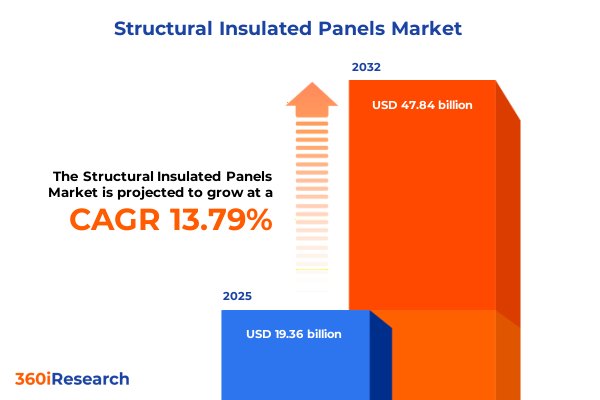

The Structural Insulated Panels Market size was estimated at USD 19.36 billion in 2025 and expected to reach USD 21.96 billion in 2026, at a CAGR of 13.79% to reach USD 47.84 billion by 2032.

This introduction unveils the rising importance of structural insulated panels as a strategic cornerstone in sustainable and efficient building design

The modern construction landscape is undergoing a profound shift as industry leaders and policymakers alike demand building solutions that balance structural integrity with superior energy performance. Structural insulated panels have emerged as a pivotal element in this evolution, offering unparalleled thermal resistance and airtightness that directly address rising concerns over greenhouse gas emissions and operational energy use. According to research from the Structural Insulated Panel Association, buildings account for 39% of total U.S. energy consumption and 38% of carbon dioxide emissions, making high-performance envelope solutions a critical priority for sustainable building stakeholders.

In response, structural insulated panels have demonstrated superior envelope performance in both new construction and retrofit applications. Laboratory studies indicate that a four‐inch panel rated at R‐14 can outperform a conventional 2×6 stick‐framed wall with R‐19 fiberglass insulation, delivering a more consistent thermal barrier and reduced air leakage. As a result, design professionals are increasingly specifying these panels to ensure compliance with stringent energy codes, such as the International Energy Conservation Code and state-level efficiency mandates. Moreover, the inherent precision of factory fabrication supports tighter project schedules and minimizes on‐site waste, aligning with modern demands for lean construction practices.

Meanwhile, developers and contractors are leveraging the modular compatibility of structural insulated panels to accelerate project delivery and expand into emerging segments. Off‐site manufacturing ecosystems, where panels are CNC-cut and quality‐checked before shipment, allow integration with volumetric modules for both residential and commercial projects. This streamlined approach reduces labor intensity and enhances build quality, signaling a transition from traditional stick framing to panelized, high‐performance systems that align with broader industry goals for efficiency, resilience, and sustainability.

Transformative shifts redefining the structural insulated panel landscape through digital manufacturing, sustainability frameworks, and modular construction integration

The structural insulated panel sector is experiencing transformative shifts that are reshaping its value proposition and accelerating mainstream adoption. Foremost among these changes is the integration of digital design workflows and advanced manufacturing technology. Leading producers now employ computer‐aided design (CAD) and CNC‐guided cutting systems to achieve dimensional precision and reduce material waste during fabrication. By automating adhesive application and lamination processes, manufacturers not only enhance product consistency but also shorten lead times, enabling contractors to adhere to tighter project schedules and deliver superior quality control.

Concurrently, the strategic imperative of carbon neutrality has elevated high‐performance insulation from a niche requirement to a key differentiator. Manufacturers are increasingly incorporating bio‐based materials and recycled core components into panel offerings, aligning with global sustainability frameworks such as net‐zero certification and green building rating systems. These material innovations not only lower embodied carbon but also address end‐of‐life circularity goals, reflecting a broader industry pivot toward decarbonization through product design and supply chain transparency.

