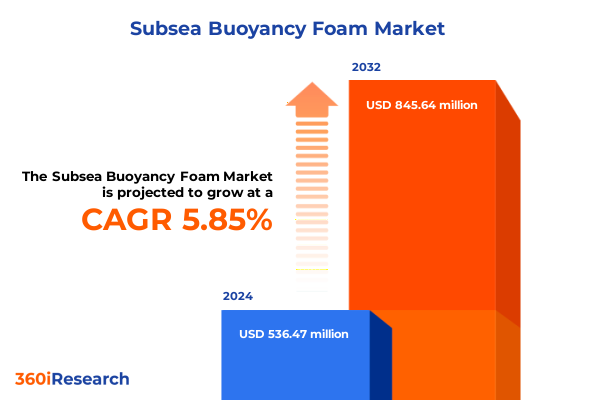

The Subsea Buoyancy Foam Market size was estimated at USD 536.47 million in 2024 and expected to reach USD 565.28 million in 2025, at a CAGR of 5.85% to reach USD 845.64 million by 2032.

Introducing Key Dynamics and Emerging Trends Revolutionizing the Subsea Buoyancy Foam Sector in Deepwater and Ultra-Deepwater Environments

Subsea buoyancy foam plays an indispensable role in modern offshore operations, providing both buoyancy control and insulation for critical subsea assets. Syntactic foam, the most widespread exemplar, is engineered by embedding hollow glass microspheres within a polymeric binder, yielding a composite that combines high compressive strength with low density. Its closed-cell structure effectively resists water ingress, ensuring buoyant performance even after decades underwater. Beyond insulation of flowlines to prevent hydrate formation and thermal losses, these foams stabilize risers, pipelines, and manifold structures, reducing the risk of damage during installation and operation in harsh marine environments.

In recent years, demand for subsea buoyancy solutions has evolved in tandem with deeper drilling campaigns and expanding marine renewable energy projects. As operators pursue ultra-deepwater targets, buoyancy modules must withstand pressures exceeding 50 MPa without significant deformation, while maintaining operational integrity across wide temperature ranges. Concurrently, industry commitments to environmental stewardship have driven the adoption of advanced polymer chemistries that minimize hazardous additives and facilitate end-of-life recovery, underscoring the strategic importance of material innovation in subsea buoyancy foam design.

Charting Transformative Technological and Environmental Shifts Through Regulatory and Innovation Lenses That Redefine Subsea Buoyancy Foam Performance Requirements

The subsea buoyancy foam landscape is undergoing transformative shifts driven by technological breakthroughs and tightening environmental regulations. Recent amendments to international standards now mandate compression resistance thresholds of at least 70 MPa at depths of 3,000 meters, spurring manufacturers to refine microsphere distributions within syntactic foam matrices to prevent premature implosion and uneven stress distribution. These shifts have accelerated the displacement of uniform-sized glass microspheres in favor of graded distributions, enhancing depth rating performance while optimizing structural integrity.

Meanwhile, regulatory imperatives such as the EU’s REACH ban on persistent flame retardants and the IMO’s guidelines on marine plastic pollution have steered developers toward silicone-based composites and ceramified syntactic formulations that reduce bioaccumulation risks by up to 60%. Industry players are also adopting sensor-embedded “smart foams” to monitor strain, corrosion, and buoyancy loss in real time-an innovation that 42% of new North Sea wind installations now leverage to ensure long-term operational reliability. Beyond oil and gas, emerging applications in CO₂ sequestration and cryogenic hydrogen transport further expand material performance requirements, driving adoption of specialty polymers capable of withstanding acidic or sub-253 °C environments.

Assessing the Cumulative Impact of United States Section 301 and Section 232 Tariff Actions on Subsea Buoyancy Foam Supply Chains in 2025

In 2025, cumulative tariff actions under U.S. trade policy have markedly impacted subsea buoyancy foam supply chains. The Office of the United States Trade Representative extended certain Section 301 exclusions on Chinese imports through August 31, 2025, providing temporary relief to exporters reliant on syntactic foam raw materials sourced from China. However, the broader continuation of a 25% duty on most polymer and composite goods from China, initiated in 2018, remains in place, elevating landed costs and incentivizing domestic sourcing where feasible.

Simultaneously, the USTR’s Section 301 review targeting maritime and shipbuilding equipment opened avenues for new fees on foreign-built vessels and cargo handling machinery, signaling potential future barriers for imported installation tools and ancillary subsea systems. Collectively, these actions underscore the necessity for manufacturers and project operators to engage proactively with trade compliance strategies, diversify supplier portfolios, and consider near-shoring or dual-sourcing tactics to mitigate exposure to ongoing tariff uncertainties.

