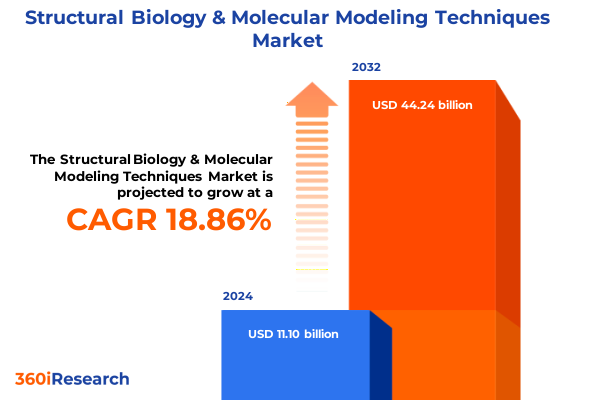

The Structural Biology & Molecular Modeling Techniques Market size was estimated at USD 13.20 billion in 2025 and expected to reach USD 15.54 billion in 2026, at a CAGR of 18.85% to reach USD 44.24 billion by 2032.

Unveiling the Next Frontier Where Experimental Breakthroughs and Computational Innovations Converge to Revolutionize Structural Biology

The frontier of structural biology and molecular modeling has entered a transformative era characterized by technological breakthroughs and multidimensional collaboration. Advances in cryo-electron microscopy have unlocked near-atomic resolution of biomolecules, enabling researchers to visualize complex assemblies that once eluded traditional methods. Concurrently, computational modeling platforms now harness the power of artificial intelligence and high-performance computing to predict and simulate macromolecular behavior with unprecedented accuracy. As a result, the synergy between experimental and in silico approaches is streamlining workflow efficiency and catalyzing novel discoveries across drug development, protein engineering, and fundamental biological research.

In addition to these methodological leaps, the field continues to benefit from enhanced data processing pipelines and open-access repositories, fostering a spirit of shared innovation. Researchers worldwide leverage integrated software suites to drive hypothesis-driven experiments and iterative design processes. This convergence of technologies, coupled with cross-sector partnerships, has laid the groundwork for a resilient and adaptive ecosystem. Against this backdrop, stakeholders-from academic institutions to pharmaceutical enterprises-are poised to capitalize on these advancements, thereby redefining the boundaries of molecular insight and therapeutic intervention.

How Cutting-Edge Cryo-EM Accessibility and AI-Driven Simulations Are Driving an Unprecedented Evolution in Molecular Modeling

Over the past decade, structural biology has undergone a paradigm shift, fueled by the democratization of cryo-EM instrumentation and the advent of deep learning algorithms tailored for molecular modeling. Researchers now routinely achieve sub-2 Å resolution with single-particle analysis, transforming the study of membrane proteins and large complexes. At the same time, ab initio modeling has matured into a reliable tool for de novo structure prediction, dramatically reducing the reliance on time-consuming crystallography and NMR methods.

Moreover, integrative platforms seamlessly combine tomography data with molecular dynamics simulations, creating holistic models that capture both static architectures and dynamic conformational landscapes. Cloud-based infrastructures further enhance accessibility, allowing distributed teams to perform large-scale ensemble simulations and data mining in real time. Consequently, the field is experiencing an accelerating feedback loop wherein experimental evidence refines in silico predictions, and computational insights guide targeted experimental validation. This virtuous cycle is setting a new standard for precision, speed, and scalability in structural analysis.

Examining the Ripple Effects of 2025 Tariff Revisions on Supply Chain Resilience and Research Continuity

The implementation of new United States tariff measures in 2025 has exerted significant pressure on global supply chains for structural biology equipment, reagents, and consumables. Import duties on specialized instrumentation and critical components have led many laboratories to re-evaluate sourcing strategies to maintain budgetary targets while ensuring uninterrupted research operations. At the same time, tariff-induced cost increases have incentivized domestic manufacturers to expand production capacity for enzymes, kits, and high-precision hardware.

Consequently, research organizations have adopted hybrid procurement models, combining in-house reagent synthesis with strategic partnerships to mitigate cost volatility. These adjustments have not only bolstered supply resilience but also encouraged investment in local quality control and custom synthesis services. In parallel, forward-looking stakeholders are leveraging predictive analytics to forecast material lead times and to align procurement cycles with funding schedules. Such proactive planning has become a cornerstone of operational continuity, ensuring that pioneering structural biology programs can proceed seamlessly despite evolving trade policies.

