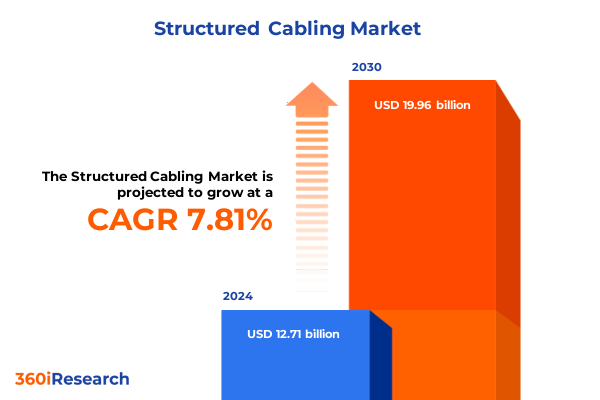

The Structured Cabling Market size was estimated at USD 12.71 billion in 2024 and expected to reach USD 13.67 billion in 2025, at a CAGR of 7.81% to reach USD 19.96 billion by 2030.

Understanding the Critical Role of Structured Cabling Infrastructure in Enabling Scalable and Reliable Enterprise-Level Connectivity Across Industries

Modern digital ecosystems increasingly rely on cohesive infrastructure frameworks to deliver seamless data, voice, and video services. Structured cabling serves as the foundational backbone that underpins enterprise networks, enabling the integration of advanced applications and intelligent building systems. It provides a standardized approach that reduces design complexity, simplifies maintenance, and enhances adaptability for future technologies. Recognizing the critical role of a well-designed cabling architecture is paramount for organizations striving to maintain high performance, minimize downtime, and support evolving bandwidth requirements.

As organizations navigate the pressures of digital transformation, the demand for an agile and scalable cabling infrastructure has never been greater. The convergence of converged networks, increased fiber adoption, and the proliferation of IoT devices necessitates a resilient cabling system engineered for longevity and flexibility. By prioritizing a holistic cabling strategy, stakeholders can mitigate risks associated with ad-hoc installations, unplanned expansions, and compatibility challenges. This introduction establishes the imperative for stakeholders to understand both the strategic importance and the technical underpinnings of a robust structured cabling solution.

Identifying Transformative Technological and Digitalization Trends Revolutionizing Structured Cabling Designs and Operational Paradigms Globally

The structured cabling landscape has undergone significant transformation driven by an accelerated pace of technological innovation. Digital transformation initiatives have elevated the importance of a high-performing wiring infrastructure capable of supporting artificial intelligence, edge computing, and real-time analytics. Simultaneously, the rollout of fifth-generation wireless networks and the expansion of IoT deployments in manufacturing, healthcare, and smart city projects have reshaped demands on cabling architectures, prompting designers to incorporate higher-density fiber pathways and advanced cable management techniques.

Moreover, emerging sustainability mandates and green building certifications are influencing material selection and installation practices. Pressure to reduce carbon footprints has led to the adoption of eco-friendly cabling materials and energy-efficient pathways that minimize power consumption within network rooms. In parallel, heightened cybersecurity concerns are redefining the role of structured cabling as a component of physical security strategies, underscoring the need for secure cable routing, tamper-resistant enclosures, and integrated monitoring solutions. Collectively, these transformative shifts are setting new benchmarks for performance, resilience, and environmental responsibility within the structured cabling sector.

Assessing the Cumulative Operational and Cost Implications of United States Tariff Measures on Structured Cabling Supply Chains and Procurement Strategies

Recent years have seen the cumulative impact of United States tariff measures exert considerable influence on the structured cabling supply chain. Tariffs on imports of cables, connectors, and related hardware have driven up acquisition costs and prompted vendors to reassess their global sourcing strategies. Several key components traditionally manufactured overseas have faced heightened duties, which in turn has pressured project budgets and installation timelines.

