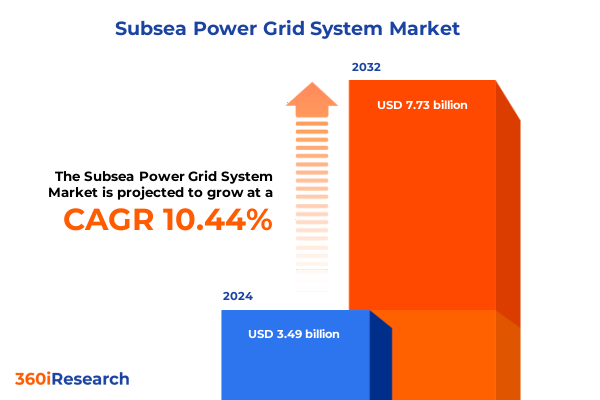

The Subsea Power Grid System Market size was estimated at USD 3.82 billion in 2025 and expected to reach USD 4.19 billion in 2026, at a CAGR of 10.57% to reach USD 7.73 billion by 2032.

Establishing a Robust Foundation for Subsea Power Grid Systems to Empower Strategic Investments and Drive Next-Generation Offshore Energy Infrastructure

The global push toward cleaner energy and greater grid resilience has ushered in unprecedented interest in subsea power grid systems. As offshore wind farms mature and subsea interconnectors evolve, stakeholders need a coherent overview of the technical, economic, and regulatory factors shaping these critical infrastructures. This introduction delivers an authoritative foundation, explaining how emerging energy demands and technological breakthroughs are driving renewed focus on undersea power transmission and distribution networks.

By exploring the convergence of advanced electrical components, robust installation methodologies, and evolving supply chain dynamics, this section clarifies why organizations across utilities, oil and gas, and renewable energy sectors are prioritizing subsea grid development. Through examining current market drivers-ranging from the decarbonization imperatives of major economies to technological improvements in component efficiency-we prepare decision-makers with the context needed to navigate this rapidly transforming environment and capitalize on new growth avenues.

Revolutionary Technological and Methodological Advancements Upending Traditional Subsea Power Network Conceptions

Over the past decade, the subsea power grid landscape has been reshaped by breakthroughs in high-voltage insulation, digital monitoring, and modular installation techniques. Transitioning from conventional copper cables to a blend of copper and fiber-optic hybrid lines has enhanced transmission capacity while enabling real-time diagnostic capabilities. These technological advancements, coupled with a shift toward Gas Insulated Switchgear in deepwater applications, signify a paradigm change in how subsea networks are conceived and managed.

Furthermore, the rise of floating installation platforms has supplemented traditional fixed seabed solutions, expanding the feasible footprint for offshore grid development. This flexibility not only reduces environmental impact through minimized seabed disturbance but also accelerates project deployment timelines. Meanwhile, the integration of variable speed drives to regulate power flow has proven essential for harmonizing intermittent renewable inputs with the stability requirements of main grid networks. Collectively, these transformative shifts underscore an industry in the midst of redefining conventional subsea practices in favor of agile, data-driven, and resilient system architectures.

Comprehensive Evaluation of the Far-Reaching Economic Consequences Stemming from United States 2025 Tariff Measures on Offshore Grid Components

The United States 2025 tariff framework has introduced a complex set of cost considerations for companies sourcing subsea power grid components internationally. Tariff increases on key elements such as copper cables and step-down transformers have not only elevated direct procurement costs but also triggered a recalibration of domestic manufacturing strategies. Faced with higher import expenses, many stakeholders are now evaluating whether to localize production of switchgear, including both air insulated and gas insulated variants, to mitigate future tariff risks.

This tariff landscape has also prompted reexamination of supply chain agility and inventory policies. In response to elevated import duties, several market participants have begun diversifying their vendor base across regions less affected by the new U.S. tariffs. This strategic pivot aims to balance cost containment with continuity of critical component supply. Additionally, engineering teams are reassessing the power rating mix-spanning high voltage, medium voltage, and low voltage systems-to optimize both performance and tariff exposure. As a result, the cumulative impact of the 2025 tariffs extends beyond immediate cost inflation to reshape long-term sourcing frameworks and investment decisions within the subsea grid ecosystem.