Unpacking the Diverse Technological and End-User Landscape That Underpins Structural Biology and Molecular Modeling Innovation

A nuanced understanding of market segmentation reveals distinct technology trajectories and user needs across multiple dimensions. When classified by technique, established methods such as X-ray crystallography, including powder and single-crystal variants, coexist alongside rapidly expanding realms of cryo-electron microscopy, from single-particle analysis to tomography, and sophisticated NMR spectroscopy encompassing both solution and solid-state approaches. Computational modeling itself spans ab initio strategies, homology frameworks, and molecular dynamics simulations, each enabling unique insights into biomolecular structure and behavior.

Turning to product typologies, research entities increasingly integrate advanced instruments with tailored reagents, consumables differentiated by enzymes or kits, and comprehensive software suites supported by specialized services. Applications range from biomarker discovery and structure-function analysis to targeted drug discovery pathways, where lead identification and optimization occupy center stage. In terms of end users, academic research institutes drive foundational exploration, biotechnology companies pioneer translational platforms, contract research organizations accelerate outsourced study, and large pharmaceutical players apply structural insights to clinical pipelines.

Finally, mapping the workflow steps underscores the importance of seamless transitions among sample preparation, data collection-whether automated or manual-data processing, and visualization. This holistic segmentation framework illuminates opportunities for targeted innovation, from enhancing sample throughput to refining computational pipelines, all of which shape the evolving ecosystem of structural biology and molecular modeling.

This comprehensive research report categorizes the Structural Biology & Molecular Modeling Techniques market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technique

- Product Type

- Workflow Step

- Application

- End User

How Regional Funding Initiatives and Collaborative Ecosystems Are Accelerating Structural Biology Advancements Across Key Geographies

Regional dynamics continue to shape research priorities and investment flows in structural biology and molecular modeling. Within the Americas, well-established pharmaceutical hubs and burgeoning biotech clusters drive demand for high-throughput cryo-EM services, state-of-the-art computational platforms, and integrated reagent workflows. Government-funded initiatives further incentivize domestic manufacturing of consumables and advanced instrumentation, fostering a self-sustaining innovation cycle.

Meanwhile, the Europe, Middle East & Africa panorama reflects robust academic-industrial collaborations, where consortia leverage centralized facilities to accelerate structure-function studies. Regulatory harmonization and pan-regional funding mechanisms facilitate cross-border partnerships, enabling shared access to high-resolution imaging centers and specialized computational resources. In tandem, emerging public–private models are cultivating capacity for next-generation NMR spectroscopy and mass spectrometry installations.

Across Asia-Pacific, research ecosystems exhibit rapid adoption of both experimental and in silico methodologies. National programs channel significant funding into indigenous instrument development, while contract research organizations capitalize on competitive cost structures and technical expertise to serve global clients. Cloud-based data processing hubs and virtual training platforms ensure that evolving techniques can scale seamlessly across diverse research environments, reinforcing the region’s pivotal role in the global structural biology network.

This comprehensive research report examines key regions that drive the evolution of the Structural Biology & Molecular Modeling Techniques market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying the Strategic Collaborations and Technological Pioneers Shaping Tomorrow’s Structural Biology Solutions

Industry leaders driving innovation in this domain blend long-standing expertise with forward-thinking partnerships. Instrumentation pioneers have expanded their portfolios to include integrated cryo-EM workflows coupled with dedicated assay kits, while specialized software developers deliver AI-enhanced modeling engines that streamline simulation setup and analysis. Service providers have scaled offerings to support end-to-end structural determination, from sample preparation and data acquisition to expert interpretation and custom reporting.

Strategic alliances between hardware manufacturers and digital solution firms are reshaping value chains, creating unified platforms that encompass both physical and computational components. Concurrently, collaborative ventures between reagent producers and academic consortia foster co-development of novel enzymes and labeling techniques tailored for high-resolution studies. Together, these synergies are establishing new benchmarks for speed, accuracy, and reproducibility, ensuring that researchers can navigate increasingly complex molecular landscapes with confidence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Structural Biology & Molecular Modeling Techniques market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atomwise Inc.

- BioSolveIT GmbH

- Biosym Technologies

- Certara, L.P.

- Chemical Computing Group ULC

- Compugen Ltd.

- Cresset BioMolecular Discovery Ltd.

- Cresset Group Limited

- Cyclica Inc.

- Cytiva

- Dassault Systèmes SE

- Genedata AG

- Moleculon, Inc.

