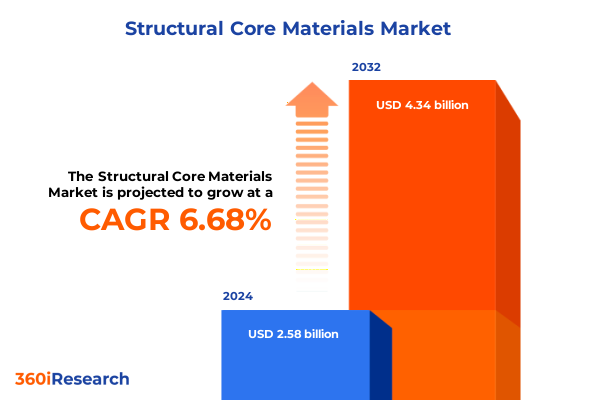

The Structural Core Materials Market size was estimated at USD 2.74 billion in 2025 and expected to reach USD 2.92 billion in 2026, at a CAGR of 6.74% to reach USD 4.34 billion by 2032.

A Comprehensive Overview of Structural Core Materials Highlighting Their Critical Functionality and Dynamic Integration Across Key Industrial Sectors

Structural core materials have emerged as critical enablers in the pursuit of lightweight, high-strength solutions across diverse industries. In recent years, engineers and product designers have increasingly turned to cores such as balsa wood, polymer foams, and engineered honeycomb to meet stringent weight reduction and performance targets. The intrinsic properties of these materials-exceptional rigidity at minimal mass, tunable thermal and acoustic insulation, and compatibility with advanced manufacturing processes-have positioned them at the heart of next-generation composite structures.

Moreover, the convergence of digital design tools with materials science has amplified the strategic importance of core materials. Advanced simulation platforms allow for precise optimization of panel thickness, shear rigidity, and energy absorption in ways that were previously impractical. Consequently, aerospace manufacturers can now iterate on honeycomb sandwich panels for cabin interiors more rapidly, while automotive OEMs have optimized foam cores for crash-worthy structural components. In this context, a thorough understanding of the structural core landscape is essential for stakeholders aiming to capitalize on these performance advantages and reduce development lead times.

Examining the Forces Driving Transformative Shifts in Structural Core Technologies and Applications Amid Rapid Industry Innovation

The structural core materials ecosystem is experiencing transformative shifts driven by technological innovation and evolving performance requirements. One of the most notable changes is the refinement of foam chemistries to deliver enhanced fire retardancy, lower density, and improved environmental profiles. High-performance formulations, such as advanced styrene acrylonitrile foam blends and tailored polyurethane systems, enable manufacturers to meet stringent safety standards in aerospace applications while simultaneously reducing overall component weight.

Additionally, the honeycomb segment has benefited from the introduction of novel alloys and resin systems that improve fatigue resistance and bond strength. Aluminum honeycomb cores now feature optimized cell geometries and corrosion-resistant coatings, while alternative substrates like Nomex® and titanium are being adopted for extreme-environment use cases. Furthermore, the integration of digital manufacturing techniques, including automated tape laying and robotic core placement, has streamlined production workflows and minimized human error. These developments collectively signal a shift toward smarter, more adaptive core solutions that address both cost efficiency and performance demands across multiple industries.

Assessing the Cumulative Effects of 2025 United States Tariffs on the Structural Core Materials Value Chain and Supply Dynamics

In 2025, newly enacted United States tariffs have begun to reshape the supply chain dynamics for structural core materials. Additional duties on imported aluminum and high-performance foam products have prompted original equipment manufacturers to reassess sourcing strategies, with several tier-one suppliers investing in domestic production capabilities. This shift not only mitigates exposure to customs duties but also reduces lead-time variability associated with transoceanic logistics.

However, the re-incorporation of tariff costs into component pricing has generated pressure on profit margins, particularly in sectors with aggressive cost targets such as automotive and wind energy. To counteract these headwinds, many manufacturers are accelerating material substitution initiatives, evaluating alternatives like paper honeycomb and bio-derived foam precursors to balance performance requirements against total landed cost. Consequently, the 2025 tariff landscape has triggered a wave of supply chain resilience planning, compelling firms to engage in strategic partnerships and pursue vertically integrated models to preserve competitive positioning.