In-Depth Analysis of Component, Installation, Voltage, Retrofit versus New Projects, and End-User Dynamics Shaping Subsea Power Grids

Analyzing the subsea power grid market through multiple segmentation lenses reveals nuanced insights that can inform targeted strategies. When viewing by component type, stakeholders must consider the balance between copper cables for baseline transmission needs and fiber-optic cables for enhanced monitoring capabilities, while navigating switchgear choices between air insulated switchgear known for cost-efficiency and gas insulated switchgear favored for compact deepwater installations. Transformer decisions require weighing the compact design benefits of step-down transformers against the higher capacity characteristics of step-up transformers, and variable speed drives emerge as critical enablers of dynamic power regulation across subsea farms and interconnects.

Installation type segmentation further clarifies how fixed installations provide robust long-term stability on shallow seabeds, while floating installations unlock capabilities in deeper waters and reduce seabed disruption. Power rating distinctions highlight how high-voltage systems support long-distance transmission between offshore and onshore locations, medium-voltage networks serve regional subsea distribution, and low-voltage configurations cater to localized offshore facilities. Moreover, evaluating subsea grid initiatives through the lens of new installation versus retrofit installation underscores the importance of modular upgrade pathways for aging infrastructure. End-user segmentation reveals that oil and gas operators prioritize robust reliability under extreme marine conditions, renewable energy developers focus on seamless integration with wind and tidal assets, and utilities emphasize grid resilience and regulatory compliance across all subsea deployments.

This comprehensive research report categorizes the Subsea Power Grid System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Installation Type

- Power Rating

- Installation Type

- End-user

Comparative Perspectives on Policy-Driven Growth, Environmental Priorities, and Technical Demands Across Key Global Subseafloor Energy Markets

Regional perspectives on subsea power grid system development highlight diverse drivers and challenges. In the Americas, expansion efforts have centered on linking offshore wind farms along the U.S. Eastern Seaboard with onshore grids, spurred by policy incentives and robust environmental standards. Latin American initiatives have also emerged, leveraging subsea connectors to integrate remote oil and gas installations into national networks, enhancing energy security in coastal nations.

Europe, the Middle East, and Africa region dynamics are driven by cross-border interconnectivity ambitions within the North Sea, coupled with renewable energy growth mandates in the European Union. The Middle East’s growing offshore gas platforms have accentuated demand for durable subsea switchgear and transformers suited to high-temperature marine environments. Meanwhile, African coastal nations are exploring subsea cables to access offshore wind potential, balancing infrastructure investment with developmental priorities.

In Asia-Pacific, rapid expansion of offshore renewable projects in countries like Japan and South Korea is fostering demand for advanced cable and switchgear technologies. Australia’s deepwater wind trials have underscored the importance of floating installation expertise, while Southeast Asian markets emphasize cost-effective retrofit paths to upgrade aging subsea networks originally built for oil and gas transport. These varied regional approaches reinforce the need for flexible, localized strategies to accommodate regulatory frameworks, marine conditions, and strategic energy objectives.

This comprehensive research report examines key regions that drive the evolution of the Subsea Power Grid System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Collaborations, Technological Leadership, and End-to-End Service Models Employed by Top Subsea Power Grid Component Providers

Leading industry players are consolidating their positions by leveraging technological innovations, strategic partnerships, and comprehensive service offerings across the subsea power grid spectrum. Major electrical manufacturers are expanding modular switchgear and transformer solutions tailored to subsea environments, often partnering with specialized engineering firms to streamline offshore installation. These alliances enable seamless integration of variable speed drives and digital monitoring platforms, enhancing overall system reliability.

Simultaneously, cable producers are investing in production capacities for high-performance copper and fiber-optic hybrid cables, ensuring shorter lead times and greater customization options for complex deepwater projects. Some conglomerates are also acquiring niche technology providers that specialize in gas insulated switchgear for compact applications, thereby capturing value along the entire supply chain. Additionally, many players are establishing regional service hubs to support both new installations and retrofit operations, offering turnkey solutions that encompass project management, on-site commissioning, and lifecycle maintenance under one contractual framework.

This comprehensive research report delivers an in-depth overview of the principal market players in the Subsea Power Grid System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aibel AS.

- Aker Solutions ASA

- Baker Hughes Company

- DeepOcean

- General Electric Company

- Hitachi Energy Ltd.

- IHC Merwede Holding B.V.

- JDR Cable Systems Ltd.

- LS Cable & System Ltd.