Steel and aluminum levies, applied under broader trade policies, have also affected the cost structure of racks, conduits, and cable trays. As a result, providers have explored nearshoring options and diversified supplier portfolios to mitigate exposure to import-related unpredictability. Contract negotiations increasingly include clauses to manage future tariff fluctuations, and stakeholders are collaborating with logistics partners to optimize inventory levels and reduce compliance complexities. Although these measures have introduced short-term challenges, they have also led to improved supply chain transparency and encouraged investments in domestic manufacturing capabilities.

Unearthing Insights into Component, Service, Application, and End-User Industry Segmentation Driving Tailored Structured Cabling Solutions Across Multiple Sectors

Segmentation based on component type reveals that cable management solutions encompassing trays, conduits, and racks & cabinets play a pivotal role in ensuring efficient cable routing and future scalability. Insights within the cables & connectors segment underscore the significance of superior coaxial, copper, and fiber optic cables, each catering to distinct performance requirements and environmental constraints. Connectivity hardware, which includes outlets & faceplates, patch panels, and RJ45 connectors & jacks, forms the physical interface that bridges active network devices with the cabling infrastructure. Meanwhile, trends in the patch cords segment, spanning both copper and fiber variants, highlight the need for precision-engineered assemblies that maintain signal integrity during link adaptations.

On the service front, installation & maintenance services continue to command attention, as rigorous certification protocols and routine inspections enhance network reliability. Network testing & certification services ensure compliance with industry standards and facilitate performance benchmarking, while structured cabling management software offers an integrated approach to asset tracking and capacity planning. Application-driven segmentation emphasizes the bespoke requirements of data centers, which demand high-density fiber environments, as well as industrial networks that operate in challenging conditions. Local area networks and office networks prioritize modular, plug-and-play designs, whereas smart building and telecommunications infrastructure segments depend on comprehensive cabling solutions capable of handling multifaceted connectivity demands.

In the context of end-user industries, banking, financial services, and insurance environments demand the highest levels of uptime and data security. Educational institutions focus on adaptability to support evolving pedagogical technologies. Energy & utilities operators require ruggedized cabling in remote locations, and government & defense sectors emphasize classified network implementations. Healthcare facilities demand hygienic pathways and redundancy for critical medical systems, while IT & telecommunications providers seek scalable systems to accommodate rapid subscriber growth. Manufacturing operations lean on robust cabling for automation and robotics, and retail & e-commerce enterprises prioritize quick-turn installations to support omnichannel initiatives.

This comprehensive research report categorizes the Structured Cabling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Enterprise Size

- Installation Type

- Application

- Distribution Channel

- End-User

Revealing Regional Dynamics Shaping Structured Cabling Adoption and Infrastructure Development Trends Across the Americas, EMEA, and Asia-Pacific Territories

A deep dive into regional dynamics reveals that the Americas continue to lead structured cabling adoption driven by comprehensive data center expansions and enterprise network upgrades. United States initiatives around 5G densification and smart city pilot programs have spurred demand for high-bandwidth fiber deployments, while Latin American markets are progressively modernizing office infrastructure to support remote work trends and digital banking services.

In Europe, Middle East & Africa, stringent regulatory frameworks and sustainability mandates have shaped cabling standards, with major smart building projects in Western Europe setting benchmarks for integrated digital infrastructure. The Middle East is witnessing surging investment in large-scale infrastructure ventures that require extensive cabling networks, and in Africa, telecommunications operators are extending fiber-to-the-home and rural connectivity programs, laying the groundwork for future structured cabling deployments.

Asia-Pacific stands out for its aggressive expansion of hyperscale data centers in China and India, reflecting the escalating demand for cloud services and e-commerce platforms. Southeast Asian governments are integrating cabling considerations into smart city strategies, and Japan’s focus on 5G indoor coverage is driving indoor cabling retrofits. Australia’s corporate sector continues to upgrade aging cabling systems, aligning with digital workplace initiatives. These regional nuances underscore the importance of tailoring structured cabling strategies to local regulatory, environmental, and technological contexts.