Unlocking Critical Market Segmentation Insights Across Applications, Materials, Construction Types, End Users, and Depth Ratings for Subsea Buoyancy Foam

Application-based segmentation reveals distinct performance and design requirements across pipeline buoyancy, riser buoyancy, subsea structure buoyancy, towed sonar array buoyancy, and umbilical buoyancy. Pipeline buoyancy modules require inline clamp buoyancy elements that integrate seamlessly around pipe geometries, while pipeline weight coatings deliver combined buoyancy and protection. Riser buoyancy shells, whether clamp-on or inline, must balance compressive resistance with fatigue life to mitigate vortex-induced vibrations.

Material type segmentation differentiates closed cell foams for general insulation from elastomeric foams that offer enhanced resilience and impact resistance. Syntactic foams-further characterized by ceramic microsphere or glass microsphere formulations-dominate deepwater applications where density control and high compressive strength are paramount.

Construction type matters as well, with block foam remaining prevalent for customizable shapes, while composite panel foam-both laminated and sandwich panels-provides pre-engineered modules for rapid integration into structures. End users in defense and security seek high-reliability systems for unmanned platforms, whereas marine research demands modules with inert composition to avoid biological contamination. Oil and gas operators prioritize cost-effective scalable foams, and renewable energy projects, particularly offshore wind and tidal energy, require lightweight buoyancy arrays that support power cables and turbine foundations without impeding longevity.

Depth rating segmentation spans standard depth installations to deepwater and ultra-deepwater fields, each demanding foams that maintain buoyancy stability under increasing hydrostatic pressures and stringent ISO standards.

This comprehensive research report categorizes the Subsea Buoyancy Foam market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Form

- Depth Rating

- Application

- End User

- Sales Channel

Revealing Key Regional Insights Highlighting Distinct Drivers and Growth Catalysts in the Americas, EMEA, and Asia-Pacific Subsea Buoyancy Foam Markets

In the Americas, buoyancy foam demand is driven by deepwater developments in the Gulf of Mexico and Brazil’s pre-salt discoveries. Operators in this region emphasize modules capable of withstanding aggressive corrosion profiles and high pressure gradients, often leveraging hybrid syntactic-foam composites for riser stabilization. The energy transition has also spurred pilot deployments of foam-insulated structures for floating offshore wind demonstrations along the U.S. East Coast.

Europe, Middle East, and Africa present a mature market where the North Sea remains a testing ground for smart foam solutions embedded with real-time monitoring sensors-information that the Hywind Tampen and Northern Lights carbon capture projects rely upon to ensure structural health and compliance with stringent OSPAR and IMO guidelines. Meanwhile, subsea initiatives in the Middle East focus on gas injection and storage, demanding acid-resistant syntactic formulations.

In Asia-Pacific, expanding offshore wind farms in China and Japan coexist with deepwater well interventions in Australia. Domestic manufacturers, including CRRC Times Electric, leverage cost-efficient closed cell foam production and nanoparticle reinforcements to meet local content requirements and support rapid deployment schedules, reflecting broader regional imperatives to secure resilient supply chains while adhering to national energy security objectives.

This comprehensive research report examines key regions that drive the evolution of the Subsea Buoyancy Foam market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Differentiators Shaping Innovation and Competitive Dynamics in Subsea Buoyancy Foam

Leading the competitive landscape, Trelleborg AB distinguishes itself through patented hollow glass microsphere syntactic foam systems that sustain compressive strengths above 100 MPa at depths beyond 3,000 meters. Its vertically integrated operations across Norway, Brazil, and Southeast Asia have secured large contracts for major offshore projects, underscoring its global reach and technical prowess.

Balmoral Group Holdings leverages fiber-reinforced composite buoyancy tailored for dynamic riser applications, focusing on fatigue resistance and rapid installation capabilities. Diab Group, now part of Safran, competes via proprietary Divinycell HT series foams that emphasize low density and high thermal stability in harsh marine conditions. CRRC Times Electric differentiates by operating Asia’s largest closed-cell polyurethane foam facility and deploying nanoparticle-reinforced modules for China’s manned submersibles, achieving up to 22% weight reductions compared to industry norms.

TechnipFMC complements the sector by integrating sensor-enabled syntactic modules in subsea compression systems, meeting multi-decade lifespan requirements in corrosive saline environments-as demonstrated in the Åsgard field-while supporting emerging CO₂ sequestration and renewable energy infrastructures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Subsea Buoyancy Foam market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alseamar S.p.A.

- Balmoral Group Holdings Limited

- Base Materials Ltd.

- Blue Robotics Inc

- CRP Subsea Ltd.

- DeepWater Buoyancy, Inc.

- Diab International AB

- Engineered Syntactic Systems

- Floatex S.r.l.

