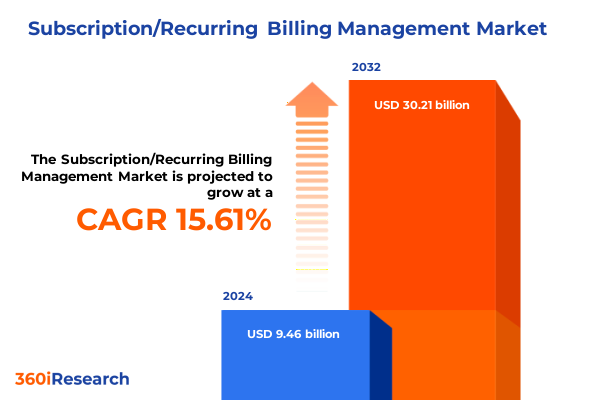

The Subscription/Recurring Billing Management Market size was estimated at USD 10.86 billion in 2025 and expected to reach USD 12.49 billion in 2026, at a CAGR of 15.73% to reach USD 30.21 billion by 2032.

Subscription and Recurring Billing Management Landscape Overview Highlighting Industry Evolution, Key Drivers, and Strategic Imperatives for Modern Enterprises

Subscription and recurring billing management has rapidly evolved into a foundational capability for enterprises seeking consistent revenue streams and deep customer engagement. Over the past decade, the proliferation of subscription-based business models has prompted organizations to rearchitect legacy billing systems and embrace specialized platforms that can handle complex pricing schedules, revenue recognition mandates, and customer lifecycle events.

Today’s executive teams recognize that manual, spreadsheet-driven invoicing cannot sustain the demands of usage-based billing, tiered pricing, and global tax compliance. To address these challenges, leading companies are standardizing on cloud-native architectures that offer continuous updates, multi-currency support, and robust integration with customer relationship management and enterprise resource planning systems. This migration is driven not only by operational efficiency goals but also by strategic imperatives around data-driven decision-making and enhanced customer experience.

Furthermore, regulatory developments-such as evolving revenue recognition standards-have elevated the stakes for billing accuracy and audit readiness. Organizations are therefore prioritizing solutions that provide complete visibility into recurring revenue, churn metrics, and subscription health indicators. As digital ecosystems grow increasingly interconnected, the ability to converge billing, revenue management, and customer analytics into a unified platform has become an essential differentiator.

Consequently, subscription and recurring billing management solutions now occupy a critical seat at the executive table. They inform product monetization strategies, enable differentiated offerings like freemium upsells, and lay the foundation for scalable growth. In this context, organizations that invest in best-in-class billing platforms are better positioned to capture market opportunities, adapt to changing customer preferences, and drive sustainable profitability.

Emerging Technologies Strategic Partnerships and Business Model Innovations Reshaping Subscription and Recurring Billing Management Ecosystem Dynamics

In recent years, the subscription billing management landscape has witnessed transformative shifts fueled by emerging technologies and changing customer expectations. Artificial intelligence and machine learning have been integrated into billing engines to support intelligent revenue forecasting, anomaly detection, and automated dispute resolution. This infusion of advanced analytics enables organizations to identify churn risks before they materialize and to tailor retention campaigns with unprecedented precision.

Simultaneously, open application programming interfaces and microservices architectures have democratized platform extensibility. Ecosystem partners can now plug in complementary services-ranging from tax compliance engines to payment fraud detection tools-without disrupting core billing workflows. As a result, the market is evolving from monolithic suites toward modular ecosystems, empowering customers to assemble bespoke solutions that align with their technical roadmaps.

Another significant trend is the rise of consumption-based and usage-driven pricing models. These structures blur traditional product boundaries, demanding real-time metering and dynamic invoicing capabilities. To support this evolution, billing platforms are incorporating real-time data ingestion pipelines, event-driven triggers, and customer dashboards that reflect live usage metrics. Organizations adopting these models are unlocking new revenue streams, improving customer trust, and gaining actionable insights into product engagement.