Unpacking Key Segmentation Insights to Illuminate Distinct Material Compositions Processes End-Use Verticals and Specialized Applications

Segmentation analysis clarifies the distinct characteristics that drive demand and innovation within structural core materials. The landscape based on material type encompasses traditional balsa wood, which continues to enjoy niche advantages in marine applications, alongside a diverse array of foams segmented into pet foam for lightweight structural panels, polyurethane variants prized for energy absorption, PVC foams offering chemical resistance, and styrene acrylonitrile formulations tailored for fire safety compliance. Parallel to this, honeycomb cores composed of aluminum and titanium deliver exceptional strength-to-weight ratios, Nomex substrates serve high-temperature environments, and paper honeycomb provides a cost-effective, environmentally friendly option for interior panels.

From the perspective of end use industries, core materials underpin critical functions across aerospace and defense platforms, where reliability and performance margins are paramount; within automotive and transportation, where crashworthiness and fuel efficiency dictate material selection; in industrial contexts including construction and manufacturing, where load-bearing panels require consistent mechanical behavior; across marine vessels, where buoyancy and structural integrity are vital; and in wind energy, where blade cores must balance fatigue resistance and low density.

Furthermore, manufacturing processes such as cold molding facilitate complex geometries with minimal residual stress, while hot molding enables rapid cure cycles for polymer-based cores. Finally, application-driven segmentation highlights the versatility of these materials: aircraft interiors benefit from tailored acoustic damping, automotive body panels leverage structural reinforcement, floor decking and industrial equipment panels require robust shear properties, marine structures demand corrosion resistance, and wind turbine blades call for high fatigue life.

This comprehensive research report categorizes the Structural Core Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Manufacturing Process

- Application

- End Use Industry

Driving Understanding through Key Regional Perspectives on Demand Innovation Regulatory Support and Growth Enablers in Major Global Territories

Regional dynamics play a pivotal role in shaping the adoption and innovation trajectories of structural core materials. In the Americas, a robust aerospace and defense ecosystem anchors demand, while automotive manufacturing hubs in North America and emerging wind energy farms in Latin America spur cross-sector collaboration and material development initiatives. Incentive programs for domestic content have further catalyzed investments in North American core production facilities, enhancing supply chain security and reducing import dependencies.

Meanwhile, Europe, Middle East and Africa continue to lead in renewable energy deployment, particularly offshore wind installations off the United Kingdom and northern Europe. These projects have driven advancements in large-format foam cores and hybrid honeycomb laminates engineered for extreme environmental resilience. Regulatory frameworks incentivizing carbon reduction and circular economy principles have also accelerated R&D into recyclable and bio-based core alternatives, reinforcing the region’s reputation as an innovation incubator.

Elsewhere in the Asia-Pacific region, rapid industrialization and maritime commerce have elevated demand for lightweight, high-strength core materials in shipbuilding and rail transportation. East Asian automotive manufacturers are integrating novel foam formulations into next-generation electric vehicles to extend range, while Southeast Asian fabrication hubs are expanding capacity to serve global composite panel requirements. Across the region, public-private partnerships have emerged to foster local material science expertise and streamline technology transfer from research institutions to commercial operators.

This comprehensive research report examines key regions that drive the evolution of the Structural Core Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategies Tactics and Innovations from Leading Industry Stakeholders Shaping the Evolution of Structural Core Material Solutions

Leading stakeholders continue to shape the structural core materials landscape through strategic investments, product innovation, and collaborative ventures. Industry incumbents are expanding capacity for advanced aluminum honeycomb manufacturing, incorporating automation and digital quality control to increase throughput and consistency. Concurrently, specialty chemical producers are unveiling new polymer formulations that enhance core adhesion and durability in composite assemblies.

Strategic partnerships between raw material suppliers and OEMs have become more prevalent, facilitating joint development programs that align core properties with specific end-use requirements. For example, collaborations aiming to optimize foam cell structure for acoustic performance in aircraft cabins have yielded proprietary materials now under certification review. In parallel, M&A activity has consolidated the supply chain, enabling select players to offer integrated solutions spanning core production, resin infusion services, and finished panel assembly.

Amid sustainability imperatives, several leading companies have introduced recycling pipelines for end-of-life honeycomb panels and foam cores. These closed-loop initiatives not only address regulatory pressures in key regions but also open new revenue streams through reclaimed material sales. As a result, stakeholders that blend technological acumen with environmentally conscious practices are positioning themselves as preferred partners for blue-chip OEMs and government contractors alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Structural Core Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3A Composites Holding AG

- Amorim Cork Composites S.A..

- Arconic Inc.

- Armacell International S.A.

