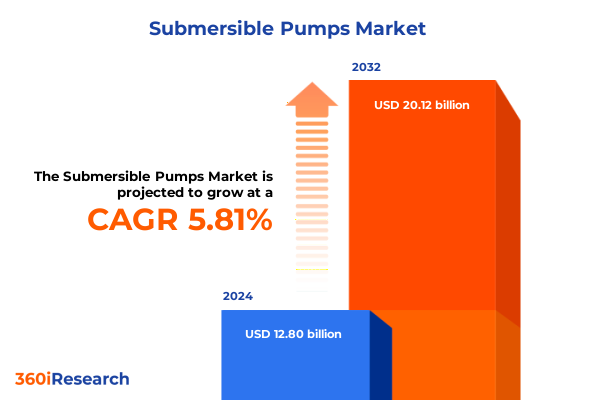

The Submersible Pumps Market size was estimated at USD 13.53 billion in 2025 and expected to reach USD 14.31 billion in 2026, at a CAGR of 5.82% to reach USD 20.12 billion by 2032.

Understanding the Evolution and Strategic Importance of Submersible Pump Technologies in Today’s Industrial Landscape

Submersible pump systems have emerged as critical enablers across a diverse array of industries, from agriculture and municipal water management to energy exploration and industrial manufacturing. Over the past decade, rising global water stress, heightened environmental regulations, and the push for energy efficiency have converged to elevate the strategic importance of submersible pump technologies. This report initiates by contextualizing the historical evolution of submersible designs-from early mechanized well applications to today’s digitally integrated, multifunctional units. It highlights how current market dynamics and technological advances are reshaping expectations around performance, reliability, and sustainability.

By drawing on recent case studies and industry milestones, the introduction establishes foundational concepts such as variable speed drives, sensor-enabled diagnostics, and corrosion-resistant materials. It underscores the necessity for industry stakeholders to adopt a forward-looking perspective that embraces rapid innovation cycles and increasingly stringent environmental mandates. As the pace of change accelerates, executives and technical leaders must realign procurement and development strategies to capture both operational efficiencies and long-term value creation. This introductory overview sets the stage for in-depth examination of transformative shifts, regulatory impacts, segmentation nuances, and actionable recommendations that follow in subsequent sections.

Examining Recent Technological, Operational, and Market Transformations Reshaping Submersible Pump Deployment Worldwide

In recent years, the submersible pump sector has experienced multiple converging forces that are redefining traditional paradigms. Digitization stands at the forefront of this transformation, with the proliferation of Internet of Things (IoT) connectivity and advanced analytics platforms enabling real-time performance monitoring, predictive maintenance, and remote asset management. These developments are complemented by innovations in drive systems, such as variable frequency drives that enhance energy efficiency and optimize hydraulic performance under fluctuating load conditions.

Simultaneously, the industry is grappling with evolving materials science breakthroughs, including the adoption of high-strength polymers and composite alloys that resist corrosion in aggressive environments. This progress is propelling extended service intervals and reducing lifecycle costs. Furthermore, shifting priorities toward sustainability have prompted manufacturers to integrate environmentally benign lubricants, solar-powered drive assemblies, and biodegradable components. Collectively, these shifts are not merely incremental; they are revolutionizing procurement models, after-sales services, and total cost of ownership frameworks on a global scale.

Assessing How 2025 United States Tariff Policies Are Reshaping Supply Chains and Competitive Dynamics in the Submersible Pump Industry

The imposition of new tariff measures by the United States in 2025 has exerted significant pressure on supply chains, sourcing strategies, and pricing structures within the submersible pump arena. Tariffs targeted at key component imports have compelled Original Equipment Manufacturers and aftermarket providers to reevaluate their geographic sourcing footprints. As a result, many stakeholders accelerated initiatives to nearshore or onshore production of critical castings, motors, and electronic controls to mitigate escalation in landed costs.

In addition, these policy changes have altered competitive dynamics by creating a more level playing field for domestic producers, while compelling multinational corporations to absorb or offset increased duties through price adjustments or strategic partnerships. The ripple effects have extended into procurement practices at large utilities, agricultural operations, and energy companies, where budgetary constraints and cost predictability drive vendor selection. Consequently, agility in tariff management and supply chain diversification has become an essential competency for industry leaders aiming to sustain profitability and service levels under evolving trade regimes.

Illuminating Critical Product, Operational, and Application-Based Segmentation Insights Driving Submersible Pump Market Dynamics

Product segmentation reveals critical performance and application nuances that inform design choices and commercialization strategies. When considering borewell, deep well, open well, and sewage configurations, manufacturers tailor hydraulic profiles, motor ratings, and sealing technologies to align with the specific operational demands of each environment. For instance, borewell units prioritize compact dimensions and high-pressure output, whereas sewage pumps emphasize clog-resistant impellers and corrosion-proof construction.

