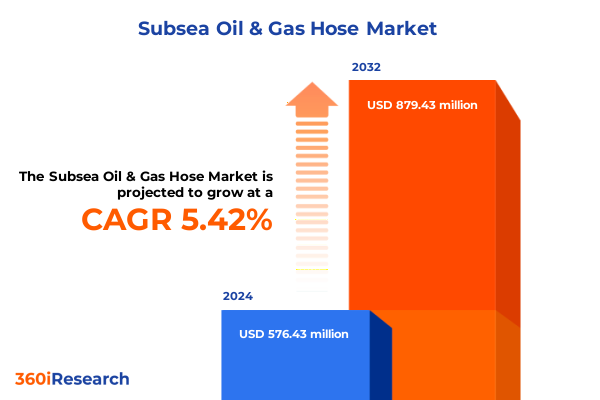

The Subsea Oil & Gas Hose Market size was estimated at USD 612.23 million in 2025 and expected to reach USD 645.45 million in 2026, at a CAGR of 5.30% to reach USD 879.43 million by 2032.

Discover the Critical Role of Subsea Oil and Gas Hoses in Enhancing Offshore Operational Efficiency and Reliability Across Production Networks

As offshore operations advance into ever more challenging marine environments, the significance of robust subsea oil and gas hoses becomes increasingly apparent to operators and service providers alike. These hoses serve as lifelines, transporting critical fluids and power signals between surface vessels, subsea infrastructure, and downhole equipment to maintain uninterrupted production cycles. Recognizing the fundamental role these components play in ensuring operational continuity, industry stakeholders are intensifying efforts to enhance hose performance under extreme pressure, variable temperatures, and corrosive conditions. Consequently, this introduction sets the stage for a deep dive into the technical, regulatory, and market forces reshaping subsea hose applications worldwide.

Building upon decades of material science developments and engineering refinements, modern subsea hose systems now integrate advanced composite reinforcements, specialized polymers, and real-time condition monitoring capabilities. These innovations are central to addressing the twin imperatives of operational safety and cost efficiency, enabling field developers to extend maintenance intervals while mitigating the risk of unplanned shutdowns. Our report begins by contextualizing the evolution of subsea hose technologies within the broader energy transition, highlighting how demands for greener operations and lower carbon intensity are driving both material innovation and digital integration across the value chain.

Unveiling the Convergence of Digital Monitoring, Advanced Materials, and Sustainability Imperatives Shaping Next-Generation Subsea Hose Solutions

The subsea hose landscape is undergoing transformative shifts as operators pursue greater flexibility and sustainability in offshore development. Among the most consequential changes is the integration of digital monitoring and predictive maintenance systems that leverage embedded fiber optic and piezoelectric sensors to deliver real-time insights on pressure fluctuations, bend fatigue, and chemical exposure. These capabilities not only alert engineers to emerging failure modes but also optimize asset health management, reducing unplanned intervention rates and fostering data-driven decision cycles.

Simultaneously, material science breakthroughs are propelling the adoption of thermoplastic elastomers, high-strength steel wire armoring, and hybrid composite configurations that balance flexibility with ultra-high burst pressures. The convergence of such materials with sophisticated design tools has facilitated the rise of bespoke hose assemblies tailored to challenging depths and flow media, thereby enabling deeper drilling campaigns and heavier chemical injection requirements. This trend is further galvanized by collaborative research initiatives among original equipment manufacturers, polymer producers, and engineering consultancies, all seeking to extend service lifetimes in ultra-deep and corrosive subsea environments.