Moreover, the convergence of panelization with modular and prefabricated construction is fostering deeper partnerships among material suppliers, general contractors, and turnkey solution providers. Integrated delivery models streamline logistics and on‐site installation, which is particularly advantageous in markets contending with skilled labor shortages. For emergency housing, multi‐story residential, and remote site applications, the synergistic use of panels and volumetric modules unlocks rapid‐deployment capabilities and supports scalable, repeatable construction methodologies. Together, these dynamics are redefining structural insulated panels as versatile, primary structural elements rather than solely as insulation adjuncts.

Assessing the cumulative impact of the evolving United States tariff regime on structural insulated panel supply chains and material cost structures in 2025

The United States tariff regime has undergone substantial evolution in early 2025, imposing layered duties on critical building materials that directly affect structural insulated panel supply chains. On March 12, the U.S. government reinstated a global 25% tariff on steel imports and increased aluminum duties from 10% to 25% under Section 232 of the Trade Expansion Act, removing previous country‐specific exemptions. Although composite panels originating under USMCA provisions remain exempt from the 25% Canada and Mexico tariff when meeting regional value content rules, uncertainty persists as policy adjustments and reciprocal measures evolve.

Simultaneously, Section 301 tariffs continue to apply to Chinese‐origin goods, adding an additional 25% duty on a range of structural components. The combined effect of Section 232 and Section 301 levies can reach cumulative rates of 50% on certain materials, amplifying cost pressures for panel producers reliant on galvanized steel fasteners and aluminum facings. These layered tariffs have prompted many manufacturers to pivot toward domestic sourcing, yet U.S. mill capacities remain constrained, leading to output bottlenecks and extended lead times for raw inputs. Fabrication delays have stretched from eight‐week to 12‐week delivery windows, underscoring the challenge of rapid supply chain rebalancing.

Consequently, industry stakeholders are recalibrating procurement strategies to mitigate exposure to import levies. Some have reduced material complexity through optimized panel designs that minimize reliance on tariff‐sensitive components, while others are exploring alternative insulation technologies exempt from specific tariff classifications. Despite these adaptation efforts, the cumulative impact of the 2025 tariff regime underscores the importance of strategic supply diversification, early procurement planning, and policy advocacy to sustain production efficiency and cost competitiveness.

Unveiling key segmentation insights across product types, resin formulations, end-user verticals, and distribution channels driving industry dynamics and specialization

Segment analysis reveals the diverse performance requirements and market dynamics across structural insulated panel configurations. When examined by product type, the market encompasses floor systems, roof assemblies, and wall panels, each demanding tailored core thicknesses, facing materials, and connection details to meet application‐specific load and insulation criteria. In residential and commercial settings, floor panels prioritize compressive strength and moisture resistance, whereas roof panels emphasize wind uplift capacity, and wall panels must balance structural load distribution with thermal bridging mitigation.

Through the lens of resin technology, panels are available with cores formulated from expanded polystyrene, polyisocyanurate, or polyurethane. Expanded polystyrene offers cost-efficient thermal resistance with consistent long‐term R‐value, while polyisocyanurate provides enhanced fire performance and higher initial R‐values, making it a preferred choice under stringent building codes. Polyurethane cores deliver the highest compressive strength and moisture impermeability, supporting applications in high‐load bearing and cold storage environments.

End‐use segmentation further highlights the adaptability of insulated panels across commercial, industrial, and residential contexts. In commercial construction, where operating cost constraints are paramount, panels are specified to achieve aggressive energy targets and aesthetic integration with curtain wall systems. Industrial applications leverage panels for climate‐controlled environments, such as refrigeration facilities, prioritizing vapor barrier integrity and rapid installation. Meanwhile, residential developers seek panels that streamline framing and insulation in a single step to accelerate homebuilding cycles and reduce capital outlays on labor and traditional thermal systems.

Distribution channels also shape product accessibility and customization options. Offline sales through dedicated building product distributors facilitate volume purchases and just‐in‐time deliveries for large‐scale projects. Meanwhile, online channels-whether via manufacturers’ websites or third‐party e‐commerce platforms-enable smaller contractors and self‐build homeowners to access standard panel kits, design resources, and technical support. This omni‐channel approach broadens market reach while ensuring that end users receive the appropriate level of specification assistance and logistical coordination.