Moreover, strategic partnerships between billing solution providers, system integrators, and industry-specific consultants have accelerated go-to-market timelines. By leveraging pre-built connectors and domain expertise, enterprises can reduce implementation complexity and achieve faster return on investment. These alliances underscore the market’s shift toward collaborative, outcome-focused engagements rather than traditional vendor-client relationships.

Assessment of Cumulative Implications of 2025 United States Trade Tariffs on Subscription and Recurring Billing Management Infrastructure and Supply Chains

The cumulative impact of United States tariffs in 2025 has reverberated across technology supply chains, influencing hardware procurement costs and software licensing agreements essential to subscription billing operations. In early 2025, the United States Court of International Trade struck down certain emergency tariffs imposed under the International Emergency Economic Powers Act, deeming them beyond executive authority. A subsequent stay by the Court of Appeals underscored ongoing legal uncertainty for businesses reliant on imported components and catalyst technologies.

Manufacturers of data center hardware and networking equipment have faced increased duties on semiconductors, circuit boards, and storage modules. Notably, Texas Instruments reported a nearly 12% decline in its share price following a cautionary profit forecast tied to anticipated tariff-induced cost pressures, signaling broader market anxiety about elevated input prices and inventory build-up. This scenario has prompted recurring billing solution providers to reevaluate their vendor portfolios, negotiate expanded volume discounts, and explore alternative sourcing corridors.

Meanwhile, the Consumer Technology Association warned that proposed tariff adjustments could erode U.S. purchasing power by up to $143 billion, potentially suppressing consumer spend on electronic goods and indirectly affecting digital service subscriptions linked to hardware ecosystems. To mitigate these headwinds, many software vendors have absorbed a portion of cost increases, leveraging SaaS delivery models that decouple billing operations from onsite hardware dependencies. Others are accelerating partnerships with on-shore manufacturers to secure preferential trade exemptions or utilize bonded warehouse strategies that postpone duty payment.

Through these adaptive measures, the subscription billing industry is demonstrating resilience against tariff volatility. Organizations that proactively align procurement strategies with legal developments and distribution economies of scale are better positioned to sustain pricing competitiveness and maintain service reliability in a dynamic trade environment.

In-Depth Examination of Business Models Billing Types Deployment Channels Applications Industry Verticals and Enterprise Sizes Driving Market Nuances

Understanding the nuanced differences across business models is essential for tailoring subscription billing strategies. Companies operating in the business-to-business sphere demand complex features such as multi-entity support, contract amortization schedules, and tailored billing cycles aligned with enterprise procurement processes. Conversely, business-to-consumer organizations prioritize intuitive checkout experiences, one-click renewals, and flexible payment options to drive acquisition and reduce friction. Direct-to-consumer ventures blend elements of both, requiring scalable self-service portals while retaining back-end controls for revenue analytics and fraud prevention.

Billing type segmentation further influences platform design and revenue capture. Flat-rate pricing models emphasize straightforward invoicing and predictable cash flows, whereas per-user structures must accommodate changes in seat counts with minimal lag. Tiered pricing introduces volume thresholds and require dynamic tier boundary adjustments as customers grow. Usage-based billing presents the greatest complexity, demanding real-time metering, event-triggered invoice generation, and granular reconciliation processes. Successful platforms support all variants within a unified architecture, enabling customers to shift between models without reimplementation.

Deployment considerations also play a critical role. Cloud deployments offer rapid scale-up, continuous feature deployment, and lower upfront infrastructure investments, appealing to organizations seeking agility. On-premise installations remain prevalent among highly regulated sectors that require data residency controls and integrate billing engines into legacy ERP ecosystems. Striking the right balance between agility and control is a strategic decision influenced by compliance requirements, total cost of ownership goals, and IT resource availability.

