strategic recommendations. The resulting framework provides a balanced, multi-dimensional understanding of market dynamics and future outlook scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Strapping Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Strapping Machine Market, by Material Type

- Strapping Machine Market, by Machine Type

- Strapping Machine Market, by Components

- Strapping Machine Market, by Power Source

- Strapping Machine Market, by Users

- Strapping Machine Market, by Application

- Strapping Machine Market, by End Use Industry

- Strapping Machine Market, by Region

- Strapping Machine Market, by Group

- Strapping Machine Market, by Country

- United States Strapping Machine Market

- China Strapping Machine Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Critical Executive Insights to Reinforce the Strategic Imperatives and Future Outlook for the Global Strapping Machine Industry

Through a systematic exploration of technological evolutions, tariff-induced cost pressures, and regional market nuances, this executive summary underscores the complexity and opportunity inherent in the strapping machine ecosystem. The interplay between automation, sustainability, and supply chain resilience emerges as a defining theme, shaping procurement decisions and shaping competitive differentiation. While headwinds such as evolving trade policies and raw material volatility present challenges, they also catalyze innovation in modular design, energy efficiency, and digital integration.

As companies position themselves for the next phase of growth, strategic agility and knowledge-driven decision-making will be paramount. By aligning investment in advanced machine capabilities with clear operational objectives and regulatory requirements, stakeholders across the value chain can enhance throughput, lower total cost of ownership, and improve environmental performance. This comprehensive view provides executives with the insights needed to chart a course through uncertain terrain and capitalize on emerging trends.

Engage with Ketan Rohom to Unlock Exclusive Access to the Comprehensive Strapping Machine Market Research Report and Propel Your Strategic Decisions

I invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your access to the definitive market research report on strapping machines. This comprehensive analysis will equip your organization with the insights, data, and strategic guidance needed to navigate evolving market conditions and gain a competitive advantage.

By partnering with Ketan, you will benefit from personalized support in understanding the report’s findings, customizing data extracts to your specific needs, and arranging enterprise licensing options for seamless integration within your organization. Reach out today to explore exclusive purchasing options, volume licensing discounts, and tailored advisory services that will accelerate your decision-making and investment planning. Take the first step toward future-proofing your operations with the in-depth, forward-looking intelligence that only this report can deliver.

- How big is the Strapping Machine Market?

- What is the Strapping Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?