Finally, sustainability imperatives are prompting a reevaluation of supply chain structures, from raw material sourcing to end-of-life recycling schemes. Eco-conscious operators are favoring hoses with lower lifecycle carbon footprints, driving OEMs to explore bio-based polymers and reclamation programs. As a result, the subsea hose sector is at the cusp of a paradigm shift where environmental stewardship and operational performance jointly shape procurement decisions and product roadmaps.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Subsea Hose Input Costs, Supply Chain Resilience, and Manufacturing Localization

In 2025, the imposition of new United States tariffs on imported subsea hose components and critical raw materials has recalibrated cost structures across the value chain. These measures, targeting polymer compounds, steel wire reinforcements, and specialized fittings, have elevated input costs for domestic assemblers while incentivizing onshore supply diversification. As a consequence, several offshore service providers have begun to localize critical manufacturing steps, reducing exposure to cross-border duties and accelerating time-to-deployment for key hose assemblies.

Beyond direct cost increases, these tariffs have triggered secondary effects in global logistics and inventory management. Companies are now balancing the need to maintain buffer stocks against the risk of obsolescence in a rapidly evolving technology landscape. Moreover, supply chain partners in traditional low-cost manufacturing hubs are exploring tariff mitigation strategies, such as regional distribution centers within the United States, to ensure continuity of delivery to offshore platforms in the Gulf of Mexico and beyond.

Looking ahead, industry leaders anticipate a gradual realignment of supplier relationships and capital expenditure plans as the full impact of the 2025 tariff regime unfolds. While short-term margin pressures may temper aggressive expansion plans, the emphasis on reshoring manufacturing capabilities could yield long-term strategic benefits by strengthening quality control, reducing lead times, and fostering deeper collaboration between OEMs and end users under a common regulatory framework.

Synthesizing Application, Hose Type, Configuration, Material, Pressure Rating, Depth, and End-User Variations to Reveal Core Market Dynamics

When examining market segmentation by application, subsea hoses serve essential roles across completion, drilling operations, intervention tasks, production processes, and well testing, with drilling functions tailored for both development drilling and exploration drilling activities and production responsibilities covering both gas production and oil production streams. In exploring hose types, the industry landscape features solutions for chemical injection, control line transmission, hydraulic service delivery, tieback connections, and advanced umbilical assemblies, the latter subdivided into electrical, fiber optic, and hydraulic umbilical deployments to meet diverse subsea operational demands. Configuration-based differentiation highlights composite lay-up designs, fabric-reinforced systems, steel wire armoured constructions, and thermoplastic configurations, each engineered to balance flexibility, pressure resistance, and fatigue life.

Material selection further refines product positioning, with polyethylene compounds delivering cost-effective corrosion resistance, PTFE-based solutions offering chemical inertness, rubber alternatives excelling in flexibility under cyclic loads, and thermoplastic polyurethane formulations providing abrasion protection and extended service durations. Pressure rating categories distinguish high-pressure lines tasked with critical injection duties, medium-pressure hoses optimized for production flow control, and low-pressure variants suitable for ancillary fluid management. Operating depth parameters encompass shallow-water requirements, deepwater performance thresholds, and ultra-deep applications where hydrostatic pressures challenge the limits of polymer resilience. Finally, the spectrum of end users spans independent operators seeking modularity and cost control, national oil companies prioritizing strategic resource security, integrated oil majors demanding turnkey reliability, and specialized service companies focused on technical excellence and rapid mobilization.

This comprehensive research report categorizes the Subsea Oil & Gas Hose market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Hose Type

- Configuration

- Material

- Pressure Rating

- Operating Depth

- Application

- End User

Mapping Distinct Offshore Development Cycles and Policy Landscapes Driving Subsea Hose Demand across Americas, Europe Middle East Africa, and Asia-Pacific

Regional demand patterns for subsea hoses reflect a diverse interplay of offshore development maturity, regulatory frameworks, and investment cycles across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, the Gulf of Mexico’s continued exploration activities and Brazil’s deepwater pre-salt projects sustain robust requirements for high-pressure umbilicals and dynamic service hoses, with localized assembly operations gaining ground in response to near-market tariff considerations. Conversely, Europe, the Middle East & Africa leverage a combination of mature North Sea fields, expanding East Mediterranean discoveries, and deepwater Gulf of Guinea concessions to drive demand for bespoke composite and steel wire armoured solutions, as operators emphasize risk mitigation in aging subsea infrastructures.