- Molsoft LLC

- NanoTemper Technologies GmbH

- Nimbus Therapeutics, Inc.

- OpenEye Scientific Software, Inc.

- Relay Therapeutics, Inc.

- Schrödinger, Inc.

- Simulations Plus, Inc.

- Tripos International

Implementing Integrated Innovation Pathways and Supply Chain Diversification to Future-Proof Structural Biology Advances

To thrive in this dynamic environment, industry leaders must adopt multifaceted strategies that balance innovation, agility, and resilience. Prioritizing investment in artificial intelligence–driven platforms will enable more predictive modeling and more efficient data interpretation, thereby shortening research timelines. At the same time, diversifying supplier networks and cultivating domestic production capabilities can mitigate the impact of evolving trade policies and supply disruptions.

Furthermore, forging cross-sector partnerships with academic institutions and regulatory bodies can accelerate method standardization and facilitate broader technology adoption. Equally important, organizations should cultivate talent pipelines through targeted training programs, ensuring that the next generation of researchers remains proficient in both traditional techniques and emergent computational methodologies. By embedding these recommendations into corporate roadmaps, leaders can position themselves at the vanguard of structural biology and molecular modeling innovation.

Employing a Robust Mixed-Methods Framework to Illuminate the Trajectory of Structural Biology and Modeling Techniques

Our research methodology combines rigorous primary and secondary approaches to deliver a comprehensive analysis of structural biology and molecular modeling. Primary inputs derive from in-depth interviews with senior executives at academic laboratories, biotechnology firms, and contract research organizations, as well as technical discussions with experts in instrument design and computational algorithm development. We supplemented these insights with detailed case studies illustrating successful deployments of cryo-EM, NMR, and advanced simulation platforms.

On the secondary side, we performed an exhaustive review of peer-reviewed publications, industry white papers, patent filings, and conference proceedings to capture the full spectrum of technological advancements. This process included cross-validation of data points and trend indicators to ensure consistency and reliability. We also hosted interactive workshops with key opinion leaders to validate emerging themes and refine strategic recommendations. By triangulating these diverse information streams, we established a robust framework that reflects both current realities and future potentials across the structural biology landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Structural Biology & Molecular Modeling Techniques market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Structural Biology & Molecular Modeling Techniques Market, by Technique

- Structural Biology & Molecular Modeling Techniques Market, by Product Type

- Structural Biology & Molecular Modeling Techniques Market, by Workflow Step

- Structural Biology & Molecular Modeling Techniques Market, by Application

- Structural Biology & Molecular Modeling Techniques Market, by End User

- Structural Biology & Molecular Modeling Techniques Market, by Region

- Structural Biology & Molecular Modeling Techniques Market, by Group

- Structural Biology & Molecular Modeling Techniques Market, by Country

- United States Structural Biology & Molecular Modeling Techniques Market

- China Structural Biology & Molecular Modeling Techniques Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Capturing the Convergence of Imaging Breakthroughs and Computational Mastery to Define the Next Decade of Molecular Discovery

As structural biology and molecular modeling continue to converge under the influence of technological innovation and collaborative momentum, stakeholders across sectors face a pivotal moment. The integration of high-resolution imaging with AI-enhanced computational platforms is redefining what is possible in drug discovery, protein engineering, and fundamental research. Simultaneously, evolving trade policies and regional funding strategies underscore the importance of adaptable supply chains and strategic partnerships.

By embracing the insights outlined herein, decision-makers can navigate the complexities of technique selection, segmentation focus, and regional dynamics with confidence. This executive summary provides a clear roadmap for aligning research objectives with emerging opportunities, ensuring that organizations maintain a competitive edge in a landscape defined by rapid change. Ultimately, the future of structural biology belongs to those who can seamlessly integrate experimental excellence with computational foresight, driving transformative outcomes at the molecular level.

Secure Exclusive Access to Transformative Insights in Structural Biology and Molecular Modeling by Engaging with Our Associate Director

I welcome the opportunity to discuss how this comprehensive report can drive strategic growth and competitive advantage for your organization. I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure access to in-depth analysis, unparalleled intelligence, and tailored insights. Take the next step toward unlocking actionable guidance that empowers your decision-making in the rapidly evolving structural biology and molecular modeling landscape. Reach out today to initiate a partnership that will shape the future of your research and innovation initiatives.

- How big is the Structural Biology & Molecular Modeling Techniques Market?

- What is the Structural Biology & Molecular Modeling Techniques Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?