- General Plastics Manufacturing Co.

- Gurit Holding AG

- Matrix Composites & Engineering Ltd.

- Polyformes Limited

- Qingdao Doowin Marine Engineering Co., Ltd

- Resinex Trading S.r.l.

- Synfoam Ltd.

- Trelleborg AB

Developing Actionable Recommendations to Navigate Tariff Pressures, Accelerate Material Innovation, and Strengthen Supply Chain Resilience in Subsea Buoyancy Foam

Industry leaders should prioritize diversification of raw material sources to mitigate ongoing 25% Section 301 tariffs and prepare for potential fee increases on imported marine equipment. By establishing secondary supply agreements within North America or leveraging regional free-trade zones, stakeholders can ensure continuity and cost predictability.

Simultaneously, accelerating material innovation remains critical. Investing in graded microsphere syntactic formulations and sensor-integrated smart foams enhances both performance and predictive maintenance capabilities, directly addressing the new ISO 13628-6 thresholds and regional environmental mandates. Collaboration with academic research centers to explore bio-based resin systems and nano-ceramic reinforcements offers pathways to reduce environmental footprints and meet operator net-zero commitments.

Finally, to strengthen supply chain resilience, organizations must integrate comprehensive trade compliance protocols, including real-time monitoring of tariff exclusion extensions and proactive engagement in stakeholder consultations for Section 301 reviews. This approach, coupled with scenario planning for evolving regulatory landscapes, empowers decision-makers to adapt swiftly and maintain project timelines.

Detailing a Rigorous Research Methodology Leveraging Primary Expert Consultations, Industry Standards Analysis, and Comprehensive Secondary Data Sources

This research employed a hybrid methodology, integrating primary consultations with subsea engineering specialists, materials scientists, and trade compliance experts. Industry interviews provided qualitative insights into emerging use cases and operational challenges, while data from governmental publications, including USTR Federal Register notices and ISO standard updates, ensured accuracy on tariff policies and technical requirements.

Secondary sources included peer-reviewed articles from Oil & Gas Journal and Sea Technology magazine, together with manufacturer white papers and competitive intelligence reports, to validate performance metrics and innovation trajectories. Segmentation analysis was structured around application, material type, construction, end user, and depth rating categories to deliver targeted insights. Each data point was cross-referenced against at least two independent sources to maintain factual integrity and eliminate bias, with ongoing validation through stakeholder feedback loops.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Subsea Buoyancy Foam market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Subsea Buoyancy Foam Market, by Material Type

- Subsea Buoyancy Foam Market, by Form

- Subsea Buoyancy Foam Market, by Depth Rating

- Subsea Buoyancy Foam Market, by Application

- Subsea Buoyancy Foam Market, by End User

- Subsea Buoyancy Foam Market, by Sales Channel

- Subsea Buoyancy Foam Market, by Region

- Subsea Buoyancy Foam Market, by Group

- Subsea Buoyancy Foam Market, by Country

- United States Subsea Buoyancy Foam Market

- China Subsea Buoyancy Foam Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Insights on Evolving Dynamics, Regulatory Impacts, and Strategic Imperatives Driving Future Opportunities in the Subsea Buoyancy Foam Landscape

The subsea buoyancy foam sector stands at a pivotal juncture, shaped by deepwater exploration ambitions, renewable energy expansions, and intensifying regulatory expectations. Material advancements-ranging from graded microsphere syntactic formulations to smart, sensor-enabled composites-are redefining performance benchmarks at depths previously unattainable. Tariff dynamics in 2025 have underscored the importance of diversified supply chains and proactive trade compliance strategies.

Regional nuances further highlight tailored market approaches, with the Americas focusing on deepwater oil and renewable pilots, EMEA championing environmental compliance and carbon capture initiatives, and Asia-Pacific balancing cost efficiency with local content imperatives. Leading companies continue to differentiate through proprietary technologies, global manufacturing networks, and strategic partnerships, signaling continued innovation. As operators confront the dual challenges of performance optimization and sustainability, the insights presented here offer a roadmap for navigating complexity and capitalizing on emerging subsea buoyancy foam opportunities.

Take the Next Step to Secure In-Depth Market Intelligence and Engage with Ketan Rohom to Access the Comprehensive Subsea Buoyancy Foam Report Today

To explore the detailed findings, gain access to actionable data, and understand the full implications of the trends, regulations, and competitive landscape shaping the subsea buoyancy foam sector, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Partnering with Ketan ensures tailored support and immediate delivery of the comprehensive research report.

Contact Ketan Rohom today to secure your copy of the market research report and empower your strategic decision-making with industry-leading insights and analyses.

- How big is the Subsea Buoyancy Foam Market?

- What is the Subsea Buoyancy Foam Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?