Asia-Pacific markets present a distinct growth trajectory, where Australia’s offshore gas-to-liquids initiatives, China’s nascent deepwater drilling programs, and Southeast Asia’s decommissioning opportunities coexist. These developments underscore the need for versatile hose configurations capable of handling unconventional fluids, prolonged exposure to tropical environments, and complex tieback applications. Moreover, emerging regulations around environmental impact reporting and lifecycle carbon emissions are motivating regional stakeholders to adopt hoses with recyclable thermoplastic elements and integrated leak-detection systems to align with global sustainability benchmarks.

Across all regions, local content requirements and national procurement policies are increasingly influential, prompting strategic alliances between international OEMs and regional fabricators. Such partnerships not only streamline compliance but also facilitate knowledge transfer and accelerate regional capacity building, fostering a more resilient and adaptive subsea hose ecosystem worldwide.

This comprehensive research report examines key regions that drive the evolution of the Subsea Oil & Gas Hose market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market-Leading Subsea Hose Manufacturers Advancing Material Science, Sensor Integration, and Global Service Capabilities

Leading firms in the subsea hose domain are advancing the frontier through investments in material innovation, digital integration, and global service networks. Trelleborg Sealing Solutions has scaled its composite hose assembly lines while embedding real-time pressure and temperature sensors in its latest umbilical products. Parker Hannifin has pioneered thermoplastic polyurethane formulations that enhance abrasion resistance and extend operational life in complex chemical injection scenarios. Curtiss-Wright has leveraged its hydraulic expertise to deliver modular service hoses with rapid-connect interfaces for expedited subsea interventions.

National Oilwell Varco’s subsea technologies division has optimized its steel wire armoured hoses to accommodate ultra-deep gas production and has expanded its Gulf Coast fabrication facilities in direct response to evolving tariff policies. TechnipFMC continues to differentiate through integrated umbilical systems that combine electrical, fiber optic, and hydraulic functions in unified assemblies, supported by its global subsea installation fleet. Additionally, regional specialist Hydrasun has emerged as a key partner for operators seeking customized hose assemblies and on-site maintenance services, reinforcing the strategic importance of agile supply chains and localized technical support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Subsea Oil & Gas Hose market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aker Solutions ASA

- Baker Hughes Company

- Eaton Corporation plc

- National Oilwell Varco, Inc.

- Nexans S.A.

- Parker-Hannifin Corporation

- Saipem S.p.A.

- Schlumberger Limited

- TechnipFMC plc

- Trelleborg AB

Advancing Subsea Hose Competitiveness through Collaborative R&D, Strategic Manufacturing Localization, and Integrated Digital Supply Chain Platforms

Industry leaders should pursue strategic investments in next-generation hose materials and embedded analytics platforms to unlock greater operational uptime and predictive maintenance capabilities. By prioritizing collaborative R&D initiatives with polymer producers and sensor technology firms, stakeholders can co-develop bespoke solutions that address emerging challenges in extreme-depth operations and evolving chemical injection profiles. Concurrently, companies must evaluate the merits of reshoring critical manufacturing processes to mitigate tariff exposures and enhance quality assurance under unified regulatory regimes.

Moreover, forging deeper alliances with national and regional fabricators through joint ventures or licensing agreements can drive local content compliance while preserving global technical expertise. Such partnerships will expedite project mobilization and reduce logistical complexities, particularly in geographically dispersed markets. Equally important is the deployment of digital platforms that integrate procurement, installation, and performance data to establish end-to-end supply chain transparency. Implementing these systems will empower operators and service providers to optimize inventory levels, forecast maintenance demands, and make data-driven procurement decisions.

Finally, firms should proactively engage with environmental and safety regulators to shape emerging standards for hose traceability, recyclability, and leak detection. By participating in industry consortiums and standardization bodies, companies can influence the development of lifecycle assessment frameworks that recognize the value of durable, low-carbon subsea hose solutions. This proactive stance will not only enhance corporate sustainability profiles but also anticipate regulatory shifts that could impact market access and project economics.