- McDermott International, Ltd

- Nexans S.A.

- NKT A/S

- Oceaneering International, Inc

- Prysmian Group

- SAIPEM SpA

- Schneider Electric SE

- Siemens AG

- Sumitomo Electric Industries, Ltd.

- ZTT International Limited

Holistic Strategic Pathways Combining Technological Innovation, Diversified Procurement, and Collaborative Risk Mitigation for Market Leaders

Industry leaders must adopt an integrated approach that aligns technological innovation with flexible procurement strategies and robust risk management. Prioritizing the development of hybrid cable solutions can enhance diagnostic capabilities and reduce long-term maintenance costs, while diversifying switchgear and transformer sourcing across both domestic and international suppliers will mitigate tariff-driven price shocks.

Moreover, elevating investment in floating installation expertise and modular retrofit packages will unlock new project opportunities in deeper waters and extend the operational life of existing infrastructure. By embedding digital monitoring tools powered by variable speed drives, operators can achieve real-time performance insights and predictive maintenance, thereby maximizing uptime and reducing unplanned outages. Finally, cultivating cross-sector partnerships-uniting utilities, renewable developers, and oil and gas operators-will facilitate knowledge transfer and joint investment frameworks, accelerating subsea grid deployment at scale.

Comprehensive Primary and Secondary Research Framework Integrating Expert Interviews, Technical Specifications Review, and Rigorous Data Triangulation

This research employed a rigorous methodology combining primary interviews with subsea electrical engineers, offshore installation specialists, and procurement executives, alongside secondary analysis of regulatory filings, industry white papers, and technical standards. Initial scoping involved a detailed review of component design specifications and installation frameworks to ensure comprehensive coverage of cables, switchgear, transformers, and variable speed drives.

Subsequent data validation leveraged insights from leading professional associations and corroborated supplier production capacities through published corporate disclosures. Segmentation analysis was conducted by mapping component types, installation modalities, power rating categories, and end-user sectors, while regional trends were synthesized from policy directives, environmental assessments, and recent offshore project announcements. Throughout the research process, strict benchmarking and triangulation protocols were applied to maintain objectivity and accuracy, ensuring the resulting analysis reliably reflects current industry dynamics without reliance on proprietary forecasts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Subsea Power Grid System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Subsea Power Grid System Market, by Component Type

- Subsea Power Grid System Market, by Installation Type

- Subsea Power Grid System Market, by Power Rating

- Subsea Power Grid System Market, by Installation Type

- Subsea Power Grid System Market, by End-user

- Subsea Power Grid System Market, by Region

- Subsea Power Grid System Market, by Group

- Subsea Power Grid System Market, by Country

- United States Subsea Power Grid System Market

- China Subsea Power Grid System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Innovation, Strategic Sourcing, and Regional Adaptation to Propel the Next Evolution in Offshore Power Transmission Systems

As the global energy landscape pivots toward cleaner and more resilient power networks, subsea power grid systems stand at the forefront of this evolution. The convergence of advanced cable technologies, modular switchgear, and digital control mechanisms offers a pathway to meet burgeoning offshore energy demands while addressing environmental and regulatory imperatives.

Moving forward, stakeholders who integrate tariff-aware sourcing strategies, invest in floating installation competencies, and leverage data-driven performance monitoring will secure competitive advantage. By aligning component innovation with market-specific requirements across the Americas, EMEA, and Asia-Pacific, industry participants can navigate regional nuances and accelerate project delivery. Ultimately, the maturation of subsea grid infrastructure promises to redefine offshore power transmission and distribution, laying the groundwork for a more interconnected, sustainable energy future.

Unlock Tailored Offshore Subsea Power System Insights by Engaging with Our Expert Specialist to Secure the Definitive Market Research Report

Elevate your strategic advantage by connecting with Ketan Rohom, an expert in offshore energy infrastructure market dynamics. This comprehensive research report offers unparalleled insights into the evolving subsea power grid system landscape, empowering you to refine investment priorities, select optimal component mix, and align growth initiatives with emerging regulatory shifts. Engage directly with an industry specialist to customize your research needs and gain timely access to actionable data that drives competitive differentiation. Reach out today to secure your copy of this vital analysis and chart a course for decisive leadership in the global offshore power sector.

- How big is the Subsea Power Grid System Market?

- What is the Subsea Power Grid System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?