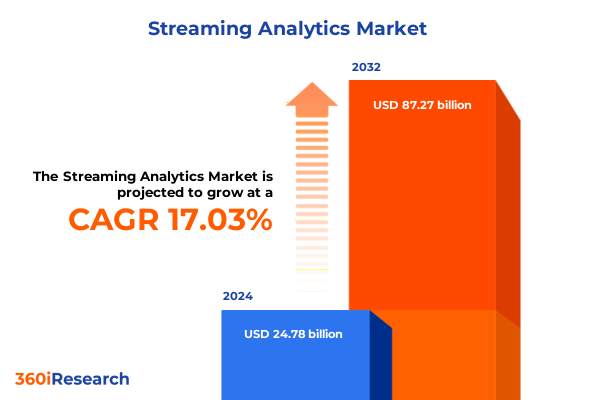

The Streaming Analytics Market size was estimated at USD 28.71 billion in 2025 and expected to reach USD 33.39 billion in 2026, at a CAGR of 17.21% to reach USD 87.27 billion by 2032.

Unlocking the Power of Continuous Data Streams to Drive Instant Insights and Transform Operational Agility

Streaming analytics has emerged as a cornerstone in the data-driven era, enabling organizations to process and act upon continuous data flows with unprecedented speed and precision. This introduction delves into how the confluence of advanced data ingestion frameworks, in-memory processing, and sophisticated event-driven architectures has reshaped operational landscapes across industries. As enterprises grapple with an ever-increasing volume of sensor feeds, transaction logs, and social streams, the demand for tools that reduce latency and fuel instant decision-making has never been greater.

In this environment, the transition from batch to stream-based processing is not merely a technology upgrade but a strategic imperative. Companies that have successfully navigated this shift report enhanced agility in risk management, customer engagement, and predictive maintenance. By embracing streaming analytics, firms can identify emerging patterns and anomalies in real time, enabling proactive interventions rather than reactive firefighting. In the pages that follow, we outline the key catalysts behind this evolution, examine transformative industry impacts, and offer actionable guidance for leveraging streaming analytics as a competitive differentiator.

Exploring How Edge Computing, Cloud-Native Platforms, and AI-Driven Anomaly Detection Are Redefining the Streaming Analytics Landscape

Over the past several years, streaming analytics has undergone transformative shifts driven by exponential growth in data generation and the rise of edge computing. Initially confined to large-scale enterprises with bespoke infrastructure, modern streaming solutions now leverage cloud-native services, open-source platforms, and serverless architectures. This democratization has been fueled by the maturation of distributed messaging systems and integrations with AI-driven anomaly detection, fostering real-time intelligence at scale.

Concurrently, the ascent of Internet of Things deployments has expanded streaming analytics beyond traditional IT operations into manufacturing, retail, and healthcare. Edge nodes now preprocess data to minimize network overhead, while centralized platforms provide holistic dashboards for cross-functional teams. Meanwhile, regulatory landscapes have adapted, introducing new data privacy frameworks that shape architectural decisions and encryption methodologies. As organizations align their operational strategies with these shifts, streaming analytics becomes a linchpin in the pursuit of resilient, agile, and insight-driven enterprise ecosystems.

Analyzing the 2025 Tariff-Induced Shifts in Hardware Sourcing and Software Consumption Patterns Impacting Streaming Analytics Economies

In 2025, United States tariffs have introduced nuanced dynamics affecting the streaming analytics value chain, particularly in hardware procurement and software licensing costs. Increased levies on semiconductor imports have prompted some hyperscale cloud providers to reevaluate sourcing strategies for network interface cards and specialized accelerators, leading to marginal rises in infrastructure expenses. This trend has sharpened the focus on software efficiency, driving greater adoption of lightweight, containerized analytics components that can deliver high performance with reduced hardware dependency.

On the software side, extended duties on international SaaS subscriptions have influenced deployment models, pivoting investments toward private cloud and on-premises installations where local licensing avoids tariff overhead. Organizations with global footprints are redesigning their financial planning to account for fluctuating import duties, emphasizing vendor partnerships that include hardware-as-a-service options. As the market adapts, the emphasis is on optimizing total cost of ownership through flexible consumption-based pricing and modular analytics services.