Application focus areas-ranging from analytics and reporting to end-to-end subscription lifecycle management-drive buyer priorities. Analytics and reporting modules furnish finance teams with actionable insights on churn rates and revenue churn metrics. Billing automation streamlines invoice generation and payment reconciliation. Revenue management capabilities ensure compliance with accounting standards. Subscription lifecycle modules enable self-service upgrades, renewals, and cancellations with minimal support overhead.

Industry verticals also shape solution roadmaps. Financial services demands rigorous audit trails and regulatory alignment. Healthcare providers require patient-centric billing with insurance reconciliation. IT and telecom sectors emphasize scalability to manage millions of usage events. Manufacturers leverage billing to monetize IoT services, while media and entertainment companies focus on digital rights and regional licensing. Retailers integrate subscription engines into e-commerce platforms to support both brick-and-mortar and online channels.

Finally, enterprise size drives feature breadth and support expectations. Large enterprises seek deep customization, dedicated support teams, and enterprise grade SLAs. Small and medium enterprises seek rapid time-to-value, intuitive interfaces, and predictable pricing, making turnkey cloud solutions particularly appealing.

This comprehensive research report categorizes the Subscription/Recurring Billing Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Business Model

- Billing Type

- Deployment Model

- Application

- Enterprise Size

- Industry Vertical

Comparative Analysis of Americas Europe Middle East Africa and Asia Pacific Subscription Billing Adoption Trends Regulatory Frameworks and Growth Catalysts

Across the Americas, North America has emerged as the preeminent region for subscription billing adoption, capturing over forty percent of global activity. The United States leads with a striking ratio of SaaS and streaming companies that have embedded automated invoicing and real-time usage metering into their digital offerings. Cloud-native deployments constitute nearly seven out of ten installations, and the integration of machine learning for revenue anomaly detection has surged by more than half between 2023 and 2025. Canada has followed suit, propelled by progressive digital economy policies that accelerate cloud migration among service providers and mid-market enterprises.

Europe, the Middle East & Africa region presents a heterogeneous tapestry of requirements. European Union regulations, particularly GDPR and e-invoicing mandates, compel billing vendors to embed robust data governance and encryption controls into their platforms. France, Germany, and the United Kingdom have been early adopters, driven by mature e-commerce and digital media sectors. Meanwhile, in the Middle East and Africa, the rise of fintech solutions and e-learning platforms has fueled a nearly fifty percent adoption increase, supported by local payment integrations and compliance with regional financial regulations.

Asia-Pacific has become the fastest-growing region, accounting for over one-fifth of global subscription billing deployments. China and India lead the charge, driven by surging mobile payment adoption and digital wallet ecosystems. Cloud-based billing platforms recorded a forty-four percent uplift in new deployments from 2023 to 2025, as organizations prioritize rapid scalability and low-code integration with localized gateway providers. Australia, Japan, and South Korea are also pushing the envelope with advanced tiered and usage-based pricing schemes, reflecting sophisticated consumer markets and high smartphone penetration rates.

Looking ahead, cross-border billing capabilities-such as multi-currency invoicing, tax automation, and language localization-will be crucial for global enterprises seeking seamless expansions. Each region’s regulatory environment, payment preferences, and compliance mandates will continue to shape vendor roadmaps and deployment strategies, reinforcing the need for solutions that can nimbly adapt to diverse market conditions.

This comprehensive research report examines key regions that drive the evolution of the Subscription/Recurring Billing Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Subscription Billing Solution Providers Highlighting Product Differentiation Strategic Alliances and Competitive Positioning Across the Ecosystem

Market participants ranging from established enterprise software giants to digital-native start-ups are vying for leadership in the subscription billing domain. Leading solutions differentiate themselves by investing in AI-augmented revenue operations, deep integration frameworks, and industry-specific accelerators. Major incumbents have responded by opening up their platforms through rich developer toolkits, enabling third-party innovation on top of core billing engines. This approach underscores an ecosystem mindset where platform extensibility is as important as built-in feature sets.