This comprehensive research report categorizes the Structural Insulated Panels market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Resin Type

- End User

- Distribution Channel

Exploring regional dynamics that influence structural insulated panel adoption across the Americas, Europe Middle East and Africa, and the Asia-Pacific markets

Regional dynamics exert a profound influence on the adoption and application of structural insulated panels. In the Americas, the drive toward energy retrofits and net-zero emissions has spurred uptake in both new residential subdivisions and commercial renovation projects. Federal incentives and state‐level efficiency mandates have further accelerated demand, particularly in cold climate states where superior insulation yields significant operational savings and grid‐load reductions.

Meanwhile, the Europe, Middle East, and Africa region is responding to evolving building codes under the European Parliament’s Energy Performance of Buildings Directive. Recent amendments require minimum energy performance standards and whole‐life carbon reporting for new and existing structures, thereby elevating the importance of high‐performance panel systems. Governments across the region are implementing net‐zero building codes, phasing out fossil fuel heating, and mandating deep renovation targets-all of which underscore the critical role of insulated panels in meeting stringent thermal and environmental criteria.

In the Asia-Pacific region, rapid urbanization and infrastructure expansion are driving the use of prefabricated construction methodologies. Countries facing acute housing shortages are leveraging modular building solutions, where panelized systems deliver faster project completion and reduced on‐site labor needs. Moreover, the cold chain logistics sector in major markets such as Japan and Australia has increasingly adopted panels with polyisocyanurate and polyurethane cores to ensure precise thermal control in food processing and pharmaceutical storage facilities. These trends reflect a broader embrace of panelization as a scalable, climate‐resilient construction strategy.

This comprehensive research report examines key regions that drive the evolution of the Structural Insulated Panels market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the strategies and performance of leading companies shaping innovation, supply chain integration, and commercialization of structural insulated panels globally

Leading companies in the structural insulated panel space are differentiating through innovation, vertical integration, and global expansion strategies. Publicly traded groups like Kingspan have leveraged advanced manufacturing facilities and R&D investments to develop panels with bio‐based core options and integrated renewable energy capabilities, ensuring compliance with emerging green building mandates. Similarly, Owens Corning has utilized its insulation expertise to enhance panel fire performance and moisture management, targeting both residential and commercial developers with performance‐certified systems.

Specialized manufacturers such as Premier SIPs and R-Control emphasize precision engineering and supply chain optimization. By offering tailored panel geometries and just‐in‐time logistics, these companies support complex building designs while minimizing material waste and storage requirements. Meanwhile, Insulspan and Enercept have expanded their footprints through strategic partnerships with design‐build firms, embedding panel solutions into turnkey construction packages for educational, healthcare, and industrial clients.

Collectively, these industry leaders are advancing product portfolios to address evolving market demands for sustainability, resilience, and digital integration. Their efforts underscore the increasing pace of consolidation, technological collaboration, and geographic diversification within the panel sector, setting a competitive benchmark for emerging players.

This comprehensive research report delivers an in-depth overview of the principal market players in the Structural Insulated Panels market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alubel S.p.A.

- CBG Building Systems, Inc.

- Hunter Panels by Carlisle Companies Incorporated

- Insulspan by PFB Corporation

- Isopan S.p.A.

- Kingspan Group

- Owens Corning Corporation

- Premier Building Systems

- Thermocore, Inc.

- Viriform Building Products Ltd

Actionable recommendations empowering industry leaders to optimize operations, enhance resilience, and capitalize on emerging opportunities in the structural insulated panel sector

To navigate the complexities of today’s tariff environment and capitalize on evolving market trends, industry leaders should adopt a multifaceted approach. First, strengthening domestic supply chain resilience through strategic partnerships with U.S. manufacturers can mitigate exposure to import levies, while collaborative forecasting models with steel and aluminum producers help secure prioritized capacity and improved lead times.