Deep Dive into Component Variations, Data Source Typologies, Organizational Scales, and Industry Applications That Illuminate Streaming Analytics Segmentation

Understanding the diverse dimensions of streaming analytics demands a nuanced segmentation approach. When examining solutions based on component, the distinction between services and software reveals that managed services accelerate time to value for organizations lacking in-house expertise, while professional services drive tailored integrations with legacy systems. Software offerings, in turn, cater to both turnkey cloud deployments and highly customizable on-premises installations. Transitioning to data source type, the proliferation of IoT streams contrasts with log data and social media feeds; consumer IoT deployments, such as wearables, generate high-velocity personal health indicators, whereas industrial IoT orchestrates machine telemetry for operational efficiency.

Focusing on organization size, large enterprises harness extensive streaming architectures to safeguard critical infrastructures and drive enterprise-wide analytics programs, whereas small and medium enterprises prioritize out-of-the-box simplicity and predictable cost structures. When assessing deployment mode, cloud-based implementations deliver rapid scalability through public or private cloud environments, while on-premises architectures remain essential for regulated industries. Vertically, banking, financial services, and insurance leverage real-time fraud detection modules, healthcare integrates patient monitoring streams, IT and telecom optimize network monitoring, manufacturing employs predictive maintenance in automotive and electronics subsegments, and retail and ecommerce refine user behavior analytics for personalized experiences. Finally, application-focused segmentation highlights fraud detection workflows addressing identity theft and payment fraud, alongside network monitoring, predictive maintenance, and user behavior analytics, each demanding specialized rule engines and machine learning inference pipelines.

This comprehensive research report categorizes the Streaming Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Data Source

- Organization Size

- Deployment Mode

- Vertical

- Use Case

Examining Regional Variations in Regulatory Mandates, Cloud Adoption Patterns, and Edge Integration Trends Driving Streaming Analytics Growth

Regional dynamics shape the streaming analytics landscape in distinct ways. In the Americas, robust digital infrastructures and a thriving innovation ecosystem drive widespread adoption of cloud-native streaming platforms. Organizations across North and Latin America leverage real-time insights to enhance customer engagement and streamline logistics. Meanwhile, Europe, Middle East & Africa contend with diverse regulatory frameworks such as GDPR, prompting a strong emphasis on data governance and localized deployment strategies; enterprises here balance between public cloud scalability and sovereign private cloud initiatives to maintain compliance.

Across Asia-Pacific, rapid industrialization and smart city projects fuel demand for edge-integrated streaming analytics. Key markets including China, India, and Australia spearhead investments in IoT-driven manufacturing and urban mobility solutions. Regional cloud champions collaborate with local telcos to embed analytics capabilities at the network edge, optimizing data flows for low-latency decision-making. These geographic variations underscore the importance of adaptable architectures and strategic partnerships tailored to region-specific regulatory, infrastructural, and market maturity conditions.

This comprehensive research report examines key regions that drive the evolution of the Streaming Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing How Hyperscale Providers, Specialized Platform Vendors, and Open-Source Communities Are Shaping Streaming Analytics Competition

The competitive landscape of streaming analytics is defined by a blend of hyperscale cloud providers, specialist platform vendors, and open-source communities. Hyperscale providers differentiate through integrated AI toolkits, global data fabric services, and pay-as-you-go pricing models that appeal to large digital-native enterprises. At the same time, specialist vendors carve out niches with industry-specific prebuilt connectors for banking fraud workflows or manufacturing telemetry pipelines. Open-source distributions foster innovation, enabling organizations to customize core stream processing engines and tap into vibrant contributor ecosystems.

Partnerships between infrastructure providers and analytics specialists further shape market dynamics, as co-developed offerings streamline deployment and unify management consoles. Strategic alliances with hardware manufacturers optimize performance for high-throughput scenarios. Additionally, certifications and compliance frameworks enhance vendor reputations in regulated sectors. Ultimately, the success of each player hinges on their ability to blend real-time data processing capabilities with seamless integration, robust security provisions, and flexible consumption models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Streaming Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alphabet Inc.

- Amazon Web Services, Inc.