Several providers have forged partnerships with cloud hyperscalers to deliver embedded billing capabilities within broader technology stacks. This tight coupling drives lower latency, simplified identity management, and integrated analytics across usage and financial data. Conversely, specialist vendors are focusing on verticalization-packaging pre-configured templates for industries such as telecommunications, digital media, and healthcare-to expedite time-to-value and reduce implementation complexity.

Competitive dynamics are also influenced by M&A activity as incumbents acquire niche players to bolster their billing portfolios. These transactions often center on securing advanced analytics modules, usage metering technologies, or customer self-service portals. As a result, solution roadmaps increasingly emphasize end-to-end lifecycle orchestration-from initial signup and trial management through renewal, upsell, and downgrade scenarios.

Innovation in pricing and packaging has become an additional battleground. Providers are experimenting with usage-aligned consumption models, outcome-based billing, and embedded financial services such as installment payment options. Organizations that prioritize flexible monetization frameworks and seamless integration with downstream financial systems are more likely to capture share in this highly competitive market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Subscription/Recurring Billing Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ActivePlatform

- Amazon.com, Inc.

- Aria Systems, Inc.

- Billwerk+ Germany GmbH

- BluSynergy

- Cerillion PLC

- ChargeBee, Inc.

- Cleverbridge AG

- Conga Corporation

- DXC Technology Company

- FastSpring

- FreshBooks

- Gotransverse LLC

- LogiSense Corporation

- MoonClerk LLC

- Oracle Corporation

- PayPal, Inc.

- Recurly, Inc.

- Salesforce.com, Inc.

- SAP SE

- SOFTRAX Inc.

- Stripe, Inc.

- VeriFone Holdings, Inc.

- Worldline S.A.

- Zoho Corporation Pvt. Ltd.

- Zuora, Inc.

Strategic Actions for Industry Leaders to Optimize Subscription and Recurring Billing Operations Enhance Customer Experience and Drive Sustainable Revenue Growth

To remain competitive, industry leaders should prioritize the adoption of AI-driven billing automation that spans invoice generation, revenue reconciliation, and dispute management. Implementing machine learning models can proactively detect billing discrepancies and forecast churn, enabling timely intervention before customer attrition occurs. Equally important is the consolidation of billing, revenue management, and customer success data into a unified platform to support holistic decision-making across product, finance, and support teams.

Leaders must also embrace modular architectures that facilitate rapid integration with e-commerce platforms, payment gateways, tax engines, and analytics dashboards. By leveraging open APIs and standardized data schemas, organizations can continuously incorporate emerging technologies without undergoing costly platform overhauls. This composable approach accelerates innovation cycles and reduces technical debt.

Furthermore, developing a clear procurement strategy is essential in an environment shaped by trade uncertainties. Securing long-term vendor contracts with rate-lock provisions, exploring on-shore hardware procurement, and maintaining dual-sourcing arrangements can mitigate cost escalations from tariffs and supply chain disruptions. Such measures ensure stable service delivery and protect profitability during periods of global trade volatility.

Finally, executives should continually reassess pricing models to reflect evolving customer usage patterns and industry benchmarks. Testing tiered, per-user, and consumption-based plans through controlled pilots can yield insights into willingness to pay, upsell potential, and margin optimization. Coupling these strategies with a data-backed governance framework enhances agility and positions the organization to capture emerging monetization opportunities.

Comprehensive Research Methodology Detailing Secondary Data Analysis Surveys Expert Interviews and Validation Processes Ensuring Rigorous Market Insights

The research underpinning this report combines comprehensive secondary data analysis with targeted primary inquiries to ensure rigor and relevance. Initial market scoping involved gathering publicly available information from regulatory filings, industry association publications, and trade journals. This was complemented by a thorough review of tariff rulings and trade court decisions to assess the impact of U.S. trade policy on technology supply chains.