Phase type further dictates equipment specifications, as single phase models dominate lower-capacity residential and small agricultural applications, while three phase pumps deliver higher efficiency and reliability in industrial and municipal contexts. Understanding this dichotomy is vital for aligning sales channels, service networks, and training programs with customer requirements.

End use industries, spanning agriculture, construction, industrial manufacturing, mining, oil and gas, and power generation, drive divergent value propositions and after-sales service models. Within industrial manufacturing, chemical and petrochemical facilities demand bespoke hygienic sealing solutions, food and beverage producers require sanitary certifications, and pharmaceutical operations necessitate compliance with rigorous clean-room and sterility standards. By synthesizing segmentation insights across type, phase, and industry applications, stakeholders can prioritize R&D investments, optimize channel strategies, and deepen domain expertise to capture high-value opportunities.

This comprehensive research report categorizes the Submersible Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Phase Type

- End Use Industry

Revealing Diverse Regional Market Behaviors and Opportunities across the Americas, EMEA, and Asia-Pacific Submersible Pump Sectors

Geographic differentiation underscores varying maturity levels, regulatory landscapes, and growth trajectories. In the Americas, robust public infrastructure spending and a resurgence in agricultural mechanization underpin demand for submersible pumps tailored to irrigation and municipal water treatment. North American utilities prioritize reliability and lifecycle service agreements, while Latin American markets often focus on entry-level price competitiveness and local assembly capabilities.

Across Europe, Middle East & Africa, sophisticated environmental regulations and the drive toward renewable energy integration have catalyzed demand for low-emission pump systems and solar-driven solar-submersible units in off-grid water supply projects. In EMEA, multinational OEMs compete alongside agile regional suppliers that excel in customized solutions for desalination plants, mining operations, and urban development schemes.

Asia-Pacific stands as the fastest evolving market, with urbanization, rapid industrialization, and government investment in water infrastructure fueling widespread adoption of smart pump technologies. In Southeast Asia, agricultural modernization initiatives spur demand for energy-efficient borewell solutions, while in East Asia, petrochemical and power generation projects require high-capacity vertical turbine and multistage submersible units. This regional mosaic highlights both divergent priorities and converging interests in digitalization, sustainability, and total cost of ownership.

This comprehensive research report examines key regions that drive the evolution of the Submersible Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves, Innovation Portfolios, and Collaborative Initiatives of Leading Submersible Pump Manufacturers and Suppliers

Leading submersible pump manufacturers are charting distinct paths to strengthen market positions through technology partnerships, strategic alliances, and targeted acquisitions. Several global players have established dedicated centers of excellence for IoT integration and digital services, collaborating with software specialists to deliver cloud-based performance dashboards and AI-driven maintenance recommendations. This focus on digital ecosystems differentiates incumbent brands and deepens customer lock-in through subscription-based service models.

Equally, there has been a notable uptick in joint ventures between OEMs and local fabricators within high-growth regions to streamline market entry, comply with regional content requirements, and optimize logistics costs. Innovative product launches, such as corrosion-resistant pump stages and noise-attenuated motor housings, illustrate how R&D investments are directly translating into competitive differentiation. Moreover, collaborative R&D agreements between pump suppliers and materials science laboratories are accelerating the qualification of carbon-fiber reinforced polymers and advanced ceramic coatings. By mapping these strategic initiatives, the analysis illuminates how the shape of competition is evolving from price-centric to value-added, technology-enabled partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Submersible Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlas Copco AB

- C.R.I. Pumps Private Limited

- Crompton Greaves Consumer Electricals Limited

- Dooch Co., Ltd.

- Ebara Corporation

- Elpumps

- Flowserve Corporation

- Franklin Electric Co., Inc.

- General Electric Company

- Grundfos A/S

- Halliburton Company

- Havells India Ltd.

- HCP Pump Manufacturer Co., Ltd.

- HOMA Pumpenfabrik GmbH

- Industrial Flow Solutions

- Kirloskar Brothers Limited

- KSB SE & Co. KGaA

- Leo Group Pump (Zhejiang) Co., Ltd.

- Lubi Industries LLP

- Mody Pumps Inc.

- Pleuger Industries

- Polycab India Limited

- Sulzer Ltd.

- The Weir Group PLC

- Xylem Inc.

Offering Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities in Submersible Pump Markets

Industry leaders seeking to secure a competitive advantage should prioritize the development of integrated digital service platforms that pair advanced analytics with user-friendly interfaces. By embedding sensors within pump assemblies and leveraging machine learning algorithms, companies can transition from reactive maintenance models to outcome-based service agreements that guarantee uptime and optimize energy consumption. This data-driven approach not only enhances customer loyalty but also generates recurring revenue streams through performance contracts.