Leveraging Multi-Source Technical Analyses, Expert Interviews, and Regional Modeling to Deliver a Holistic Subsea Hose Market Assessment

This research effort combined rigorous secondary analysis of technical publications, regulatory filings, and patent databases with primary interviews conducted across the subsea energy ecosystem. Technical experts at leading hose manufacturers, offshore operators, and service contractors provided insights into emerging performance requirements, material selection criteria, and supply chain dynamics. These qualitative perspectives were supplemented by quantitative data derived from shipment records, import-export logs, and capital expenditure disclosures to triangulate market behavior and cost drivers.

Analytical frameworks included segmentation modeling based on application, hose type, configuration, material composition, pressure rating, operating depth, and end-user classification to ensure a comprehensive understanding of demand patterns. A regionally focused approach dissected market nuances across the Americas, Europe Middle East & Africa, and Asia-Pacific, accounting for local content regulations, environmental standards, and infrastructure maturity. Findings were validated through stakeholder workshops and expert panels to refine scenario assumptions and identify key inflection points.

Throughout the process, strict data governance protocols were maintained to ensure the integrity and confidentiality of proprietary information, while continuous peer review cycles guaranteed methodological rigor and minimized bias. The resulting analysis provides a robust foundation for strategic decision-making, offering both high-level overviews and deep-dive insights into the evolving subsea hose market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Subsea Oil & Gas Hose market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Subsea Oil & Gas Hose Market, by Hose Type

- Subsea Oil & Gas Hose Market, by Configuration

- Subsea Oil & Gas Hose Market, by Material

- Subsea Oil & Gas Hose Market, by Pressure Rating

- Subsea Oil & Gas Hose Market, by Operating Depth

- Subsea Oil & Gas Hose Market, by Application

- Subsea Oil & Gas Hose Market, by End User

- Subsea Oil & Gas Hose Market, by Region

- Subsea Oil & Gas Hose Market, by Group

- Subsea Oil & Gas Hose Market, by Country

- United States Subsea Oil & Gas Hose Market

- China Subsea Oil & Gas Hose Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Highlighting the Intersection of Material, Digital, Regulatory, and Regional Dynamics That Will Determine the Future Trajectory of Subsea Hose Solutions

In an era of intensifying offshore ambitions and tightening environmental mandates, subsea oil and gas hoses emerge as pivotal enablers of operational resilience and productivity. Technological advancements in materials and digital monitoring are converging to extend service lifespans, reduce intervention costs, and support deeper, more complex subsea developments. Simultaneously, regulatory shifts such as the 2025 United States tariffs and evolving local content requirements are reshaping supply chains and manufacturing footprints.

By synthesizing segmentation insights across applications, hose types, and operating conditions, this executive summary illuminates the core dynamics influencing procurement strategies and product innovation. Regional patterns underscore the importance of flexible, localized production capabilities to address diverse offshore regimes and policy environments. Finally, profiling leading manufacturers and identifying actionable recommendations equips industry stakeholders with a strategic roadmap to navigate market uncertainties and capitalize on emerging opportunities.

As the subsea energy sector continues its transformation, the agility to integrate new materials, digital tools, and collaborative supply chain models will define competitive advantage. Stakeholders that proactively align technical development with evolving regulatory landscapes and sustainability goals will be best positioned to drive the next wave of offshore exploration and production efficiency gains.

Secure Undisrupted Access to Critical Subsea Hose Market Intelligence with Personalized Guidance from Our Sales & Marketing Leadership

To access the full breadth of strategic insights, detailed analyses, and forward-looking perspectives contained in this comprehensive market research report, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Leveraging an extensive portfolio of subsea energy sector expertise, Ketan is prepared to guide you through the report’s content, answer any bespoke inquiries, and facilitate a seamless procurement process that ensures you receive the critical intelligence needed to inform your next business move.

- How big is the Subsea Oil & Gas Hose Market?

- What is the Subsea Oil & Gas Hose Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?