Primary research entailed structured interviews with executives from billing solution vendors, systems integrators, and end-user organizations across key verticals. These interviews provided firsthand perspectives on implementation challenges, feature demand, and procurement strategies. Findings were validated through a series of expert workshops, during which draft insights were critiqued and refined by senior practitioners in finance, IT, and operations roles.

Segmentation analyses were conducted using a multi-layered approach, encompassing business model, billing type, deployment preference, application focus, industry vertical, and enterprise size. Regional assessments leveraged macroeconomic indicators, digital adoption indexes, and trade policy databases to map out geographic nuances. Competitive profiling was informed by product roadmaps, partnership announcements, and merger and acquisition activity tracked over the past 18 months.

The final report integrates quantitative and qualitative findings, ensuring a balanced perspective that addresses both statistical trends and strategic imperatives. All data points have been cross-checked against multiple sources to minimize bias and uphold the highest standards of market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Subscription/Recurring Billing Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Subscription/Recurring Billing Management Market, by Component

- Subscription/Recurring Billing Management Market, by Business Model

- Subscription/Recurring Billing Management Market, by Billing Type

- Subscription/Recurring Billing Management Market, by Deployment Model

- Subscription/Recurring Billing Management Market, by Application

- Subscription/Recurring Billing Management Market, by Enterprise Size

- Subscription/Recurring Billing Management Market, by Industry Vertical

- Subscription/Recurring Billing Management Market, by Region

- Subscription/Recurring Billing Management Market, by Group

- Subscription/Recurring Billing Management Market, by Country

- United States Subscription/Recurring Billing Management Market

- China Subscription/Recurring Billing Management Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Integrated Perspective on Subscription and Recurring Billing Management Emphasizing Strategic Alignment Operational Excellence and Future Industry Trajectories

Subscription and recurring billing management has matured into a strategic discipline that spans technology, finance, and customer experience. Organizations that align their billing infrastructure with broader digital transformation initiatives gain the agility to introduce innovative pricing models, comply with regulatory requirements, and drive long-term customer loyalty. The interplay between advanced analytics, modular architectures, and strategic sourcing ensures resilience against external shocks such as trade disruptions.

As market dynamics continue to shift, companies must monitor tariff developments, evolving buyer preferences, and competitive consolidation to fine-tune their technology roadmaps. Embracing AI-driven automation and unified data platforms will be key to unlocking new revenue streams and minimizing churn. Meanwhile, a nuanced understanding of regional adoption patterns and segmentation priorities enables more precise go-to-market strategies.

Ultimately, the ability to orchestrate subscription lifecycles-from onboarding through renewal and expansion-will distinguish leaders from followers. By investing in best-in-class billing solutions, strategic partnerships, and data governance frameworks, enterprises can transform recurring billing from a back-office function into a catalyst for sustainable growth and competitive differentiation. This integrated approach will be paramount as the subscription economy evolves in an era defined by digital consumption and global interconnectivity.

Connect with Ketan Rohom to Obtain Customized Subscription Billing Market Intelligence and Empower Strategic Growth Initiatives

Reach out to Ketan Rohom (Associate Director, Sales & Marketing) today to secure your organization’s competitive edge with the complete subscription and recurring billing management market research report. Tailored to address your unique strategic objectives, this comprehensive study delivers actionable insights on industry drivers, tariff impacts, segmentation dynamics, and regional growth trajectories. Engage directly with Ketan to discuss custom data requirements, exclusive benchmarking opportunities, and enterprise licensing models designed to accelerate your decision-making timelines. Equip your leadership team with the intelligence needed to optimize pricing strategies, refine deployment roadmaps, and identify high-potential markets before your competitors do. Don’t miss the chance to transform complex billing challenges into sustainable revenue engines-contact Ketan now to explore special subscription packages, volume-based discounts, and early-access deliverables that will position your organization for long-term success.

- How big is the Subscription/Recurring Billing Management Market?

- What is the Subscription/Recurring Billing Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?