- Cloudera, Inc.

- Confluent, Inc.

- Databricks, Inc.

- Hazelcast, Inc.

- IBM Corporation

- Impetus Technologies, Inc.

- Materialize, Inc.

- Microsoft Corporation

- Oracle Corporation

- Redpanda Data, Inc.

- SAP SE

- SAS Institute Inc.

- Snowflake Inc.

- Software AG

- Splunk Inc.

- StreamSets, Inc.

- Striim, Inc.

- TIBCO Software Inc.

Implementing a Multi-Layered Architectural Strategy Coupled with Governance, Teams, and Performance Validation to Maximize Streaming Analytics ROI

Industry leaders seeking to harness streaming analytics effectively should prioritize a layered approach to architecture that balances edge and centralized processing. Establishing a center of excellence ensures governance and fosters best practices, while investing in low-code or no-code interfaces accelerates internal adoption. Organizations must also cultivate multidisciplinary teams that combine data engineering, DevOps, and domain expertise to operationalize streaming pipelines efficiently.

Furthermore, embracing open standards and interoperable APIs mitigates vendor lock-in and future-proofs investments. It is critical to conduct periodic performance audits, leveraging synthetic workloads to validate latency and throughput objectives. Companies should negotiate flexible service-level agreements that include burstable capacity and multiregional redundancy. Lastly, aligning streaming analytics initiatives with broader digital transformation goals ensures executive buy-in and drives measurable business outcomes across functions.

Detailing a Hybrid Approach Incorporating Executive Interviews, Secondary Literature Analysis, and Expert Validation Panels for Accurate Streaming Analytics Insights

This research leverages a hybrid methodology combining primary and secondary data sources. In-depth interviews with technology leaders, data architects, and industry practitioners provided qualitative insights into deployment challenges and strategic priorities. These perspectives were triangulated against secondary literature, including technology white papers, regulatory documentation, and case study compendiums, to establish context and benchmark best practices.

Quantitative analysis involved synthesizing vendor capabilities, feature comparisons, and cost model evaluations from public company disclosures and platform documentation. The segmentation framework was validated through expert workshops and a structured Delphi panel, ensuring relevance across industries and geographies. Throughout the process, rigorous data governance protocols were applied to maintain confidentiality and accuracy, resulting in a robust foundation for the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Streaming Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Streaming Analytics Market, by Component

- Streaming Analytics Market, by Data Source

- Streaming Analytics Market, by Organization Size

- Streaming Analytics Market, by Deployment Mode

- Streaming Analytics Market, by Vertical

- Streaming Analytics Market, by Use Case

- Streaming Analytics Market, by Region

- Streaming Analytics Market, by Group

- Streaming Analytics Market, by Country

- United States Streaming Analytics Market

- China Streaming Analytics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing How Transformative Architectural Trends, Tariff Dynamics, and Strategic Segmentation Unite to Empower Real-Time Data Excellence

This executive summary has navigated the evolving streaming analytics landscape, spotlighting the transformative shifts in architecture, the nuanced impacts of US tariffs, and the intricate segmentation that guides solution selection. By synthesizing regional dynamics and competitive forces, we have illuminated pathways for organizations to harness continuous data flows to drive strategic decisions. Moving from insight to action, the recommendations equip industry leaders with the tactical guidance necessary to optimize real-time analytics initiatives and secure sustainable value.

As streaming technologies continue to advance, the ability to adapt rapidly, foster cross-functional collaboration, and maintain rigorous performance standards will distinguish market frontrunners. The subsequent chapters build upon this foundation, offering an in-depth exploration of vendor landscapes, technical deep dives, and functional use cases to empower your journey toward real-time data mastery.

Take the Next Step Toward Real-Time Data Mastery by Engaging with Our Associate Director to Access This Comprehensive Streaming Analytics Report

We appreciate your interest in this comprehensive streaming analytics report. For personalized guidance on how these insights can transform your organization’s real-time data strategy, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can walk you through detailed findings, discuss tailored solutions, and facilitate prompt access to the full report. Engage today to unlock the competitive advantage that real-time intelligence delivers.

- How big is the Streaming Analytics Market?

- What is the Streaming Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?