This comprehensive research report examines key regions that drive the evolution of the Structured Cabling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves, Partnerships, and Technological Innovations Shaping Leading Structured Cabling Providers’ Competitive Edge

Leading structured cabling providers have pursued a range of strategic moves to fortify their market positions and address evolving customer needs. One prominent trend involves forging partnerships with software vendors to deliver integrated cabling management platforms that combine real-time monitoring with predictive analytics. Such alliances accelerate innovation cycles and enable solutions that streamline installation workflows and capacity forecasting.

In parallel, key companies are expanding product portfolios to include higher-specification fiber solutions and enhanced cable management offerings that support greater density and simplified maintenance. Certain providers have executed targeted acquisitions to secure specialized technologies, bolstering their competitive advantage in niche segments such as high-speed connectors and modular cabling enclosures. Focused investments in research and development have yielded next-generation materials designed to optimize signal performance and fire safety ratings, while sustainability initiatives align product roadmaps with end-user mandates for reduced environmental impact.

Collaborative ventures with industry consortia have also emerged, establishing adherence to evolving global cabling standards and promoting interoperability. By positioning themselves at the intersection of physical infrastructure and digital intelligence, these leading companies are shaping the future trajectory of the structured cabling market and reinforcing their status as innovation-driven solution providers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Structured Cabling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AddOn Networks

- Automated Systems Design, Inc.

- Belden Inc.

- Black Box by AGC Networks Limited

- Cisco Systems, Inc.

- CommScope Holding Company, Inc.

- Corning Incorporated

- Dätwyler Holding Inc.

- Furukawa Electric Co., Ltd

- Hitachi, Ltd.

- Hubbell Incorporated

- Hubnetix Corporation

- Kalothia

- LanStar Systems, Inc.

- Legrand SA

- Leviton Manufacturing Co., Inc.

- LINX LLC

- Mizpah IT Networks

- Molex, LLC by Koch Industries, Inc.

- National Technologies

- Nexans S.A.

- Nutmeg Technologies

- Paige Electric Co, LP by GCG Company

- Panduit Corp.

- Professional Cabling Solutions, LLC

- Rittal GmbH & Co. KG by Friedhelm Loh Group

- Safe and Sound Security

- Schneider Electric SE

- SCS Technologies Inc.

- Siemens AG

- Superior Essex International Inc.

- TE Connectivity Ltd.

- TELECO INC.

- The Network Installers

- The Siemon Company

- Wesco International, Inc.

Outlining Actionable Strategies to Enhance Resilience, Innovation, and Market Responsiveness for Stakeholders in the Structured Cabling Industry Ecosystem

Industry leaders can seize growth opportunities by implementing a series of targeted strategies that enhance agility and foster continuous innovation. First, prioritizing investment in high-performance fiber optic technologies and modular cable management solutions will address the escalating demand for bandwidth-intensive applications and simplify network expansions. Simultaneously, integrating advanced structured cabling management software into service offerings creates a unified platform for real-time asset visibility, predictive capacity planning, and streamlined compliance reporting.

To mitigate supply chain vulnerabilities, organizations should diversify sourcing channels and nurture strategic relationships with both domestic and international suppliers. Investing in localized manufacturing capabilities can reduce exposure to import fluctuations and improve delivery timelines. In parallel, engaging cross-functional teams in regular training and certification programs ensures that installation and maintenance crews remain proficient with the latest industry protocols and safety requirements.

Finally, embedding sustainability objectives into product design and operational practices positions companies to meet emerging regulatory mandates and customer expectations. By adopting eco-friendly materials and energy-efficient installation techniques, stakeholders not only lower environmental footprints but also differentiate their service portfolios. Taken together, these actionable measures will reinforce resilience and support market responsiveness in a rapidly evolving structured cabling ecosystem.