Second, investing in digital manufacturing and automated production lines enables cost optimization and flexible customization. By integrating CAD‐to‐factory workflows and robotic lamination processes, firms can reduce per‐unit overhead, accelerate project delivery, and minimize on‐site assembly errors. This digital transformation not only enhances quality control but also supports rapid scaling in response to fluctuating demand patterns.

Third, diversifying material portfolios to include bio‐based and recycled core alternatives addresses both sustainability requirements and potential tariff exemptions. Research into mycelium composites, recycled polystyrene aggregates, and advanced polyisocyanurate formulations can yield new product lines that align with circularity objectives and government incentives for low‐carbon building products.

Finally, engaging proactively with policymakers to shape fair trade practices and tariff classifications is essential. Through industry associations and targeted advocacy, companies can influence the criteria for duty exemptions on critical components, ensuring that high‐value insulative materials remain competitively priced. Collectively, these actions will equip organizations to maintain operational efficiency, enhance product differentiation, and seize growth opportunities in a dynamic global marketplace.

Detailing the research methodology underpinning insights on structural insulated panels through primary interviews, secondary data analysis, and triangulation processes

This report’s insights stem from a rigorous, mixed‐method research methodology designed to ensure accuracy, relevance, and actionable intelligence. Primary research consisted of in‐depth interviews with executives, engineers, and procurement specialists at leading panel manufacturers, system integrators, and large‐scale end users across residential, commercial, and industrial segments. These conversations provided qualitative perspectives on market drivers, supply chain constraints, and innovation roadmaps.

In parallel, secondary research involved systematic analysis of public filings, industry association publications, government trade data, and regulatory directives pertaining to tariffs, energy codes, and building performance standards. Data from the U.S. International Trade Commission and international counterparts was triangulated with commercial intelligence from trade journals and peer‐reviewed studies to validate market dynamics and policy impacts.

Quantitative benchmarking, including material cost indices and project lead‐time surveys, offered empirical context to the qualitative findings, enabling robust cross‐verification of emerging trends. Finally, a multi‐stakeholder workshop was convened to test preliminary conclusions and stress‐test scenario assumptions, ensuring the final recommendations reflect collective industry consensus and strategic viability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Structural Insulated Panels market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Structural Insulated Panels Market, by Product Type

- Structural Insulated Panels Market, by Resin Type

- Structural Insulated Panels Market, by End User

- Structural Insulated Panels Market, by Distribution Channel

- Structural Insulated Panels Market, by Region

- Structural Insulated Panels Market, by Group

- Structural Insulated Panels Market, by Country

- United States Structural Insulated Panels Market

- China Structural Insulated Panels Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Drawing conclusive perspectives on structural insulated panel market evolution and strategic imperatives for stakeholders navigating complex industry shifts

The structural insulated panel market stands at a pivotal juncture, where material innovation, regulatory pressures, and global trade dynamics intersect to reshape industry trajectories. The continued emphasis on energy efficiency and decarbonization is driving broader adoption of panels as primary envelope solutions, while tariffs and supply chain disruptions underscore the necessity for strategic sourcing and operational agility.

Looking ahead, companies that master integrated digital manufacturing, diversify sustainable core materials, and engage proactively in policy dialogue will secure competitive advantage. Regional growth strategies tailored to the unique regulatory landscapes of the Americas, EMEA, and Asia-Pacific will further unlock sector expansion, particularly as urbanization and retrofit demand intensify.

Ultimately, the convergence of performance, sustainability, and economic imperatives heralds a new era for structural insulated panels-one defined by resiliency, innovation, and scalable impact. Stakeholders that embrace these imperatives today will be best positioned to lead the built environment toward a more efficient, low‐carbon future.

Energize your strategic planning with direct access to expert insights by connecting with Ketan Rohom to secure the comprehensive structural insulated panel research report

Interested stakeholders are invited to gain comprehensive market insights and strategic guidance by purchasing the full market research report. Please reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure access to the in-depth data, expert analysis, and actionable findings necessary to inform your organization’s competitive strategies and investment decisions.

- How big is the Structural Insulated Panels Market?

- What is the Structural Insulated Panels Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?