- BASF SE

- Constellium SE

- Diab Group

- Evonik Industries AG

- Gurit Holding AG

- Hexcel Corporation

- Huntsman Corporation

- Lantor BV

- Marex Composites

- Plascore, Inc.

- SABIC

- The Dow Chemical Company

Formulating Actionable Industry Strategies to Enhance Resilience Optimize Production and Drive Sustainable Growth in Core Material Ecosystems

Industry leaders should prioritize investments in bio-derived core materials to meet rising regulatory and consumer demand for sustainable products. By fostering partnerships with research institutions and biotechnology firms, manufacturers can accelerate the development of plant-based foam precursors and recyclable honeycomb substrates, securing a competitive edge in ESG-driven procurement decisions.

Furthermore, organizations must fortify their supply chains through regional diversification and nearshoring strategies. Establishing additional production or conversion sites in key geographies will mitigate tariff exposure, shorten logistics cycles, and enhance responsiveness to localized demand fluctuations. Complementary to this, deploying advanced digital twins and predictive analytics can optimize inventory levels and preempt supply disruptions.

To fully harness material potential, OEMs and tier-one suppliers should integrate simulation platforms early in the design cycle. Leveraging finite element analysis and topology optimization tools will enable rapid iteration of core geometry and laminate stack-ups, reducing costly overdesign and accelerating time-to-market. Ultimately, a holistic strategy that combines sustainable innovation, supply chain resilience, and digital transformation will position industry stakeholders for long-term growth and operational excellence.

Detailing a Rigorous Research Methodology Integrating Qualitative and Quantitative Techniques to Ensure Comprehensive Insight and Analytical Validity

This analysis is grounded in a rigorous methodology blending qualitative insights with quantitative validation. Primary research comprised in-depth interviews with executives, engineers, and procurement leaders across OEMs and tier-one suppliers, providing firsthand perspectives on material challenges and strategic priorities. Concurrently, secondary research included a systematic review of academic literature, trade publications, and regulatory filings to capture technological advances and policy developments.

Data triangulation was applied to reconcile diverse inputs, ensuring consistency across regions, applications, and material types. Quantitative assessments were conducted using proprietary datasets that detail production capacities, trade flows, and procurement trends. Throughout the process, findings were validated by an advisory panel of industry experts, whose feedback refined analytical frameworks and ensured alignment with current market realities.

By combining robust primary and secondary research with expert validation, this study delivers actionable insights that reflect both emerging innovations in core material science and the practical considerations of engineering design, procurement, and manufacturing operations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Structural Core Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Structural Core Materials Market, by Material Type

- Structural Core Materials Market, by Manufacturing Process

- Structural Core Materials Market, by Application

- Structural Core Materials Market, by End Use Industry

- Structural Core Materials Market, by Region

- Structural Core Materials Market, by Group

- Structural Core Materials Market, by Country

- United States Structural Core Materials Market

- China Structural Core Materials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Core Insights to Conclude the Strategic Implications and Forward-Looking Perspectives of Structural Core Material Dynamics

In summary, structural core materials stand at the nexus of performance, sustainability, and cost optimization. The convergence of advanced foam chemistries, engineered honeycomb substrates, and digital manufacturing techniques is redefining the possibilities for lightweight composites. At the same time, the 2025 tariff environment is reshaping global supply chains, underlining the imperative for regional diversification and vertically integrated production models.

Segmentation analysis illustrates that tailored core solutions-ranging from balsa wood for marine panels to aluminum honeycomb for aerospace skins-enable precise alignment with end-use requirements. Regional insights reveal that incentives and regulatory frameworks in the Americas, EMEA, and Asia-Pacific are driving differentiated innovation pathways, while key industry players continue to leverage partnerships, M&A, and sustainability initiatives to strengthen their market positions.

As organizations navigate these dynamics, a strategic approach that prioritizes sustainable material development, digital design integration, and supply chain resilience will be essential. By synthesizing technological trends with pragmatic recommendations, this analysis equips decision-makers with the insights needed to capitalize on emerging opportunities and manage potential risks within the structural core materials landscape.

Engage with Our Associate Director to Secure Comprehensive Structural Core Material Analysis Tailored to Your Specific Business Objectives and Needs

To explore how this comprehensive analysis of structural core materials can drive innovation and operational excellence in your organization, engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can tailor the report insights to address your unique strategic priorities and provide guidance on implementing cutting-edge material technologies. Reach out today to secure your copy of the full research report and embark on a data-driven journey to optimize performance and sustain competitive advantage.

- How big is the Structural Core Materials Market?

- What is the Structural Core Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?