Detailing Research Methodology Integrating Primary Interviews with Secondary Data Sources to Deliver Rigorous Structured Cabling Market Insights

The research methodology underpinning this analysis integrates a rigorous mix of primary and secondary research approaches to ensure depth and reliability. The secondary phase entailed an exhaustive review of publicly available technical literature, regulatory filings, industry white papers, and supplier documentation to establish a comprehensive baseline of structured cabling technologies and standards. Concurrently, proprietary databases were leveraged to validate historical trends and technical specifications.

Primary research included in-depth interviews with senior executives, field engineers, and independent consultants who specialize in network infrastructure deployment. These conversations provided valuable insights into real-world implementation challenges, emerging customer requirements, and regional variances in regulatory compliance. Survey data collected from end users across multiple industries offered quantitative perspectives on prioritization criteria, decision-making processes, and satisfaction metrics.

Data triangulation techniques were employed to cross-validate findings from disparate sources, while rigorous quality checks ensured consistency and accuracy. The combined insights were synthesized to produce a coherent narrative that captures both the technical intricacies of structured cabling systems and their strategic implications for stakeholders. This approach guarantees that the report’s conclusions are grounded in empirical evidence and reflect the latest market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Structured Cabling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Structured Cabling Market, by Offering

- Structured Cabling Market, by Enterprise Size

- Structured Cabling Market, by Installation Type

- Structured Cabling Market, by Application

- Structured Cabling Market, by Distribution Channel

- Structured Cabling Market, by End-User

- Structured Cabling Market, by Region

- Structured Cabling Market, by Group

- Structured Cabling Market, by Country

- United States Structured Cabling Market

- China Structured Cabling Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Summarizing Key Strategic Takeaways and Industry Imperatives for Decision-Makers to Navigate the Evolving Structured Cabling Environment with Confidence

This executive summary has illuminated the multifaceted nature of the structured cabling landscape, highlighting transformative forces from technological innovation to trade policy impacts. By dissecting component, service, application, and end-user industry segmentation, stakeholders can better align solution offerings with the specific demands of diverse operational environments. Regional analyses further underscore the importance of tailoring strategies to local market conditions and regulatory frameworks.

Examining the strategic maneuvers of leading providers reveals a concerted shift toward integrated digital solutions, sustainable product design, and collaborative standardization efforts. The actionable recommendations presented herein outline a clear path for industry participants to strengthen supply chain resilience, accelerate innovation, and enhance service delivery through advanced software integration. Collectively, these insights empower decision-makers to navigate complexity with confidence and position their organizations for long-term success.

As the pace of digital transformation continues its upward trajectory, a forward-looking cabling strategy becomes indispensable. By adopting the outlined imperatives and leveraging robust market intelligence, stakeholders will be equipped to meet emerging challenges and capitalize on the next wave of connectivity-driven growth.

Encouraging Engagement and Report Acquisition Through Direct Collaboration with Ketan Rohom for In-Depth Structured Cabling Market Intelligence

As businesses seek to accelerate growth through digitization, the path to unlocking robust connectivity begins with direct collaboration with Ketan Rohom, Associate Director of Sales & Marketing. With an extensive background in guiding enterprise decision-makers, Ketan can tailor an acquisition strategy that aligns with your organizational requirements. Engaging in a tailored consultation ensures access to the most comprehensive insights and practical guidance needed to navigate today’s complex structured cabling environment.

To take the next step toward a future-ready infrastructure, reach out and schedule a personalized dialogue with Ketan. His consultative approach is designed to assess your unique challenges, deliver actionable recommendations, and facilitate prompt access to the full report. Empower your teams with the clarity and direction required to implement advanced structured cabling solutions that support evolving network demands.

Secure your competitive advantage by leveraging in-depth market intelligence and expert counsel. Contact Ketan Rohom today to transform data-driven insights into strategic initiatives that drive efficiency, scalability, and innovation across your enterprise.

- How big is the Structured Cabling Market?

- What is the Structured Cabling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?