Additionally, executives must evaluate the merits of nearshoring critical component production in light of tariff volatility and geopolitical risk. Establishing modular manufacturing cells in target markets can reduce lead times, lower inventory carrying costs, and improve responsiveness to local specifications. Partnerships with regional engineering firms and contract manufacturers can further bolster flexibility and compliance with local content policies.

Furthermore, investing in materials innovation will remain a key differentiator. Allocating R&D resources toward the development of next-generation corrosion-resistant alloys, polymer composites, and environmentally benign lubricants can unlock new application segments in harsh environments, from deep-sea oil extraction to wastewater management in densely populated urban centers. By adopting a holistic strategy that harmonizes digital services, supply chain resilience, and materials excellence, industry stakeholders will be well positioned to capture value in an increasingly competitive marketplace.

Detailing the Comprehensive Research Methodology Employed to Ensure Robustness, Transparency, and Credibility of Market Insights

This research report is underpinned by a rigorous multi-tiered methodology designed to ensure the integrity, relevance, and depth of insights. It commenced with a comprehensive review of patent filings, trade publications, and technical whitepapers to identify emerging technological trends and regulatory developments. Concurrently, primary interviews were conducted with equipment OEMs, distribution channel executives, end-user maintenance managers, and independent pump service providers to validate hypotheses and gather nuanced perspectives across various application sectors.

Quantitative data collection involved an extensive survey of end users and sales representatives covering equipment performance metrics, service intervals, and total cost implications. This was complemented by an analysis of customs and trade databases to track tariff impacts and supply chain shifts. Geospatial mapping tools were employed to visualize regional demand patterns, while statistical clustering techniques helped distill customer segmentation profiles based on operational intensity, service requirements, and application criticality.

All data inputs were cross-verified through triangulation with secondary sources, including regulatory filings, environmental compliance reports, and publicly disclosed financial statements. The research team also conducted site visits to manufacturing and test facilities to assess validation processes for new materials and digital monitoring platforms. This layered approach ensures stakeholders can rely on the findings for strategic decision-making and risk mitigation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Submersible Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Submersible Pumps Market, by Type

- Submersible Pumps Market, by Phase Type

- Submersible Pumps Market, by End Use Industry

- Submersible Pumps Market, by Region

- Submersible Pumps Market, by Group

- Submersible Pumps Market, by Country

- United States Submersible Pumps Market

- China Submersible Pumps Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Synthesizing Key Findings and Strategic Implications for Stakeholders Navigating the Evolving Submersible Pump Landscape

The collective findings underscore a market at the intersection of accelerating technological innovation, evolving trade policies, and diverse end-use demands. Digital integration, driven by IoT and predictive analytics, is reshaping service paradigms and creating new commercial models centered on uptime guarantees and energy optimization. Concurrently, material science breakthroughs are extending pump lifecycles and enabling applications in increasingly aggressive environments.

Tariff adjustments in the United States have catalyzed a recalibration of supply chain strategies, prompting agile manufacturers to nearshore or localize production in response to trade uncertainties. Segmentation analyses reveal that type, phase configuration, and industry end use each carry unique performance and value considerations, while regional dynamics in the Americas, EMEA, and Asia-Pacific present distinct growth trajectories and competitive landscapes. Strategic initiatives by leading companies indicate a pronounced shift from commoditized practices toward technology-enabled partnerships and value-added services.

Looking ahead, stakeholders who embrace integrated digital service offerings, resilient supply chain architectures, and materials innovation will outperform peers in both mature and emerging markets. This report provides a cohesive blueprint for executives, engineers, and procurement professionals to align their strategies with these forces and capitalize on the evolving submersible pump landscape.

Connecting Decision Makers with Expert Insights and Direct Engagement Opportunities to Secure the Full Submersible Pump Market Report

As companies navigate complex procurement decisions and seek to harness the latest industry intelligence, this report serves as the definitive resource for informed strategy. We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore customized research solutions tailored to your specific needs. Engaging with Ketan Rohom provides direct access to expert guidance on application-specific analyses, regional deep dives, and competitive benchmarking. Whether you require executive briefings or detailed technical appendices, his team will ensure timely delivery and personalized support. Initiate this collaboration to secure a competitive edge, align operational objectives with market opportunities, and drive sustainable growth in the submersible pump sector. Contact Ketan Rohom today to unlock the full potential of this comprehensive market research report and transform insights into impactful strategies

- How big is the Submersible Pumps Market?

- What is the Submersible Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?